Markets may be headed for a long weekend, but there’s little time to relax. The week ending July 5 brings a flood of critical economic data, political drama in Washington, and earnings from key player Constellation Brands, Tesla’s June delivery report — all packed into just four trading days.

Check this: Markets Rally as Trade Talks Gain Steam and Dollar Weakens

Here’s everything investors need to watch:

1. June Jobs Report – Market Mover of the Week

- Release: Thursday, July 3, at 8:30 a.m. ET

- Investors and the Federal Reserve alike will be watching this report closely.

- After strong job growth in May, analysts expect a slight slowdown as companies face tariff uncertainty and consumer sentiment softens.

- Any sign of a rising unemployment rate above 4.3% or cooling wage growth could push the Fed closer to rate cuts.

- Average hourly earnings will be scrutinized for inflation signals.

Context: The labor market’s resilience has allowed the Fed to hold off on rate cuts. But President Donald Trump has ramped up pressure on the central bank to lower rates, and softer data could shift sentiment quickly.

2. Trump’s “One Big Beautiful Bill” Deadline

- Target deadline: July 4, but procedural delays have pushed Senate debate into the week.

- The bill includes $4.5 trillion in tax cuts and $1.2 trillion in spending cuts — and faces resistance over its impact on the $3.3 trillion projected deficit.

- Democrats have delayed proceedings by forcing clerks to read the full 940-page bill aloud.

- Any last-minute breakthrough or delay could rattle bond markets and influence dollar sentiment.

Also watch: Updates on tariff talks with Canada, India, and Taiwan ahead of the July 9 trade deal deadline. Trump’s stance on extending or enforcing that date remains fluid.

3. Tesla (TSLA) June Deliveries – Wednesday

- Tesla will report its Q2 delivery numbers on Wednesday, following a disappointing Q1 with a 13% drop in deliveries.

- Investors will look for signs of demand recovery amid EV competition and price wars.

- Watch for:

- Geographic breakdowns (China, US, Europe)

- Model mix (Model 3/Y vs. Cybertruck)

- Production or supply chain updates

Impact: A beat or miss could swing Tesla shares and ripple across the entire EV sector, including battery and charging infrastructure stocks.

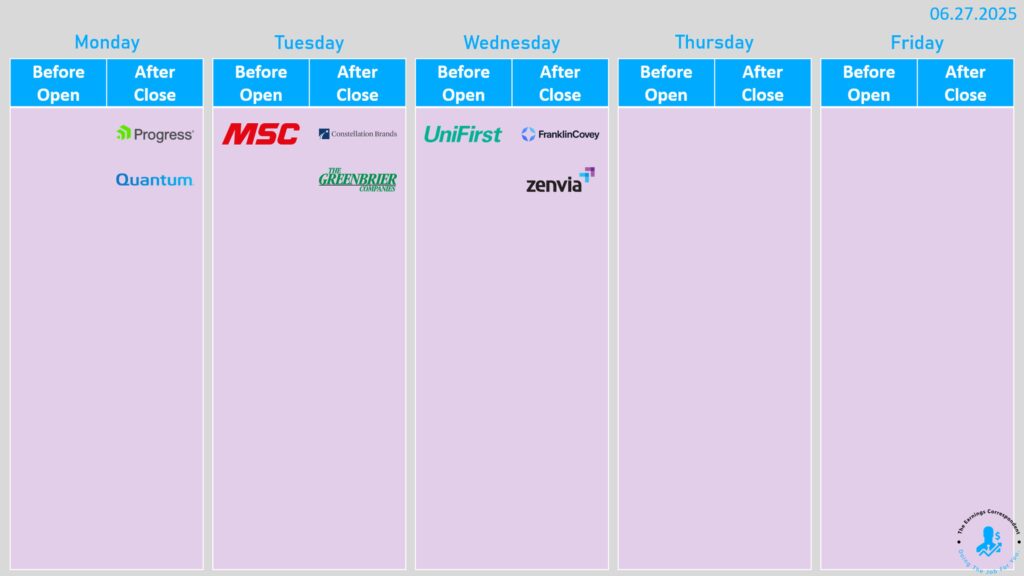

4. Constellation Brands Earnings – Tuesday

- The maker of Modelo and Corona reports earnings after trimming its outlook last quarter.

- Investors will focus on beer sales trends, pricing power, and any hints about inflation’s effect on margins.

🧾 Other earnings: MSC Industrial (MSM), Greenbrier (GBX), Franklin Covey (FC), and Unifirst (UNF).

5. Manufacturing & Services Data Flood

- Monday: Chicago PMI (June)

- Tuesday: ISM Manufacturing Index, Construction Spending, JOLTS Job Openings

- Thursday: ISM Services Index, Factory Orders, Initial Jobless Claims, Trade Balance

The ISM Manufacturing Index will be watched for signs of industrial recovery, especially after several months below the key 50 level.

Why it matters: Manufacturing sentiment often acts as a leading indicator for GDP and equity performance. Surprises here could drive moves in cyclical and industrial stocks.

6. Powell’s Speech – Tuesday, 9:30 a.m. ET

Fed Chair Jerome Powell speaks Tuesday, potentially offering key clues on the central bank’s rate cut timeline. His tone — whether cautious or dovish — could move tech, utilities, and financials.

7. Holiday Trading Schedule

- Thursday, July 3: Early close at 1 p.m. ET

- Friday, July 4: Markets closed for Independence Day

Lower liquidity and compressed trading windows could mean heightened volatility, especially around Wednesday and Thursday morning data releases.

This Week’s Key Calendar:

| Date | Event |

|---|---|

| Monday | Chicago PMI, Fed’s Goolsbee speaks |

| Tuesday | ISM Manufacturing, JOLTS, Powell speech, Constellation earnings |

| Wednesday | ADP Employment, Tesla Deliveries, FC/UNF earnings |

| Thursday | June Jobs Report, ISM Services, Factory Orders, Early market close |

| Friday | Markets Closed – Independence Day 🇺🇸 |

It’s a short week, but a high-stakes one. Jobs data, Tesla, and tax policy headlines will dominate, all with limited time for markets to digest. With stocks at record highs, even a small surprise could cause outsized moves — so expect fireworks, even before July 4.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Markets Rally as Trade Talks Gain Steam and Dollar Weakens

Regencell’s $33 Billion Collapse: The GameStop Moment of Chinese Biotech?

The $OST Scam: How Nasdaq-Listed Penny Stock Wiped Out Thousands of Lives

Why Palantir Stock Is Sinking Today

Trump’s Tariff Deadline? ‘Not Critical,’ Says White House

Nike Reports After the Bell: Here’s Why Wall Street Expects a Weak Quarter

US IPOs Soar 53% in 2025, Led by Circle and CoreWeave — But Can the Boom Last?

In a First-of-Its-Kind Decision, Anthropic and Meta Win Copyright Lawsuits Brought by Authors