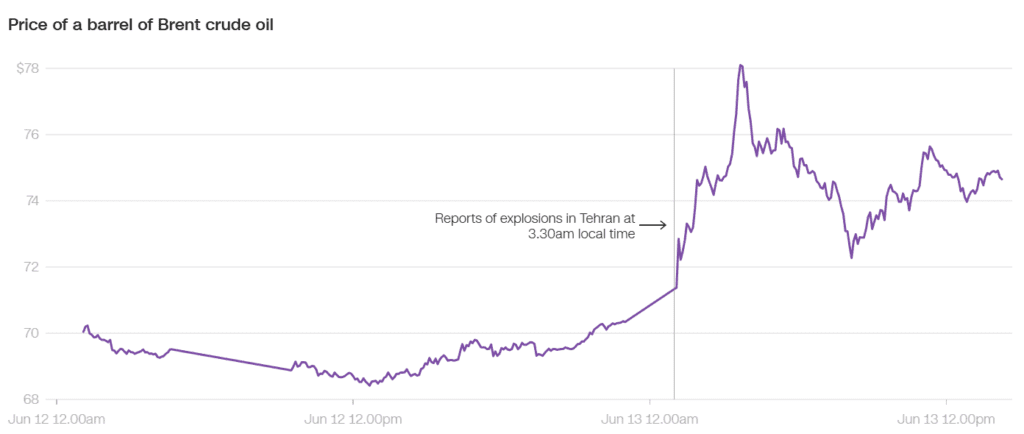

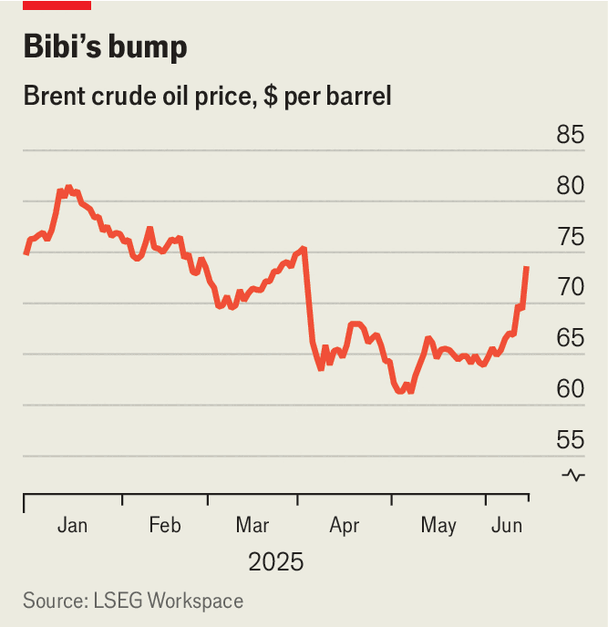

Global oil prices have surged to their highest levels since 2021 following Israel’s surprise airstrikes on Iranian nuclear and military sites. The escalation — already being called one of the most dangerous Middle East flashpoints in a decade — is reviving fears of a broader conflict that could choke off vital energy supplies and destabilize global markets.

But beyond Friday’s 13% spike in crude and a 9% surge in Brent, history suggests these kinds of geopolitical shocks have a mixed — and often short-lived — impact on oil prices and inflation. So, what makes this conflict different?

What Happened: Airstrikes, Retaliation & Market Panic

Israel confirmed it launched a targeted attack on Iran’s Natanz uranium enrichment facility and other military sites, citing an “imminent nuclear threat.” Iranian state media reported the death of General Hossein Salami, head of the IRGC, and warned of a “severe response.” A nationwide state of emergency was declared in Israel amid fears of missile retaliation.

- WTI crude: +9.66% to $74.64

- Brent crude: +9.27% to $75.79 — biggest single-day gain since 2020

- Gold: +1.6%, as investors fled to safe havens

- US gas prices: Expected to rise 10–25 cents per gallon

President Trump insisted the US had no involvement but said the strike could be “great for the market” if it eliminates Iran’s nuclear threat.

“Ultimately, it would be great for the market. Iran won’t have a nuclear weapon — that’s a win for everyone,” he told The Wall Street Journal.

