The Q2 2025 13F filings have landed—offering a window into how the world’s most influential investors are repositioning their portfolios. From Berkshire Hathaway to Tiger Global, the moves reveal who’s all-in, who’s cashing out, and who’s pivoting with conviction. Let’s dive in.

Related: Billionaire Investors Reveal Q1 2025 Portfolio Moves: Buffett, Ackman, Tepper, Burry & More

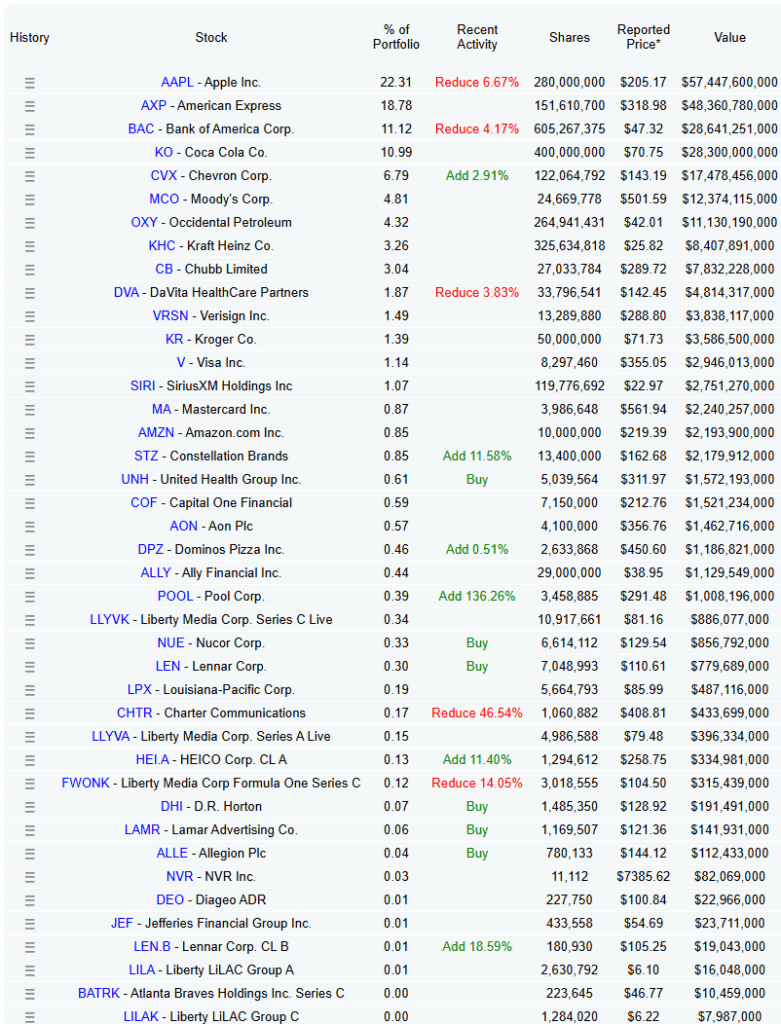

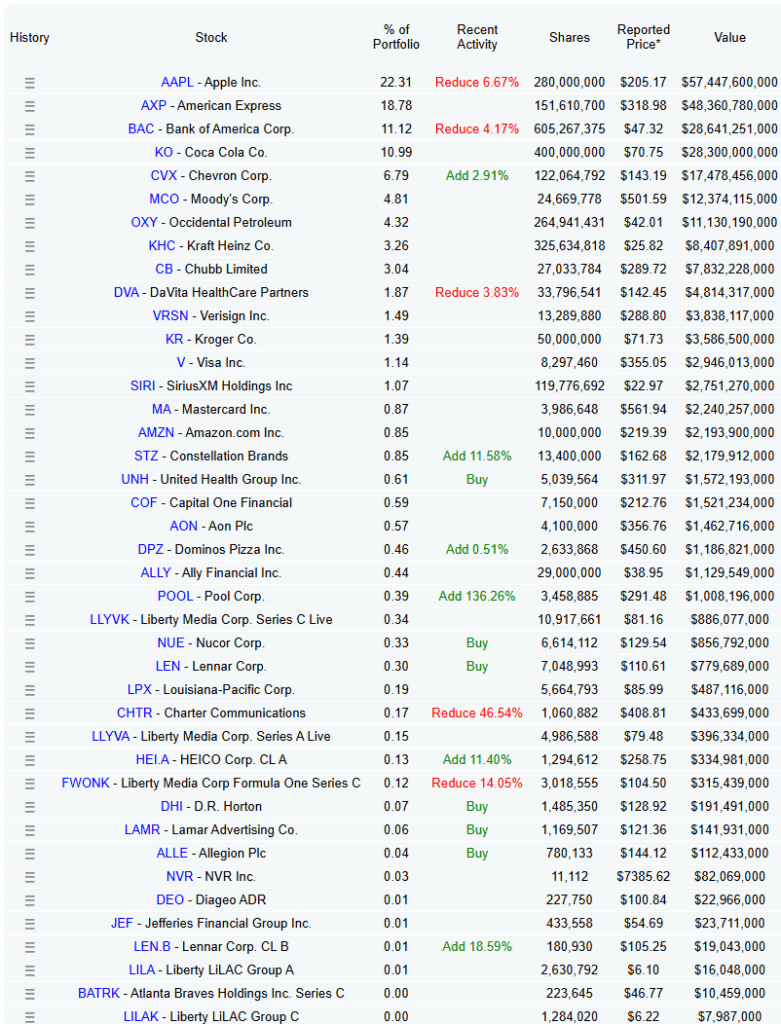

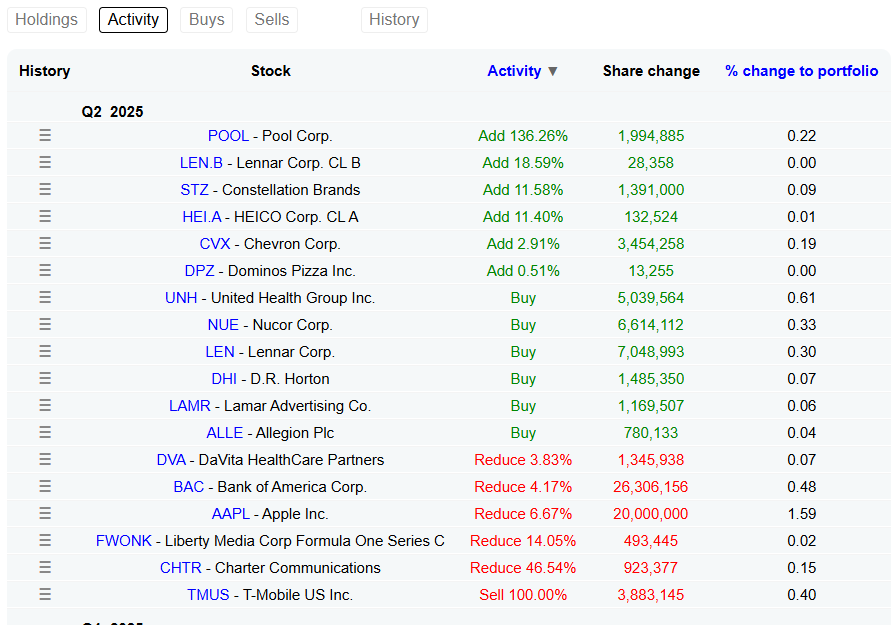

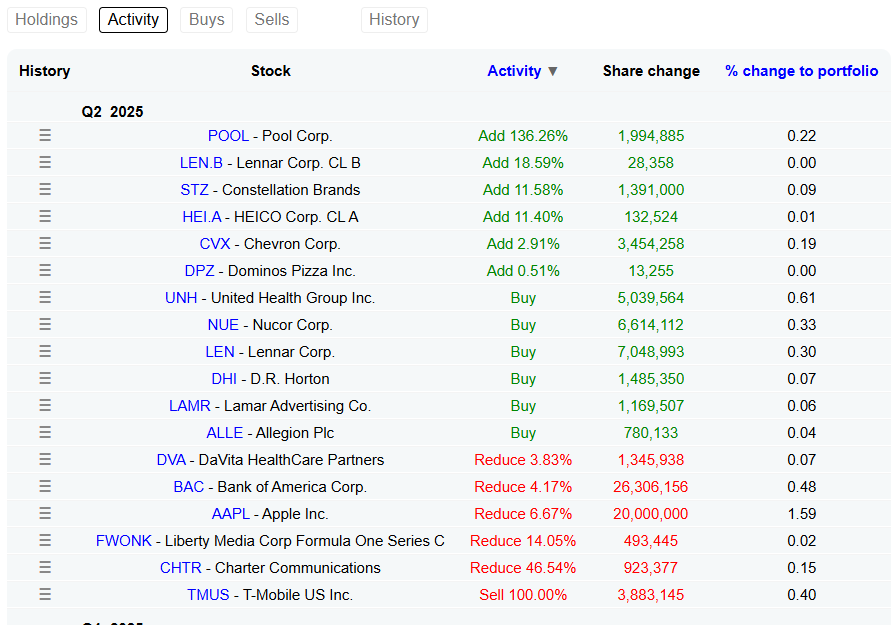

Warren Buffett – Berkshire Hathaway

Portfolio Tilt: Quiet blue-chip shifts with calculated bets

New Positions: $UNH, $NUE, $LEN, $DHI, $LAMR, $ALLE

