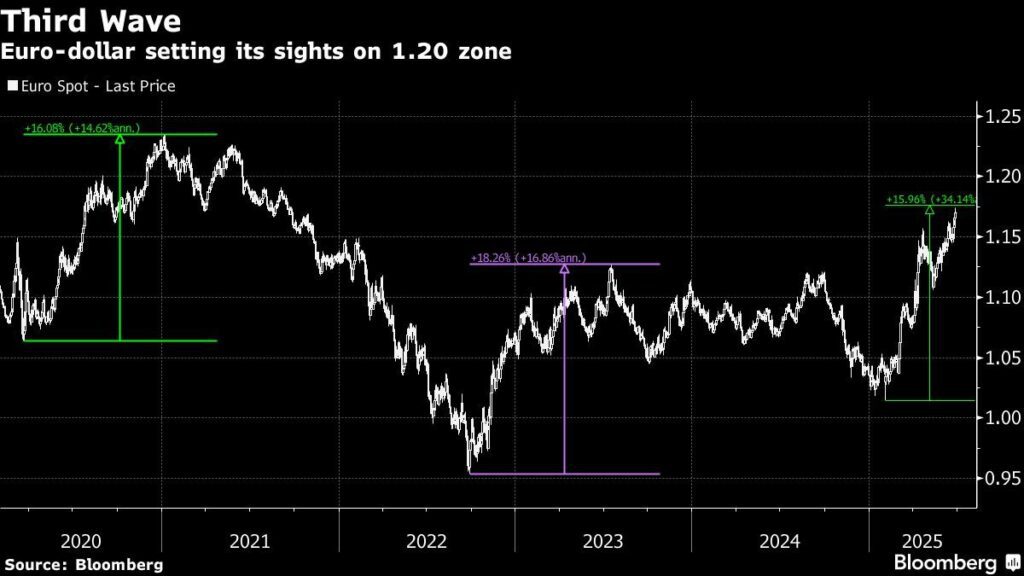

The euro surged past $1.17 on Friday, marking its highest level since September 2021, as momentum builds behind the European currency and the US dollar slumps. The common currency is up over 3% in June, on track for its sixth straight monthly gain—a feat not seen since 2017.

Behind the move: rising confidence in Europe’s recovery, waning fears about aggressive ECB cuts, and growing speculation that the Federal Reserve will slash rates at least twice before year-end. In contrast, the ECB is expected to ease just 25 basis points, giving the euro an interest rate advantage.

“The euro will continue to benefit from persistent dollar pessimism,” said Antonio Ruggiero, strategist at Convera.

Dollar in Retreat

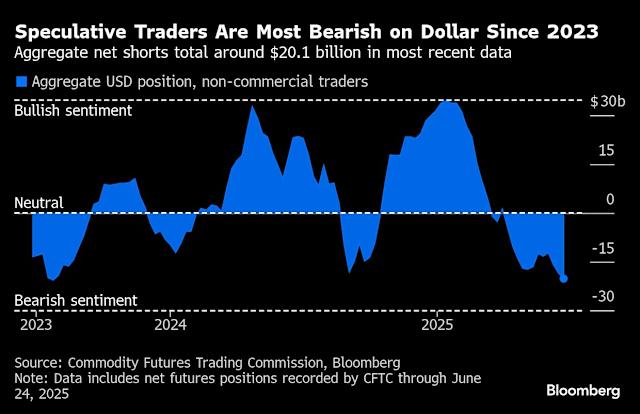

The Bloomberg Dollar Spot Index closed the week down 1.2%, hovering near a three-year low. The dollar has fallen nearly 9% year-to-date, with speculative traders holding $20.1 billion in net short positions—their most bearish stance since mid-2023, according to CFTC data.

Adding to the dollar’s weakness:

- Trump’s push for Fed Chair Jerome Powell to resign

- Growing consensus that Trump will name a dovish replacement

- Weak GDP data and softening consumer spending

“The fortunes of the macro US economy for the back half of this year don’t look so great,” said Helen Given, FX trader at Monex.

