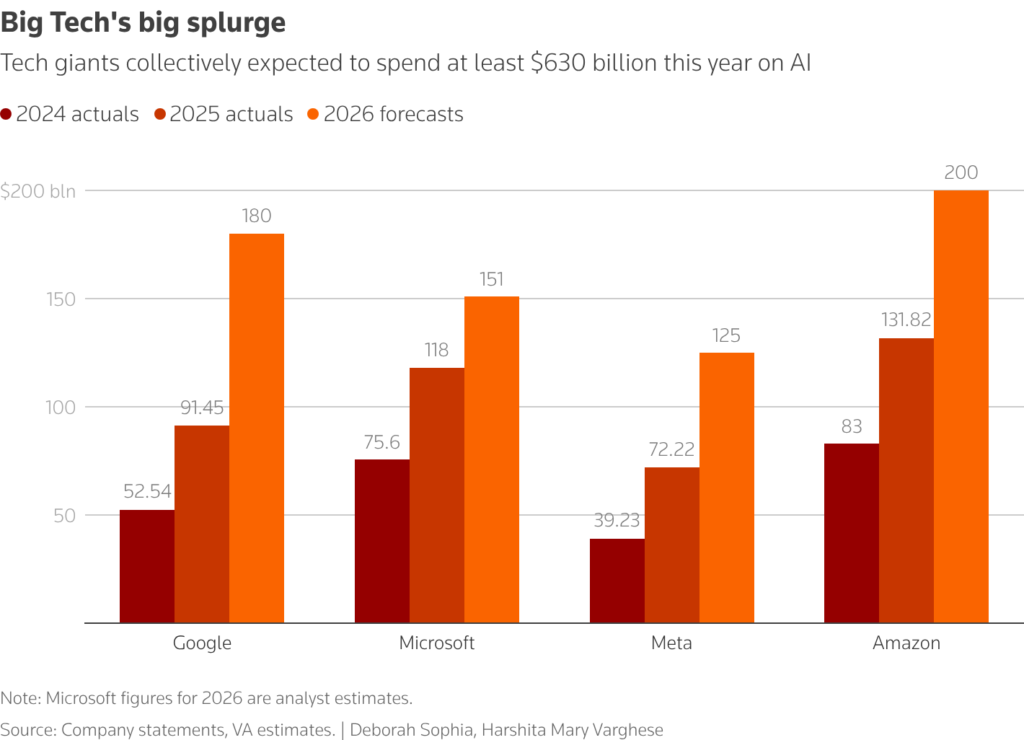

Big Tech giants are ramping up artificial intelligence investments, with Alphabet, Microsoft, Amazon and Meta expected to spend more than $630 billion combined this year, intensifying debate over whether returns will justify soaring valuations.

AI Spending Surges

Amazon is leading the charge, reserving roughly $200 billion for capital expenditures. Alphabet follows with up to $185 billion, while Meta has projected as much as $135 billion. Microsoft has also committed heavily to AI infrastructure and cloud expansion.

Analysts say investor patience may be tested.

“Investors right now are not forgiving about large investments without clear signal on return on invested capital,” Morgan Stanley analysts noted.

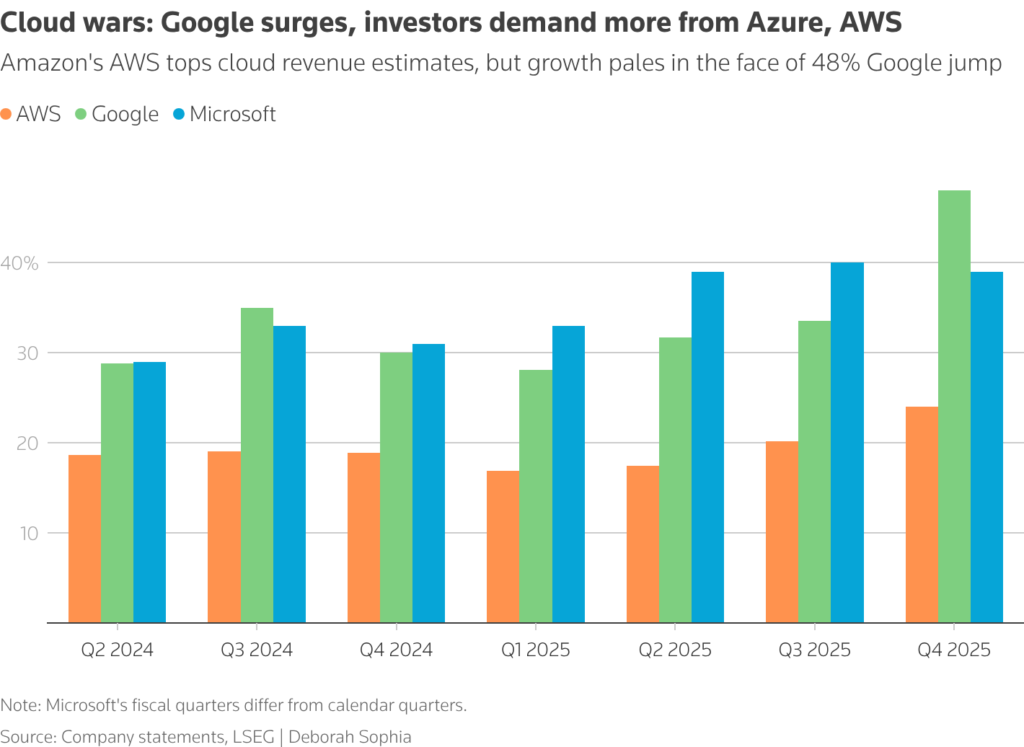

Cloud Growth Holds Up

Despite concerns, cloud revenue remains a bright spot.

