Every quarter, funds managing over $100 million must share their portfolio moves as part of their 13F filings. These filings can be goldmines, providing unique insights into recent decisions made by some of the best money managers. So, let’s look at the Q4 2024 update, regarding App Economy Insights.

As usual, this seasonal article comes with some caveats. Blindly replicating the trades of the so-called ‘smart money’ is a recipe for disaster. Investing decisions are like shots from the 3-point range on a basketball court. Even Steph Curry—the best shooter in history—misses more than half of his attempts. In investing, there is no such thing as a sure bet.

Your patience and capacity to stay the course matters more than what you put in your portfolio. Your success hinges on your behavior. Peter Lynch says you should “know what you own and why you own it.”

Conviction is a critical step in an investing framework because all companies go through a rough patch, and their stock inevitably collapses, at least temporarily.

1. Hedge funds’ strategies

Hedge funds are financial titans known for their sophisticated and flexible investment strategies aimed at achieving sky-high returns.

Here’s a breakdown of the pillars shaping their strategies:

- Market conditions: Hedge funds adjust their sails according to the economic winds. In bull markets, long positions may be favored, while bear markets might see an uptick in short selling or other defensive tactics.

- Sector trends: Changes in consumer behavior or new legislation can drive hedge funds toward specific industries and influence their buying patterns.

- Company fundamentals: A company’s earnings, cash flow, and management quality often dictate investment choices.

- Macroeconomic factors: Global events, from interest rate changes to geopolitical shifts, significantly influence hedge fund decision-making.

- Quantitative models: Many funds employ complex, proprietary models, uncovering opportunities that traditional analyses might miss.

- Risk management: Hedge funds don’t just chase returns; they also strategically diversify to mitigate risks.

- Investor sentiment: The market’s mood can lead to undervalued opportunities or selling points in a euphoric market.

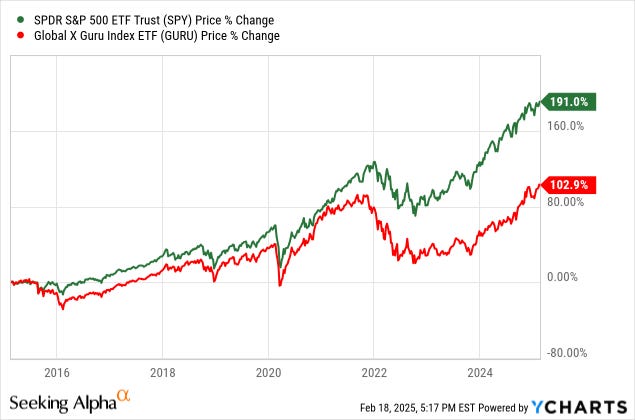

It doesn’t always work out. The Global X Guru ETF (GURU), mirroring some top hedge funds, illustrates a sobering reality: it has trailed behind the S&P 500 (SPY) over the past decade.

The hefty ‘2 and 20’ fee structure (2% of managed assets and 20% of profits) adds to this underperformance and can significantly erode returns. Intense market competition has put this model under scrutiny.

For individual investors, the takeaway is clear: while hedge funds’ dynamic strategies and potential for high returns are enticing, understanding their methodologies and the associated costs is crucial.

2. Top holdings and top buys in Q4

In early 2020, before the COVID rally and subsequent market collapse, I selected a list of 20 top-performing hedge funds, according to TipRanks. Their methodology was based on the alpha generated compared to the S&P 500. It’s not perfect, but it’s a good starting point. Let me know if you want specific funds on this list.

So let’s see what these funds, often featured in my social media feeds and podcast rotation, have been up to lately.

Remember, technology, communication, and consumer services represent most of the S&P 500, so it’s not surprising that these categories are well represented in the list below.

Top 5 holdings end of December:

The portfolios reveal the usual suspects. The nine stocks below represent nearly half of the top holdings:

- ☁️ Hyperscalers: AMZN, GOOG, MSFT.

- ⚙️ AI tech stack: META, NVDA, TSM.

