After last week’s brutal jobs report and Trump’s firing of the labor stats chief, investors face a tense week packed with earnings, Fed speeches, and fresh trade and inflation signals.

Markets are entering the new week on edge after Friday’s dramatic selloff, which delivered the worst one-day loss in months for major indexes. The S&P 500 dropped 2.41%, the Nasdaq fell 2.21%, and the Dow plunged 2.92%, while the small-cap Russell 2000 tanked 4.20%.

The trigger? A dismal July jobs report, shocking 258,000-job downward revisions for May and June, and President Trump’s unprecedented firing of the BLS commissioner, raising alarm bells over the integrity of future economic data. (More about: Job Numbers Drama Explodes, Economists Warn of Crisis Ahead) Combine that with the new Trump tariffs taking effect on August 7, and this week’s events could be pivotal for market direction.

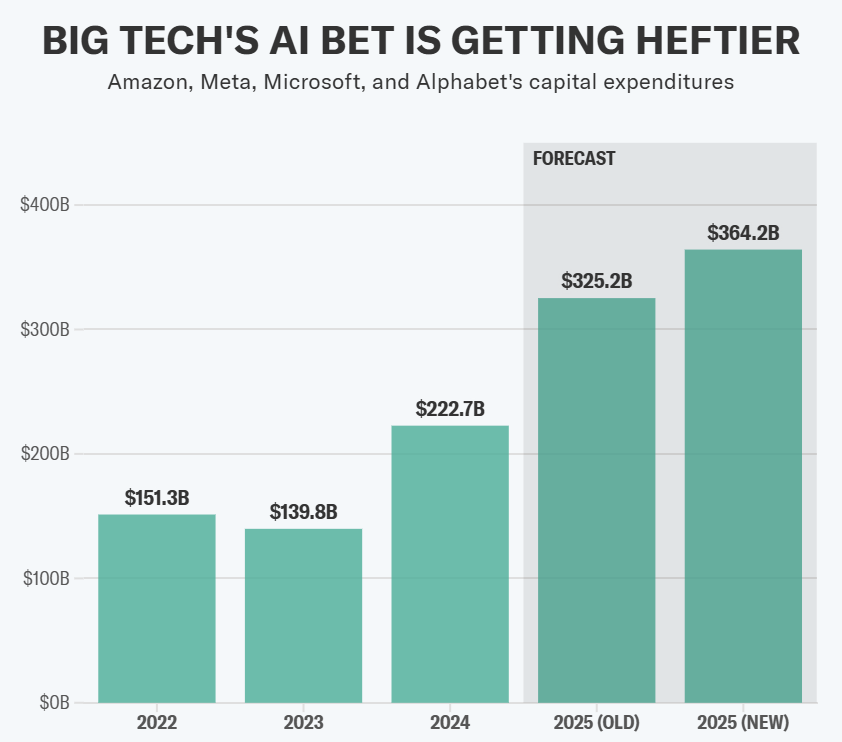

AI Still a Key Market Driver

Despite Friday’s sell-off, analysts say the AI boom remains intact. Capital Economics argues the dip is “overdone,” noting Big Tech’s strong earnings and continued heavy investment. “Hyperscalers are still all-in on AI,” wrote economist James Reilly, keeping the outlook positive for tech-heavy equities.

