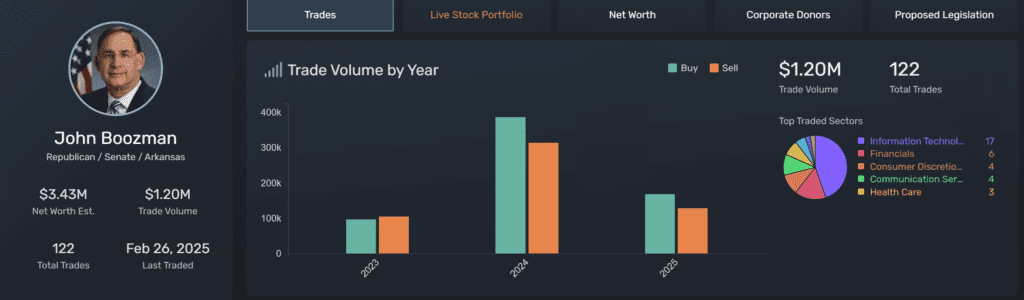

Senator John Boozman of Arkansas, a prominent member of the Senate Committee on Environment and Public Works, recently disclosed a series of stock transactions filed on March 6, 2025. Notably, his investments in Ecolab Inc. (NYSE: ECL) and the Sprott Lithium Miners ETF have garnered significant attention due to their alignment with his legislative focus and current geopolitical developments.

| Stock | Ticker | Transaction Type | Amount | Filed Date | Traded Date | Sector |

|---|---|---|---|---|---|---|

| Motorola Solutions | MSI | Purchase | $1,001 – $15,000 | Mar 6, 2025 | Feb 26, 2025 | Technology |

| Nvidia Corp | NVDA | Purchase | $1,001 – $15,000 | Mar 6, 2025 | Feb 26, 2025 | Semiconductors |

| Invesco Short Term Treasury | TBLL | Purchase | $1,001 – $15,000 | Mar 6, 2025 | Feb 26, 2025 | Fixed Income |

| Sprott Uranium Miners ETF | URNM | Purchase | $1,001 – $15,000 | Mar 6, 2025 | Feb 25, 2025 | Uranium Mining |

| iShares S&P 500 Growth ETF | IVW | Sale (Partial) | $1,001 – $15,000 | Mar 6, 2025 | Feb 14, 2025 | ETF |

| Microsoft Corp | MSFT | Purchase | $1,001 – $15,000 | Mar 6, 2025 | Feb 14, 2025 | Technology |

| Boston Scientific Corp | BSX | Purchase | $1,001 – $15,000 | Mar 6, 2025 | Feb 13, 2025 | Healthcare |

| Amazon.com Inc | AMZN | Purchase | $1,001 – $15,000 | Mar 6, 2025 | Feb 26, 2025 | E-commerce |

| American Express | AXP | Purchase | $1,001 – $15,000 | Mar 6, 2025 | Feb 26, 2025 | Financial Services |

| Ecolab Inc | ECL | Purchase | $1,001 – $15,000 | Mar 6, 2025 | Feb 26, 2025 | Water Treatment |

| First Trust North American Energy | EMLP | Sale (Partial) | $1,001 – $15,000 | Mar 6, 2025 | Feb 26, 2025 | Energy |

| First Trust Global Tactical Commodity Strategy | FTGC | Sale (Partial) | $1,001 – $15,000 | Mar 6, 2025 | Feb 26, 2025 | Commodities |

| Sprott Lithium Miners ETF | LITP | Purchase | $1,001 – $15,000 | Mar 6, 2025 | Feb 26, 2025 | Lithium Mining |

Background on Senator John Boozman

Senator Boozman has been serving Arkansas in the U.S. Senate since 2011. As a member of the Senate Committee on Environment and Public Works, he plays a crucial role in shaping policies related to environmental protection, infrastructure, and public works. His legislative interests often intersect with sectors like water treatment and energy, making his recent investments particularly noteworthy.

Investment in Sprott Lithium Miners ETF

The Senator’s purchase of the Sprott Lithium Miners ETF aligns with recent geopolitical developments. The United States and Ukraine have entered into a mineral agreement aimed at securing critical minerals essential for renewable energy technologies. This deal is expected to benefit companies involved in lithium extraction and processing, potentially boosting the value of related ETFs. (Related: US and Ukraine are planning to sign minerals deal: Here are some stocks which could stand to benefit)

Deep Dive into Ecolab Inc. (ECL)

Ecolab Inc. is a global leader in water, hygiene, and energy technologies and services. The company’s solutions promote safe food, maintain clean environments, optimize water and energy use, and improve operational efficiencies for customers in various industries, including food, healthcare, energy, hospitality, and industrial markets.

