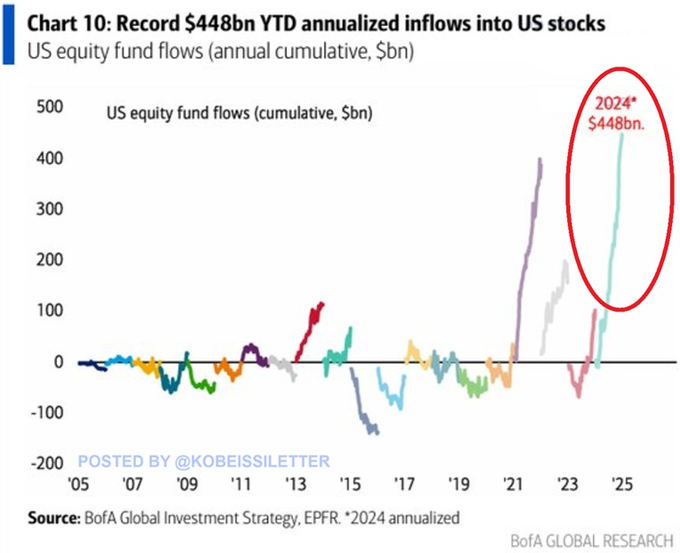

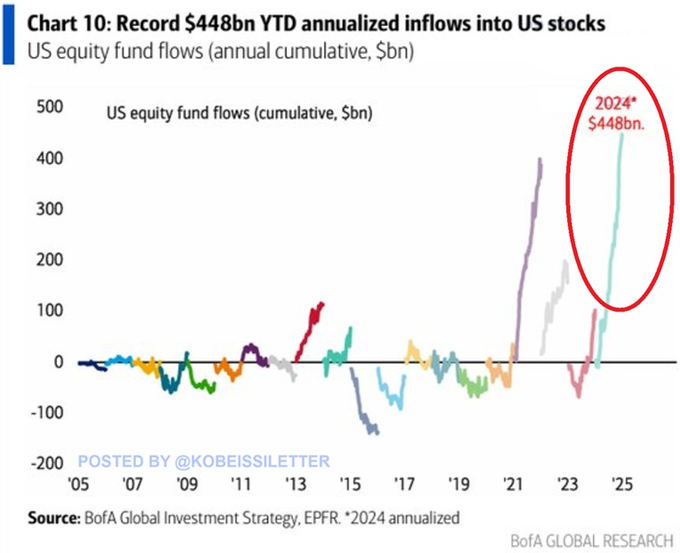

Retail is buying near RECORD levels:

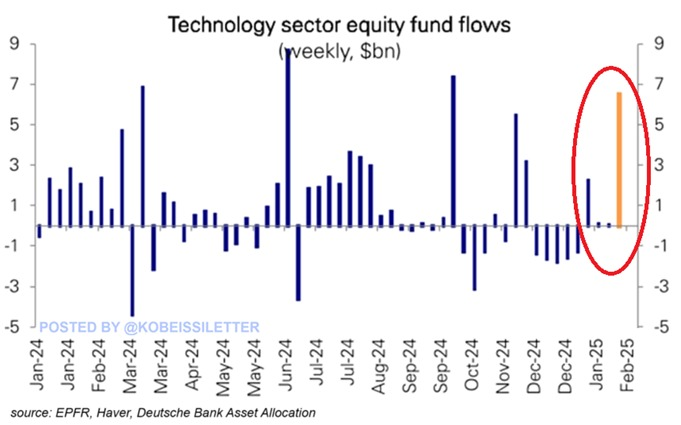

On Monday, retail traders purchased +$3 BILLION of equities after the drop, the largest purchase since 2015. Last week, retail traders bought +$8 BILLION of equities amid DeepSeek AI worries.

Has retail ever been this bullish?

This comes after a record $448+ billion flowed into US stocks in 2024. For the last 2 years, every dip has been a buying opportunity as big tech’s dominance as grown. As the trade war and AI disruption builds, retail is betting on the same outcome going forward.

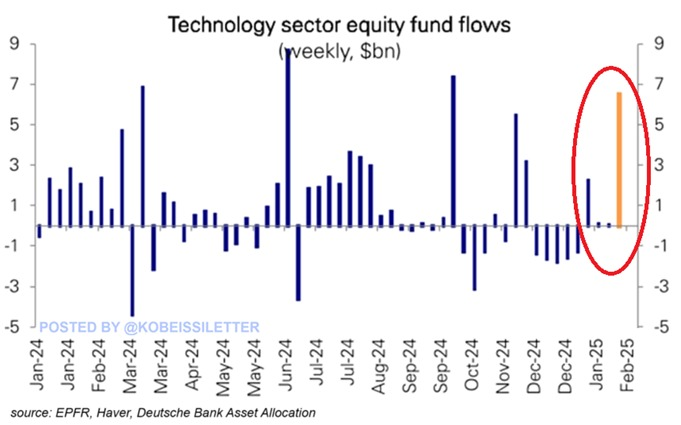

Last week, US technology sector equity fund inflows hit ~$6.5 BILLION. This also marks one of the largest weekly inflows over the last 2 years. Total equity fund inflows reached ~$25 billion last week.