Exited: $TMUS

Top Adds: $POOL (+136 %), $LEN.B (+18.6 %), $STZ (+11.6 %), $HEI.A (+11.4 %), $CVX (+2.9 %), $DPZ (+0.5 %)

Top Cuts: $AAPL (–6.7 %), $CHTR (–46.5 %), $FWONK (–14.1 %), $BAC (–4.2 %)

Bill Ackman – Pershing Square Capital

Portfolio Tilt: Bold tech and services plays

New Position: $AMZN (+5.82M shares)

Exited: $CP

Top Adds: $GOOGL, $BN, $HLT, $HTZ

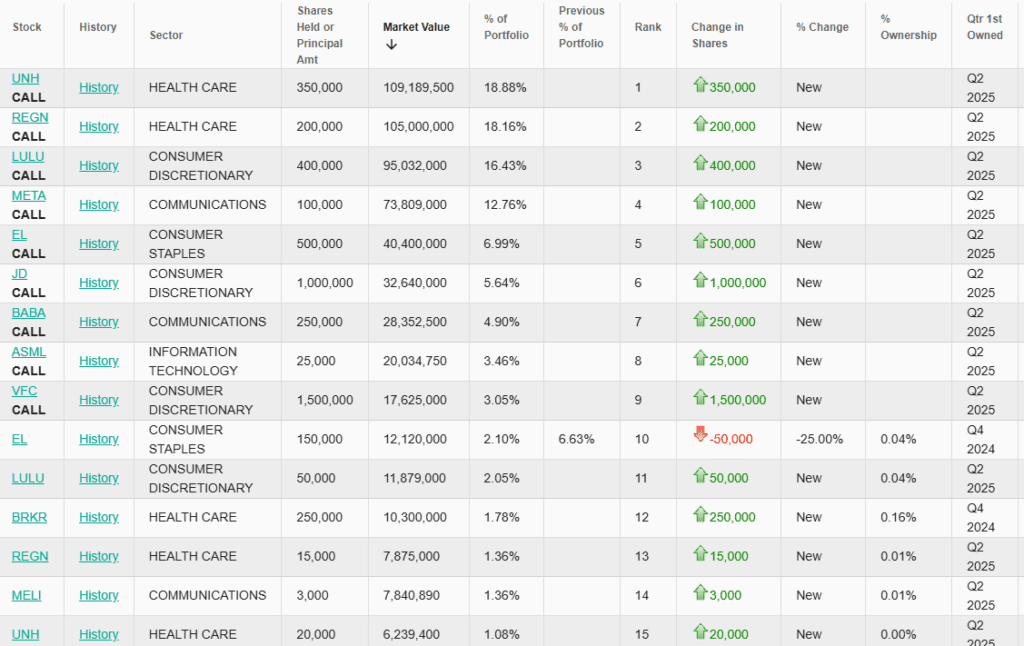

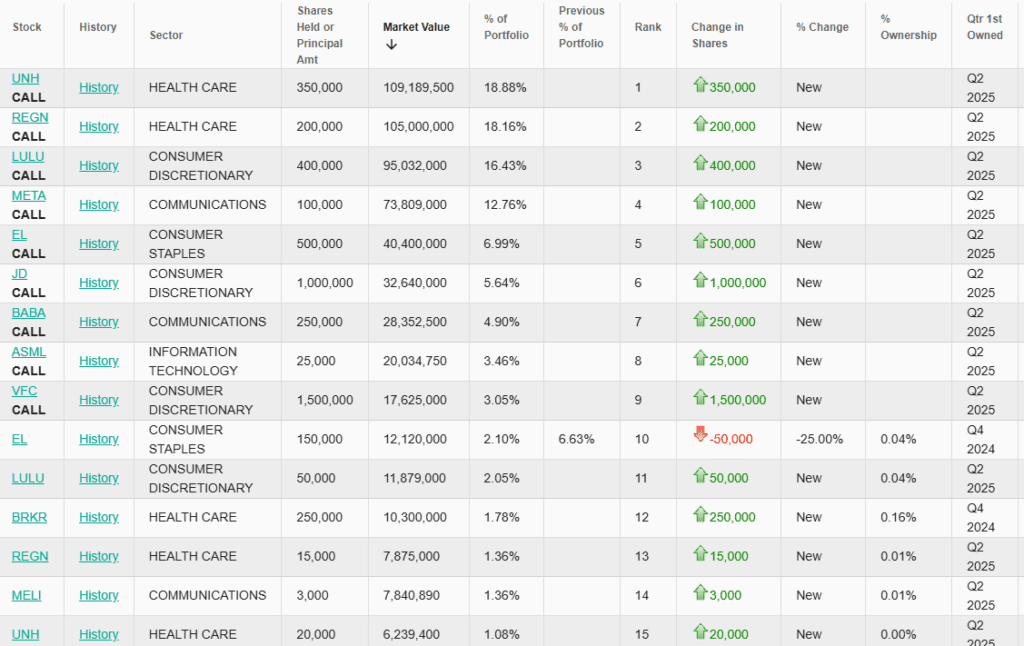

Michael Burry – Scion Asset Management

Portfolio Tilt: Deep contrarian reset

New Buys: $UNH (calls + stock), $REGN (calls + stock), $LULU (calls + stock), $META (calls), $EL (calls + stock), $JD (calls), $BABA (calls), $ASML (calls), $VFC (calls), $BRKR, $MELI

