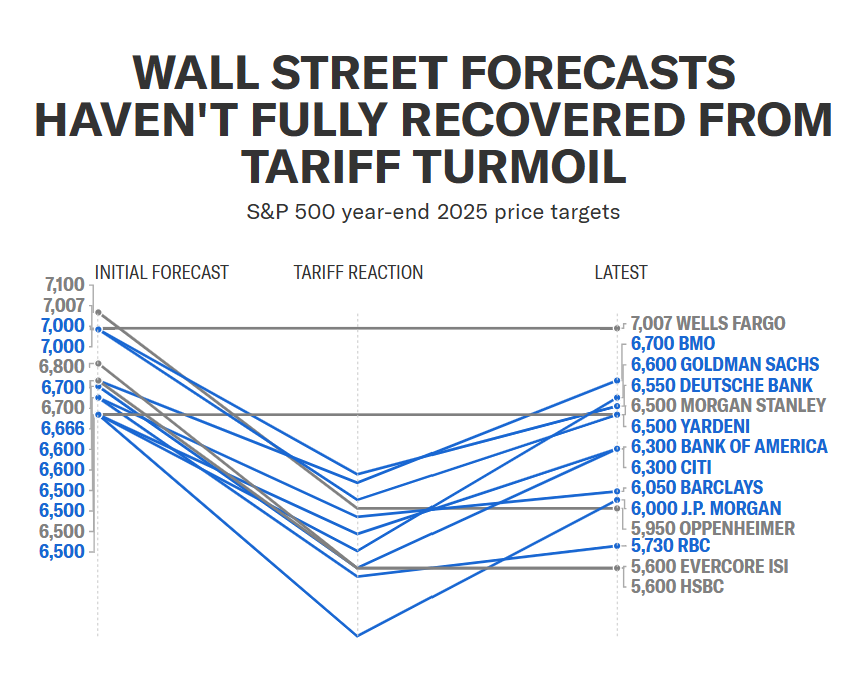

Wall Street begins the new week just shy of record highs. Still, fresh catalysts are coming fast: second-quarter earnings from the nation’s biggest lenders, June inflation data, key consumer-spending and housing figures, and a full roster of Federal Reserve speakers. Together, these releases will set the tone for the second half of July, when the Fed decides whether sticky prices and tariff uncertainty justify holding rates at 5¼ % for a fifth straight meeting.

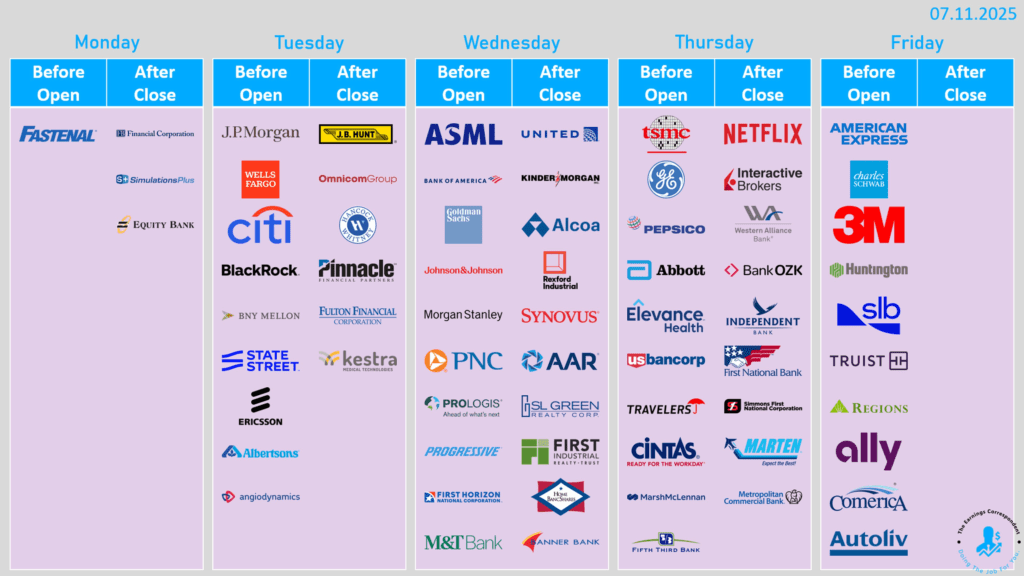

1. Earnings Season Opens With the Banks

| Day | Headline reporters | What to watch |

|---|---|---|

| Tue 15 Jul | JPMorgan Chase, Wells Fargo, Citigroup, BlackRock, State Street, BNY Mellon | Net-interest income after a full quarter of 5 %+ rates; trading and investment-banking fees after the spring IPO/M&A revival. |

