Markets opened Thursday cautiously, with investors digesting fresh political turbulence from Washington just as geopolitical fears had begun to ease. President Donald Trump reignited volatility by publicly criticizing Fed Chair Jerome Powell, suggesting he could name a replacement as soon as September — a move that rattled confidence in the Federal Reserve’s independence.

According to the Wall Street Journal, Trump is actively considering naming Powell’s successor as early as this summer, months before the Fed Chair’s term ends in May 2026. The reported shortlist includes Kevin Warsh, Kevin Hassett, Scott Bessent, David Malpass, and Fed Governor Chris Waller — a lineup that signals a shift toward Trump-aligned economic ideology.

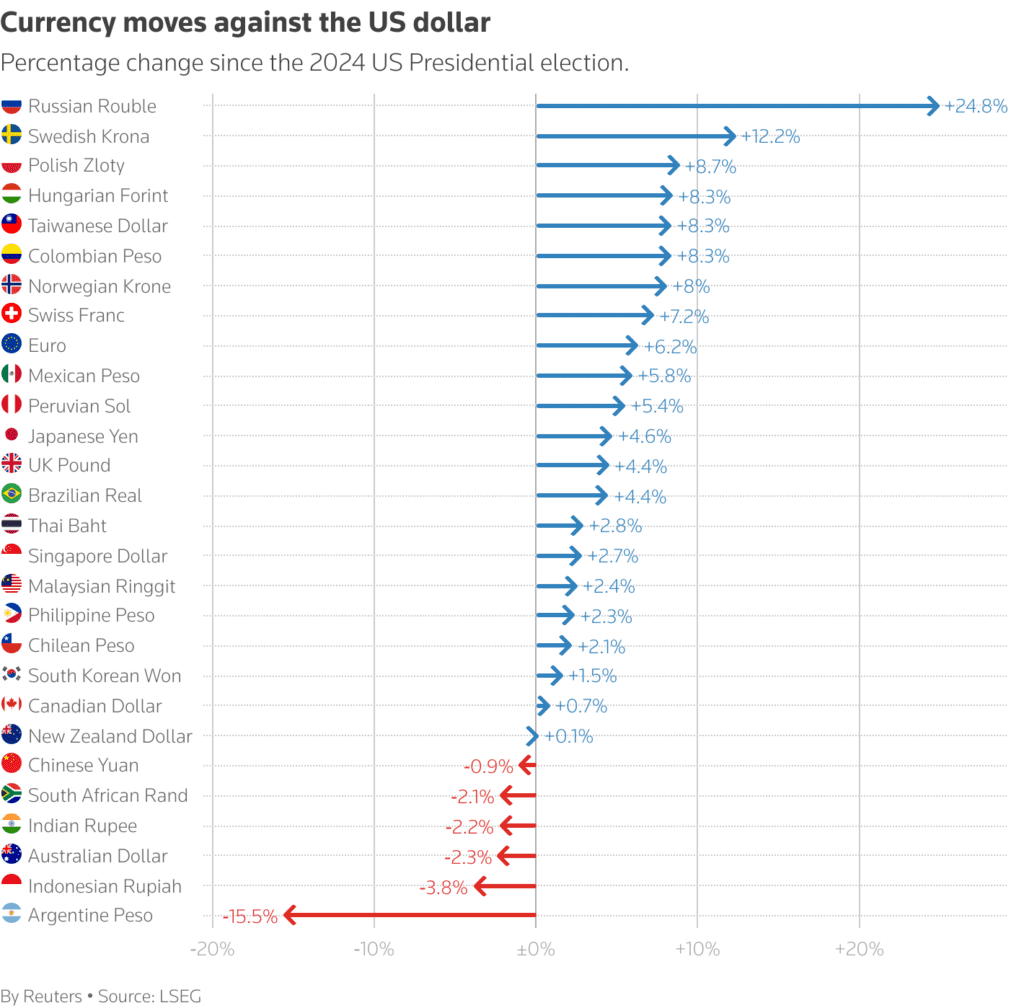

The headlines intensified existing fears over the Federal Reserve’s independence, a concern that has already weighed heavily on the US dollar this week.

“Markets are likely to bristle at any early move to name Powell’s successor, particularly if the decision appears politically motivated,” said Kieran Williams at InTouch Capital Markets. “It could recalibrate rate expectations and trigger reassessment of dollar positioning.”

The reaction was immediate:

- The US dollar index slid further, now down 10% year-to-date — its worst run since 2017.

- The euro spiked to $1.1710, the highest since September 2021, before paring gains.

- The Swiss franc hit 0.8025, its strongest level against the dollar in over a decade.

- The dollar index touched 97.265, its lowest since early 2022.

Traders have responded swiftly, now pricing in a 25% chance of a Fed rate cut in July, up from 12% a week ago. Markets expect 64 basis points in total cuts by year-end.

Meanwhile, JPMorgan warned that Trump’s tariff agenda could stoke inflation and dent economic growth — projecting a 40% chance of recession.

“The upshot of these developments is that our baseline scenario incorporates the end of a phase of U.S. exceptionalism,” JPMorgan analysts wrote — a shift that’s increasingly reflected in the dollar’s slide and the euro’s surge.

These fresh political tremors come just as markets were stabilising on news of an Israel–Iran ceasefire, helping the S&P 500 rebound close to record highs. But Trump’s unpredictability — from tariff threats to possible Fed leadership changes — has injected renewed uncertainty into global markets.

Futures Point Up — But Caution Lingers

- S&P 500 futures: +0.12%

- Nasdaq 100 futures: +0.17%

- Dow futures: +0.09% (or +38 points)

Despite Wednesday’s flat close, all three major US indexes are on track for a positive week, with the S&P 500 still under 1% from its February record.

But not everyone is convinced the rally has legs.

“This can’t hold,” said Komal Sri-Kumar on CNBC, citing the fiscal drag from Trump’s “One Big Beautiful Bill”, rising tariff-driven inflation, and geopolitical fragility.

Key Watch Items Today:

- PCE inflation data (Friday): Fed’s preferred measure; Powell expects May core inflation to tick up to 2.6%.

- Weekly jobless claims (Thursday 8:30 AM ET): A key snapshot of labor market resilience.

- Earnings: Walgreens reports pre-market; Nike follows after the bell.

- Defence stocks: On watch after NATO members agreed to Trump’s push for 5% of GDP in military spending.

Meanwhile, Shell (SHEL.L) denied rumors of a blockbuster takeover bid for BP (BP.L), calming speculation sparked by a Wall Street Journal report.

With Powell under pressure, the dollar on the ropes, and inflation data looming, global markets are bracing for another potentially volatile turn. Investors may need to buckle up — the summer is heating up in more ways than one.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Kalshi Hits $2 Billion Valuation as Prediction Markets Go Mainstream

S&P 500 Nears All-Time High After Stunning Rebound from April Lows

Trump rebukes Israel and Iran hours after ceasefire: Latest Updates

Ceasefire “Now in Effect” as Israel and Iran End 12 Days of War — But Deadly Strikes Continue

Trump Announces Ceasefire Between Israel and Iran

Why Oil Prices Plunged and Stocks Rose After Iran’s Missile Attack on US Bases

Markets Brace for Chaos as Strikes, Inflation, and FED: What to watch this week

Iran–Israel–US Conflict Erupts: Nuclear Strikes, Hormuz Threats, and Global Fallout

US-Iran Conflict Escalates After Strikes on Nuclear Sites: What We Know So Far