President Donald Trump just opened a new front in his trade and economic war—this time targeting pharmaceutical giants with aggressive pricing mandates and fresh import tariffs. The moves are designed to lower drug costs in the US, but they’re already rattling markets, sparking industry backlash, and raising global supply chain concerns.

If you think this is just political posturing, think again. Here’s what just happened—and what it means next.

Two Fronts, One Message: Lower Prices, Or Else

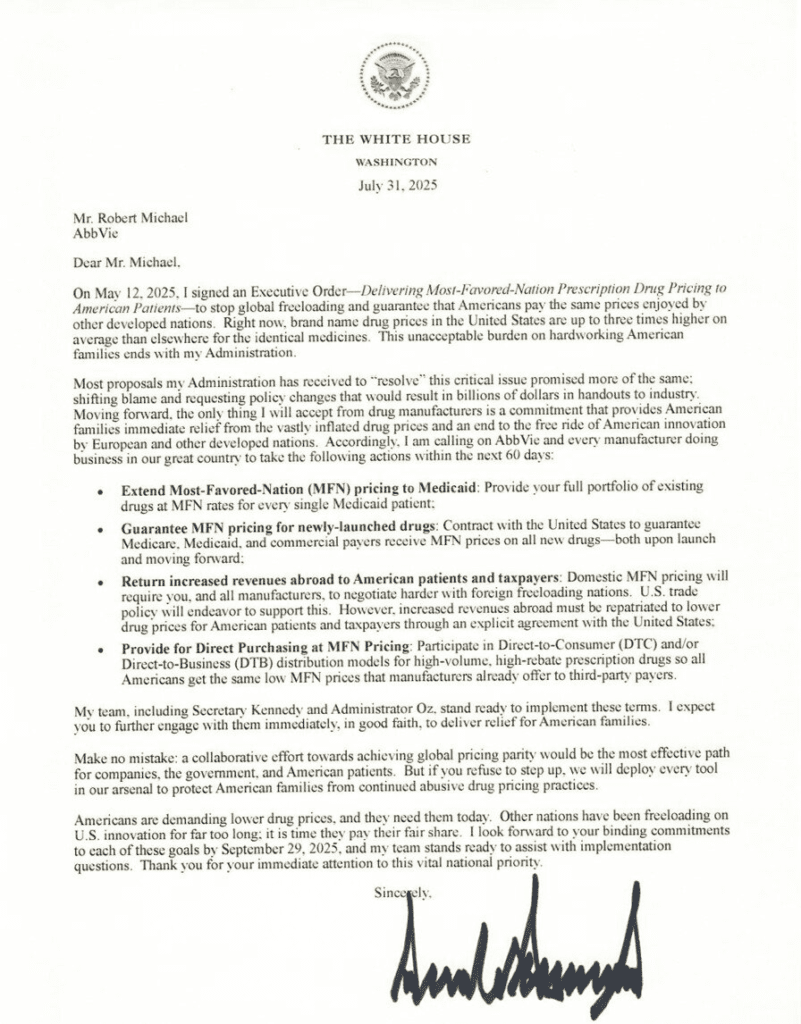

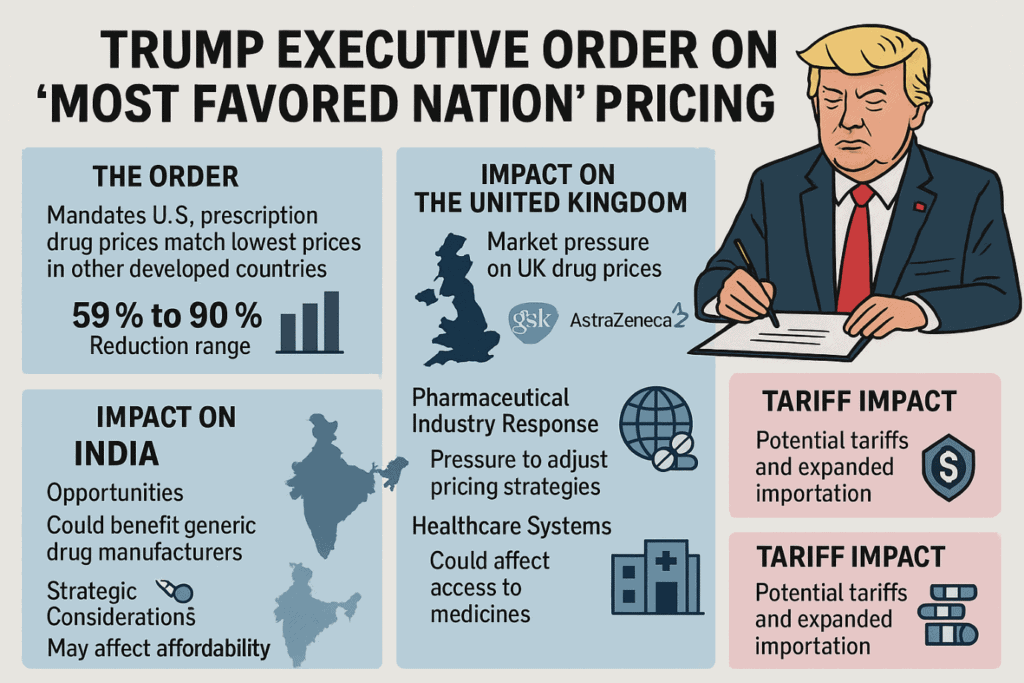

First, Trump sent formal letters to 17 top pharmaceutical CEOs—Pfizer, Merck, Johnson & Johnson, Eli Lilly among them—demanding that they immediately offer “Most-Favoured-Nation” pricing. That means matching the lowest global price for any drug sold in the US. And he’s not giving them much time: they have until September 29 to respond with binding commitments.

“If you refuse to step up,” Trump wrote, “we will deploy every tool in our arsenal.”

This pressure follows his May 2025 executive order on drug pricing, but this time he’s going directly after the companies—publicly and aggressively.

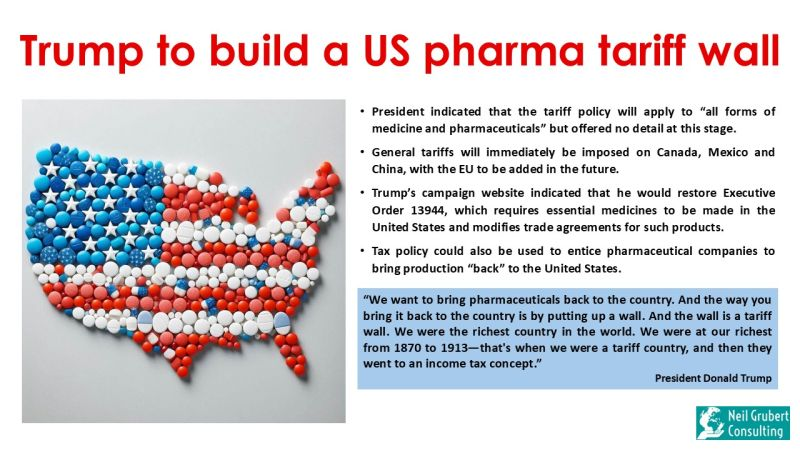