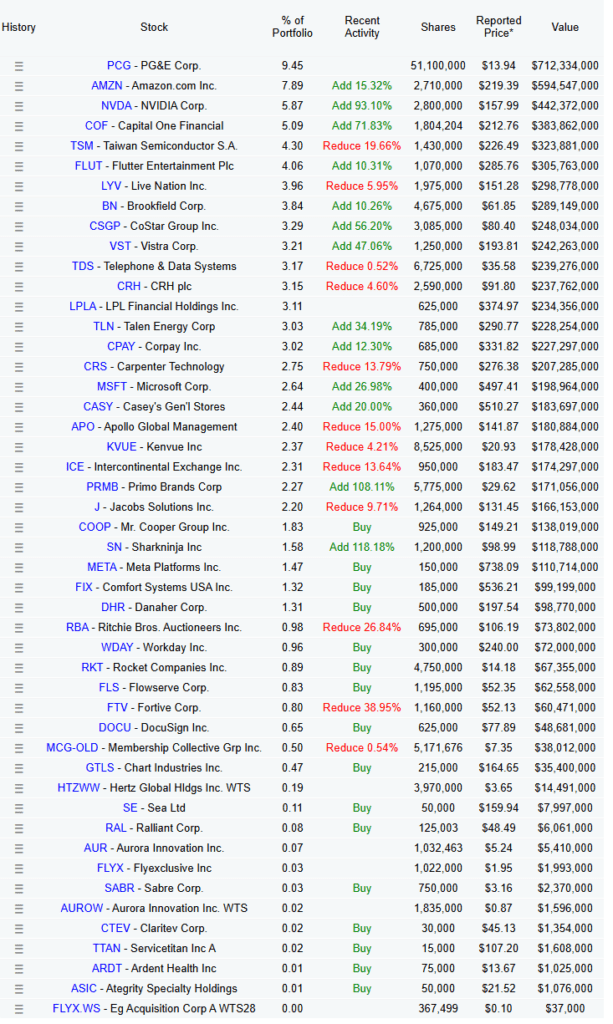

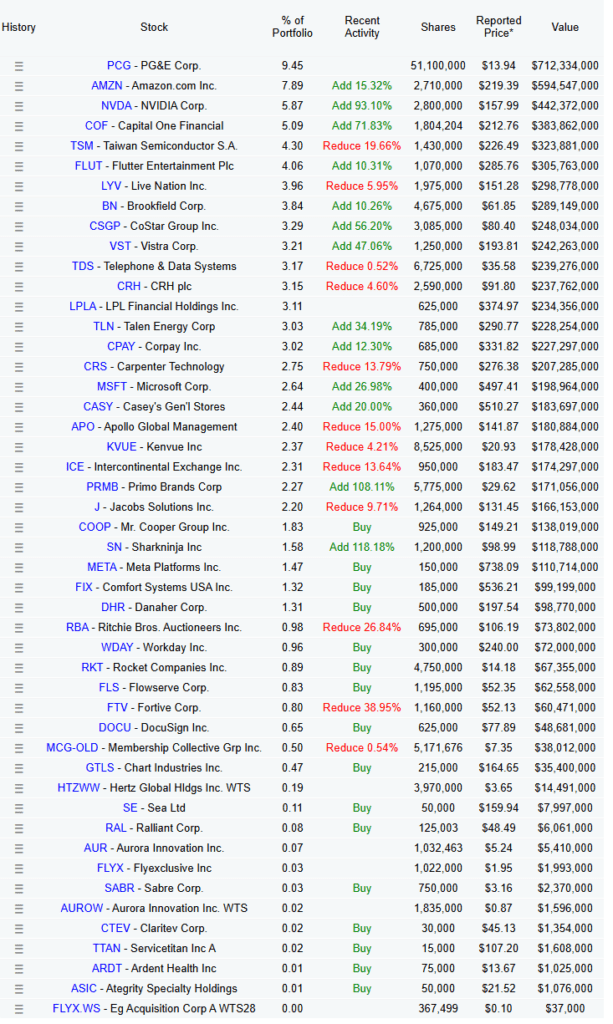

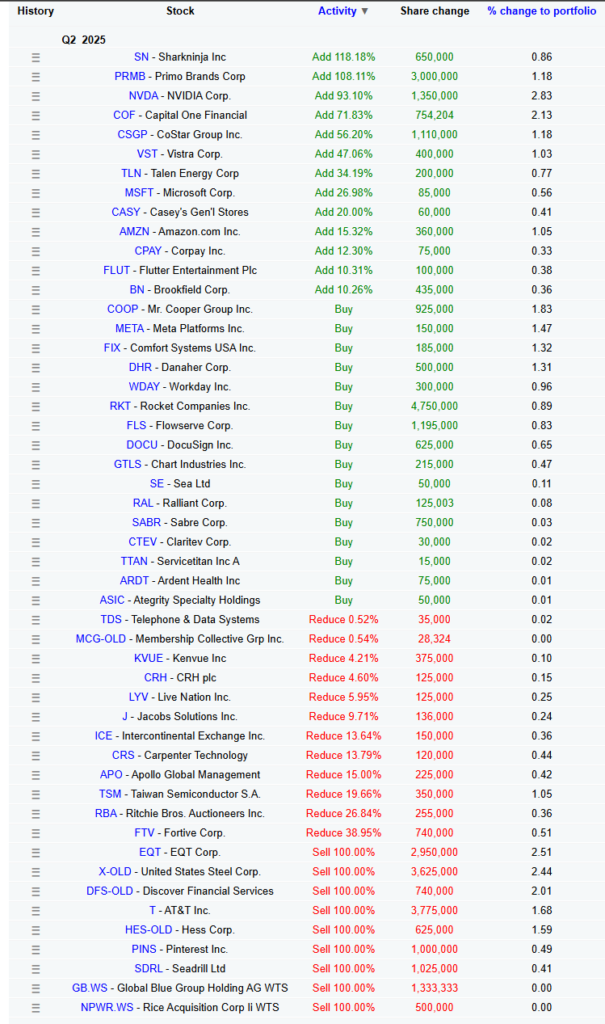

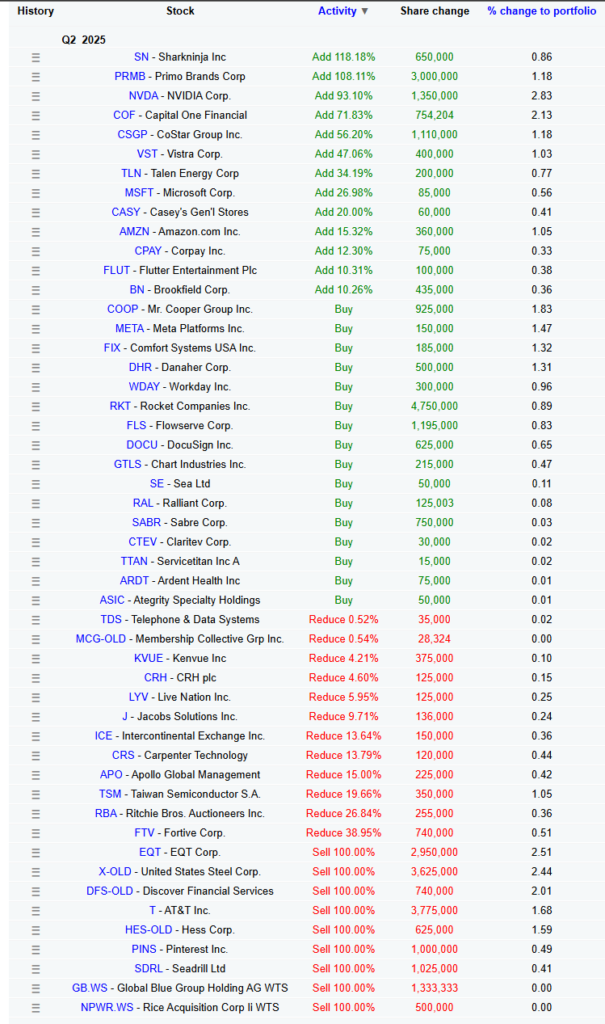

Dan Loeb – Third Point

Portfolio Tilt: High-conviction, multi-stock builds

New: $COOP, $META, $FIX, $DHR, $WDAY, $RKT, $FLS, $DOCU, $GTLS, $SE, $RAL, $SABR, $CTEV, $TTAN, $ARDT, $ASIC