| Wed 16 Jul | Bank of America, Goldman Sachs, Morgan Stanley, PNC | Capital-markets trends (MS/GS) and loan-loss provisions as consumer delinquencies tick higher. |

| Fri 18 Jul | American Express, Truist, 3M | Credit-card spend vs. slowing retail sales; loan growth at regional banks still under Fed scrutiny. |

Stress-test green lights gave large banks leeway to boost payouts last month, so investors will focus on dividend/buy-back signals as well as any commentary about the Aug. 1 tariff cliff.

2. Tech, Chips and Streamers Step Up

- TSMC (Thu) – First detailed look at global AI-chip demand since the foundry reported a 40 % first-half revenue jump.

- Netflix (Thu) – With ad-tier uptake rising, Wall Street expects another double-digit sales gain; any color on international subscriber churn after tariff-related currency swings will be key.

- Johnson & Johnson, Novartis, GE Aerospace, PepsiCo round out a diverse slate, giving clues on health-care pricing, aircraft-engine backlogs and consumer staples volume.

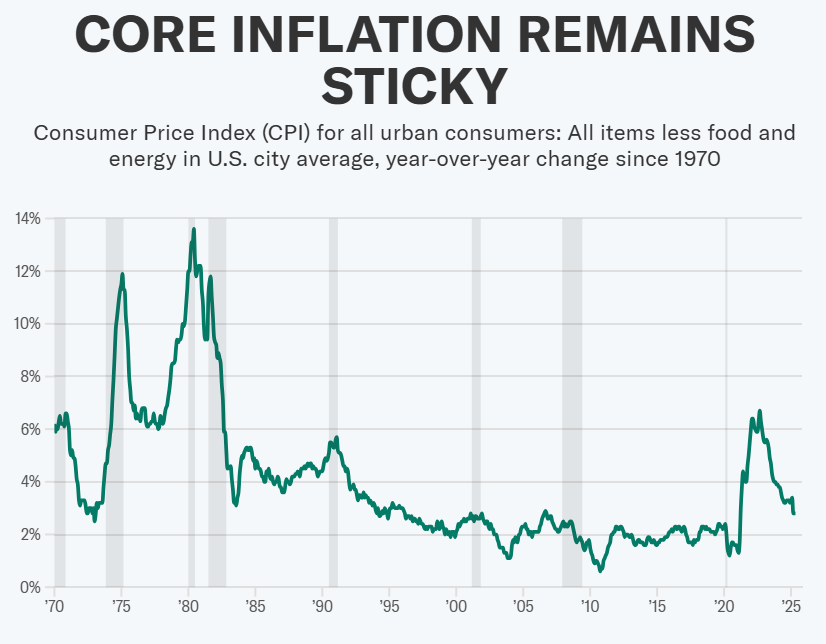

3. The Inflation Pulse

| Release | Consensus | Prior | Why it matters |

|---|---|---|---|

| CPI (Tue) | Headline +0.3 % m/m, 2.6 % y/y; Core +0.3 % m/m, 2.9 % y/y | +0.1 % m/m; 2.4 % y/y | A move further above the Fed’s 2 % target would harden expectations for a “no-cut” decision on July 30. |

| PPI (Wed) | +0.3 % m/m; Core +0.2 % | +0.1 % | Pipeline cost data show whether tariffs are seeping into wholesale prices. |

Oxford Economics notes that lower oil prices earlier this spring are “rolling off the books,” reducing a key disinflation tailwind just as tariffs on consumer goods ramp up.

4. Spending, Production and Housing

- Retail Sales (Thu) – Forecast at +0.1 % after May’s 0.9 % pull-back, when consumers front-loaded purchases ahead of tariff hikes.

- Industrial Production (Wed) – Expected to rebound slightly after two soft months; watch auto assemblies for signs of supply-chain strain.

