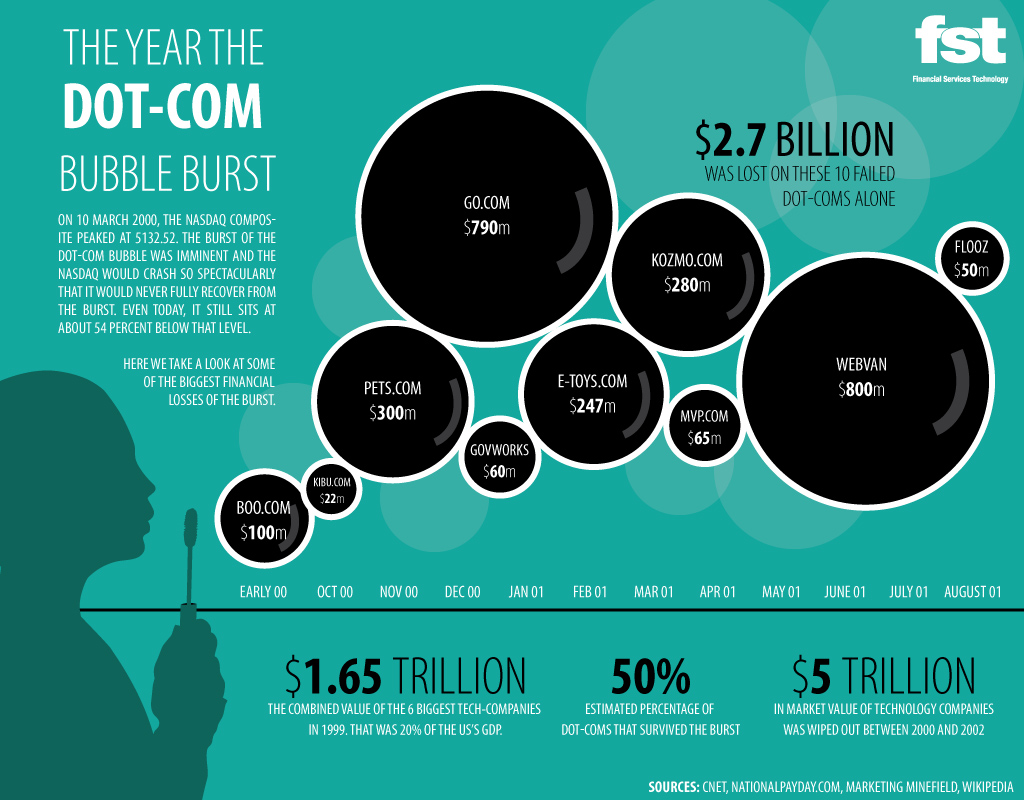

The Dot-Com Bubble Burst of 2000 is one of the most famous examples of a speculative bubble in financial history.

The collapse of the dot-com bubble highlights the dangers of irrational exuberance, unsustainable valuations, and the risks of chasing market trends without considering broader macroeconomic fundamentals.

The late 1990s were a time of extraordinary optimism.

The rise of the internet promised to revolutionize industries, and tech companies were at the forefront of this transformation. Investors poured money into dot-com companies, many of which had little more than a business plan and a catchy name. Stock prices skyrocketed, with the Nasdaq Composite Index more than doubling between 1997 and 1999.

However, the euphoria surrounding tech stocks masked serious underlying issues. Many of the companies that went public during this period had little to no revenue, and their business models were often unproven. Despite this, valuations soared, with some companies reaching market capitalizations in the billions of dollars without ever turning a profit.

By March 2000, the bubble began to burst.

Investors, realizing that many of these companies would never be profitable, started selling off their shares. Over the next two years, the Nasdaq plunged by 78%, wiping out trillions of dollars in market value and leaving investors reeling.

The Macro Mistake

The Dot-Com Bubble Burst was a classic case of irrational exuberance, where investors ignored fundamental analysis in favor of chasing the next big thing. The result was a massive misallocation of capital and a devastating collapse when the bubble burst.

- Unsustainable valuations: Many dot-com companies were valued based on hype rather than actual earnings or cash flow. When it became clear that these companies would not live up to their lofty expectations, their stock prices plummeted.

- Chasing trends: Investors flocked to tech stocks because they believed they could not lose. This herd mentality led to a speculative frenzy that drove prices far beyond what was justified by the underlying fundamentals.

- Ignoring macro signals: The broader economy was showing signs of weakness in 2000, but investors were so focused on the tech sector that they failed to notice the warning signs. As a result, they were caught off guard when the bubble burst.

The Macro Lesson

The Dot-Com Bubble Burst offers several critical macroeconomic lessons:

- Valuation matters: No matter how exciting a sector may be, fundamentals like earnings, cash flow, and profitability remain critical. The dot-com bubble showed us that ignoring these fundamentals can lead to massive losses when reality sets in.

- Beware of herd mentality: When investors chase trends without considering the underlying risks, it creates bubbles that eventually burst. Staying disciplined and focusing on long-term value is essential for avoiding the pitfalls of speculative markets.

- Watch for macroeconomic warning signs: The dot-com bubble burst occurred at a time when the broader economy was slowing. As macro investors, it’s important to consider the macro environment when assessing market risks, even if a particular sector is experiencing rapid growth.

The collapse of the dot-com bubble led to a deep bear market, with tech stocks losing nearly 80% of their value. Many companies that had been valued in the billions went bankrupt, and thousands of investors saw their wealth evaporate.

It took several years for the market to recover, and the tech sector remained under pressure for much of the early 2000s.

Investors who remained cautious during the dot-com boom and focused on fundamentals were able to avoid the worst of the collapse.

Additionally, those who recognized the signs of a speculative bubble early on had the opportunity to short overvalued tech stocks, profiting from the market’s eventual decline.

The Dot-Com Bubble Burst serves as a reminder of the dangers of irrational exuberance and the importance of staying disciplined in the face of speculative frenzies.

Source: Macro Mornings

Related:

Chinese AI team wins global award for replacing Nvidia GPU with industrial chip

Debt Cycles and Their Impact on Markets: In-Depth Look at Long-Term Debt Cycle Theory

Internal Ripple Emails Expose Anti-Bitcoin Smear Campaign

Trump wants to CRASH STOCK MARKET, but It’s All Part of the His Plan

‘I hate to predict things’: Trump doesn’t rule out US recession in 2025

Institutional Investors Bet $1B on These 4 Stocks—Should You?

Nasdaq 100 Crashes After Dimon & Buffett Sell-Off: What Did They Know?

CrowdStrike: Deep Dive into Company Fundamentals & Market Forecast

How Google tracks Android device users before they’ve even opened an app

Crypto Capital Of The World? Trump’s Bitcoin Reserve Plan Sparks Debate

Next S&P 500 Inclusion Coming: Here are Potential Stock Additions