In a quiet suburb north of Toronto, Eric Jackson sits in a modest home office — not a Wall Street high-rise — staring at the blinking screens of a hedge fund that nearly disappeared two years ago. His fund, EMJ Capital, once managed over $20 million. In 2022, that number dropped by 99%, battered by the tech crash, a fleeing anchor investor, and mounting operating costs.

Now, in 2025, Jackson finds himself at the center of a financial phenomenon that’s sweeping retail trading once again.

And it all started with a 70-cent stock.

The Bet That Changed Everything

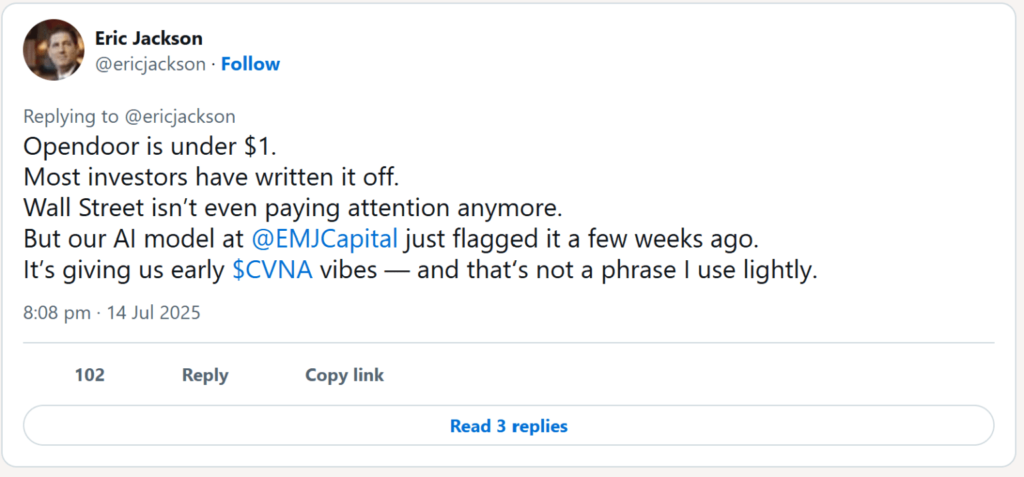

In late June, Opendoor Technologies (OPEN) — a once-hyped real estate disruptor — was trading for less than a dollar. Most investors had written it off. But Jackson saw something else: tailwinds, and a market bottom.

So, he bought back in.

Then he tweeted. Then Reddit found him. And then the stock exploded 312% in six sessions (between July 14 and 21)

What followed was a scene straight out of 2021. Options activity spiked. Opendoor’s name trended on WallStreetBets. Meme accounts began pasting Jackson’s face onto Roaring Kitty, the infamous hero of the GameStop saga. Even Jackson was stunned.

“I never expected it to be called a meme stock,” he said. “I think Opendoor is a real business.”

From Obscurity to Infamy

Jackson had been here before—almost.

Back in 2014, he captured Wall Street’s attention with a 99-page activist pitch targeting Yahoo’s then-CEO Marissa Mayer. He called for her ousting, which ultimately came in 2017 after Yahoo’s sale to Verizon. But after that brief moment in the spotlight, he disappeared again — buried under market losses and investor withdrawals.

By 2023, EMJ Capital was on life support. Jackson had cut staff, downsized offices, and was running the entire operation solo from home.

“This business almost went under so many times,” he said. “I’ve just tried to keep it lean and survive.”

In 2022, he had bet big on Carvana and Opendoor. Carvana skyrocketed 1,400% — but Jackson sold too early. Opendoor collapsed 80%, and he capitulated, selling what was once his largest holding.

“It was like a divorce,” he said. “You don’t want to look at your wife’s Instagram. You don’t want to look at the chart.”

A New Meme Cycle, But Different

But the 2025 meme-stock wave is unlike the COVID-era frenzy.

By week’s end, the S&P 500 quietly closed at a record high, and the meme frenzy faded just as fast as it began. But the message was clear: this behavior isn’t abnormal anymore—it’s structural.