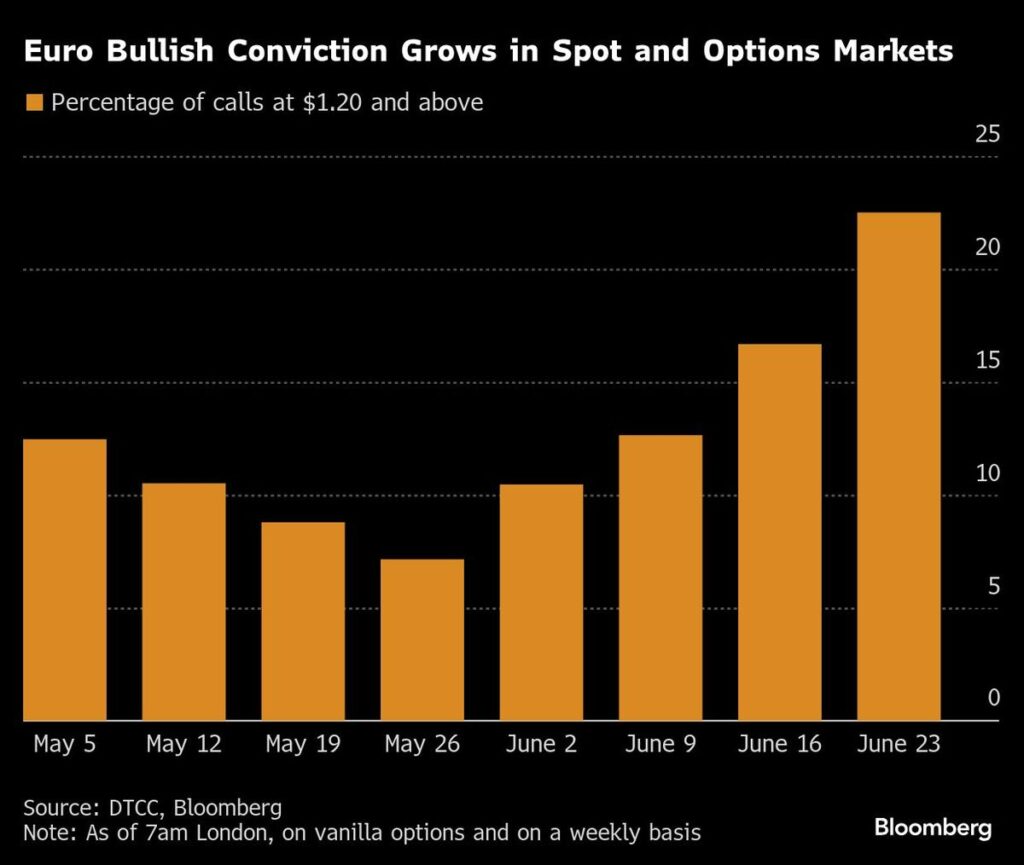

Currency Traders Flip to Euro Bulls

Hedge funds have flipped bullish on the euro for the first time since April, and risk reversals on the dollar index have turned negative across the board, signaling bearish sentiment on the greenback.

UBS strategists now expect the euro to climb to $1.23 by year-end, with the Japanese yen forecast to strengthen to 130 per US dollar as US rates fall faster than peers across the G-10.

“US interest rates can decline more quickly in coming months than in much of the rest of G-10,” UBS wrote.

Euro’s Edge

The euro’s rise is partly driven by shifting global trade alignments and calls from EU policymakers to elevate the euro’s global role amid US volatility. Analysts also highlight Europe’s relative macro stability as a draw for investors fleeing the dollar.

“European currencies are best placed to transform the dollar’s weakness into strength,” wrote Bloomberg strategist Ven Ram. But he warned: “The euro’s journey higher will be far from linear.”

Macro Flash: Stagflation Fears Mount

Friday’s US data added to the dollar gloom:

- Personal spending dropped in May—the steepest decline in 2025

- The core PCE index, the Fed’s preferred inflation gauge, rose 0.2%, slightly above expectations

“Higher PCE readings and weaker personal spending feed into the stagflation story,” said Win Thin, global strategist at Brown Brothers Harriman. “Not a good combo for the dollar.”

The euro is surging, and the dollar is cracking under the weight of Fed policy shifts, political uncertainty, and soft economic data. As Trump presses for rate cuts and markets brace for a dovish Fed reset, European assets are once again in vogue—with the euro leading the charge.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s trade deals are stalling out at worst possible time

What Traders Have Gotten Wrong in 2025

What to Watch in Markets This Week: Jobs Report, Tesla Delivery, Trump’s Budget Deadline

Markets Rally as Trade Talks Gain Steam and Dollar Weakens

Regencell’s $33 Billion Collapse: The GameStop Moment of Chinese Biotech?

The $OST Scam: How Nasdaq-Listed Penny Stock Wiped Out Thousands of Lives