Exits: $EQT, $X, $DFS, $T, $HES, $PINS, $SDRL, $GB.WS, $NPWR.WS

Top Adds: $SN, $PRMB, $NVDA, $COF, $CSGP, $VST, $TLN, $MSFT, $CASY, $AMZN

Top Cuts: $FTV, $RBA, $TSM, $APO, $CRS

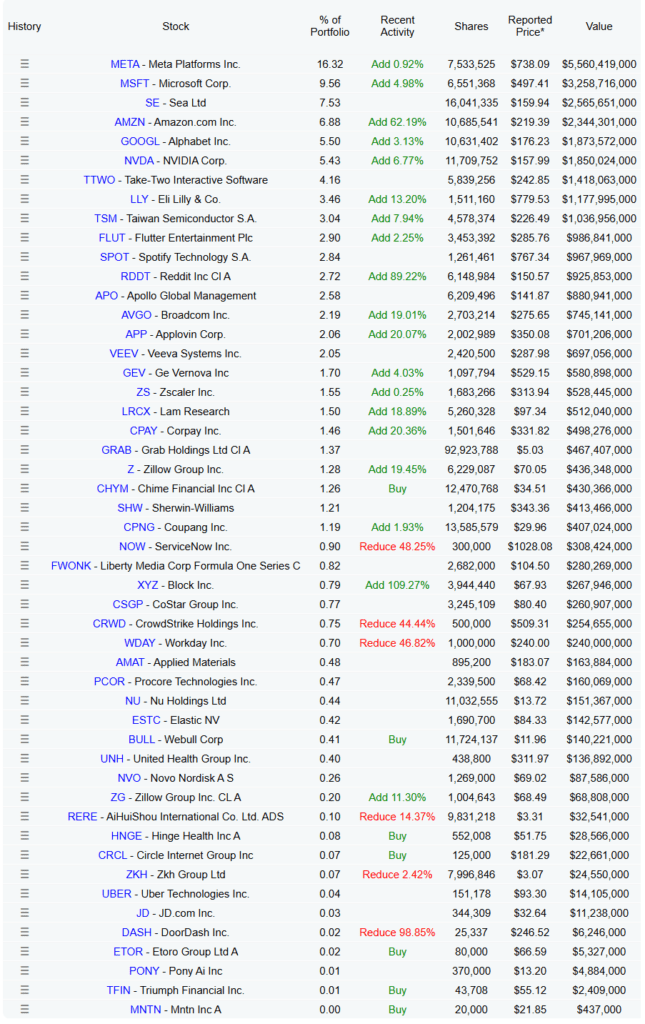

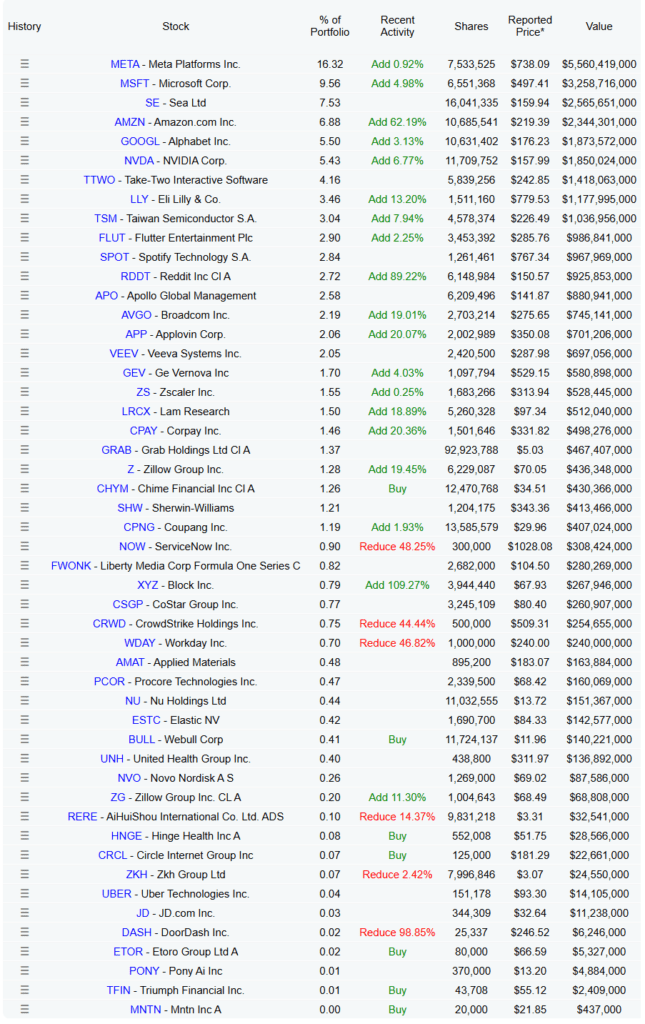

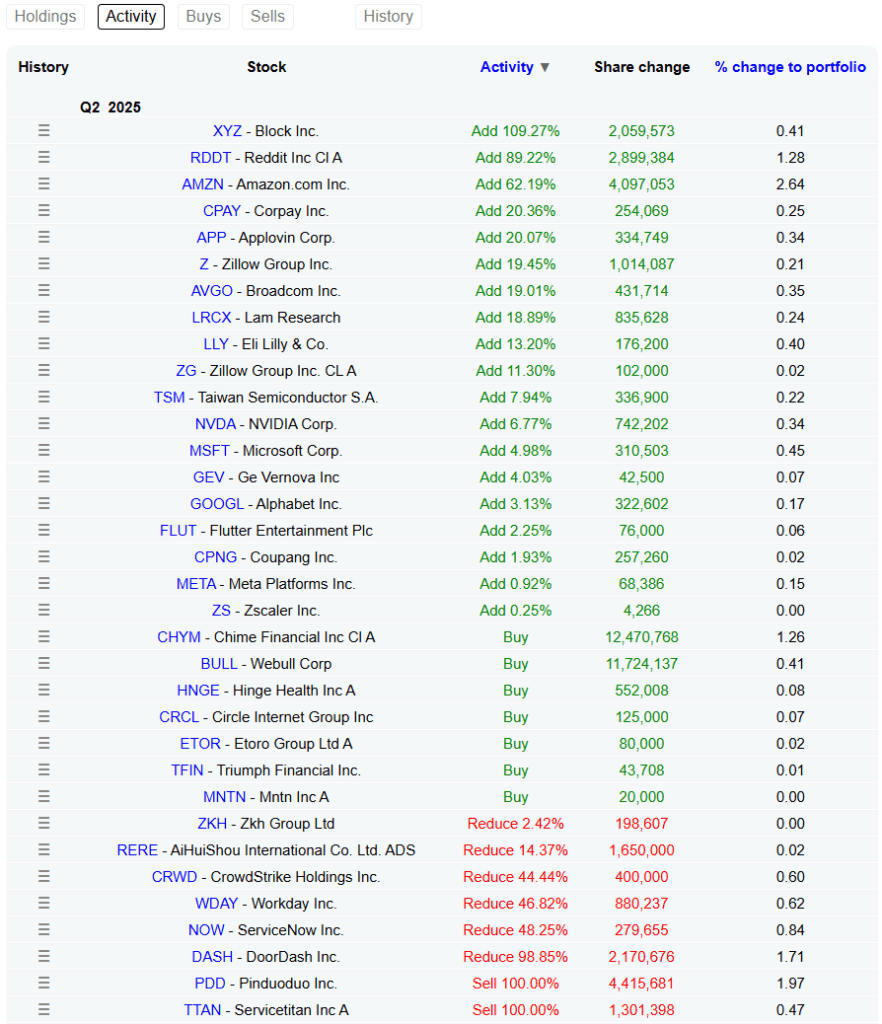

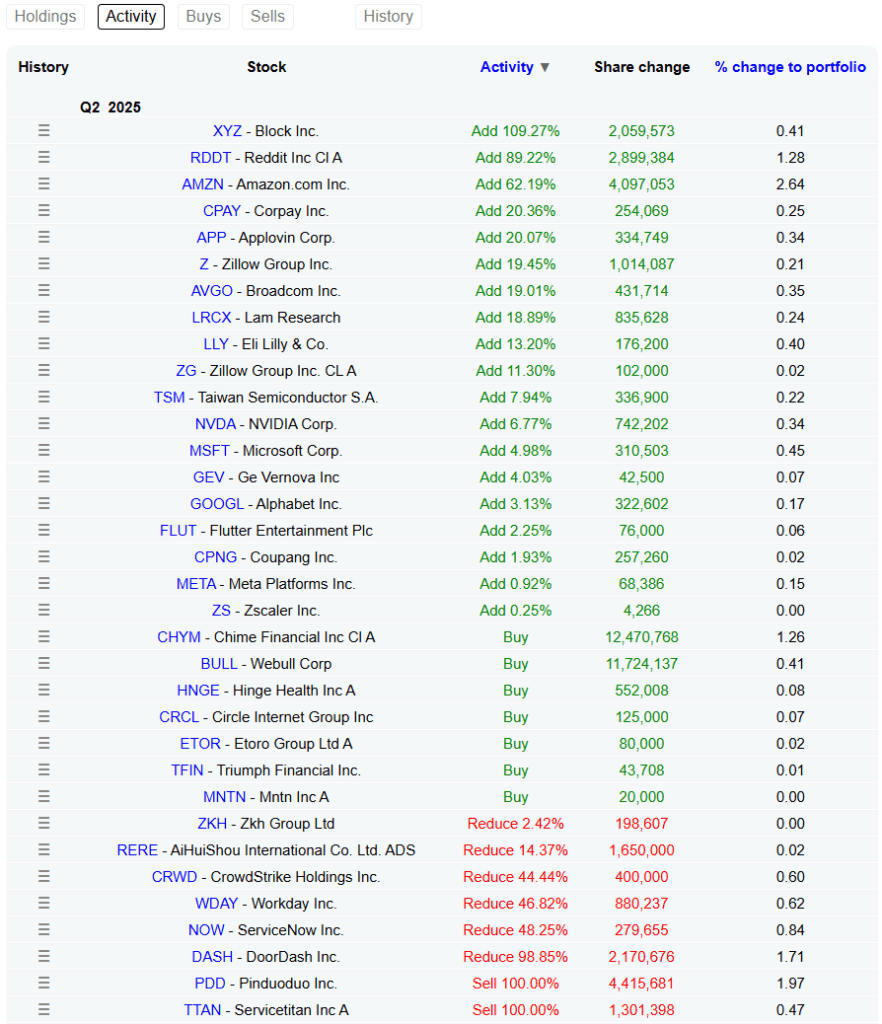

Chase Coleman – Tiger Global