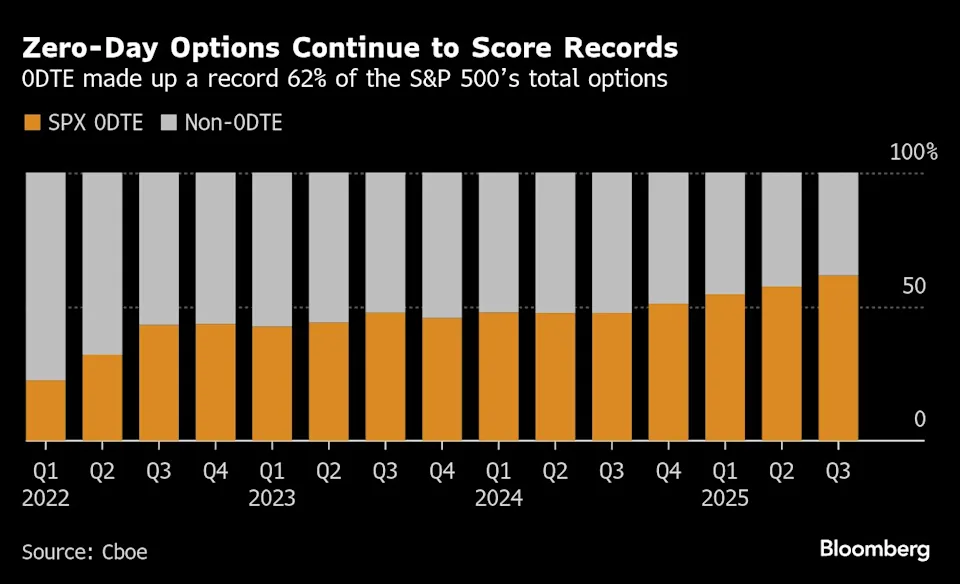

Analysts say we’ve entered a new phase, where bursts of short-dated option trading, meme coordination, and quick flips are no longer “moments” but just part of the market’s operating system. 62% of all S&P 500 options this quarter expire in 24 hours, with more than half of that activity coming from retail traders.

They’re also more ruthless: GoPro spiked 73% intraday, only to fade. Krispy Kreme popped 39%. Cipher Mining (another EMJ holding) jumped 39%. Iren Ltd. surged 25%. Kohl’s, Beyond Meat, and DNUT all joined the action — driven not by fundamentals, but by vibes.

More about: Meme Stock Trap is BACK: Why Retail Traders Are Falling for Same Trap in 2025

“We’ve normalized memeing,” said Peter Atwater, a behavioral market expert. “There’s a yawn to it now.”

The more aggressive traders? They’ve already moved on—to leveraged ETFs, crypto, prediction markets, and CCC-rated junk bonds, where returns are spicier and risk is higher. Meme stocks have become what he calls a “cultural rerun.”

“It’s like 30-year-olds dancing to music 20-year-olds used to party to,” Atwater quipped.

Meanwhile, the surge in alternative speculation continues- in just 4 weeks:

- Crypto funds took in $12.2B in the past four weeks, the biggest such inflow ever.

- Goldman’s short basket index has jumped 60% since the post–Liberation Day crash.

- CCC junk bonds are on track for seven straight weeks of gains, while the leveraged-loan market just had one of its busiest weeks ever.

Even market makers have adapted. “They know how to hedge and price for this now,” said Garrett DeSimone of OptionMetrics. In 2021, inverted call skews (a sign of bullish option buying) affected over 50% of S&P 500 stocks. This time? Just 21%.

The Meme Manager Himself

Since the Opendoor rally, Jackson has received 600+ calls and emails from would-be investors.

The irony? EMJ Capital isn’t an ETF. You can’t just buy in. And despite the attention, Jackson still hasn’t landed a major new backer.

Some investors even pulled out after Opendoor’s rise — simply because they didn’t want to be associated with “meme stocks.”

But Jackson doesn’t care. He’s back in Opendoor — this time for the long haul. He sees a path to $82 per share by 2028, and expects the company to signal profitability at its next earnings call on August 5.

“This is the hundred-bagger,” Jackson said. “Carvana didn’t save me. I sold it too early. But I’m staying with Opendoor.”

Where Does This Go Now?

The resurgence of meme trading doesn’t signal a market bubble—but it does signal a shift in power.

Retail traders aren’t anomalies anymore — they’re structural participants. They’ve survived the rate hikes, the inflation cycles, and the post-COVID crash. Now they’re flipping stocks faster than Wall Street can explain them.

“Retail really wants to be involved in this market,” said Jay Woods of Freedom Capital Markets. “And that’s bullish.”

Whether Opendoor holds or fades, Eric Jackson’s face is already etched into meme stock history—not as a joke, but as the guy who didn’t quit when everything screamed “Game Over.”

Now, he just might be getting the last laugh.

In short: the meme-stock storm has evolved into a steady climate — and the retail crowd is no longer a disruptor. They’re part of the system.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

The $OST Scam: How Nasdaq-Listed Penny Stock Wiped Out Thousands of Lives

Mystery $33 Billion Medical Fortune Collapses in Days – Regencell