Political Reactions

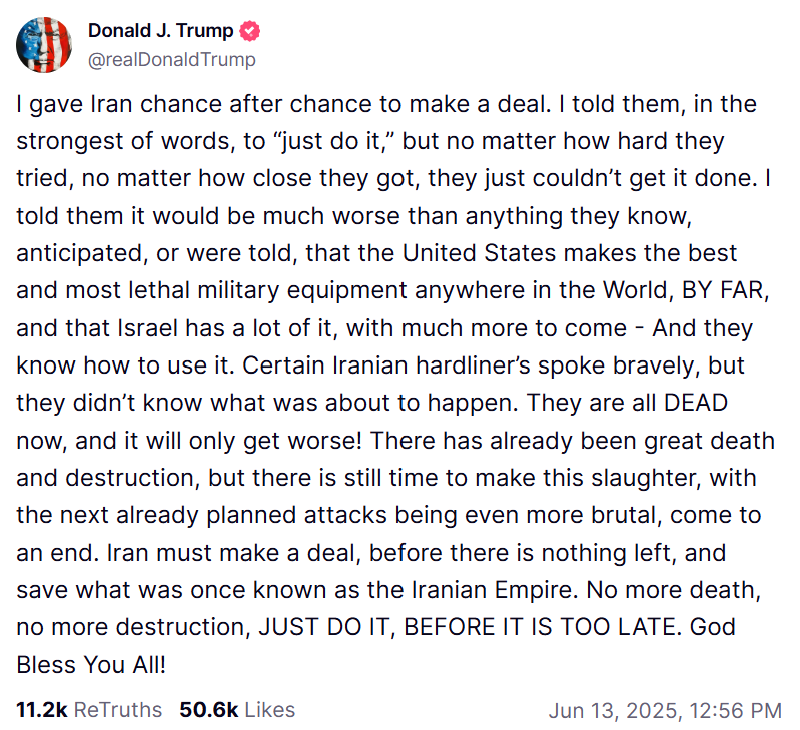

President Trump, while supporting Israel’s right to self-defense, stated Friday:

“JUST DO IT, BEFORE IT’S TOO LATE” — urging Iran to negotiate its nuclear program before further escalation.

He later told The Wall Street Journal that:

“Ultimately, it could be great for the market. Iran won’t have a nuclear weapon — that’s a win for everyone.”

Meanwhile, global leaders and financial markets are bracing. The S&P 500 fell 1.2%, Nasdaq dropped 1.3%, and gold surged 1.6%, as investors fled to safe-haven assets.