Portfolio Tilt: Emerging new names, trimming overlaps

New: $CHYM, $BULL, $HNGE, $CRCL, $ETOR, $TFIN, $MNTN

Exits: $PDD, $TTAN

Top Adds: $XYZ, $RDDT, $AMZN

Top Cuts: $DASH, $WDAY, $CRWD, $NOW

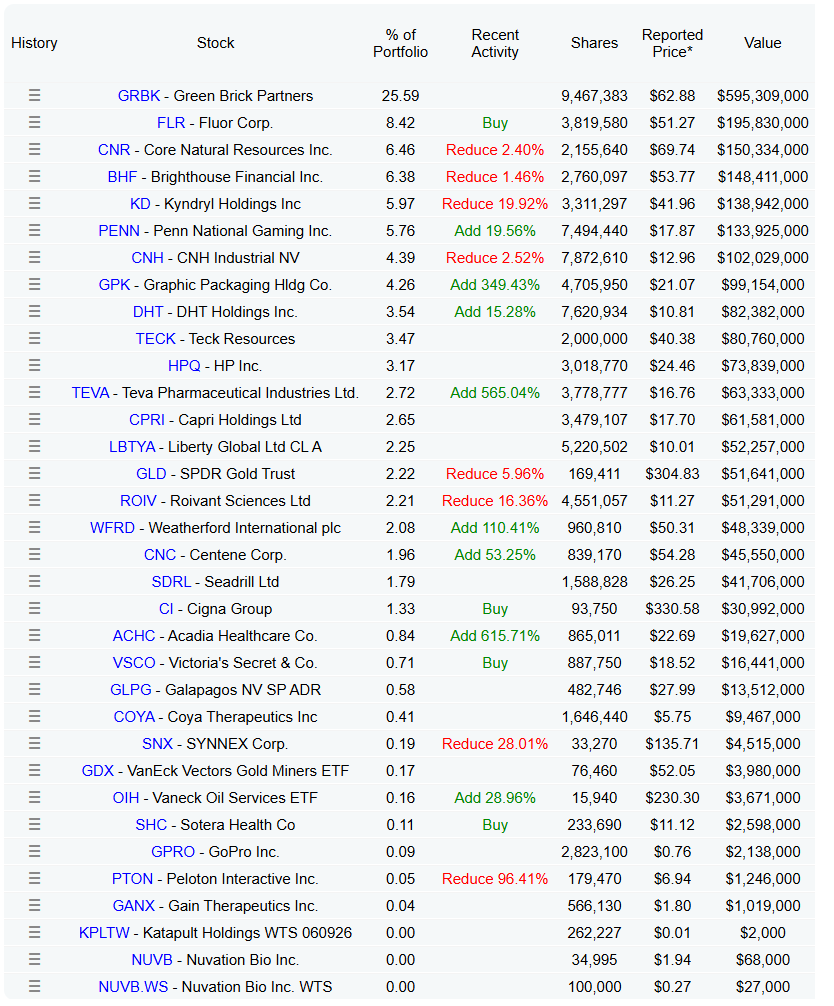

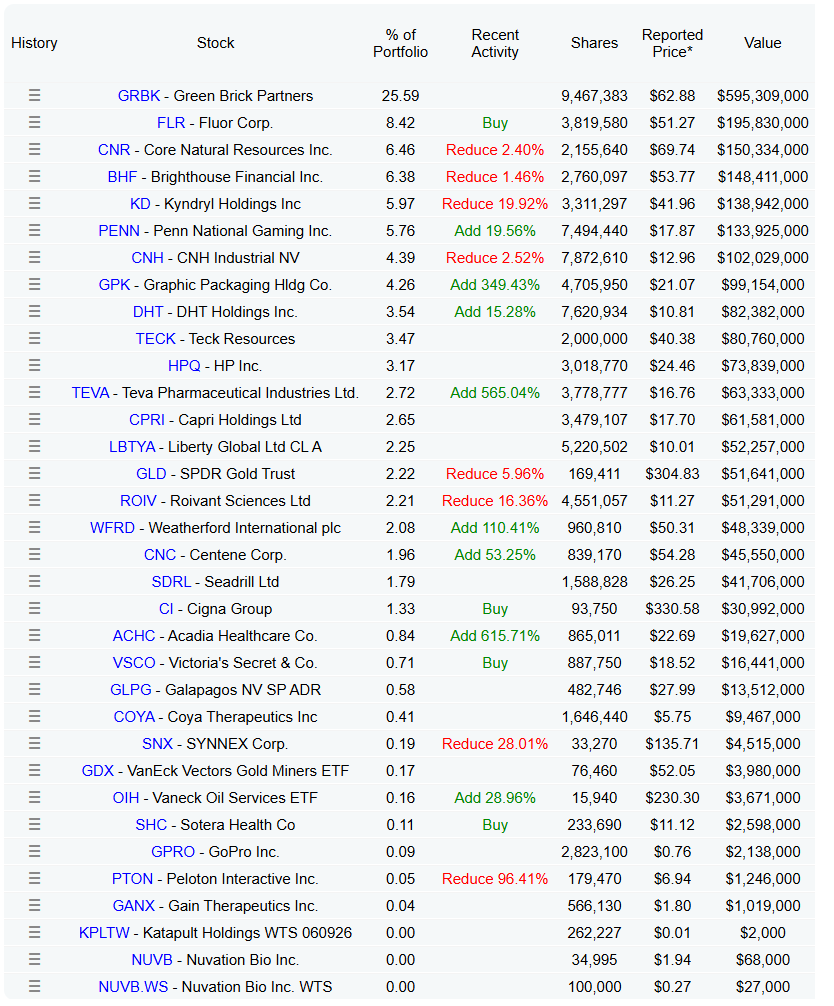

David Einhorn – Greenlight Capital

Portfolio Tilt: Tactical clarity

New: $FLR, $CI, $VSCO, $SHC

