The upcoming week, from March 10 to March 14, 2025, is set to feature several significant economic events and corporate earnings releases that could influence financial markets.

Next week’s inflation reports and consumer confidence data will be critical in shaping expectations around Federal Reserve policy, while earnings from companies like Oracle, Adobe, and Lennar will offer insight into tech, software, and housing sectors.

Key Economic Events & Their Market Impact

Consumer Price Index (CPI) – Wednesday, March 12

- What it Measures: Tracks changes in prices consumers pay for goods and services (inflation gauge).

- Why it Matters: A key driver for Fed policy decisions on interest rates.

- Market Impact Historically:

- July 2023 CPI cooled to 3.2%, triggering a 3% rally in the Nasdaq as hopes for rate cuts increased.

- October 2023 CPI came in hotter at 3.7%, causing the S&P 500 to fall 1.3% amid fears of prolonged higher rates.

Producer Price Index (PPI) – Thursday, March 13

- What it Measures: Tracks wholesale inflation – what producers get paid for goods/services.

- Why it Matters: Signals future consumer inflation trends.

- Market Impact Historically:

- December 2023 PPI rose 0.3%, stoking inflation concerns. Treasury yields spiked, and the S&P 500 dropped 1.6% that day.

- Conversely, August 2023 PPI came in flat, boosting market optimism and sending the Dow Jones up 1.1%.

University of Michigan Consumer Sentiment – Friday, March 14

- What it Measures: Gauges consumer attitudes on the economy and spending.

- Why it Matters: High confidence typically means more spending; low sentiment signals slowing growth.

- Market Impact Historically:

- February 2024 Consumer Sentiment hit 79.6, the highest since mid-2021, helping boost the S&P 500 by 0.9%.

- June 2023 Sentiment plunged to 63.0, triggering fears of a spending slowdown and a 1.4% sell-off in discretionary stocks.

