This week’s key events are all about the labor market and the Federal Reserve. With crucial employment data and 9 Fed speakers, markets will react to any shifts in interest rate expectations. Below is a breakdown of each event, its scheduled time, market impact, and historical reactions.

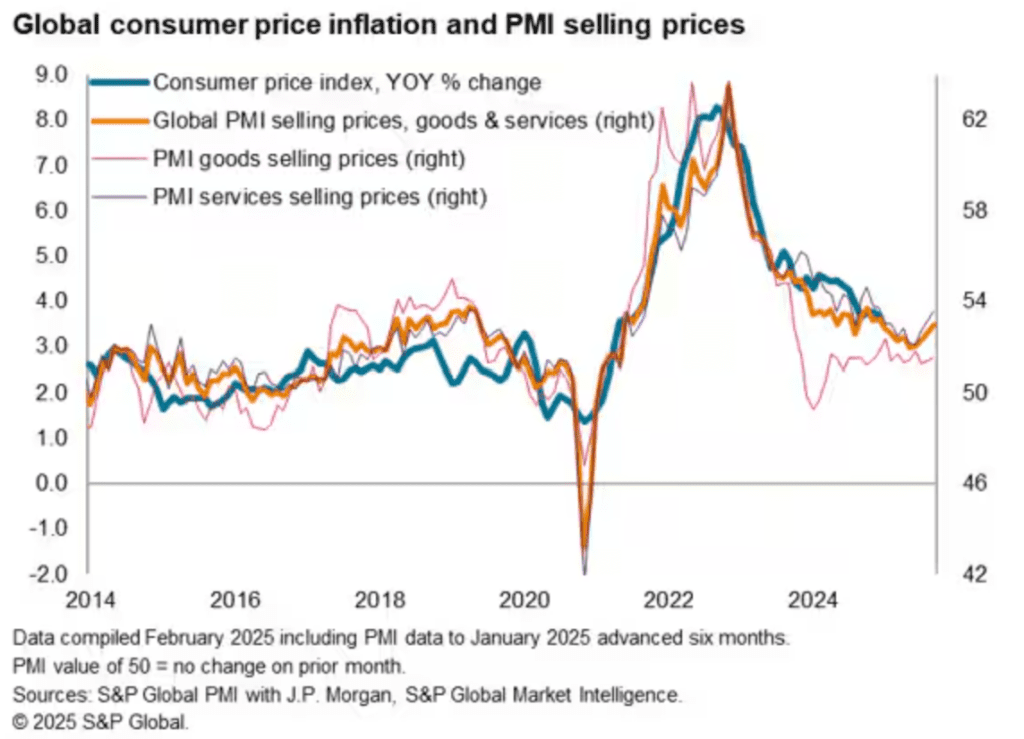

Monday, March 3 (10:00 AM EST) – ISM Manufacturing PMI (February)

What to Watch:

- Measures U.S. manufacturing activity.

- A reading above 50 signals expansion, while below 50 signals contraction.

- Investors monitor new orders, employment, and supplier deliveries for inflationary pressures.

- A strong PMI suggests a robust economy, while a weak PMI could fuel recession fears.

📉 Market Impact:

✔ Above expectations (PMI > 50): Stocks may rise, especially industrials (XLI ETF) and cyclical sectors.

✔ Below expectations (PMI < 50): Recession fears could send equities lower, with industrials and materials hit hardest.

✔ Supply chain delays or high prices in the report: Inflation concerns could push bond yields higher, pressuring tech stocks.

📊 Historical Stock Market Reaction:

- October 2024: PMI dropped to 46.7 (contraction), sparking a 1.3% drop in the S&P 500 due to recession concerns.

- December 2024: PMI rebounded to 47.4, boosting industrial stocks and lifting the Dow by +0.9%.

Wednesday, March 5 (8:15 AM EST) – ADP Nonfarm Employment Change (February)

What to Watch:

- A preview of Friday’s official jobs report, tracking private-sector hiring trends.

- Breaks down small vs. large business hiring, a key signal for economic health.

- Investors watch wage growth to gauge inflation risks.

📉 Market Impact:

✔ Stronger-than-expected hiring: Bond yields may rise, pressuring growth stocks (Nasdaq, tech, ARKK ETF).

✔ Weaker-than-expected hiring: Signals slowing economy, leading to rate-cut bets and stock market gains.

📊 Historical Stock Market Reaction:

- January 2025: ADP reported 107K jobs added (vs. 150K expected), triggering a 1.2% Nasdaq rally as rate-cut bets increased.