Adds: $TEVA, $GPK, $WFRD

Exit: $DLTR

Reductions: $PTON, $SNX, $KD

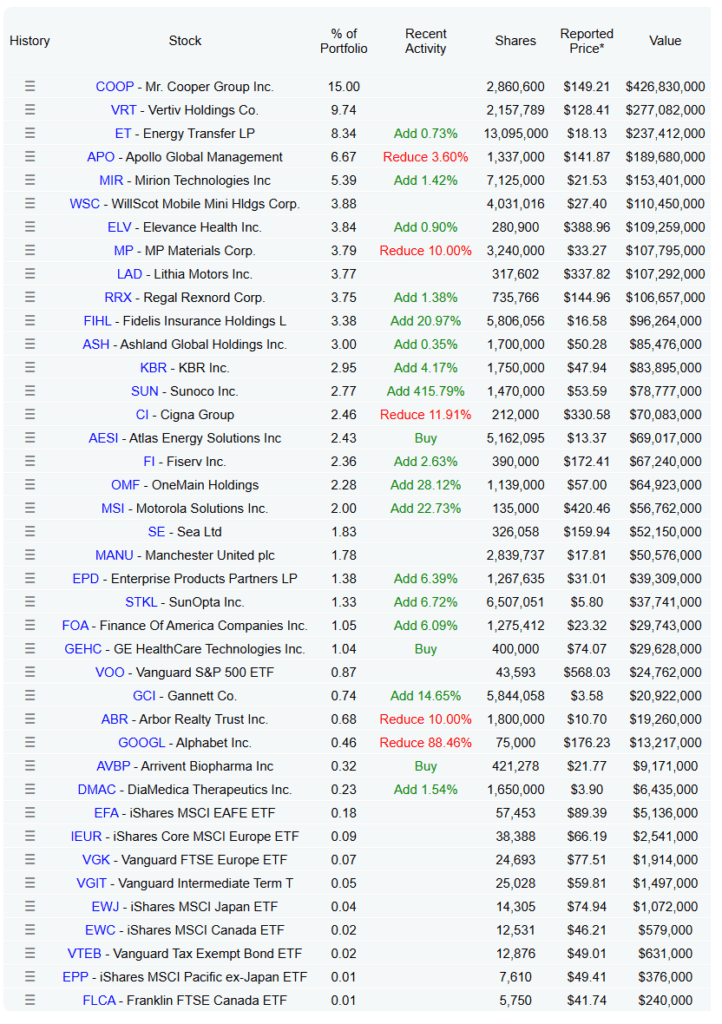

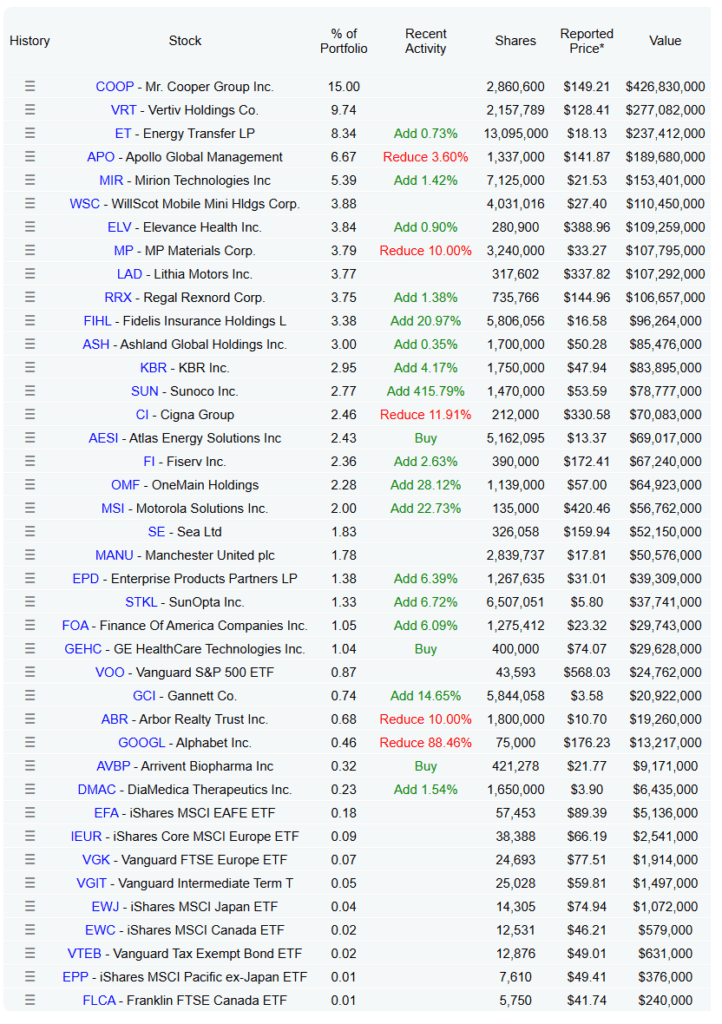

Leon Cooperman – Omega & Related Funds

Portfolio Tilt: Focused refinement

Adds: $GEHC, $AESI

Exits: $LVS, $MSFT

Reductions: $GOOGL, $MP, $CI

David Tepper – Appaloosa Management

Portfolio Tilt: Strategic reorientation

New: $INTC, $RTX, $IQV, $UAL, $DAL, $WHR, $GT, $MHK

Exits: $AAPL PUT, $AVGO, $EXEEL, $LVS, $SPYX PUT, $SMH PUT, $WYNN

Top Adds: $UNH, $NVDA, $TSM, $XYZ

Top Cuts: $BABA, $PDD, $FXI, $ORCL

Starboard Releases 13F: Increases: $KVUE, $DSK, $AQN, $ALIT, $CRM, $ROG Decreases: $MTCH, $HR, $IJH, $PFE, $RIOT, $GDOT, $FTRE, $GDDY, $WIX New Stakes: $BDX, $TRIP