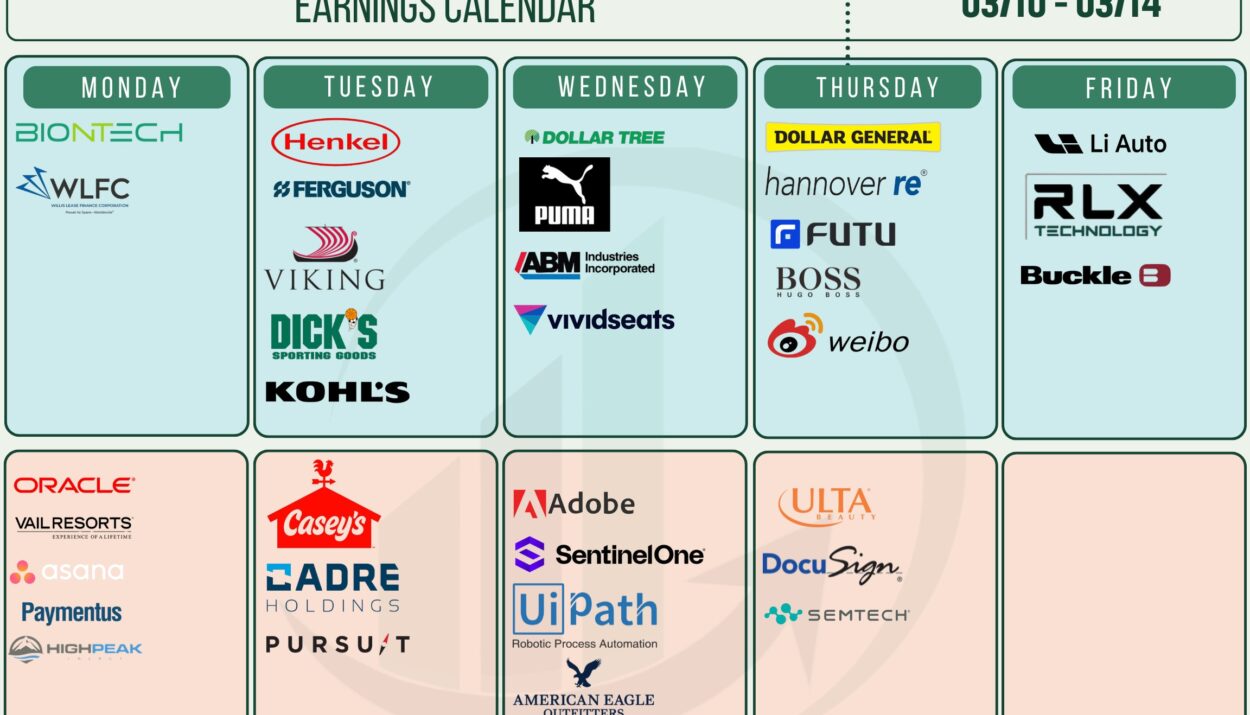

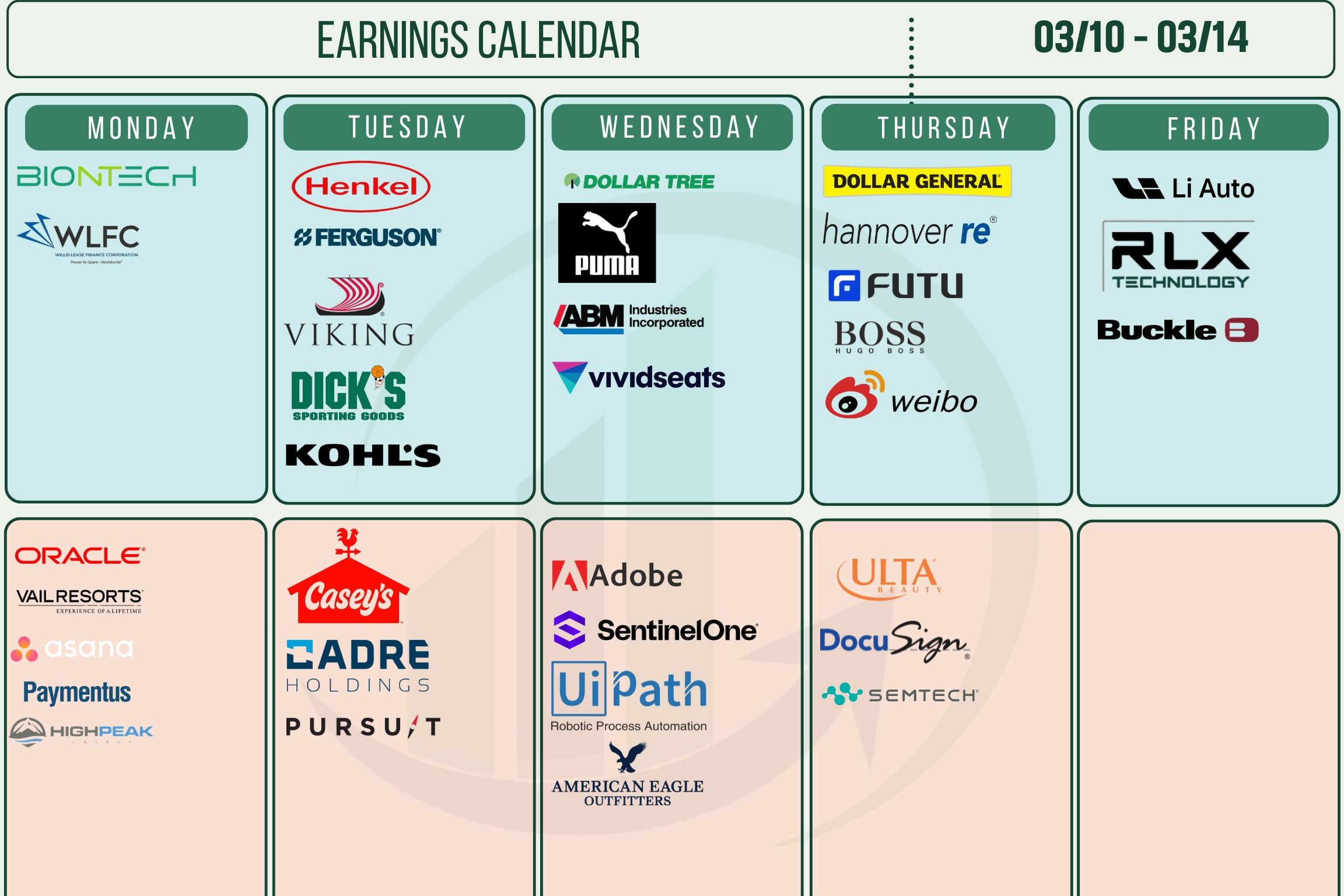

Upcoming Earnings Reports (March 10 – 14, 2025)

