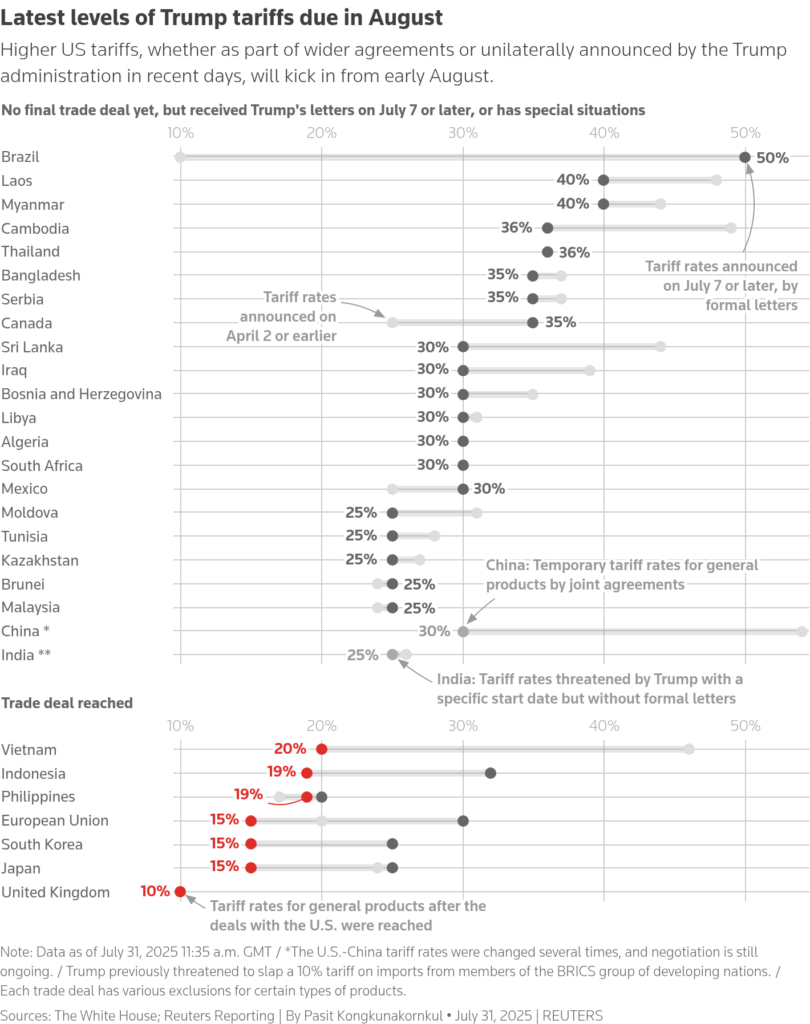

Markets around the world woke up to the full force of President Donald Trump’s new global tariff regime, which officially went into effect late Thursday. The White House imposed fresh duties ranging from 10% to 41% on imports from dozens of countries. Notably:

- Canada: 35% tariff across non-USMCA goods

- India: 25%

- Taiwan: 20%

- Thailand: 19%

- Switzerland: 39%, one of the steepest

Mexico received a 90-day reprieve, while the EU, Japan, and South Korea were spared after recently clinching trade deals.

Trump also reintroduced a global minimum tariff of 10% and issued a reminder that baseline duties for non-compliant trade partners could escalate further.

More about: Trump Imposes New Global Tariff Rates, Effective August 7

Adding to the trade complexity, Trump’s new order includes 15% tariffs on pharmaceutical imports from the EU and India, reigniting debate over global drug prices. The pharmaceutical sector slid across European and Indian markets, with companies bracing for higher US entry costs.

Despite the sweeping action, the market reaction was muted, with many investors suggesting the worst-case tariffs feared back in April had not materialized. Still, Asia saw red:

- South Korea’s KOSPI dropped 3.4%

- Taiwan down nearly 1%

- MSCI Asia ex-Japan fell 0.7% for the 6th straight session

European markets opened softer, with Euro Stoxx 50 futures slipping 0.3%.

Amazon Falls, Apple Rises as Tech Sentiment Splits

Amazon delivered a solid quarter, beating expectations on revenue, AWS growth, and ad performance. Yet a wide guidance range for the current quarter rattled investors, triggering a sharp sell-off after hours.

Apple, on the other hand, impressed with its best revenue growth since 2021. Strong iPhone sales and a 13% YoY jump in China helped lift sentiment. CEO Tim Cook addressed AI concerns directly, promising major investments and openness to acquisitions that support Apple’s roadmap.

Together, the two giants highlight a growing divide in tech: investors want near-term clarity—not just long-term AI promises.

Cautious Tone Ahead of Key US Jobs Report

Markets are treading water ahead of today’s critical nonfarm payrolls report. Analysts expect 110,000 jobs added in July, with unemployment ticking up to 4.2%. After Wednesday’s FOMC hold and Thursday’s hotter inflation data, traders see just a 39% chance of a Fed cut in September, down from 65% a week ago.

The report could swing sentiment significantly—either reviving dovish hopes or cementing a hawkish Fed stance.

Global Snapshot

| Asset Class | Latest | Trend |

|---|---|---|

| US 10Y Treasury | 4.37% | ↔ Steady |

| Dollar Index (DXY) | 100.1 | ↑ Best week since 2022 |

| USD/JPY | 150.7 | ↑ Highest since March |

| Gold | $3,286/oz | ↔ Flat |

| WTI Crude Oil | $69.36/bbl | ↔ Steady |

| Brent Crude | $71.84/bbl | ↑ Slightly higher |

Today’s Watchlist

- Economic Data:

- US Nonfarm Payrolls (8:30am ET)

- ISM Manufacturing (10:00am ET)

- Eurozone Flash CPI (expected 1.9% YoY)

- Earnings Before Market:

- Moderna, Exxon, Chevron, Regeneron, Enbridge

- No major earnings after market close

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years