At the same time, the White House confirmed what had been feared for weeks: a 15% tariff on European pharmaceutical imports. That tariff kicks in next month as part of Trump’s broader reciprocal trade push. It’s lower than the 200% tariff previously floated—but still a major shock to the system.

The Tariff Side: Why Europe Is in the Crosshairs

Europe exports nearly half of the active pharmaceutical ingredients used in the US. That means any new tax on imported drugs—especially from the EU—won’t just hit foreign companies. It could disrupt access, raise prices, and create headaches for US healthcare systems that rely on overseas manufacturing.

PhRMA, the main industry lobby, responded fast: “These actions threaten the affordability and availability of life-saving medications.”

White House officials say certain generic drugs will be exempt, but haven’t said which ones. The EU has hinted at reciprocal moves, while the pharmaceutical supply chain is bracing for weeks of turbulence.

Winners and Losers in Pharma Stocks

Trump’s 15% tariff announcement sent a wave of volatility across the pharmaceutical sector on Thursday, with investors scrambling to reassess which companies stand to lose—and which may quietly gain. The NYSE Arca Pharmaceutical Index fell nearly 3%, reflecting deep market unease, while individual stocks like Eli Lilly ($LLY), Pfizer ($PFE), Merck ($MRK), and Gilead Sciences ($GILD) dropped between 1.5% and 5% during the session.

