Hims & Hers Health (NYSE: HIMS), a telehealth pioneer transforming how consumers access wellness, mental health, and sexual health products, will report Q1 2025 earnings on May 5, 2025, after market close.

With shares up over 200% in the past 12 months, Wall Street and retail traders are watching closely to see if the company can continue its high-growth, profitability-approaching journey.

We combed through all available research, analyst reports, earnings calendars, and management commentary to bring you the most comprehensive earnings preview.

What Wall Street Expects

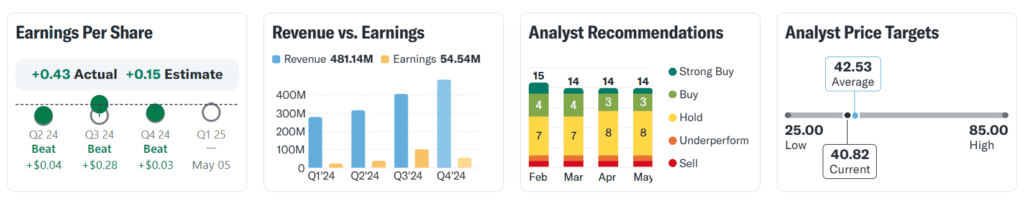

- Revenue estimate: ~$278–280 million → up ~42% year-over-year (YoY)

- EPS estimate (GAAP): break-even to slightly negative (around -$0.01 to $0.00)

- Adjusted EBITDA: positive ~$10–12 million range

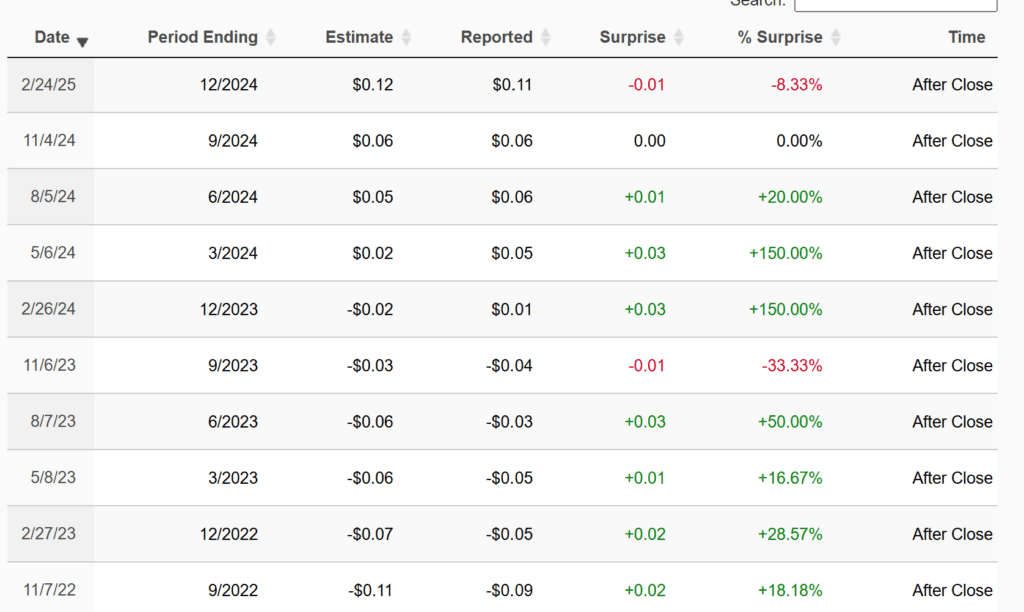

According to Zacks, HIMS has consistently beaten consensus revenue estimates for the last 10 quarters, with surprises averaging ~8–10%. EPS surprises have been more volatile, but the company has steadily narrowed its losses

Core Themes and Catalysts

✅ Sustained Consumer Demand Across Vertical Lines

Per Yahoo Finance and Businesswire, the company continues to see strong demand across its core categories:

- Sexual health (ED, birth control)

- Mental health (anxiety, depression medications)

- Dermatology (hair loss, skincare)

- Weight management (GLP-1 drugs, a new growth driver)

Management has highlighted particularly explosive growth in mental health and weight management subscriptions, which have been key revenue accelerators.

✅ Subscription Model Driving Recurring Revenue

Hims & Hers runs a direct-to-consumer (DTC) subscription model with >90% of revenue from recurring sources.