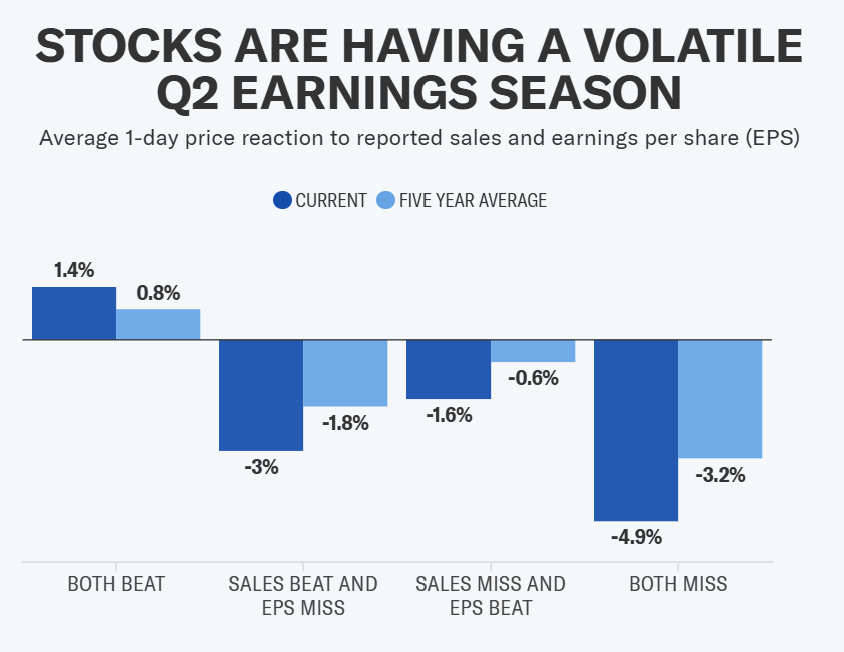

Earnings Volatility Remains High

With two-thirds of S&P 500 companies having reported, earnings growth is tracking at 10.3%, up from 5% in late June (FactSet). But individual stock moves have been sharp: Meta surged 12% on a beat, while Novo Nordisk plunged 20% after cutting guidance. Evercore ISI’s Julian Emanuel notes that S&P 500 stocks missing both sales and EPS estimates are now dropping 4.9% on average, well above the 5-year norm. Investors are clearly punishing anything less than perfect.

Markets now turn to a quieter economic calendar, but a packed earnings slate and policy news flow keep volatility in play. With 122 S&P 500 companies reporting, including tech names like Palantir and AMD and consumer giants like Disney and Uber, sentiment remains fragile.

Markets are watching everything this week.

5 Key Themes to Watch This Week

1. AI and Chip Stocks Under Pressure

Palantir (PLTR) kicks off earnings Monday, with investors watching how government contracts and AI hype translate into revenue.

AMD (Tues) is in the spotlight as Wall Street weighs whether its new MI350 chips can compete with Nvidia and if AI demand can keep powering semiconductor stocks higher.

2. Consumer Spending Test: Disney, McDonald’s, Uber

Earnings from McDonald’s, Uber, and Disney (all Wednesday) will test the health of US consumer sentiment amid sticky inflation and shaky job growth.

Watch for signs of pressure on middle-income households, weak travel demand, or pullbacks in streaming subscriptions.

3. Trump’s Tariffs Go Live

The new tariff rates take effect Wednesday (Aug 7), covering dozens of countries.

Investors will monitor which companies flag cost pressures on earnings calls — especially those with global supply chains (retail, autos, tech hardware).

4. Fed Watch: Speeches After the Storm

After two Fed officials dissented in favor of rate cuts last week, markets will parse new speeches from Mary Daly, Raphael Bostic, and Alberto Musalem for signs of a shift in tone.

Rate cut odds for September jumped to 85%, but if inflation or trade shocks escalate, the Fed could stay cautious.

5. Data Integrity & Market Trust

With Trump firing BLS chief Erika McEntarfer after criticizing “phony” job data, economists and investors fear a long-term credibility issue.

Bond markets will be particularly sensitive, especially during this week’s Treasury auctions.

Weekly Economic & Earnings Calendar

| Date | Event / Data | Notable Earnings | Fed Speakers |

|---|---|---|---|

| Mon, Aug 4 | Factory Orders (June) | Palantir (PLTR), Vertex (VRTX), Axon (AXON) | — |

| Tues, Aug 5 | US Trade Deficit (June) ISM Services PMI (Jul) S&P Services PMI (final) | AMD, Pfizer, Caterpillar, Amgen, Arista Networks, BP | — |

| Wed, Aug 6 | — | Disney, McDonald’s, Uber, Novo Nordisk, Airbnb, Sony, DoorDash, Shopify | Mary Daly (SF Fed) |

| Thurs, Aug 7 | Initial Jobless Claims Q2 Productivity Wholesale Inventories Consumer Credit (June) | Eli Lilly, Gilead, ConocoPhillips, Motorola, Monster Beverage | Raphael Bostic (Atlanta Fed) |

| Fri, Aug 8 | — | — | Alberto Musalem (St. Louis Fed) |

With earnings season peaking and Trump-era policy risks intensifying, this week could mark a key turning point for markets. Will tech giants hold up under macro pressure? Will Fed speakers soothe markets, or signal a deeper rift inside the central bank? And will Trump’s data war shake investor trust?

One thing is certain: volatility is back, and every number, speech, and chart is about to matter a lot more.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years