Markets opened Wednesday with a sharp rally in copper and measured reactions in equities and commodities, as President Trump’s 50% copper tariff plan sent shockwaves through global metals markets. But despite the aggressive move, financial markets signalled calm, not chaos.

Copper Breaks Records on Trump Shock

- New York Comex copper futures surged to a record $5.9535/lb Tuesday — a nearly 17% intraday spike.

- Prices later cooled and settled at $5.5495/lb by 2 p.m., still the highest daily close in history.

- The Comex–LME copper spread widened to over 20%, signaling major arbitrage opportunities as traders race to front-run the tariff deadline.

- Trump’s proposed August 1 enforcement date has accelerated physical shipments into the US from top exporters like Chile, Canada, and Mexico.

Juan Carlos Guajardo, head of Plusmining, said the sharp spike reflects “a market that expected a softer tariff — now there’s a rush to buy before the window closes.”

More about: Copper Prices Surge To Record High In Largest Increase Since ‘80s—Here’s Why

Trump’s Cabinet Meeting: Key Moments

President Trump’s Cabinet meeting covered far more than copper tariffs. Here are the main headlines:

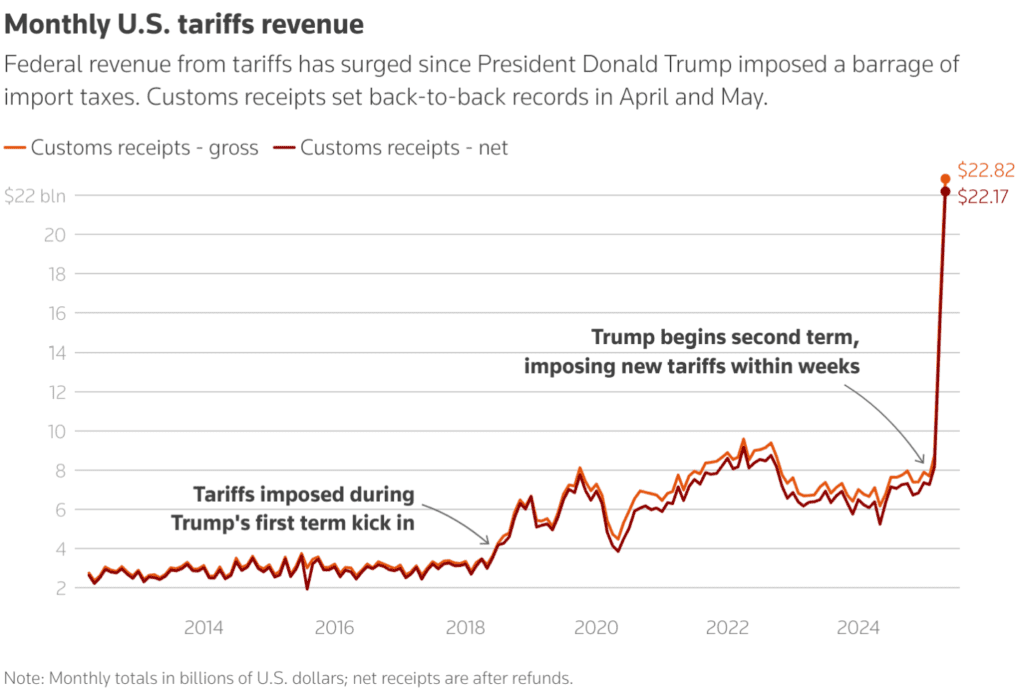

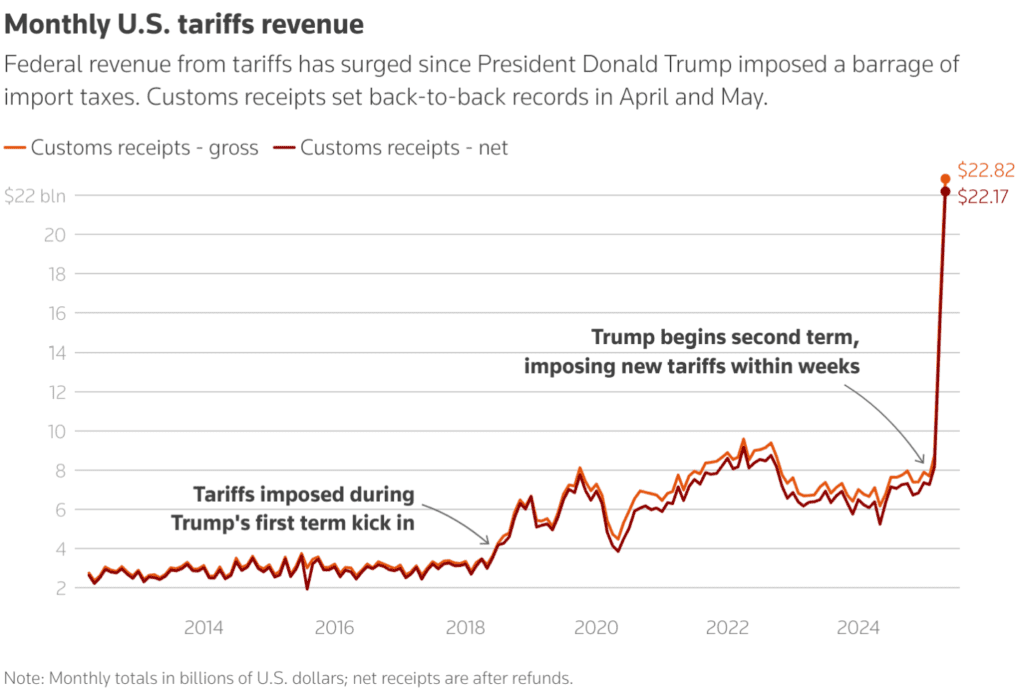

Tariff Announcements

- Trump confirmed the 50% copper tariff, likely effective July 31 or August 1.

- He said a letter to the EU outlining tariff rates would be sent “probably in two days.”

- Trump also floated 200% pharmaceutical tariffs, but said pharma firms will get “a year or more” to prepare. (Trump Slaps 50% Tariff on Copper, Threatens 200% Duties on Pharmaceuticals)

Foreign Policy & Defense

- Trump confirmed a second meeting with Netanyahu later that day, focused “almost exclusively on Gaza.”

- US envoy Steve Witkoff said “proximity talks” are underway to reach a 60-day ceasefire, with 10 live and 9 deceased hostages set to be released.

- Trump criticized Putin, saying:

“We get a lot of bulls— thrown at us by Putin… He’s very nice, but it turns out to be meaningless.”

Military & Domestic Security

- Trump praised military strikes on Iran’s nuclear facilities and Homeland Security’s flood response in Texas.

- He announced a Friday visit to Texas with First Lady Melania.

NYC Remarks