Bullish sentiment is extremely strong right now.

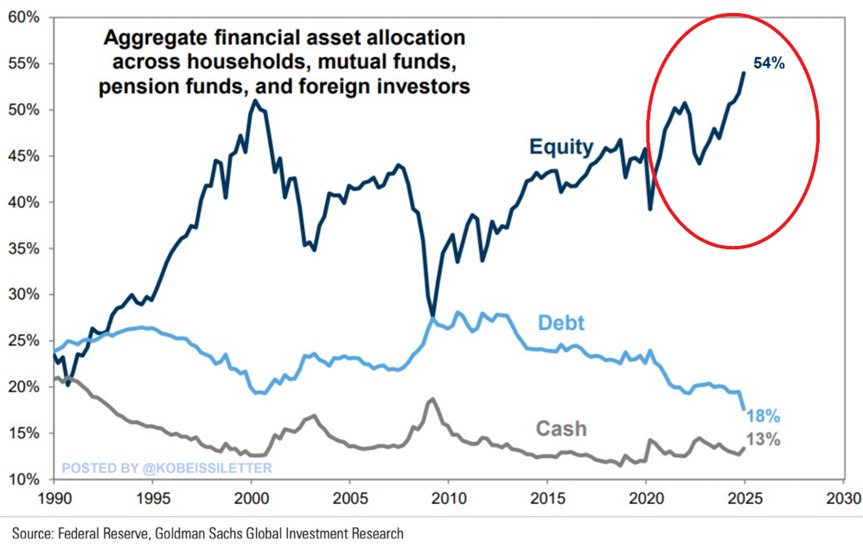

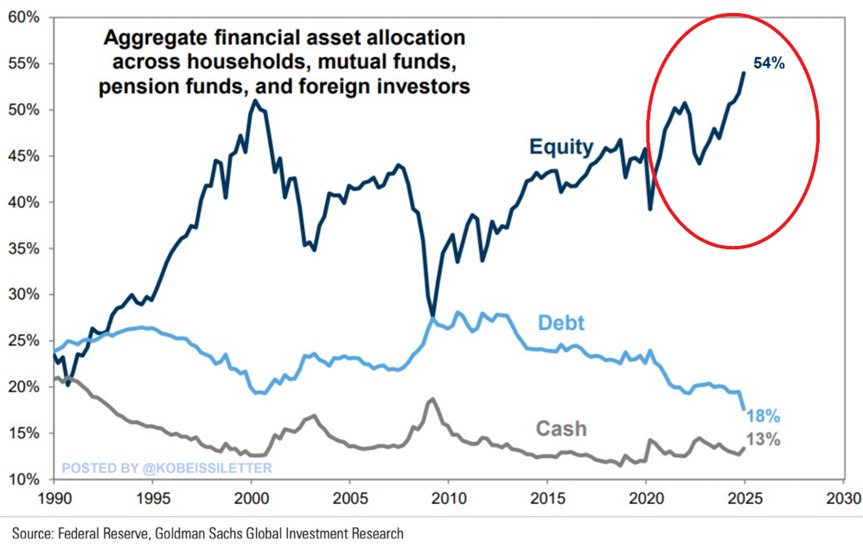

In fact, bullish sentiment is so strong that a record 54% of financial assets are now allocated to US stocks. This is nearly DOUBLE the levels seen in 2008 while debt investments have fallen to a record low 18%. Equity allocation is officially above the 2001 Dot-Com bubble peak.

And it’s not just stocks.

