Stocks entered positive territory for the year last week as optimism over a temporary U.S.-China trade truce lifted markets. But beneath the green tickers and celebratory headlines, a deeper concern is rising among executives and investors alike: earnings estimates and corporate guidance may no longer matter—at least not in the way they used to.

“If you are relying on earnings estimates and corporate guidance to inform your investing decision-making process right now, just stop it. It’s a total waste of time.”

— Brian Sozzi, Yahoo Finance

A Shifting Landscape

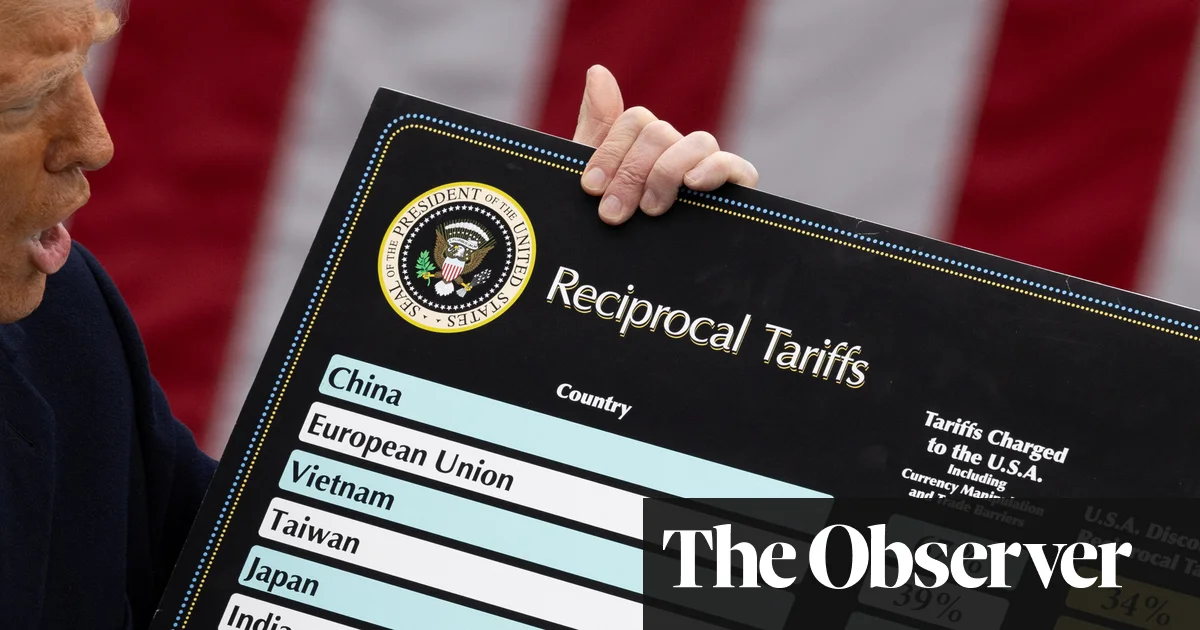

The backdrop is chaotic. Tariff uncertainties, social media-driven market reactions, and geopolitical instability have made long-term forecasting nearly impossible. One Fortune 500 executive recently said the newly imposed 30% tariff rate may become the ‘new norm’ unless a breakthrough is reached.

Even strong earnings from companies like Walmart (WMT) and Cisco (CSCO) weren’t enough to inspire investor confidence. And while the Magnificent Seven tech giants—Microsoft, Apple, Amazon, Meta, Alphabet, Nvidia, and Tesla—continued to climb, other sectors showed that even slight uncertainty around guidance could send stocks tumbling.

CEOs Pull the Plug on Forecasts

Executives are growing skeptical too. Mattel (MAT) CEO Ynon Kreiz has already dropped forward guidance due to trade-related volatility, while United Airlines (UAL) still issues a double-range forecast that insiders say is more of a punchline than a roadmap.

Even Walmart, which reiterated its earnings outlook, added a caveat: they’re raising prices across categories, and tariffs could make their forecast obsolete. CFO John David Rainey told Yahoo Finance that price hikes could reach double digits if tariffs spike again.

“I’m just shooting in the wind to give you a number when I don’t know what the ground rules are,” said former Medtronic CEO Bill George, who also served on the boards of Target, ExxonMobil, and Goldman Sachs.

“If you tell me what the rules are, I’ll tell you what we’ll do.”

George, who once intentionally missed estimates to reset investor expectations, believes that guidance is outdated in today’s environment.

Analysts Still See Growth—But Should They?

Despite all the warnings, Wall Street is still calling for over 10% earnings growth this year. But some strategists aren’t buying it.

“The whole system’s earnings are too high, and they’re going to come down,” said Adam Parker, founder of Trivariate Research.

“The stock market can go up when earnings go down, for sure—but those earnings are higher than normal, and we’ve had tariffs. That’s not all priced in.”

Why It Matters

For decades, corporate guidance and Wall Street estimates have acted as key signposts for investors navigating markets. Now, with that guidance clouded by macroeconomic shocks and political unpredictability, investors may be flying blind.

It raises a serious question: In 2025, can traditional valuation models and earnings forecasts still serve as reliable tools? Or is stock picking and agility becoming the only viable strategy in this climate?

As the market adjusts to new economic norms, one thing is clear: the old rules may no longer apply.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Earnings Calendar, Fed Speech, Housing Data: What to Watch This Week

UK overtakes China as second-largest US Treasury holder

CERN Scientists Turn Lead into Gold — Why This Is Bigger Deal for Bitcoin Than You Think

Nvidia, Cisco, Oracle and OpenAI are backing the UAE Stargate data center project

Trump vs. Tim Cook: Apple’s Global Strategy Sparks Debate Over Economic Patriotism and AI Security

US and EU break impasse to enable tariff talks

China Tightens Control Over AI Data Centers

Trump: US will set new tariff rates, bypassing trade negotiations

Sundar Pichai Interview on AI, Search, and Future of Google

Billionaire Investors Reveal Q1 2025 Portfolio Moves: Buffett, Ackman, Tepper, Burry & More