The US stock market enters the final days of July with a historic rally, but a flurry of economic and corporate events in the week ahead could challenge the optimism. The S&P 500, Nasdaq, and Dow all closed at record highs last week, fueled by strong earnings, resilient economic data, and receding fears over Trump’s trade wars. But with key inflation readings, labor reports, and earnings from Apple, Amazon, Microsoft, and Meta, investors may soon be forced to reconcile sentiment with fundamentals.

“This is likely the most consequential week of the summer,” said Josh Schafer of Yahoo Finance. “You’ve got central bank policy, jobs data, GDP, and over 160 S&P 500 companies reporting earnings. That’s a lot of risk to price in.”

1. Federal Reserve Meeting: No Cut Expected, But Tone Matters

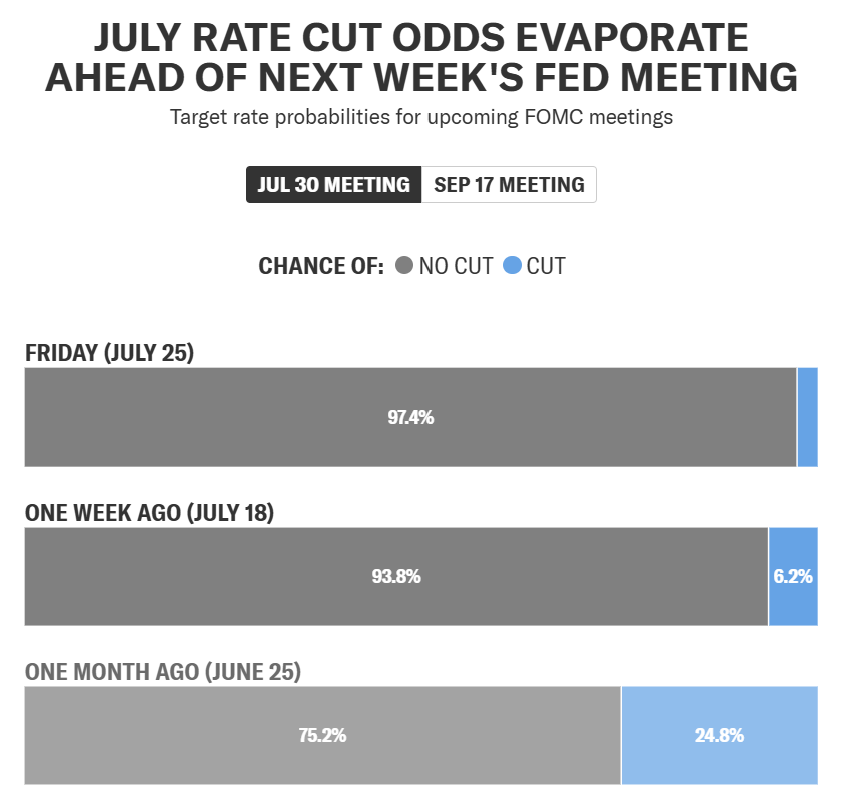

The Fed’s July policy meeting is set for Wednesday, and markets overwhelmingly expect no change to interest rates. According to the CME FedWatch Tool, odds of a cut this week are just 3%, though a 64% chance of a cut by September remains in play.

The real focus will be on the tone of the statement and dissent within the Fed. JPMorgan’s Michael Feroli said that any dissent should be read more as “auditioning for the Fed chair job” than reflecting a major policy shift.

“We think the Fed will remain patient and data-dependent,” said BNP Paribas’ Andrew Husby. “Policy is likely to stay on hold through year-end unless inflation or labor data dramatically change.”

2. Big Tech Earnings: Spotlight on AI & Spending

The earnings spotlight will fall on four of the “Magnificent Seven”:

- Microsoft and Meta report Wednesday

- Apple and Amazon follow on Thursday

With Alphabet already raising its capex outlook by $10 billion to $85B for 2025, investors will scrutinize whether other tech giants are ramping up AI infrastructure and cloud investments—or pulling back.