According to MarketBeat and Schwab, this “stickiness” has been critical for revenue predictability and margin expansion:

- Active subscribers reached 1.7 million in Q4 2024, up 48% YoY

- Average revenue per user (ARPU) has grown steadily, signaling strong cross-selling and upselling

✅ Gross Margin Expansion Story

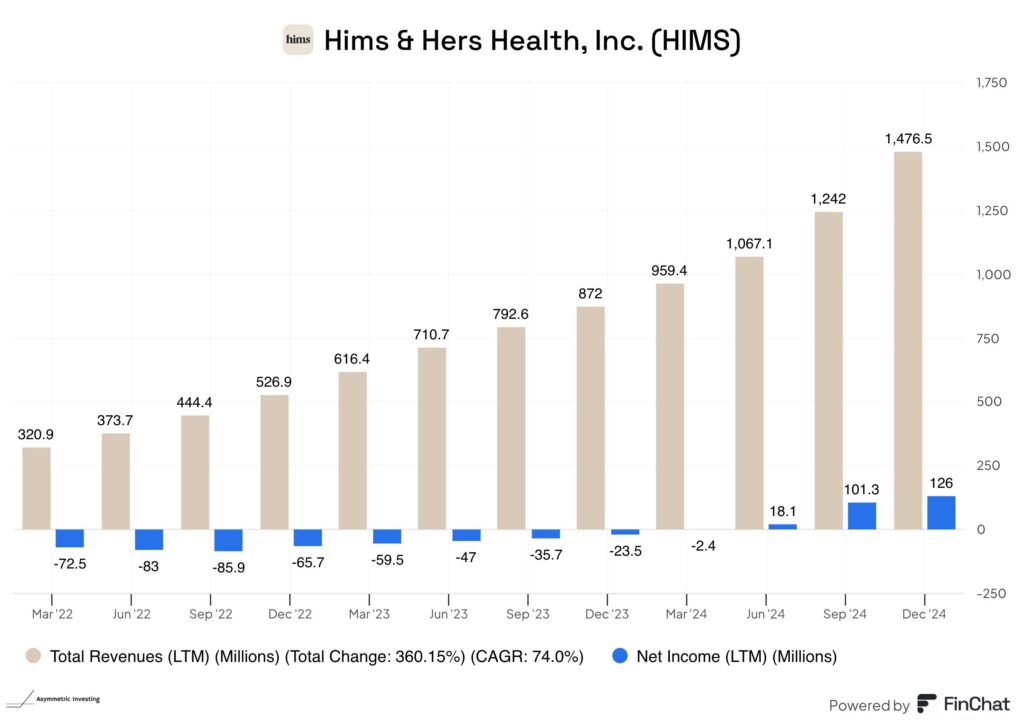

Gross margins have jumped from ~74% in 2022 to ~80% by the end of 2024, per WSJ and Nasdaq data.

- Supply chain optimizations, direct sourcing of medications, and pharmacy integration have been key levers

- Management reiterated a long-term gross margin target of ~85%, setting HIMS apart from many DTC peers

✅ Path to Profitability in Sight

MarketWatch and Schwab highlight that while HIMS has been unprofitable on a GAAP basis, its adjusted EBITDA margins have improved from negative 10% in 2022 to positive mid-single digits in Q4 2024.

Analysts expect Q1 2025 to mark another milestone with positive adjusted EBITDA for the fourth straight quarter, signaling operational leverage.

Bullish Thesis — Backed by Facts

1️⃣ Massive TAM, Early Penetration

The global telehealth market is projected to reach $500B by 2030 (MLQ.ai). HIMS is still early, especially in mental health, which it entered less than three years ago.

2️⃣ Weight Loss Category as New Catalyst

The company recently added GLP-1 medications (like Ozempic and Mounjaro alternatives) to its platform, addressing the red-hot U.S. weight loss market, a $100B+ opportunity. Analysts from Yahoo Finance believe this could double revenue from existing subscribers over time.

3️⃣ Strong Brand and Customer Loyalty

MarketChameleon data shows low churn and rising lifetime value (LTV) across subscribers, with the company ranked among the top DTC health brands by online engagement.