- 💳 Payments: MELI, SHOP, V.

Now, let’s turn to the most timely part!

What are the stocks that picked the spotlight in Q4 as top buys?

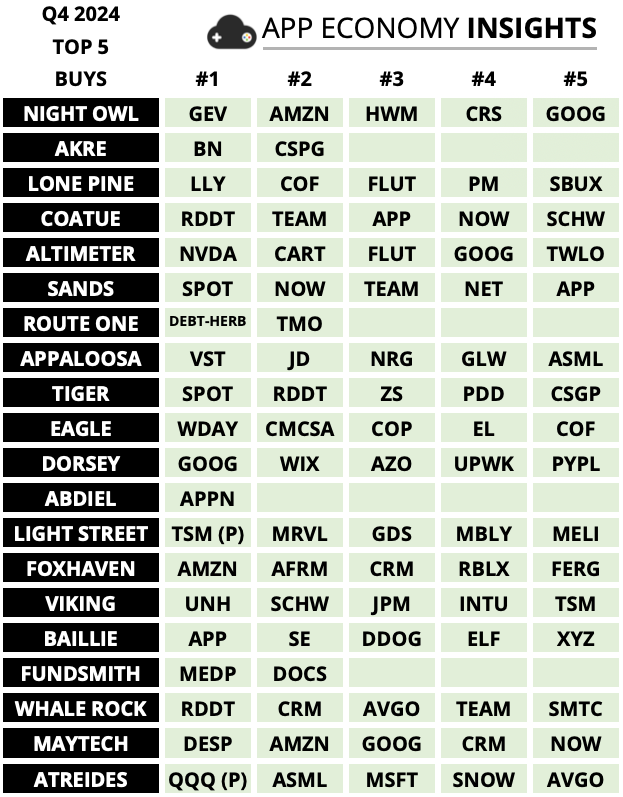

Top 5 buys in Q4 (stocks they bought the most during the quarter):

Here are some themes from the recurring names:

- 💻 Enterprise Software: APP, CRM, NOW, TEAM.

- ⚙️ Semiconductors: ASML, AVGO.

- 📱 Digital platforms: RDDT, SPOT.

- ☁️ Hyperscalers: AMZN, GOOG.

- 🏈 Sports betting: FLUT.

- 🏢 Real Estate: CSGP.

Take note of the subtle changes this quarter:

- Some Magnificent 7 are back: Alphabet and Amazon were back at the top of the buy lists. In addition, Altimeter allocated an extra 5% to its massive NVDA holding (now 19% of the fund). The rest of the Mag 7, though? Still MIA. After many quarters that saw META and MSFT as some of the most popular buys, funds were not adding to their positions in Q4. Tesla was also nowhere to be found.

- Enterprise Software remains a favorite: AI is unlocking new monetization avenues for software giants. While much of the focus has been on the bottom and middle layers of the AI tech stack, these funds are shifting their attention to the top layer, with AI agents representing a crucial catalyst. If inference costs decrease, software solutions with a broad distribution are well-positioned to win.

- Flutter is still getting some love: After Tiger Global and Viking last quarter, it was Lone Pine and Altimeter’s turn to add to the online gambling powerhouse.

- New digital platforms rise: Reddit and Spotify had a strong 2024, and these funds have noticed. With continued growth and impressive margin expansion, they show that it’s never too late for a business to demonstrate operating leverage.

As a reminder, I intentionally ignore these funds’ top sells, as they can be misleading. So often, the top sells include some of these money managers’ highest conviction holdings, which they’re merely trimming for risk management purposes.

What else was noteworthy among other funds outside of my scope?

- Pershing Square (Bill Ackman) increased again his position in Brookfield (BN), now 16% of the fund. The high-profile investor also recently announced a $2.3 billion investment in Uber, likely making it his top holding at the end of Q1 2025.

- Duquesne (Stanley Druckenmiller) built up a 5% position in Teva Pharmaceutical (TEVA). He significantly trimmed his Coupang (CPNG) investment, which is still his fifth-largest holding.