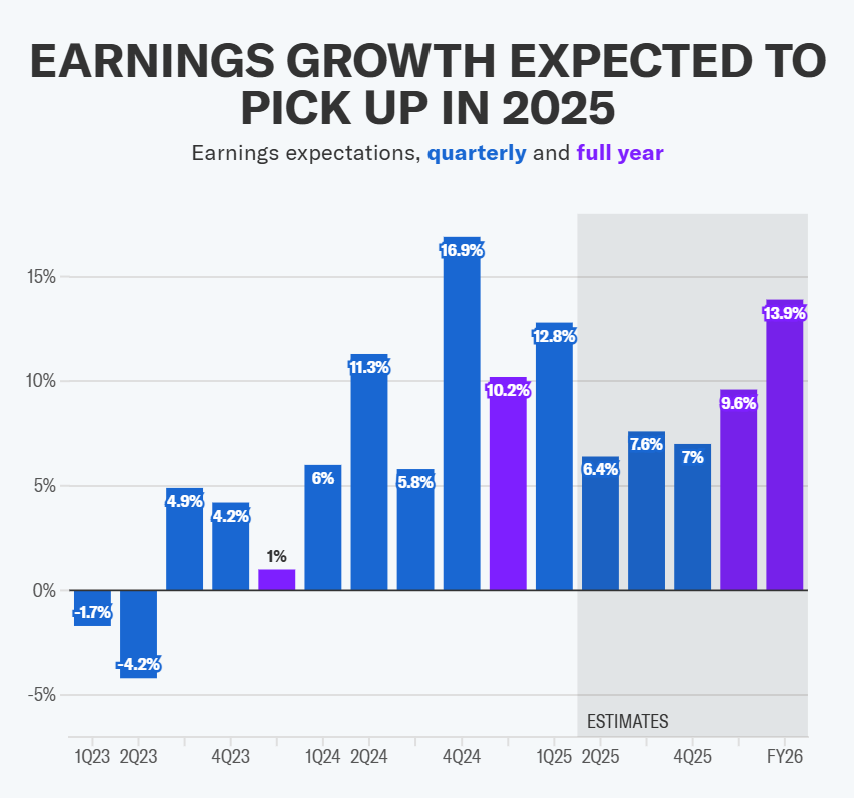

“Investors want to see how AI spend is translating into revenue and margin expansion,” said Citi’s Scott Chronert. “So far, beat-and-hold guidance has been enough to push markets higher, but how long can that last?”

Other major names reporting this week include Qualcomm, Coinbase, Starbucks, Ford, Visa, Chevron, and ExxonMobil.

More about: Wall Street Keeps Breaking Records, But Big Tests Are Looming

3. Economic Data Dump: GDP, PCE, and Labor Market in Focus

A wave of economic reports will hit before and after the Fed:

- Wednesday: Q2 GDP (expected +3.0% after Q1’s -0.5%)

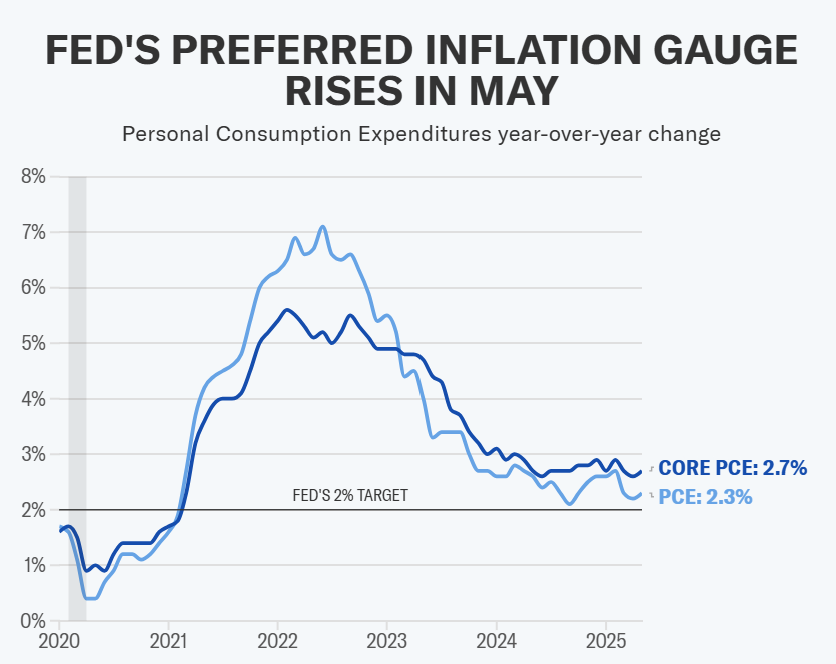

- Thursday: Core PCE inflation (Fed’s preferred gauge, expected +0.3% MoM, +2.7% YoY)