🗓️ Monday, March 10

| Company | Ticker | Estimated EPS | Estimated Revenue | Sector |

|---|---|---|---|---|

| BioNTech | BNTX | $0.41 | $4.5B | Biotechnology |

| Willis Lease Finance | WLFC | $1.25 | $220M | Financial Services |

| Oracle | ORCL | $1.49 | $12.4B | Technology |

| Vail Resorts | MTN | $6.29 | $1.1B | Leisure |

| Asana | ASAN | -$0.01 | $150M | Technology |

| Paymentus | PAY | $0.12 | $120M | Technology |

| HighPeak Energy | HPK | $0.15 | $130M | Energy |

🗓️ Tuesday, March 11

| Company | Ticker | Estimated EPS | Estimated Revenue | Sector |

|---|---|---|---|---|

| Henkel | HENKY | €1.20 | €5.0B | Consumer Staples |

| Ferguson | FERG | $1.59 | $7.2B | Industrials |

| Viking Holdings | VIK | $0.36 | $1.5B | Financial Services |

| Dick’s Sporting Goods | DKS | $3.50 | $3.6B | Consumer Discretionary |

| Kohl’s | KSS | $0.73 | $4.0B | Consumer Discretionary |

| Casey’s General Stores | CASY | $1.65 | $3.0B | Consumer Staples |

🗓️ Wednesday, March 12

| Company | Ticker | Estimated EPS | Estimated Revenue | Sector |

|---|---|---|---|---|

| Dollar Tree | DLTR | $1.25 | $7.4B | Consumer Staples |

| Puma | PUMSY | €0.50 | €1.2B | Consumer Discretionary |

| ABM Industries | ABM | $0.79 | $1.6B | Industrials |

| Vivid Seats | SEAT | $0.10 | $150M | Communication Services |

| Adobe | ADBE | $4.97 | $5.6B | Technology |

| SentinelOne | S | -$0.15 | $75M | Technology |

| UiPath | PATH | $0.05 | $220M | Technology |

| American Eagle Outfitters | AEO | $0.35 | $1.3B | Consumer Discretionary |

🗓️ Thursday, March 13

| Company | Ticker | Estimated EPS | Estimated Revenue | Sector |

|---|---|---|---|---|

| Dollar General | DG | $2.50 | $9.0B | Consumer Staples |

| Hannover Re | HNR1.DE | €2.00 | €6.0B | Financial Services |

| Futu Holdings | FUTU | $0.85 | $200M | Financial Services |

| Hugo Boss | BOSSY | €0.80 | €800M | Consumer Discretionary |

| WB | $0.70 | $500M | Communication Services | |

| Ulta Beauty | ULTA | $5.20 | $2.6B | Consumer Discretionary |

| DocuSign | DOCU | $0.61 | $705M | Technology |

| Semtech | SMTC | $0.50 | $180M | Technology |

🗓️ Friday, March 14

| Company | Ticker | Estimated EPS | Estimated Revenue | Sector |

|---|---|---|---|---|

| Li Auto | LI | $0.10 | $1.0B | Consumer Discretionary |

| RLX Technology | RLX | $0.05 | $250M | Consumer Staples |

| Buckle | BKE | $0.85 | $300M | Consumer Discretionary |

Conclusion

This week is all about inflation numbers and big-name earnings. Historically, CPI and PPI have been major catalysts for market swings, while consumer sentiment gives key insight into spending trends.

Investors should expect increased volatility, especially after inflation reports. Earnings from Oracle and Adobe could have an outsized effect on the tech-heavy Nasdaq, while Lennar’s results will reveal clues about the housing market.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Institutional Investors Bet $1B on These 4 Stocks—Should You?

Nasdaq 100 Crashes After Dimon & Buffett Sell-Off: What Did They Know?

CrowdStrike: Deep Dive into Company Fundamentals & Market Forecast

How Google tracks Android device users before they’ve even opened an app

Crypto Capital Of The World? Trump’s Bitcoin Reserve Plan Sparks Debate

Next S&P 500 Inclusion Coming: Here are Potential Stock Additions

Congress Trading: A Spotlight on Ecolab (ECL)

Trump’s Bitcoin Reserve: A Game-Changer or a Market Shock?

TSMC and Intel Investments at Risk as Trump Targets $52B CHIPS Act

What Analysts Think of Broadcom Stock Ahead of Q1 Earnings?

What Analysts Think of BigBear.ai Stock Ahead of Earnings?

The 10 Stocks Hedge Funds Love—and Hate—the Most

Why Is the Stock Market Still Panicking after Nvidia Strong Earnings…?