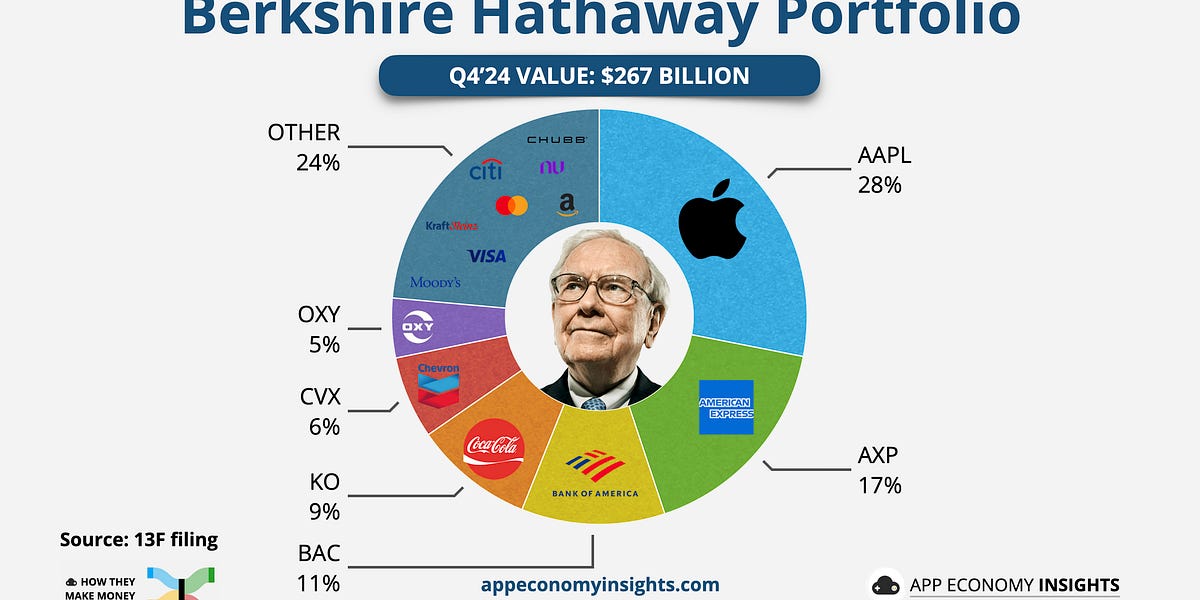

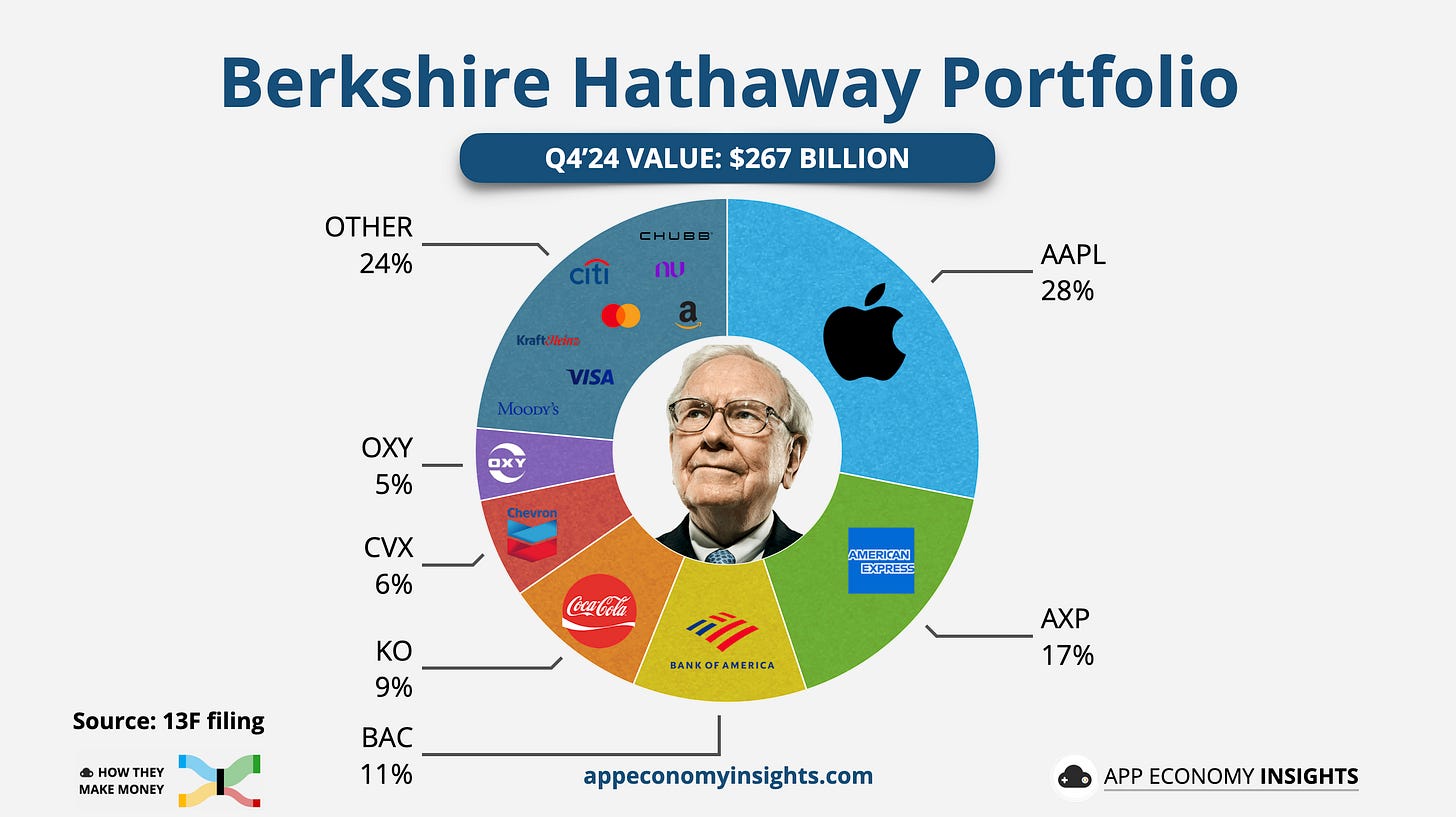

- Buffett’s Berkshire Hathaway also submitted the latest 13F. While not a hedge fund, it’s a significant portfolio to track.

- No more Apple trimming: After significant cuts in 2024, the Oracle of Omaha kept his AAPL stake unchanged. Yet, Apple remained his largest position, accounting for 28% of the portfolio.

- Bank of America was trimmed by ~15%: BAC remains the third-biggest holding behind American Express (AXP).

- Small new entrants: Berkshire started a new position in Constellation Brands (STZ) and added to his Domino’s Pizza (DPZ), but keep in mind these are each less than 0.5% holdings. ( Read: What’s in Warren Buffett’s Latest Stock Portfolio?)

3. Case studies

Let’s look at three recurring names in the top buys list in Q4.