Superinvestor Portfolio Stats: Big Tech Still Rules, but Rotations Are Underway

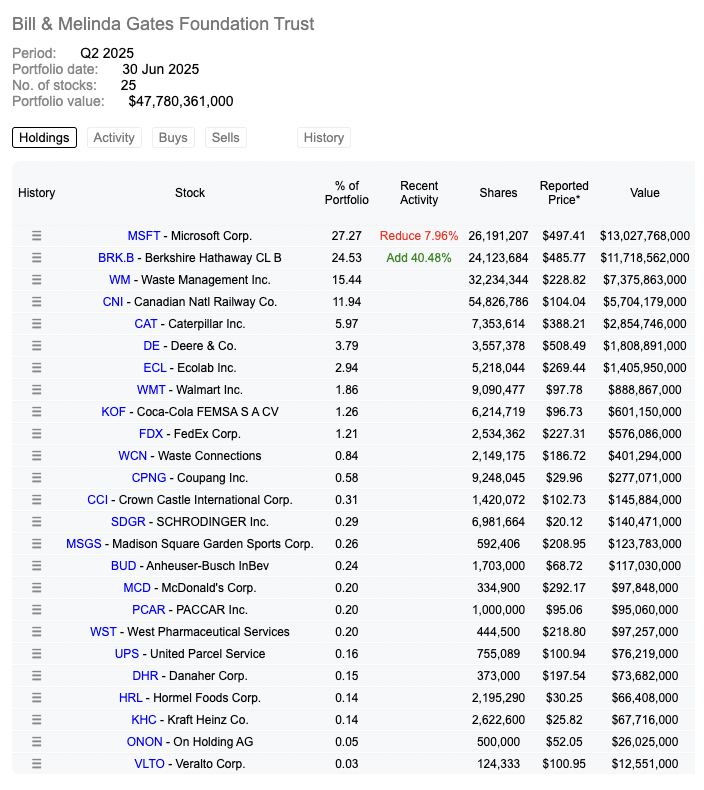

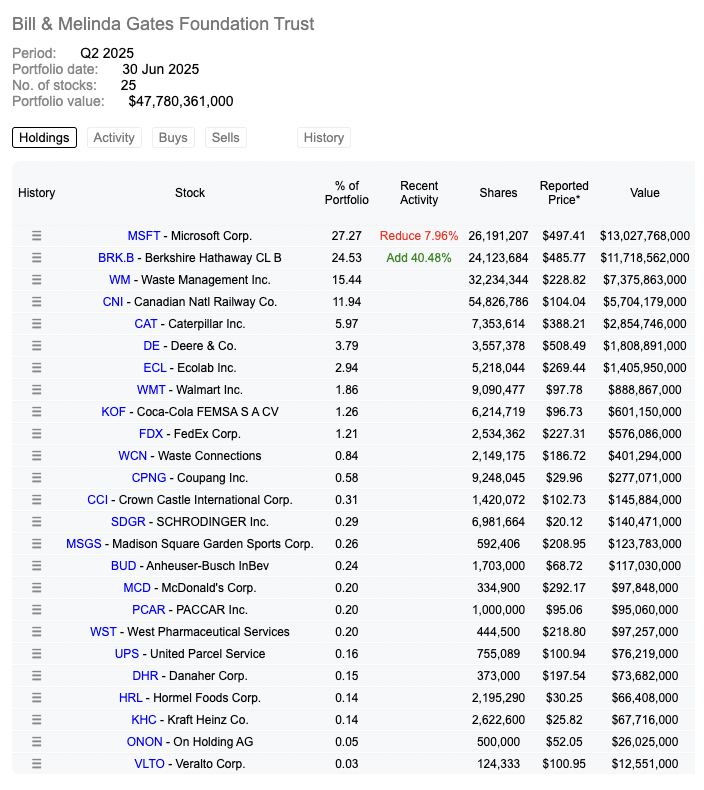

The latest Q2 2025 13F filings confirm one thing — big tech dominance isn’t going anywhere. Microsoft ($MSFT), Alphabet ($GOOGL), Meta ($META), Amazon ($AMZN), and Apple ($AAPL) remain at the top of both the most-owned and highest portfolio weight rankings. But beneath the surface, there’s plenty of movement.

The Top 10 Most Owned Stocks chart shows familiar names across tech, consumer, and finance — a sign that superinvestors still anchor their portfolios in proven market leaders. The Top 10 by % Allocation list, however, reveals a few outliers like Carvana ($CVNA), which surged into the rankings thanks to high-conviction positions from select managers.

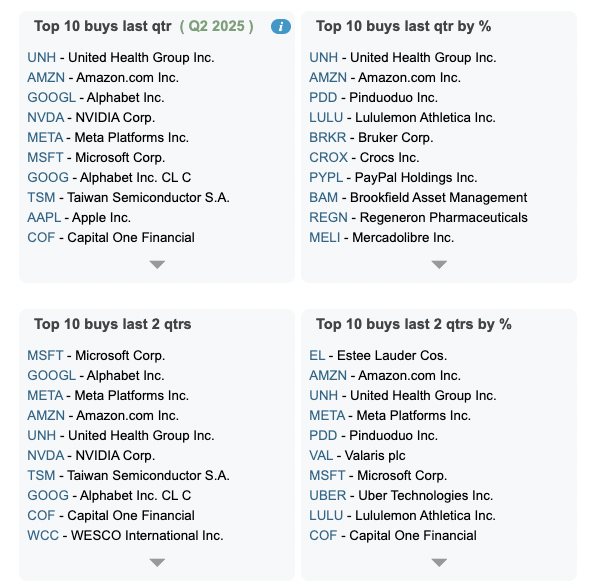

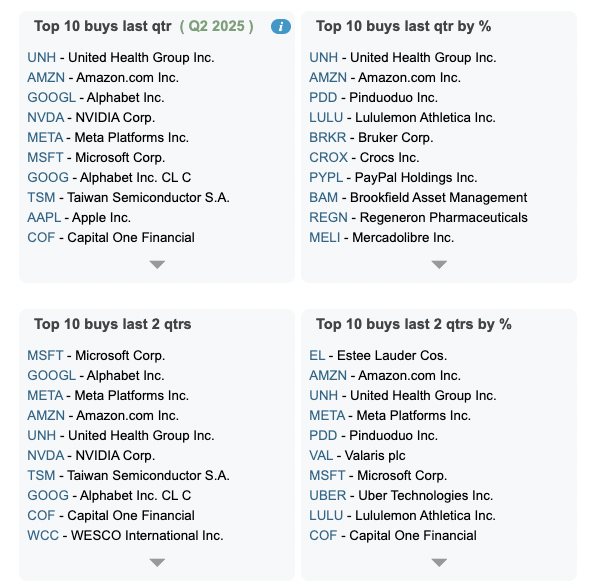

Q2 2025 Buying Trends: From Steady Blue-Chips to Aggressive Growth Bets

The Top Buys of Q2 2025 reveal strong inflows into UnitedHealth Group ($UNH), Amazon ($AMZN), Pinduoduo ($PDD), Lululemon ($LULU), and Bruker ($BRKR). By dollar volume, Amazon and UnitedHealth dominated the quarter, while niche plays like Crocs ($CROX) and Regeneron ($REGN) saw sharp percentage increases in investor conviction.

Looking at the past two quarters combined, Microsoft and Alphabet continue to attract steady buying interest, while energy plays like Valaris ($VAL) and turnaround bets like Uber ($UBER) have also gained traction.

Top 10 Stocks Most Sold – Q2 2025

- Apple (AAPL) – Berkshire Hathaway offloaded around 20 million shares, lowering its stake by approximately 6.7% and generating roughly $4 billion in sales.

- Bank of America (BAC) – The firm reduced its holdings by around 26 million shares, a cut of roughly 4.2%.

- Charter Communications (CHTR) – Berkshire slashed this position by nearly 46.5%, exiting a substantial chunk of its stake.

- T-Mobile (TMUS) – Fully exited by Berkshire in Q2, a clean divestment of its multi-billion-dollar position.

- DaVita (DVA) – Marked among top positions reduced, with Berkshire trimming its exposure.

- Meta Platforms (META) – Saudi Arabia’s Public Investment Fund (PIF) fully divested its holdings in Meta in Q2.

- Shopify (SHOP) – PIF also sold its entire position in Shopify during Q2.

- PayPal (PYPL) – Another full exit by PIF, as part of a broad retreat from key U.S. tech stocks.

- Alibaba (BABA) – PIF divested its stake in Alibaba as well during the quarter.

- FedEx (FDX) – PIF ended its investment in FedEx, completing its strand of divestitures in Q2.

What These Sales Mean

- Berkshire Hathaway continues shedding mature and high-cap positions—especially in tech and financials—suggesting a strategic rotation away from past holdings.

- Saudi Arabia’s PIF sharply pivoted away from U.S. consumer and tech equities, likely reallocating capital toward strategic sovereign investments and growth sectors at home.

What These Moves Signal

The Q2 filings paint a vivid picture:

- Buffett’s steady add-ons show continued confidence in select blue-chips and energy.

- Ackman and Loeb are leaning into growth sectors like tech and services.

- Tepper and Burry remain contrarians, repositioning heavily amid macro shifts.

- Cooperman, Einhorn, and Tiger Global appear laser-focused on high-conviction plays and trimming non-core exposure.

Q2 2025 shows that while big tech remains the backbone of superinvestor portfolios, there’s an undercurrent of strategic rotation — into health care, consumer growth stories, and select contrarian bets. The mix suggests managers are preparing for a market where defensive strength, secular growth, and opportunistic plays all matter.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.