Investors are entering Thursday with heightened caution as geopolitical tensions, central bank decisions, and rising inflation pressures combine to cloud the global economic outlook.

President Donald Trump’s private approval of U.S. strike plans on Iran, revealed earlier this week, has sent tremors through financial markets. While he has yet to issue a final order, Bloomberg and Reuters both report that senior U.S. officials are preparing for a possible military operation within days. Trump’s ambiguity — “I may do it. I may not do it.” — has only added to the market’s unease.

Markets Braced for Escalation

According to Reuters, the mere possibility of U.S. involvement in Israel’s campaign against Iran has rattled investors already digesting global rate decisions and trade policy risks.

A Report warns that a U.S. strike could trigger a “knee-jerk selloff” in stocks, spike oil prices past $85, and deliver a negative supply shock to an economy already under stress from Trump’s aggressive tariffs. Citigroup economists said that higher oil prices could raise inflation and lower global growth — a central bank’s nightmare.

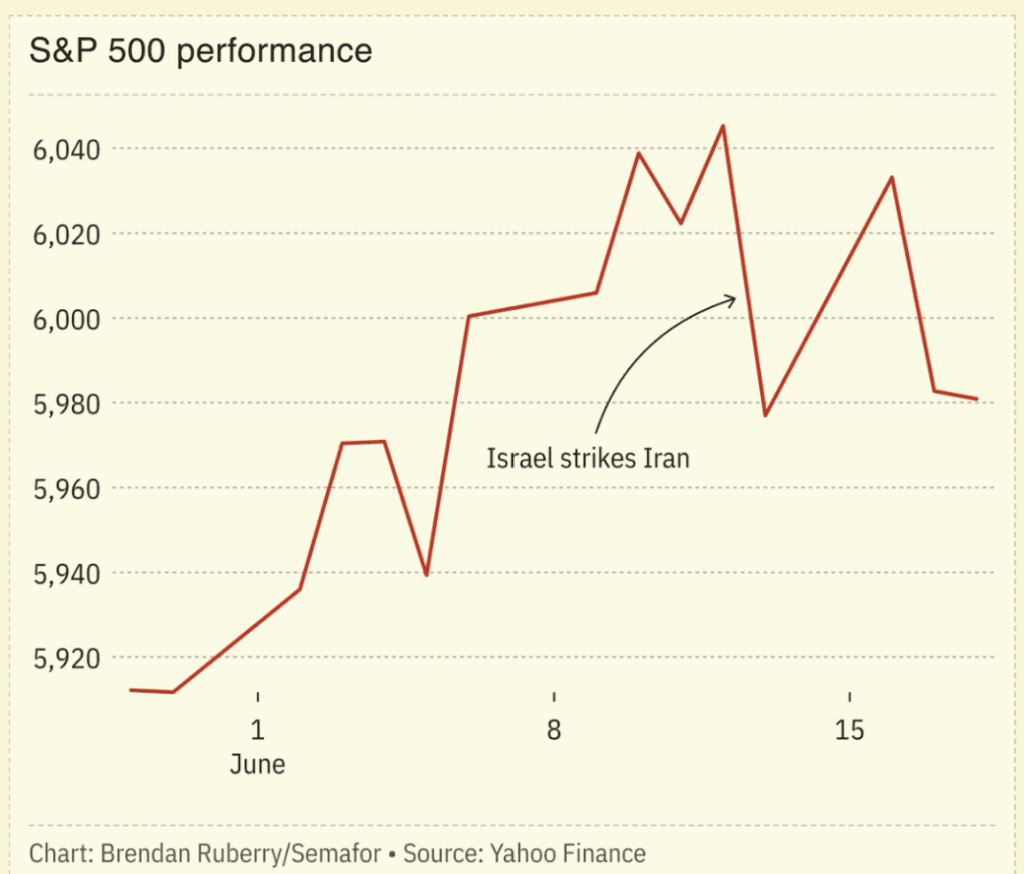

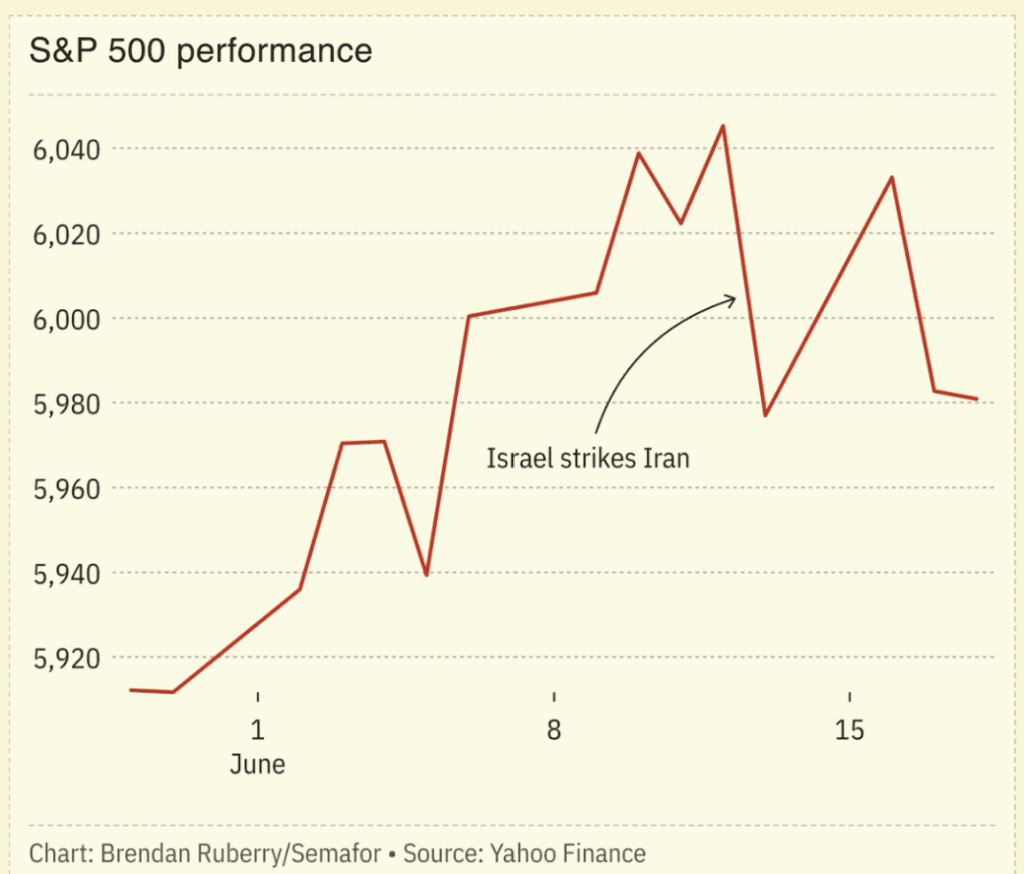

Despite the tension, U.S. equities remain near record highs. The S&P 500 closed just 2% below its February peak, but energy stocks have surged, with Exxon Mobil up 3.8% and Valero Energy gaining 5% this week alone. The Aerospace & Defense index also touched new highs, driven by expectations of increased military spending.

“Markets Can’t Ignore This Much Longer”

Bond markets have moved more cautiously, with U.S., German, and U.K. 10-year yields locked in tight ranges. Safe-haven demand lifted Treasury prices, while the U.S. dollar gained nearly 1% versus the yen and franc since last Friday.

“I think Trump will try to avoid a war, but if it happens, markets won’t take it lightly,” said Peter Cardillo of Spartan Capital.

Even betting markets are pricing in risk: Polymarket odds of U.S. military action against Iran before July sit at 63%, down from 82% earlier this week — but still nearly double what they were before the conflict began.

Central Banks Tighten the Narrative

Adding to the uncertainty, central banks in Britain, Switzerland, Norway, and Taiwan are set to announce policy decisions today. The Bank of England, in particular, is expected to highlight the inflationary impact of surging oil, despite a recent cooling in core CPI data.