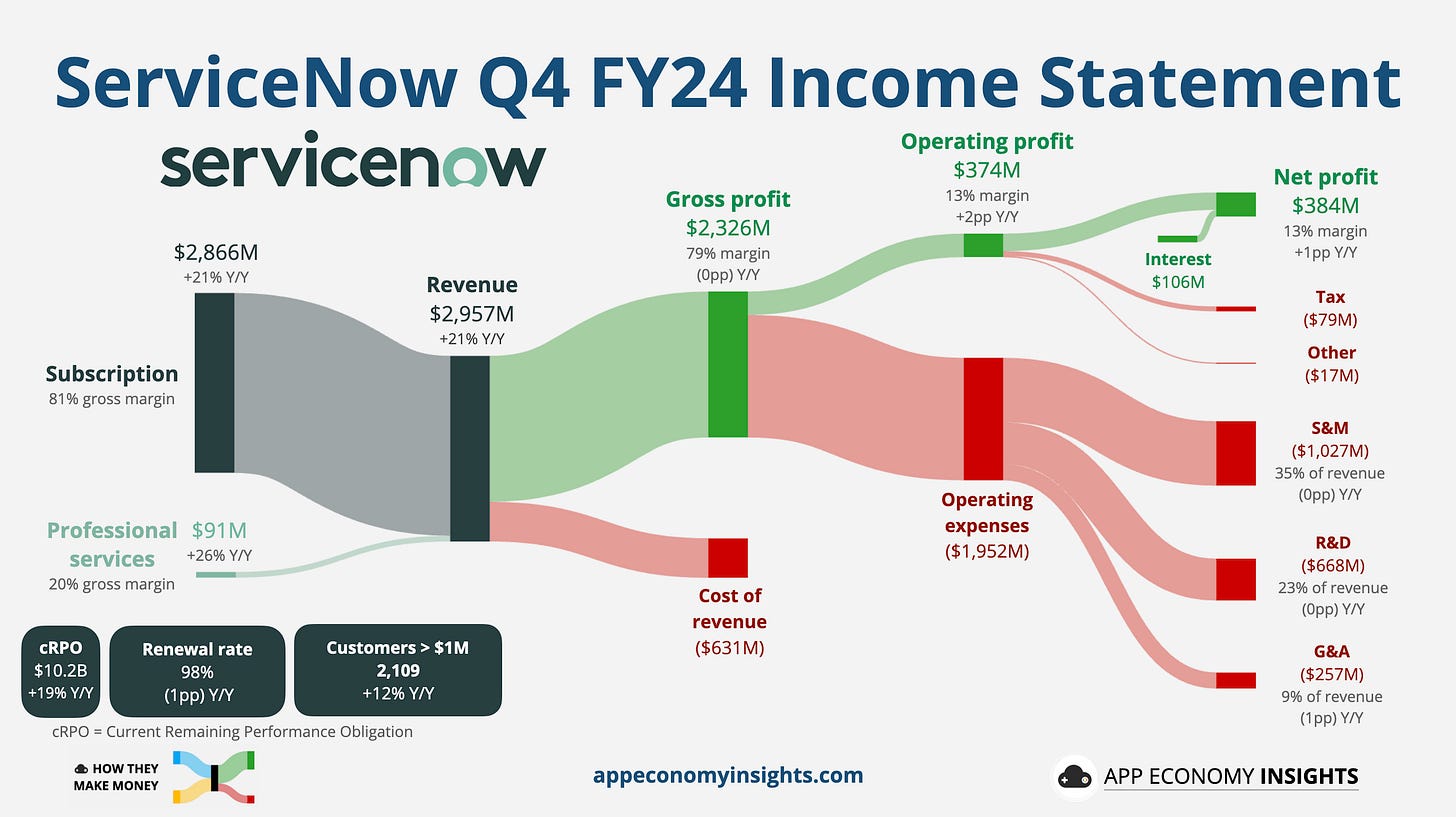

ServiceNow (NOW): AI Pivot

- AI adoption vs. near-term growth pains: ServiceNow’s AI-driven automation tools are gaining traction, with Now Assist service desk deals up 150% quarter-over-quarter. However, the company prioritizes AI adoption over immediate revenue growth, shifting to a pay-as-you-go pricing model instead of upfront subscriptions. This move is designed to drive long-term value but led to near-term revenue guidance missing Wall Street estimates.

- Federal & Enterprise tailwinds pushed to late 2025: ServiceNow is a major vendor for the US government and enterprise IT. Management cited potential federal spending disruptions tied to the election cycle but expects growth to accelerate in the second half of 2025. Meanwhile, expanded AI partnerships with Google, Visa, and Oracle position ServiceNow as a key player in enterprise automation.

- Shareholder-friendly moves: ServiceNow approved a $3 billion share buyback. The company generated $3.5 billion in free cash flow in 2024, reinforcing its strong financial foundation as it navigates macro uncertainties.