- Trump said he may step in to “straighten out” New York, adding:

“We have tremendous power at the White House… maybe we’ll have to straighten it out from Washington.”

Ukraine Arms Pause

- Asked who paused the Ukraine weapons shipment, Trump replied:

“I don’t know, why don’t you tell me?”

He confirmed the Pentagon will resume shipments.

Cabinet Closer: Trump on Art

- The meeting ended with Trump spending 10 minutes discussing the artwork and decor in the Cabinet room, shifting from policy to personal reflections.

Global Market Snapshot (as of 09:00 GMT+3)

| Asset/Index | Price/Level | Daily Move |

|---|---|---|

| Comex Copper | $5.55/lb | 🔺 +12.2% |

| LME Copper | $9,565/ton | 🔻 -0.9% |

| S&P 500 Futures | 6,267 | 🔺 +0.18% |

| Euro Stoxx 50 | 4,615 | 🔺 +0.22% |

| FTSE 100 | 8,232 | 🔺 +0.14% |

| DAX (Germany) | 18,650 | 🔺 +0.26% |

| Bitcoin (BTC) | $108,786 | 🔺 +1.3% |

| Brent Crude Oil | $84.60/barrel | 🔺 +0.6% |

| Gold | $2,320/oz | 🔺 +0.2% |

| USD/JPY | 162.30 | 🔺 +0.5% |

Market Mood: Calm, Not Complacent

Despite Trump’s tariff barrage — including a new 200% pharma tariff threat with a year-long phase-in — global equities are holding ground:

- US stocks dipped slightly Tuesday but are stabilizing pre-market.

- European futures are modestly higher amid expectations of a clear framework for US–EU trade talks.

- Asian equities were mixed: China’s CSI 300 hit a new 2025 high on stimulus hopes, while Australia’s ASX 200 sagged after the central bank held rates steady.

- Copper market remains in panic mode, but stocks, crypto, and oil are stable or slightly higher.

What to Watch Today

- ECB’s de Guindos and Philip Lane are set to speak — markets will monitor tone on rate cuts and inflation.

- BoE Financial Stability Report due — potential insight into systemic risks tied to global trade realignment.

- Federal Reserve’s June minutes expected later — key for reading rate path and inflation expectations.

Trump’s copper tariff is a major market event—but unlike 2018, the broader reaction has been calculated, not chaotic. With new tensions over copper, pharma, Europe, and the Middle East all in play, August 1 looms as the next big inflection point.

Markets are holding steady. But they’re not taking their eyes off Trump.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.