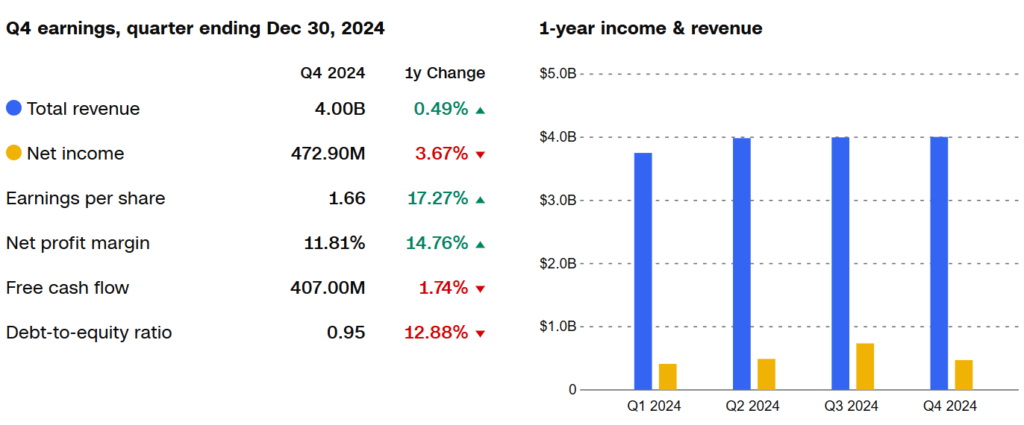

Financial Performance

- Revenue: In 2024, Ecolab reported revenues of $15.74 billion, marking a 2.75% increase from the previous year.

- Net Income: The company’s net income for 2024 stood at $2.11 billion, a significant rise from $1.37 billion in 2023.

- Earnings Per Share (EPS): The EPS for 2024 was $7.37, with projections indicating a rise to $7.62 in 2025 and $8.61 in 2026.