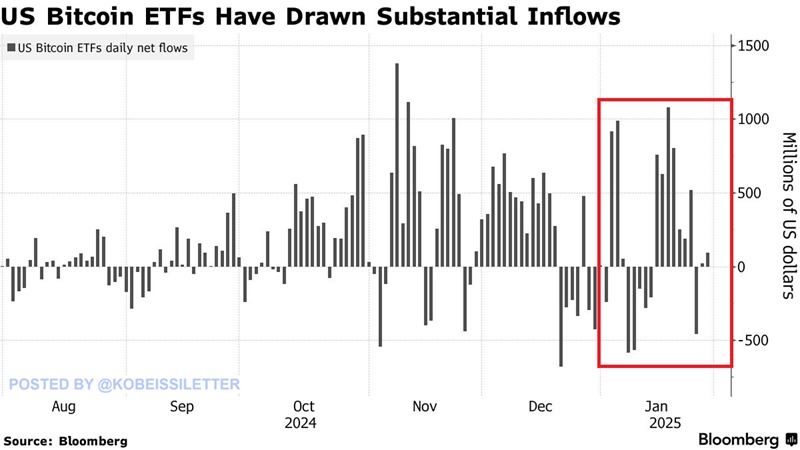

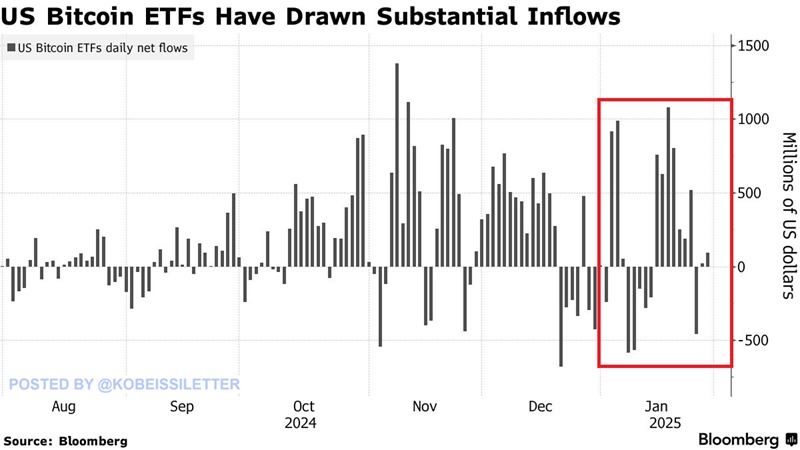

Bitcoin ETFs saw one of their biggest monthly inflows on record in January, with $4.5 billion of net inflows. Bitcoin ETF AUM has officially surpassed $125 billion for the first time in history. It took gold ETFs 20 years to reach this milestone.

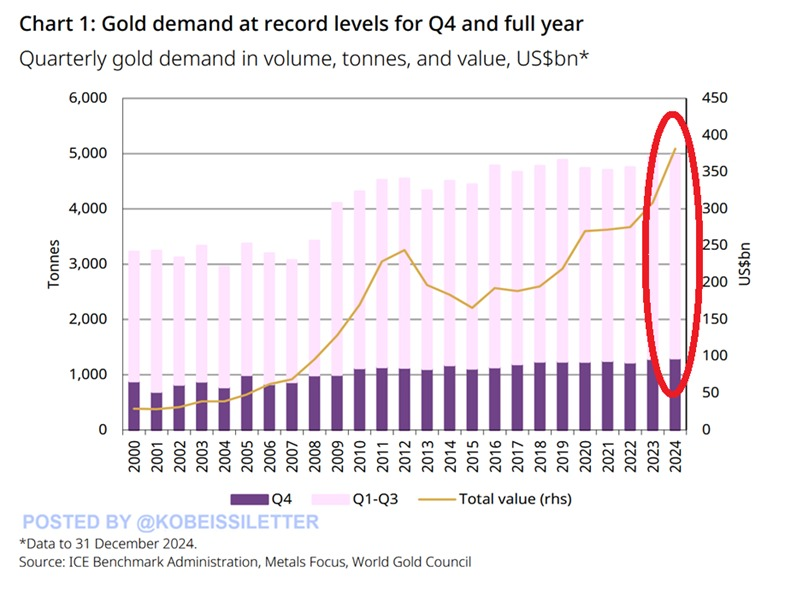

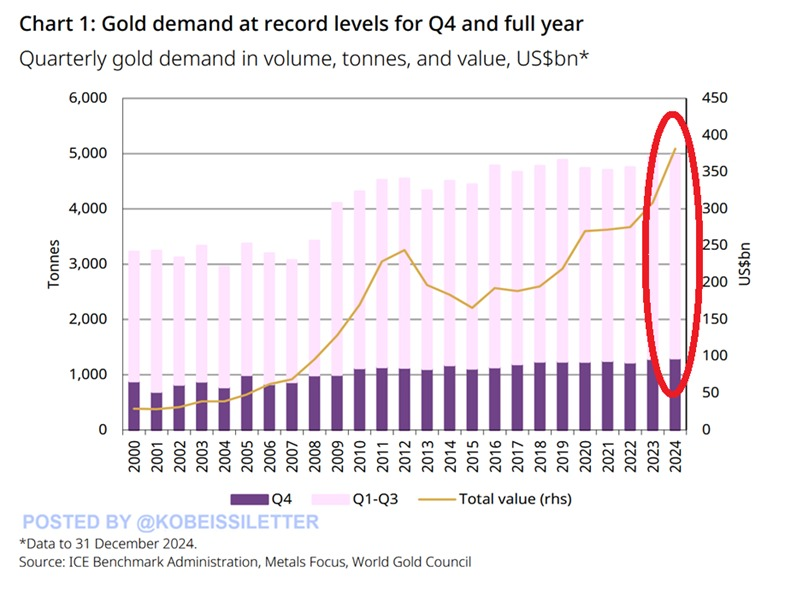

Take a look at the gold in the third chart.