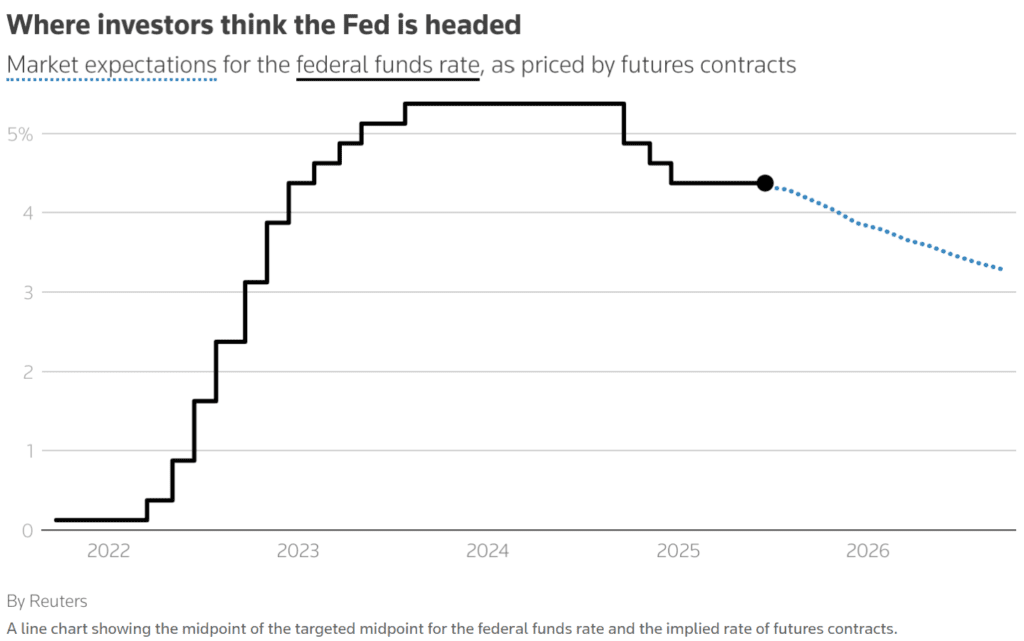

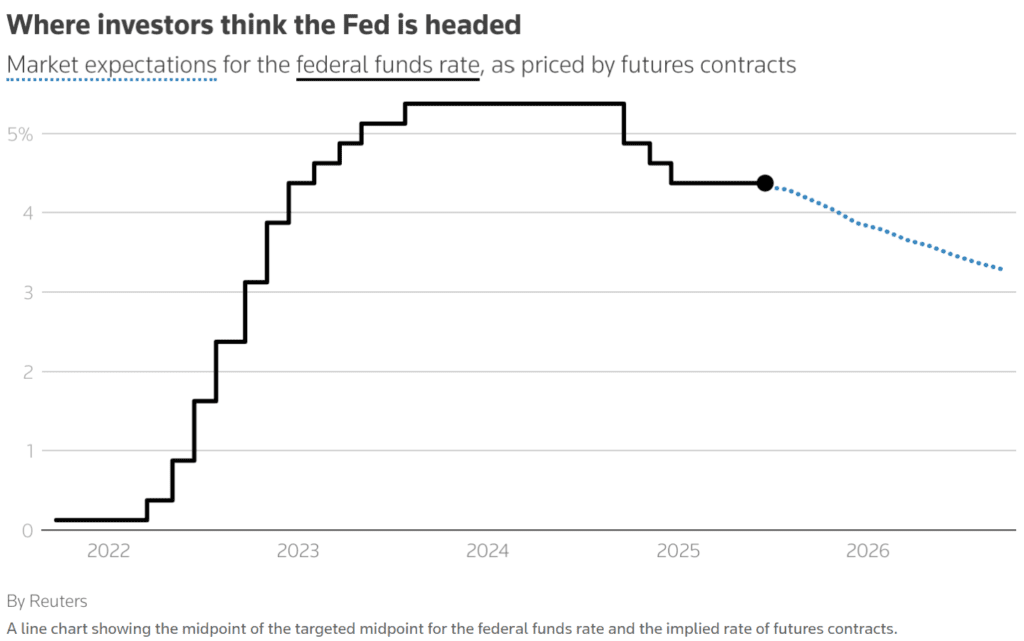

On Wednesday, the Federal Reserve kept rates steady, but Chair Jerome Powell warned that tariffs — and potentially oil — could push inflation higher.

“We expect a meaningful amount of inflation in the coming months,” Powell said, dampening optimism about rate cuts.

Trade, Tariffs, and a Foggy Summer

The markets’ other looming concern: Trump’s July tariff deadline. Analysts say little progress has been made on securing new trade deals, keeping global uncertainty high. The World Bank recently slashed its 2025 global growth forecast to 2.3%, citing tariffs and geopolitical instability as major headwinds.

Meanwhile, Eurozone finance ministers meet in Luxembourg today, with discussions on Bulgaria’s euro adoption and fiscal guidance on the agenda. Remarks from ECB officials may offer further signals on the bloc’s monetary path after a cautious rate pause earlier this month.

What to Watch Today:

- Rate decisions: U.K., Switzerland, Norway, Taiwan

- ECB speeches: Luis de Guindos, François Villeroy de Galhau

- Eurogroup meeting in Luxembourg

- U.S. markets closed for Juneteenth National Independence Day

Markets are caught between rate cut hopes and war risk fears. With Trump’s Iran plans confirmed but not yet triggered — and central banks reluctant to pivot amid inflation threats — volatility is likely to return fast if headlines turn hotter.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Iran Refuses to Surrender as Trump Mulls Strike: Tensions Surge in Middle East Conflict

Trump Demands Iran’s ‘Unconditional Surrender,’ Escalates Pressure in Israel-Iran Conflict

US and UK Seal Trade Deal — but Steel Tariffs Unresolved

Trump Exits G7 Early as Leaders Urge Mideast Ceasefire: What the Summit Delivered

OpenAI considers antitrust action against Microsoft amid tensions

What Is Trump’s ‘Revenge Tax’ — and Why It’s Scaring Off Foreign Investors