4️⃣ Consistent Revenue Beats

HIMS has beaten revenue estimates in every quarter for the past 10 quarters (Zacks, MarketBeat) — a sign of underappreciated execution.

5️⃣ Gross Margin Strength and Capital Discipline

While many digital health companies chase growth at any cost, HIMS has methodically built gross margin and is now on track for consistent adjusted EBITDA profitability.

Bearish Thesis — Risks, With Data

1️⃣ Profitability Still Thin

Despite revenue scale, HIMS remains GAAP unprofitable and could stay so through at least mid-2025, per WSJ and MarketWatch. This makes the stock vulnerable if macro pressures or marketing costs spike.

2️⃣ Customer Acquisition Costs (CAC) Climbing

Nasdaq and Yahoo note that while ARPU is rising, so is CAC, particularly on platforms like TikTok and Instagram. If the company fails to improve efficiency, margins could get squeezed.

3️⃣ GLP-1 Supply and Pricing Risks

Weight loss drugs are in short supply globally, and prices remain volatile. HIMS depends on reliable sourcing to meet subscriber demand and maintain gross margins.

4️⃣ Competitive Threats

Amazon Pharmacy, Ro, and GoodRx are expanding aggressively into the same verticals. Analysts at MLQ.ai warn that customer loyalty could get tested if bigger platforms undercut on price.

5️⃣ Stock Valuation Stretched

With the stock up over 200% in the past year, valuation multiples are rich. Any growth slowdown or margin miss could trigger a sharp pullback, especially with high retail ownership.

Prediction and Market Sentiment

- Revenue beat expected: Most analysts believe HIMS will top the ~$278M consensus estimate

- EPS surprise possible: Street expects near break-even, but operational leverage could deliver a small positive

- Key metric to watch: Active subscribers (consensus ~1.8M) and ARPU growth; Wall Street will punish slowing user growth

- Guidance watch: FY2025 outlook must confirm >35–40% YoY revenue growth and continued margin improvement

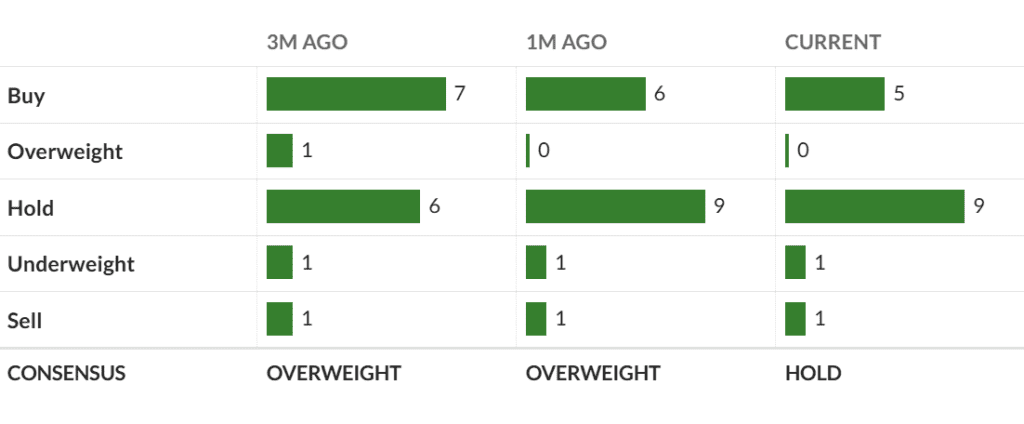

Valuation, Ratings, and Sentiment Check

- Market cap: ~$3.5B

- YTD performance: +85%

- Forward sales multiple: ~5x

- Analyst ratings (MarketBeat, WSJ): 6 Buy, 3 Hold, 1 Sell

- Average price target: ~$16 (vs. ~$14 current)

Final Takeaways for Investors, Traders, Beginners

For investors:

HIMS is one of the strongest growth stories in digital health, but valuation demands flawless execution. Stay focused on subscriber growth, ARPU, and margins.

For traders:

Expect high volatility around earnings. The stock has a history of 10–15% post-earnings moves, especially if subscriber or profit metrics surprise.

For beginners:

Understand that while HIMS looks like a “hot growth stock,” it’s still in the early profitability phase. Be patient, diversify, and avoid chasing short-term momentum blindly.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Palantir Q1 2025 Earnings Preview and Prediction: What to Expect