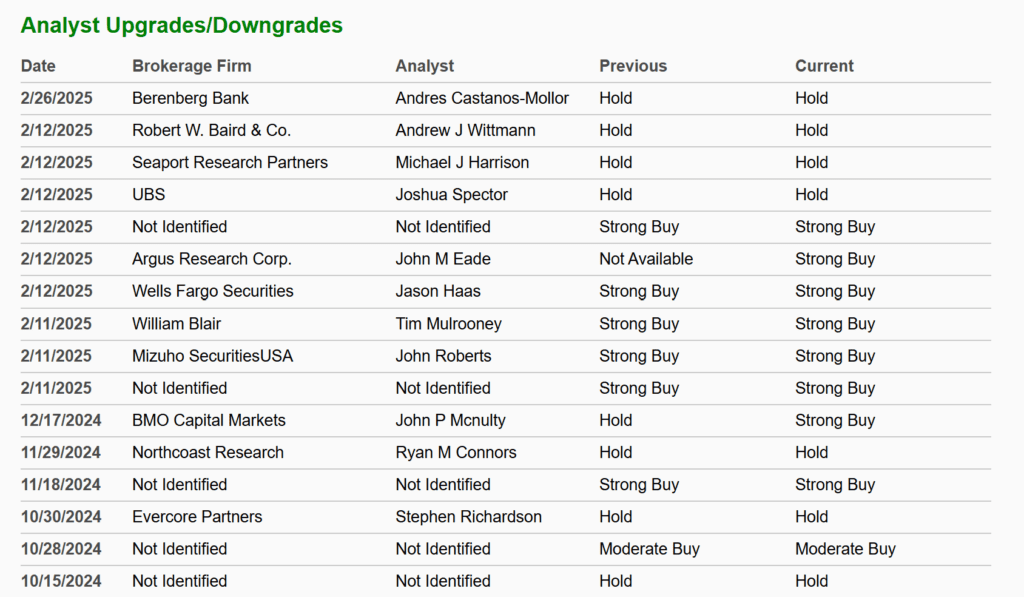

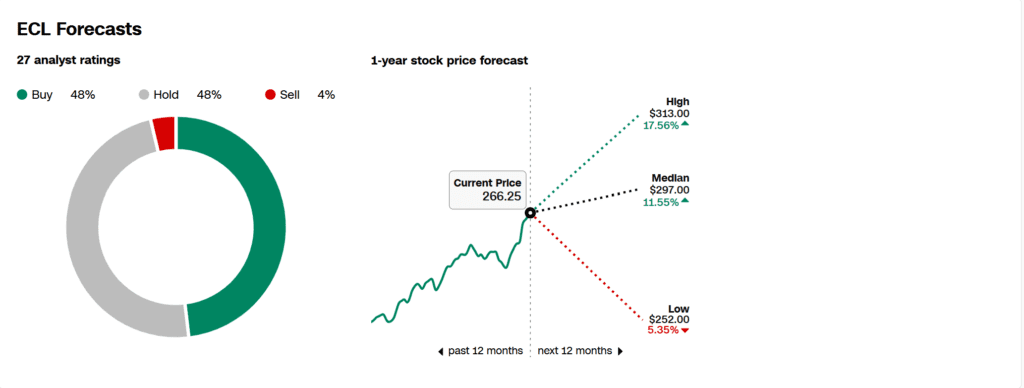

Analyst Ratings and Price Targets

- Consensus Rating: Ecolab holds a “Buy” consensus among analysts, reflecting optimism about its growth prospects.

- Price Targets: The average 12-month price target is $287 – $297, with forecasts ranging from a low of $250 to a high of $313. This suggests a potential upside from the current stock price.

Bullish Points

- Market Leadership: Ecolab’s dominant position in the water treatment and hygiene industry provides a competitive edge, allowing it to capitalize on global trends emphasizing sustainability and resource efficiency.

- Financial Growth: Consistent revenue and earnings growth highlight the company’s robust financial health and its ability to generate shareholder value.

- Analyst Support: The “Buy” consensus and favorable price targets from analysts reflect strong confidence in Ecolab’s future performance.

Bearish Points

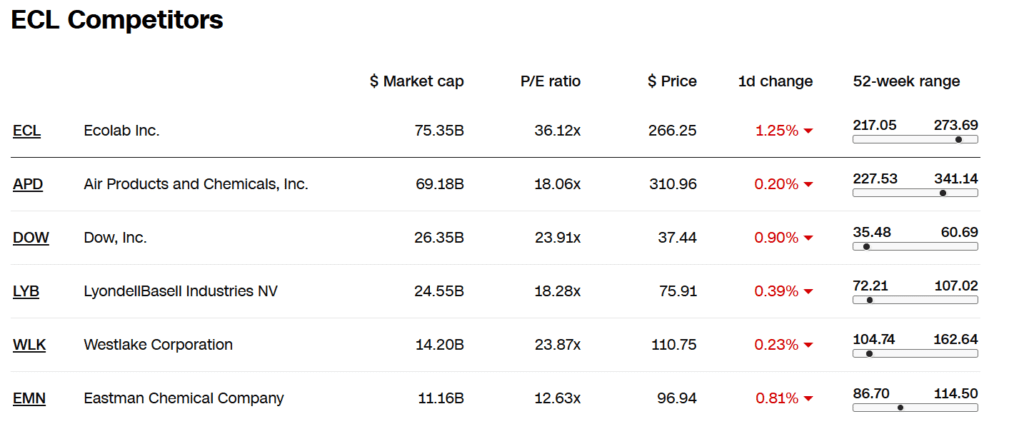

- High Valuation: Ecolab’s current Price-to-Earnings (P/E) ratio stands at 36.50, which is relatively high compared to industry peers, potentially limiting short-term stock appreciation.

- Market Volatility: Broader market fluctuations and economic uncertainties could impact Ecolab’s stock performance, especially given its global operations.

- Operational Challenges: Supply chain disruptions or increased operational costs could affect profit margins and overall financial performance.

Contracts and Outlook

Ecolab continues to secure significant contracts across various sectors, reinforcing its market position. The company’s focus on innovation and sustainability positions it well to meet the increasing demand for environmentally friendly solutions. With global emphasis on water conservation and hygiene, Ecolab is poised for sustained growth.

Conclusion

Senator Boozman’s recent investments in Ecolab Inc. and the Sprott Lithium Miners ETF reflect strategic positioning in sectors aligned with his legislative interests and current geopolitical trends. Ecolab’s strong financial performance, market leadership, and positive analyst outlook present a compelling case for investors. However, considerations regarding valuation and market volatility are essential for a balanced investment perspective.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

TSMC and Intel Investments at Risk as Trump Targets $52B CHIPS Act

What Analysts Think of Broadcom Stock Ahead of Q1 Earnings?

What Analysts Think of BigBear.ai Stock Ahead of Earnings?

The 10 Stocks Hedge Funds Love—and Hate—the Most

Why Is the Stock Market Still Panicking after Nvidia Strong Earnings…?

After Trump announced the US Strategic Crypto Reserve, What’s coming next?

Market Debate: Economic Slowdown or Sector Rotation?

Methods for More Consistent Gains in Penny Stocks

3 Solar Stocks Worth Buying in 2025

ETF Inflows at Record Highs – A Bullish Signal or a Bubble?