- November 2024: A strong ADP report (200K+) pushed yields above 5%, causing a 0.8% drop in the S&P 500.

Thursday, March 6 (8:30 AM EST) – Initial Jobless Claims

What to Watch:

- A weekly report on how many people are filing for unemployment benefits for the first time.

- Provides a real-time snapshot of labor market strength.

📉 Market Impact:

✔ Rising jobless claims (>230K): Could boost stocks as markets expect Fed rate cuts.

✔ Falling jobless claims (<200K): Suggests a tight labor market, raising fears of higher rates for longer.

✔ Claims above 250K: Recession fears may trigger a bond rally (lower yields) and push investors toward defensive sectors (utilities, healthcare, consumer staples).

📊 Historical Stock Market Reaction:

- June 2024: Claims jumped to 261K, causing a 1.5% rally in the S&P 500 as rate-cut bets surged.

- September 2024: Claims fell to 190K, causing a tech selloff as investors feared continued Fed tightening.

Friday, March 7 (8:30 AM EST) – Nonfarm Payrolls (February Jobs Report)

What to Watch:

- The most important economic report of the month.

- Includes total jobs added, unemployment rate, and wage growth.

- A strong report means the labor market is still tight, which could delay rate cuts.

- Key focus: Wage growth, as it impacts inflation expectations.

📉 Market Impact:

✔ Jobs added >250K + wage growth >0.4%: Bond yields spike, stocks sell off, especially rate-sensitive sectors (tech, real estate, utilities).

✔ Jobs added <150K + weak wage growth: Stocks rally on expectations of Fed rate cuts.

✔ Unemployment rate >4%: Markets may react positively, anticipating policy easing.

📊 Historical Stock Market Reaction:

- January 2025: A shocking 353K jobs added sent yields soaring, causing a 0.9% drop in the S&P 500 as traders reduced rate-cut expectations.

- November 2024: A soft 130K jobs added led to a +1.7% rally in tech stocks, as the market priced in an earlier Fed pivot.

Friday, March 7 (10:00 AM EST) – Fed Chair Powell Speaks

What to Watch:

- Powell will testify before Congress, discussing inflation, interest rates, and economic risks.

- Investors will analyze his tone for rate-cut hints or continued hawkishness.

- Will the Fed delay cuts until mid-2025 or start earlier in Q2?

📉 Market Impact:

✔ Dovish Powell (mentions inflation is easing, rate cuts soon): Stocks rally, especially tech and growth sectors.

✔ Hawkish Powell (inflation still a concern, rate cuts delayed): Bond yields jump, sending stocks lower.

✔ Mentions job market strength: Could reinforce the “higher for longer” narrative, hurting interest-rate-sensitive sectors.

📊 Historical Stock Market Reaction:

- August 2024 Jackson Hole Speech: Powell emphasized that inflation remained sticky, causing a 1.8% drop in the S&P 500 and a selloff in high-growth tech stocks.

- December 2024 FOMC Meeting: Powell hinted at potential rate cuts in June 2025, leading to a 2.5% Nasdaq rally.

Multiple Fed Speakers Throughout the Week

What to Watch:

- 9 Fed officials will deliver speeches throughout the week.

- Will they align with Powell’s stance, or will doves vs. hawks cause market confusion?

📉 Market Impact:

✔ Unified dovish tone: Stocks rally, bond yields fall.

✔ Diverging messages (some hawks, some doves): Increased market volatility.

📊 Historical Stock Market Reaction:

- March 2024: A surprise hawkish shift by Fed speakers caused a 2.2% drop in the S&P 500 in one day.

Key Takeaways

🔹 Labor market data is the biggest market driver this week—expect high volatility.

🔹 Stronger economic data = delayed rate cuts = stock market pressure.

🔹 Weaker data = rate-cut bets increase = stocks rally.

🔹 Powell’s speech on Friday could be the week’s biggest catalyst.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

3 Solar Stocks Worth Buying in 2025

ETF Inflows at Record Highs – A Bullish Signal or a Bubble?

Which Stocks Super Investors Bought Recently?

How long can NVIDIA stay untouchable?

Trump Organization Files Trademark for Metaverse & NFT Trading Platform

Trade war is back: After new tariffs S&P 500 erased $500+ BILLION of market cap, Bitcoin dropped

Trump vows March 4 tariffs for Mexico, Canada, extra 10% for China over fentanyl

How Trump’s 25% EU Tariffs Could Impact the Stock Market & Key Sectors

How Will Tesla Be Affected by 25% EU Tariffs?

Trump vows to slap 25% tariffs on EU and claims bloc was ‘formed to screw US