Historical Lens: How Oil Reacts to War

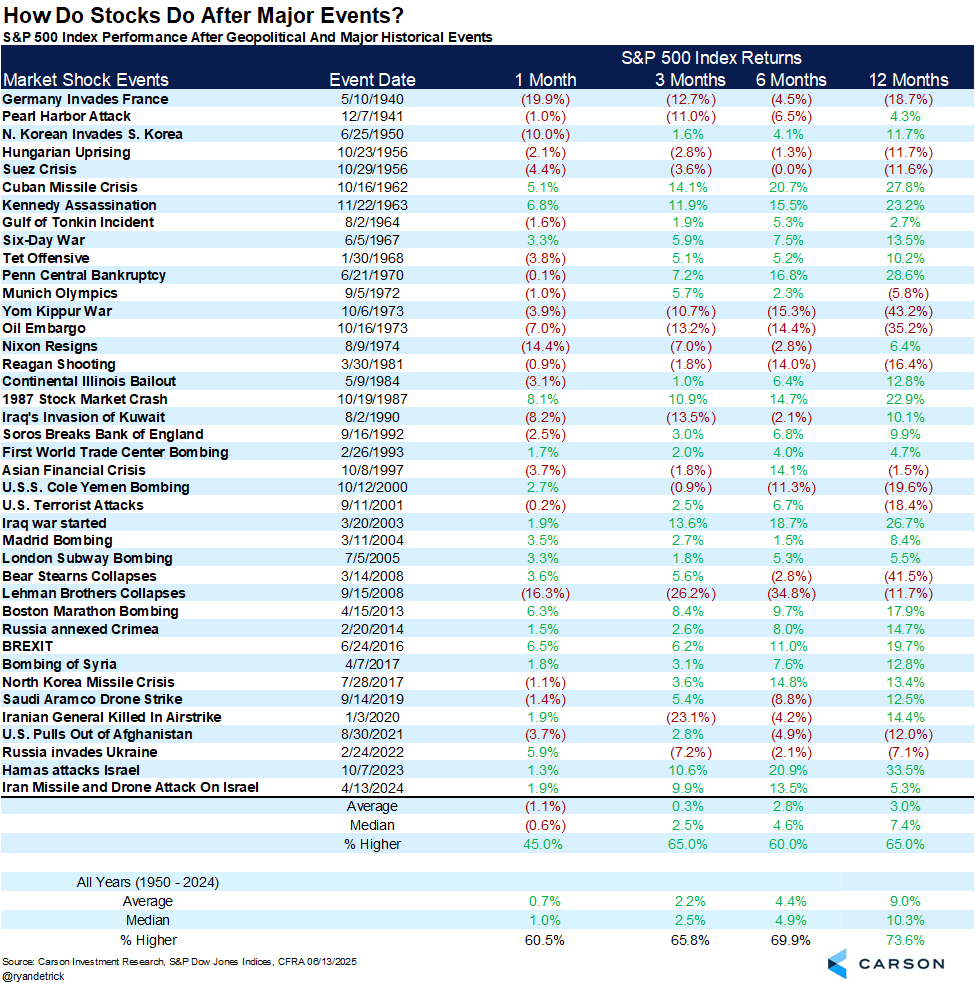

According to S&P 500 data from Carson Investment Research:

- Middle East conflicts historically trigger oil spikes — but most are short-lived unless oil infrastructure is directly targeted.

- Example:

- Iraq War (2003): Crude jumped 20%, but normalized in 3 months

- Saudi Aramco Drone Strike (2019): Oil surged 14%, but fell back quickly

- Russia-Ukraine (2022): Oil spiked to $130+, with a longer inflation tail

This time, analysts warn the Strait of Hormuz — where 20% of global oil passes daily — is at greater risk than in past conflicts.

“The big risk is disruption at Hormuz. If that happens, oil could spike above $130,” said Jorge León of Rystad Energy.

Analyst Warnings: What Could Happen Next?

- JPMorgan: Worst-case scenario could send crude to $130 and drive US CPI to 5%

- Goldman Sachs: Sees Brent topping $90 short-term if Iran exports fall

- RBC’s Helima Croft: Iran could follow its 2019 playbook, attacking tankers and refineries

- IEA (Fatih Birol): Ready to release emergency oil reserves if supply is hit

- OPEC: Urges calm, calling IEA comments “fearmongering”

Why This Time Feels Different

While Middle East tensions are nothing new, several factors make this conflict uniquely dangerous for oil markets:

- Direct hit on Iran’s nuclear program — seen as a red line by Tehran

- Unilateral Israeli action — increases odds of uncontrolled escalation

- Trump’s tariff-heavy energy policy — limits flexibility to calm markets with diplomacy

- Low global oil stockpiles — inventories were already strained before the attack

- Summer demand surge — driving season in the US amplifies every spike

“We’re still at the tip of this situation,” said GasBuddy’s Patrick De Haan. “Iran calling the strikes a declaration of war doesn’t bode well for the flow of oil.”

What This Means for Gas, Inflation & Consumers

- US gas prices could rise 10–25 cents per gallon over the next two weeks

- Airlines and shipping costs may increase globally if tensions persist

- Food and retail prices could see a knock-on effect from energy inflation

- Central banks may delay rate cuts if inflation rebounds

Already, energy stocks are outperforming broader markets:

- $XLE (Energy ETF): +1% on the day

- $XOM (ExxonMobil) and $EOG (EOG Resources) rallied sharply

- Gold prices: Nearing all-time highs above $3,450/oz

What Comes Next?

Three scenarios are on the table:

- Limited retaliation: Iran hits Israeli military targets → market stabilizes

- Wider conflict: Attacks on oil infrastructure or US bases → $100+ oil

- Strait of Hormuz disruption: Worst-case → global supply crisis, strategic reserves tapped

Most analysts don’t expect record-breaking highs yet, but warn that any Iranian strike outside Israel’s borders could change the game.

“This is a wake-up call,” said MST Marquee’s Saul Kavonic. “The market has underestimated how fragile the global oil system really is.”

Oil markets are back on a war footing. What began as a targeted Israeli strike could spiral into a full-blown regional showdown — one with massive consequences for energy, inflation, and global economic stability.

Whether crude hits $100, $120 or even $130 will depend not just on what Iran does next, but on whether global players like Trump, Saudi Arabia, and OPEC can contain the fire — or fan the flames.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

2025 Stock Rally Isn’t Just About Magnificent 7 Anymore

Trump Says Israel Attack ‘Great for Market’ as Stocks Plunge, Oil Soars After Iran Retaliation

10 Reasons China Is Leading the Robot Race

Trump Unloads on EV Mandates, Talks Musk, Tariffs, and National Guard: Here’s What He Said

Why gold beat Euro to become world’s second-largest reserve asset

Trump-Musk Feud Last Phase: Tesla WON

Washington Starts to ‘De-Musk’: 5 Stocks Poised to Gain From the Shift