Federal Reserve Chair Jerome Powell has raised the alarm unemployment.

“While uncertainty remains elevated, it is now becoming clear that the tariff increases will be significantly larger than expected,” Powell said Friday at a conference for business journalists.

He added that “the same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

“No Question That’s a Difficult Situation”

The remarks mark Powell’s most direct response yet to the Trump administration’s latest trade policy shift, which includes double-digit reciprocal tariffs on over 180 countries and a 25% tariff on all imported automobiles. Many economists now fear the onset of stagflation—a dreaded combination of high inflation and stagnant growth.

Powell made clear the Fed’s dual mandate—price stability and full employment—was now in jeopardy.

“Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem,” he said.

Powell: “We’ve Taken a Step Back”

Though Trump has publicly called on the Fed to cut interest rates, Powell refused to commit to any policy change and stressed independence from political pressure.

“It’s not clear what the appropriate path for monetary policy will be, and we have to wait to see how this plays out before we start to make those adjustments.”

“We’ve taken a step back and we’re watching to see what the policies turn out to be and the ways in which they will affect the economy, and then we’ll be able to act,” Powell added.

He was also firm about keeping politics out of the central bank’s decisions:

“The American people expect the Fed to tell the truth and that is what it will do.”

Trump Fires Back

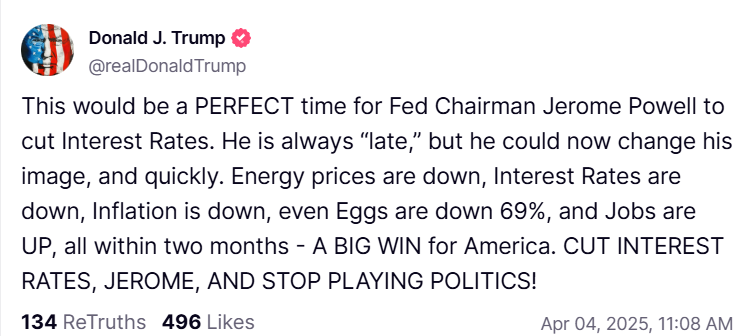

Trump, however, had already fired shots earlier in the day on Truth Social, urging Powell to slash rates.

“This would be a PERFECT time for Fed Chairman Jerome Powell to cut Interest Rates. He is always ‘late,’ but he could now change his image, and quickly,” Trump wrote.

“Energy prices are down, Interest Rates are down, Inflation is down, even Eggs are down 69%, and Jobs are UP… CUT INTEREST RATES, JEROME, AND STOP PLAYING POLITICS!”

Wall Street: Turmoil Continues

The markets have not taken the tariff news well:

- The Dow Jones is now down 1,700+ points in just two days.

- The S&P 500 has dropped nearly 10% since mid-March.

- China announced a 34% retaliatory tariff on all U.S. goods, starting April 10.

Fed Vice Chair Philip Jefferson also voiced concern, saying,

“If uncertainty persists or worsens, economic activity may be constrained.”

The Fed’s Balancing Act

Powell admitted the central bank is in a tight spot:

“If we find ourselves in that situation, we look at how far each of the two variables [inflation and unemployment] is from its goal… and we weigh those things and make a decision about what to do.”

He concluded by expressing measured confidence:

“We are well positioned to deal with the risks and uncertainties we face as we gain a better understanding of the policy changes and their likely effects on the economy.”

Related: Trump Announces Tiered Tariffs on China, EU, India, Others — “This Is Just the Start”

‘No Winner In A Trade War’: China, EU And Others React To Trump’s Reciprocal Tariffs

This Is the Largest Tax Shock in Nearly 60 Years

Here’s What Will Cost More After Trump’s Tariffs: Coffee, Cars, More