- Friday: July jobs report (101,000 jobs expected, unemployment seen ticking up to 4.2%)

This trifecta could determine not just the Fed’s September move, but also investor expectations on growth resilience.

“If GDP rebounds and inflation stays sticky, the Fed could push back against rate cut bets,” noted ING’s James Knightley. “But a weak jobs print might tip the balance toward September easing.”

4. Euphoria Meets Reality: Is the Market Overheating?

Despite macro uncertainties, the S&P 500 has gained over 1.5% in the past week alone, with tech and speculative names leading the charge.

Goldman Sachs warns that its “speculative trading indicator” is flashing red—hovering just below levels seen during the dot-com bubble and the 2021 SPAC frenzy. It measures volumes in unprofitable stocks, penny stocks, and high-P/S companies.

“These levels have historically signaled strong short-term gains, but poor medium-term outcomes,” said Goldman strategist Ben Snider.

The return of meme stocks, soaring crypto bets, and AI hype have all contributed to this melt-up, raising questions about whether fundamentals are being left behind.

Weekly Market Calendar: What to Watch

| Day | Economic Events | Key Earnings | Key Tickers |

|---|---|---|---|

| Monday | Dallas Fed Manufacturing | Tilray, Whirlpool, Waste Management | $TLRY, $WHR, $WM |

| Tuesday | JOLTS, Consumer Confidence, Home Price Index | Boeing, PayPal, Starbucks, Visa, Spotify, P&G, UPS, SoFi, UnitedHealth, Booking Holdings | $PYPL, $SOFI, $SPOT, $UNH, $PG, $BA, $UPS, $V, $SBUX, $BKNG |

| Wednesday | Fed Decision, Q2 GDP (est. +3.0%), ADP Private Payrolls | Meta, Microsoft, Qualcomm, Ford, Robinhood, Etsy, Hershey, Virtu, Teva, Altria, Arm, Carvana | $VRT, $ETSY, $HSY, $MSFT, $META, $HOOD, $QCOM, $ARM, $CVNA, $F, $EBAY |

| Thursday | Core PCE, Personal Income & Spending, Jobless Claims | Apple, Amazon, Coinbase, Reddit, Roku, CVS, Mastercard, AbbVie, Roblox, Norwegian Cruise Line | $MA, $ABBV, $RBLX, $AMZN, $AAPL, $COIN, $MSTR, $RDDT, $NET, $ROKU, $FSLR, $RKT |

| Friday | Nonfarm Payrolls (est. +101K), Unemployment (est. 4.2%), ISM PMI Consumer Sentiment (University of Michigan) | ExxonMobil, Chevron, Colgate-Palmolive, Regeneron, T. Rowe Price, Fluor | $XOM, $CVX, $CL, $REGN, $TROW, $FLR |

With equities riding high and optimism back in full swing, the market is entering a high-risk, high-reward week. Investors will be looking for clarity from the Fed, confirmation from Big Tech, and stability in labor and inflation data. Any surprises—good or bad—could jolt sentiment as August kicks off.

“We’re at a point where good news has been priced in,” said Chronert. “Now the question is: can reality keep up?”

Related:

Wall Street Keeps Breaking Records, But Big Tests Are Looming

Tariff Shock Incoming: Trump’s August 1 Deadline to Hike Prices on Food, Clothing, and Cars

Hottest Business Strategy This Summer Is Buying Crypto

Accidental King of Meme Stocks: How a Canadian Hedge Fund Manager Sparked 2025’s Retail Rebellion