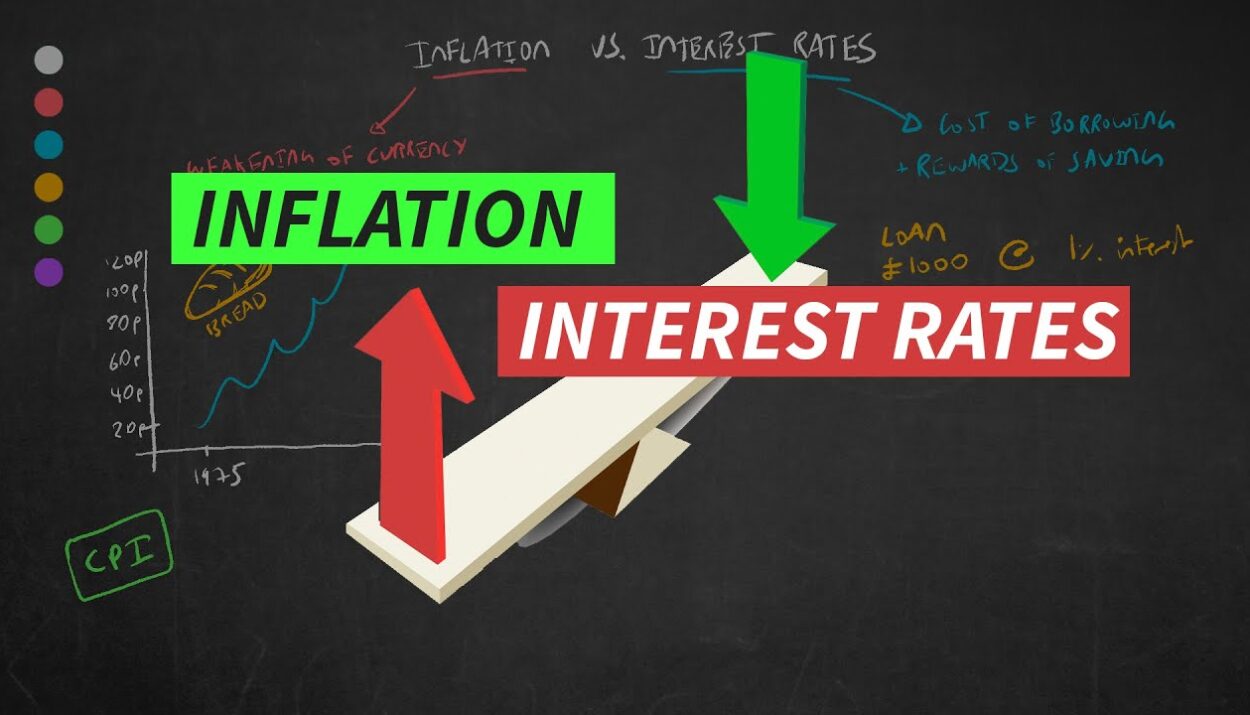

Inflation and interest rates are two closely interconnected pillars of economics. They directly influence financial markets, consumer behavior, and economic policy decisions. Understanding their relationship is crucial for anyone trying to grasp how modern economies function.

What Are Inflation and Interest Rates?

Inflation is the rate at which the general price level of goods and services rises over a period, eroding purchasing power. Central banks aim to keep inflation at a manageable level, often around 2% annually, which is considered healthy for economic growth.

Interest rates, on the other hand, represent the cost of borrowing money or the reward for saving. They are typically set by central banks, such as the Federal Reserve in the United States or the European Central Bank, as a tool to control inflation and stimulate or cool down the economy.

The Connection Between Inflation and Interest Rates

The relationship between inflation and interest rates can be summarized by the following key points:

1. Interest Rates as a Tool to Manage Inflation

When inflation rises above desired levels, central banks typically increase interest rates to curb spending and borrowing. This decreases overall demand, which can bring inflation back under control. Conversely, if inflation is too low, central banks may reduce interest rates to stimulate borrowing and spending, encouraging economic growth.

2. Real Interest Rates and Inflation

Real interest rates are calculated by subtracting the inflation rate from the nominal interest rate. For example, if a savings account offers a nominal interest rate of 5% and inflation is 3%, the real interest rate is 2%. During periods of high inflation, real interest rates can become negative, eroding the value of savings.

3. Lag Effect

Changes in interest rates don’t immediately affect inflation. It can take months or even years for the impact of higher or lower interest rates to fully manifest in the economy.

How Do Interest Rate Hikes Combat Inflation?

- Reduced Borrowing: Higher interest rates increase the cost of borrowing for businesses and individuals, leading to reduced loans and credit use.

- Lower Consumer Spending: Expensive loans and credit card rates result in less disposable income, slowing consumer demand.

- Increased Savings: Higher interest rates make saving more attractive, further reducing consumer spending.

What Happens When Interest Rates Are Low?

- Encouraged Borrowing: Lower interest rates make loans more affordable, driving investments in housing, businesses, and other sectors.

- Increased Spending: With borrowing easier and savings offering lower returns, consumers are more likely to spend.

- Economic Stimulus: Low interest rates can pull an economy out of a recession by boosting overall demand.

Historical Examples of Inflation and Interest Rate Trends

- 1980s High Inflation

In the early 1980s, the U.S. faced inflation rates exceeding 10%. The Federal Reserve raised interest rates to nearly 20%, effectively bringing inflation under control but also causing a short-term recession. - COVID-19 Pandemic Era

During the pandemic, interest rates were slashed to near-zero levels to stimulate economic activity. However, this, combined with supply chain disruptions, led to inflation surging in 2021-2022. In response, central banks raised rates aggressively to combat inflation.

Inflation and Interest Rates: A Global Perspective

United States: The Federal Reserve uses inflation data, such as the Consumer Price Index (CPI), to decide on interest rate changes. Its recent strategy has been to maintain inflation around 2%.

European Union: The European Central Bank follows a similar policy framework but has historically dealt with deflation risks, prompting prolonged periods of low-interest rates.

Emerging Markets: Countries like Turkey and Argentina have faced hyperinflation, which forced central banks to raise interest rates significantly. However, such measures often create challenges for economic growth.

| Country/Region | Inflation Rate | Central Bank Interest Rate |

|---|---|---|

| United States | ~3.5% | 4.3% |

| European Union | ~4.2% | 3.15% |

| Argentina | ~110% | 21% |

| Japan | ~1.0% | 0.5% |

The Role of Expectations in Inflation and Interest Rates

Market and consumer expectations also play a significant role in the relationship between inflation and interest rates. If people expect inflation to rise, they may demand higher wages or increase prices, creating a self-fulfilling cycle. Central banks often signal their policy intentions to manage these expectations.

Key Takeaways

- Balancing Act: Central banks must balance stimulating economic growth with controlling inflation through interest rate policies.

- Investment Impacts: Inflation and interest rates directly affect investment choices, including stocks, bonds, and real estate.

- Personal Finance: Understanding this relationship can help individuals manage debt, savings, and investment portfolios effectively.

Related articles:

Lower rates AND lower inflation? Is it possible? Here’s the math

Inflation and its effect on asset prices

How to Calculate the Inflation Rate – The formula

Sources