- Google Cloud posted the fastest growth, up 48%, fueled by demand for its Gemini AI model.

- Microsoft Azure grew 39%.

- Amazon Web Services, the largest cloud provider, expanded 24%.

Strong AI integration across cloud platforms has helped maintain momentum, even as competition intensifies.

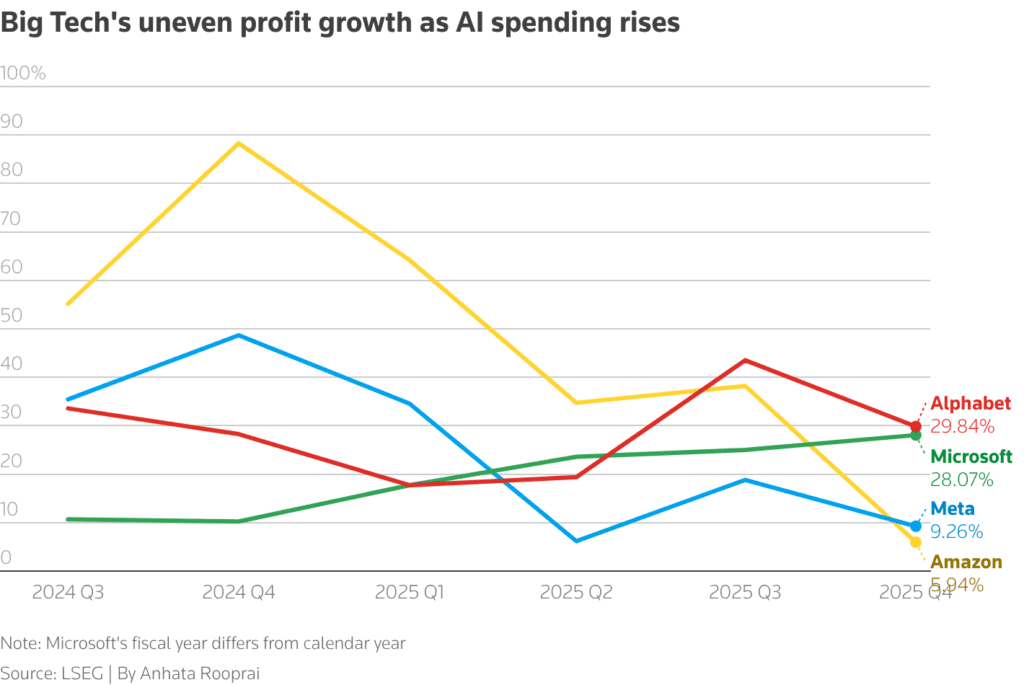

Profits Mixed as Costs Climb

The surge in spending is weighing unevenly on profits.

Amazon and Meta saw profit growth pressured by higher expenses tied to AI infrastructure. Meanwhile, Microsoft reported its strongest profit growth in two years, reflecting stronger cost control and enterprise demand.

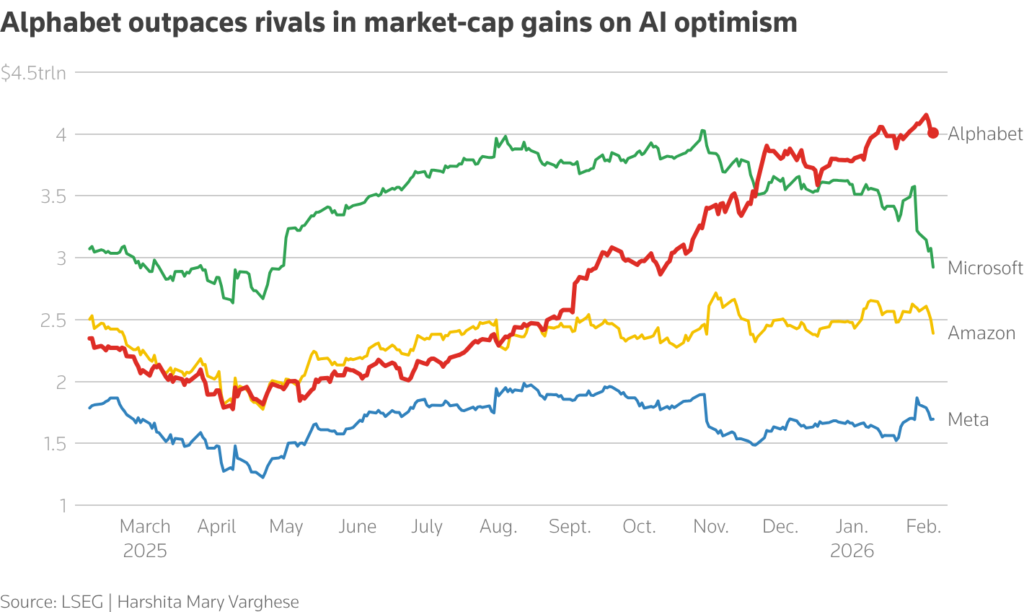

Market Reaction

Investor optimism around Gemini and Alphabet’s deal to power Apple’s revamped Siri has boosted Alphabet’s stock, which has recently outperformed peers.

Still, with AI capex accelerating sharply, markets are watching closely for evidence that the massive outlays will translate into sustainable earnings growth rather than just bigger data centers.

For now, Big Tech is making it clear: the AI race is far from over.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.