Markets shook after Fed Chair Jerome Powell warned Trump’s new tariffs would likely trigger “even higher inflation and slower growth.” His comments, delivered at the Economic Club of Chicago on April 16, hit Wall Street hard, raising red flags about the possibility of stagflation, a rare and dangerous economic combo. ( More about: Powell Warns Trump Tariffs Could Force Fed Into Economic Dilemma Not Seen in Decades)

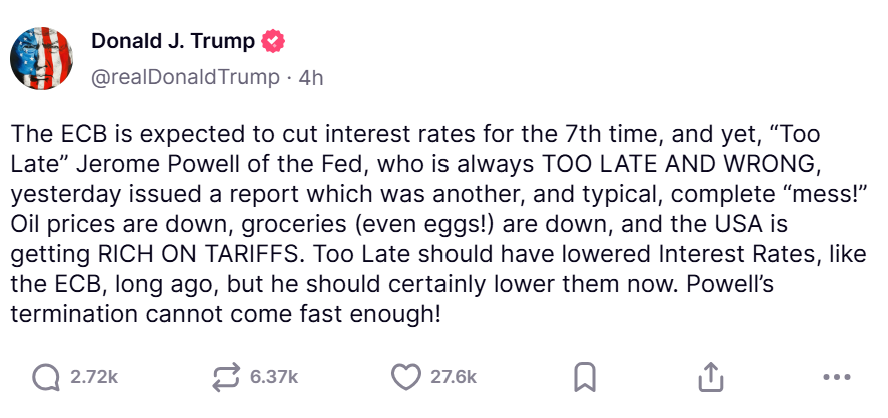

The next morning, Trump erupted on Truth Social: “Jerome Powell of the Fed, who is always TOO LATE AND WRONG, yesterday issued a report which was another, and typical, complete ‘mess!’”

“His termination cannot come soon enough.”

“He should certainly lower interest rates“

This wasn’t just a personal attack. It was a direct challenge to the Fed’s monetary stance — and to Powell’s refusal to act as a political tool. Trump has long wanted cheap money to juice the economy, especially heading into 2026. But Powell’s dilemma is complex:

Why hasn’t the Fed acted?

Because Trump’s tariff policy creates a policy trap:

If Powell raises interest rates to control inflation caused by import taxes (tariffs), it will:

– cool spending,

– slow down borrowing,

– and potentially stall an already weakening economy.

But if Powell cuts rates to stimulate the economy under tariff pressure, it risks:

– encouraging excess spending,

– heating up prices,

– and making inflation even worse.

That’s the classic stagflation bind — rising prices + weak growth = limited good options.

Powell has been careful. He’s held rates steady recently — not because the economy is strong, but because it’s too fragile for aggressive moves. The Fed is watching closely.

Meanwhile, Trump keeps pushing. He’s criticised Powell multiple times this year alone:

– In January, after oil prices fell, Trump demanded cuts.

– In March, when the Fed kept rates unchanged, he again called for looser policy, hours later.

But Powell has consistently stood his ground. After Trump’s 2024 election victory, Powell was asked point-blank if he would resign if the president requested it.

“No,” he said bluntly, pausing to let the message land.

When asked whether Trump could legally fire or demote him, Powell replied: “Not permitted under the law.”

The Fed was created in 1913 by Congress as an independent central bank. While the president can technically remove a Fed governor “for cause,” legal scholars say that disagreeing over policy isn’t enough. It would likely require misconduct or dereliction of duty.

Powell has emphasized the Fed’s independence many times. Most recently, at Fed HQ last month: “I did answer that question in this very room some time ago, and I have no desire to change that answer and have nothing new for you on that today.”

Finblog takeaway: Trump wants lower rates to shield the economy from his own tariffs — and help his political agenda.

Powell is caught in a balancing act, trying to guard the economy without fueling more inflation.

Their clash isn’t just personal — it could reshape Fed credibility, market confidence, and U.S. monetary stability.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia’s CEO makes surprise visit to Beijing after US restricts chip sales to China

The Rule of 40: Your Ultimate Guide to Evaluating Software Stocks

How does the Eurodollar System Influence Global Markets?

Nvidia faces $5.5 billion charge as US restricts chip sales to China

China to now pay up to 245% tariffs on imports to US: Trump’s latest move

China appoints new trade envoy in face of tariff turmoil

Rumoured Iphone Fold could cost over $2,000 at launch

What the Market Isn’t Telling You: Gold, Bonds, Hedge Funds & Fed’s Next Move