- Homebuilder Sentiment (Thu) & Housing Starts (Fri) – Builders face the same low-inventory tailwind but also higher mortgage rates; June starts are seen rising 3.5 % after a steep May drop.

5. Fed Speak and Rate-Cut Odds

Before the pre-meeting blackout begins on Friday night, markets will hear from:

- Michelle Bowman (Tue)

- Lorie Logan (Tue)

- Michael Barr (Tue)

- John Williams (Wed)

CME FedWatch futures price a <5 % chance of a July cut, down from 20 % a month ago, as policymakers wait to “see the whites of disinflation’s eyes” in the post-tariff data.

6. Day-by-Day Snapshot (Eastern Time)

| Day & Date | Key Earnings Reports | Economic Data / Events |

|---|---|---|

| Monday · July 14 | Fastenal (FAST) | — |

| Tuesday · July 15 | JPMorgan (JPM), Citi (C), Wells Fargo (WFC), BlackRock (BLK), State Street (STT), Bank of New York Mellon (BK), Albertsons (ACI), JB Hunt (JBHT), Ericsson (ERIC) | • Consumer Price Index, Jun. • NY Fed Empire State Manuf. Jul. (-9 exp., -16 prev.) • Fed speakers: Lorie Logan, Michelle Bowman, Michael Barr |

| Wednesday · July 16 | Bank of America (BAC), Goldman Sachs (GS), Morgan Stanley (MS), PNC Financial (PNC), Johnson & Johnson (JNJ), United Airlines (UAL), ASML (ASML), Progressive (PGR), Alcoa (AA), Kinder Morgan (KMI) | • Producer Price Index, Jun. • Industrial Production & Capacity Utilization, Jun. (+0.1 % exp., -0.2 % prev.) • Fed Beige Book (2 p.m.)• Fed speaker: John Williams |

| Thursday · July 17 | Netflix (NFLX), Taiwan Semi (TSM), PepsiCo (PEP), US Bancorp (USB), Abbott (ABT), Cintas (CTAS), Interactive Brokers (IBKR), GE Aerospace, Novartis (NVS), Travelers (TRV) | • Retail Sales, Jun. • Import Price Index, Jun. (+0.2 % exp., 0 % prev.) • Initial Jobless Claims (wk ended Jul 12) 235 k exp. (227 k prev.) • Philly Fed Manuf. Jul. (-0.5 exp., -4 prev.) • Business Inventories, May • Homebuilder Sentiment, Jul. (33 exp., 32 prev.) |

| Friday · July 18 | American Express (AXP), 3M (MMM), Charles Schwab (SCHW), Ally (ALLY), Truist (TFC), Regions Financial (RF), Huntington Bancshares (HBAN) | • Housing Starts, Jun. +3.5 % exp. (-9.8 % prev.) • Building Permits, Jun. -0.3 % exp. (-2 % prev.) • Univ. of Michigan Consumer Sentiment, Jul. prelim. 61.5 exp. (60.7 prev.) |

7. Why It Matters

Markets have largely shrugged off President Trump’s escalating tariff schedule so far. This week’s CPI and retail-sales prints will reveal whether price pressures and consumer fatigue are beginning to bite, while big-bank CEOs will offer the first real-time read on loan growth and credit quality since the “Liberation Day” shocks in April. A benign data/earnings mix could keep the S&P 500 grinding higher; any negative surprise will hit while liquidity is thin and Fed policy is on hold.

Either way, by Friday afternoon investors should have a clearer sense of whether the summer rally can survive a tariff-heavy, rate-uncertain third quarter.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Hegseth Orders Every US Squad Armed by 2026: Defense Stocks Up

Tesla Paid for Elon’s Politics — Will the “America Party” Help or Hurt?

Shaken, Not Stirred: Markets brush off Trump’s latest tariff barrage

Wall Street Remains Resilient Amid New Tariff Threats

Trump Slaps 50% Tariff on Copper, Threatens 200% Duties on Pharmaceuticals

Dow, S&P 500, Nasdaq Drop as Trump Slaps 25–40% Tariffs on Trade Partners

Global Stocks Are Crushing US – But Which Ones?

Markets This Week: Tariff Chaos, Fed Clarity, Prime Day, and Earnings Heat Up

Elon Musk Launches ‘America Party’ After Breaking With Trump