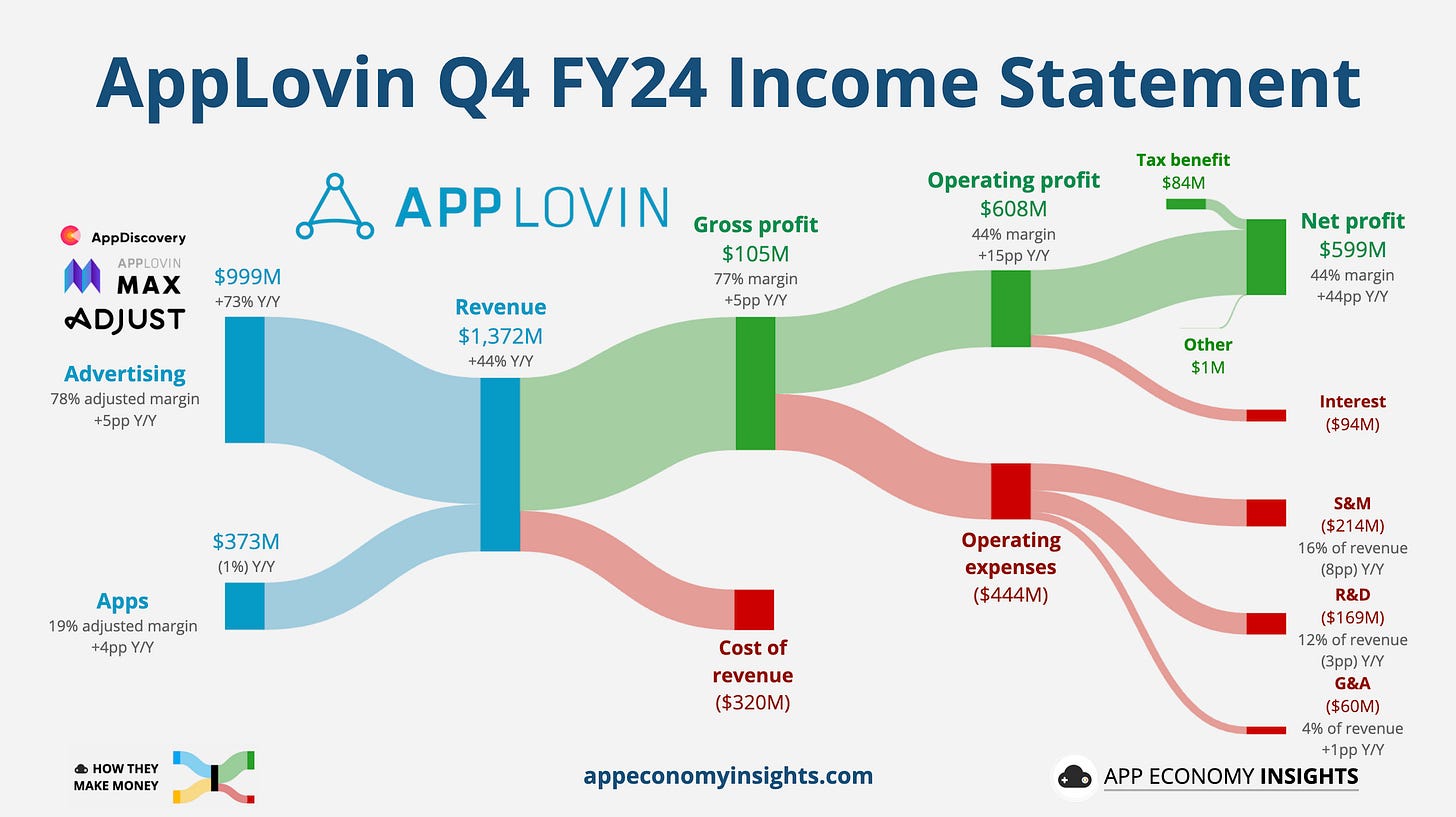

AppLovin (APP): Ad Takeover

- From games to AI-powered ads: AppLovin is fully pivoting to AI-driven advertising. It is divesting its game development business for $900 million to double down on its ad tech platform. This shift expands its reach beyond gaming into e-commerce and other verticals, unlocking a significantly larger market.