But beyond the knee-jerk reaction, analysts are beginning to draw a clear line between structural winners and losers under the new trade regime.

The Hardest Hit: EU-Heavy Drugmakers

At the top of the risk pile are European-based pharmaceutical giants such as:

- Novartis ($NVS)

- Roche ($RHHBY)

- GlaxoSmithKline ($GSK)

These companies are highly reliant on exporting drugs to the US, and the new 15% import tariff directly increases their cost to compete in the world’s largest pharmaceutical market. Analysts warn that this will compress margins, threaten market share, and may even trigger production shifts over time. TD Cowen’s Steve Scala emphasized that even a moderate tariff like this could eat into free cash flow and force firms to rethink their global manufacturing strategies.

Retaliatory risks are also in play. With Brussels already signaling potential countermeasures, these EU-based firms may find themselves caught in a politicized pricing war.

Also in the Crosshairs

Some US firms may not be directly targeted by tariffs but still face indirect pressure:

- Biogen ($BIIB) and Amgen ($AMGN): Analysts, including Jefferies’ Michael Yee, have flagged these firms due to their international tax structures and overseas production hubs. If the White House escalates its push to punish “profit shifting” abroad, these companies could be vulnerable.

- Pfizer ($PFE) and Merck ($MRK): Despite being headquartered in the US, both have substantial global manufacturing and supply chains, leaving them more exposed to trade frictions and rising compliance risks.

Structurally Better Positioned: U.S.-Centric Players

In contrast, a handful of US-based drugmakers appear relatively insulated from the immediate impact of Trump’s tariffs. These include:

- AbbVie ($ABBV)

- Bristol Myers Squibb ($BMY)

- Eli Lilly ($LLY)

What sets these companies apart is their heavy U.S. manufacturing footprint. With much of their production based domestically, they aren’t subject to import tariffs. This gives them a natural buffer against the new costs that European rivals will now face.

In addition to this geographic advantage, these companies could see indirect benefits:

- As tariffs increase EU competitors’ costs, domestic firms may gain market share.

- Their lower exposure to retaliatory action or EU currency volatility also makes them more stable in a shifting policy environment.

Even though shares of $LLY and $ABBV declined with the broader market on Thursday, analysts caution that this is likely a short-term reaction to sector-wide uncertainty, rather than a reflection of long-term fundamentals.

The Ireland Factor: Ireland has come under specific criticism from Trump for its low corporate tax rates and dominance in global drug exports. In 2024 alone, Ireland exported nearly $50 billion worth of medicines to the US, making it one of the most exposed regions under the new tariff regime. Any action targeting tax havens or EU trade preferences will likely have outsized ripple effects on companies operating from Ireland—many of which include the big names above.

While almost every pharma stock took a hit on Thursday, analysts are not treating them equally. The market is beginning to price in which companies will bear the brunt of these policies—and which may quietly benefit.

The dividing line comes down to manufacturing geography, exposure to EU supply chains, and vulnerability to Trump’s broader “America First” economic agenda. Tariffs may just be the first step.

Can Trump Enforce It?

Legally, it’s not clear Trump can force companies to implement “Most-Favored-Nation” pricing. In his first term, courts blocked similar efforts. But the pressure alone is having an effect. CEOs are weighing concessions, new discount programs, and public messaging to deflect blame if prices stay high.

Pfizer released a cautious statement: “We’re committed to working with the administration to improve access and affordability.”

Analysts say behind-the-scenes negotiations are already underway—but few expect companies to fully comply without a legal fight or Congressional action.

What Comes Next?

- September 29: Deadline for drugmakers to respond to Trump’s pricing demands.

- August: EU pharma tariffs go live, with further action possible against India or China.

- Fall 2025: More clarity expected on supply impacts, R&D shifts, and possible retaliatory tariffs from Europe.

Some believe this is just the beginning. Trump’s team has floated Section 232 tariffs on other foreign drug sources and hinted at further executive actions targeting the medical supply chain. For now, the message from the White House is simple:

You want access to the US market? Lower your prices—or pay up.p

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years