Gold demand rose by 29 tonnes in 2024 to a record 4,975 tonnes. In Q4 2024, gold demand jumped by 10 tonnes to 1,297 tonnes, also an all-time high. In 2024 alone, central banks acquired 1,045 tonnes of gold. That’s 3 straight years with 1000t+ purchased.

What does this all mean? More volatility is coming.

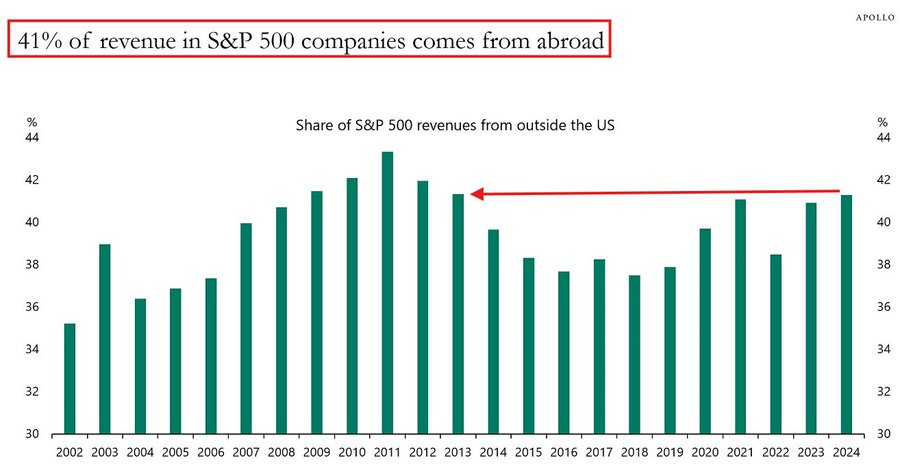

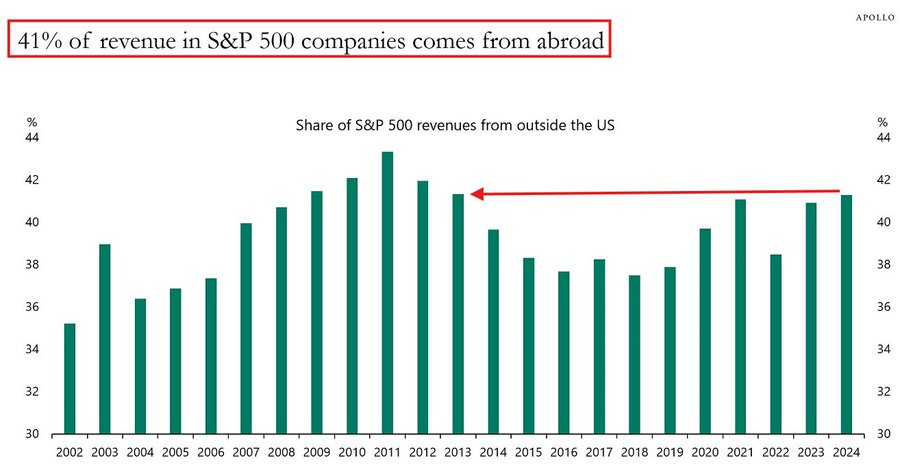

Positioning is at extremes as we begin another trade war. Currently, 41% of revenue in the S&P 500 comes from outside of the US. This is the highest since 2013 and significantly above the 2018-2019 levels in the last trade war.

Furthermore, most of the buying has been concentrated in technology stocks. 30% of US imports from China are in the computer and electronic category. Not to mention US chip exports to China and Singapore which are also in the spotlight.

This market will be HIGHLY tradable.

Technology stocks’ enterprise value now equals a record 62.5% of US GDP. As the trade war is highly focused on these technology names, we expect bigger swings.

Retail traders are set for a wild 2025.

Source: TKL

Related

Alphabet and AMD Stocks Decline Post-Earnings Amid Investor Concerns

Is AMD is next Intel? An In-Depth Analysis

Is Palantir Proving to be the Dark Horse AI Stock?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.