- Explosive growth, but valuation debate: Q4 revenue surged 44% year-over-year to $1.37 billion, crushing expectations. Advertising revenue soared 73%, fueled by AI-driven ad placements. However, after a 750% stock rally in a year, some analysts question whether the valuation has run too hot.

- Self-serve ads are coming: AppLovin is building a self-service advertising platform to attract all advertisers, from e-commerce to fintech. This could be a game-changer, allowing businesses to launch AI-optimized ad campaigns with minimal friction, but execution remains key.

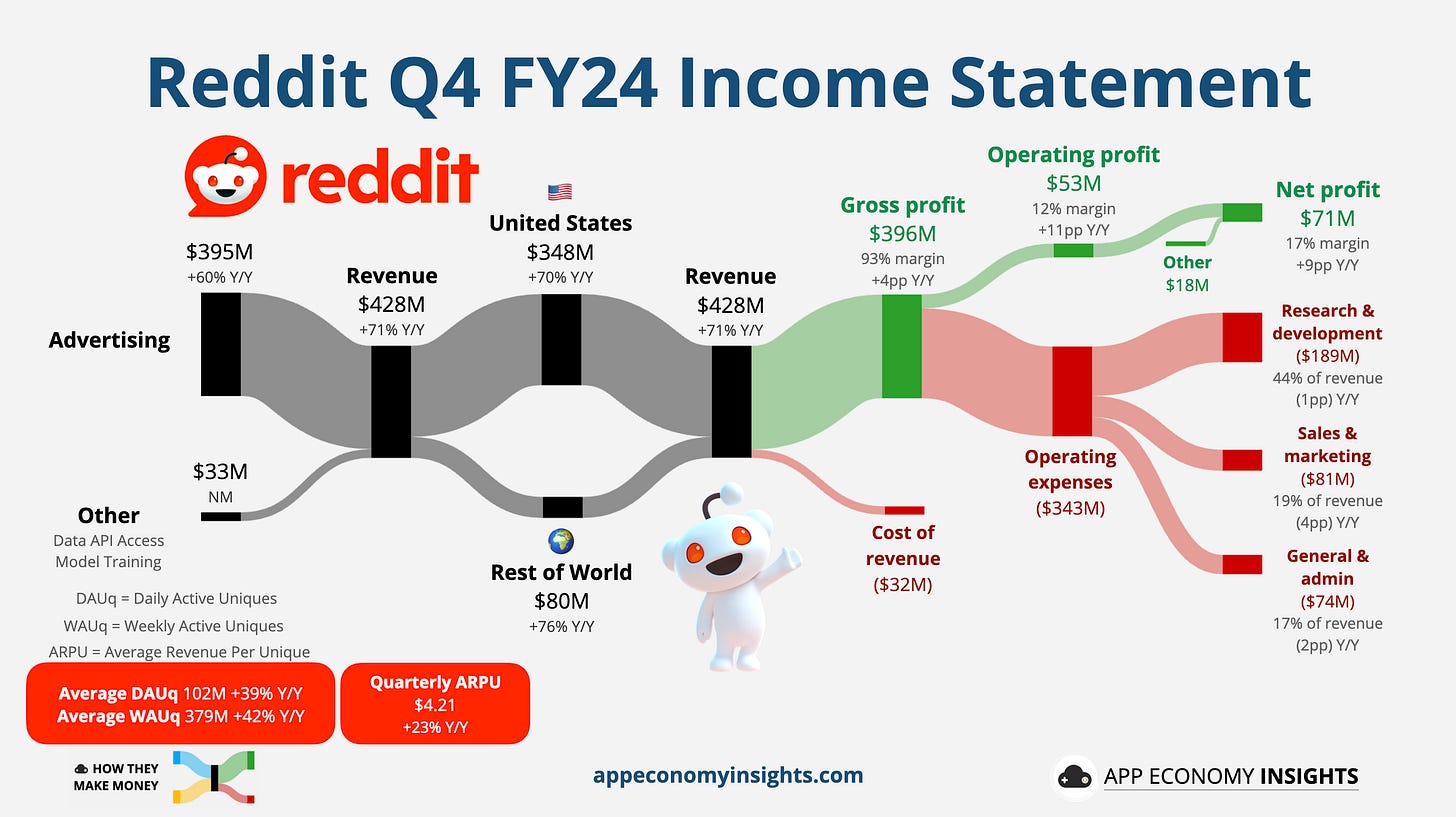

Reddit (RDDT): Ad Surge

- Ad revenue soars, but user growth disappoints: Reddit’s Q4 revenue surged 71% to $428 million, driven by a 60% jump in ad sales, as mid-market and SMB advertisers flocked to the platform. However, user growth fell short of expectations, with 102 million DAUs vs. the projected 103 million, partially due to Google algorithm changes impacting logged-out traffic.

- AI-powered search & data monetization: The company is doubling down on AI, launching Reddit Answers to enhance search functionality and engagement. Meanwhile, $203 million in data-licensing deals with Google and OpenAI signal Reddit’s push beyond ads for revenue diversification. More AI partnerships are expected.

- Profitability & paywalls on the horizon: Reddit posted its second straight profitable quarter, but soaring R&D costs—up 69% to $189 million—raised concerns. To boost monetization, Reddit plans to introduce paid subreddits in 2025, a major shift from its historically open-access model.

4. Implications for individual investors

Hedge fund activities can be a gold mine of information, but they also come with additional caveats:

- Diversify: Hedge funds don’t put all their eggs in one basket. Spread your investments across various sectors and regions. You don’t have to bet the farm on a single company to generate wealth.

- Look ahead: Many top funds invest with a future focus. They’re not swayed by today’s headlines but by a company’s potential in the next few years. It’s a good reminder not to let daily market buzz cloud our long-term vision.

- Dig deeper: Sure, hedge funds have teams diving into every detail of a company. But that doesn’t mean you don’t need to do your homework. Read about your investments, stay updated, and trust but verify.

- Watch the fees: Costs eat into profits. It sounds simple, yet many overlook this. As Jack Bogle said, “In investing, you get what you don’t pay for. Costs matter.” Always know what you’re being charged.

- Use filings as a starting point: 13F filings can offer great insights but are not real-time updates. These are snapshots, sometimes old ones. Still, they’re great conversation starters for your research.

Watching hedge funds can be instructive, but your investment journey is personal. Make informed decisions that suit your goals and risk appetite.

Bottom line

Successful investing is not just about emulating the ‘smart money’; it’s about aligning your portfolio with your unique financial goals and understanding the risks involved.

While most of us won’t have the vast resources of a hedge fund, we possess something just as potent—the ability to invest with patience and a long-term vision.

Investing isn’t about blindly following the herd. It’s about carving your own path, armed with knowledge, patience, and a relentless pursuit of growth and learning.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Will Elon Musk Enter Quantum Computing? Here’s Why It Might Happen in 2025

Intel Turbulent Week: Breakup Rumors, Strategic Deals, and What It Means for $INTC Stock

Nvidia CEO Jensen Huang directly addresses DeepSeek stock sell-off, saying investors got it wrong

Gold market cap hit $20 TRILLION for first time in history. Why are people still piling into gold?

Analysis: Is Kelsier’s $200MM insider trading scandal the next FTX?

How Dirty Money From Fentanyl Sales Is Flowing Through China

Trump plans to impose 25% tariffs on autos, chips and pharmaceuticals – Stock Market Impact

Congressional Stock Trading Scandal: Lawmakers Profit Big on Palantir Stock Surge

Bullish Momentum vs. Financial Reality in Palantir