The start of 2025 has ushered in significant developments for major luxury retailers in the United States, signalling a transformative shift in the retail landscape. Iconic names like Neiman Marcus, Saks Fifth Avenue, and Nordstrom are redefining their strategies amidst changing consumer behaviours, economic uncertainties, and geopolitical instabilities. Recent mergers and acquisitions highlight the industry’s determination to adapt and innovate for the future.

Saks Global Acquires Neiman Marcus Group (NMG)

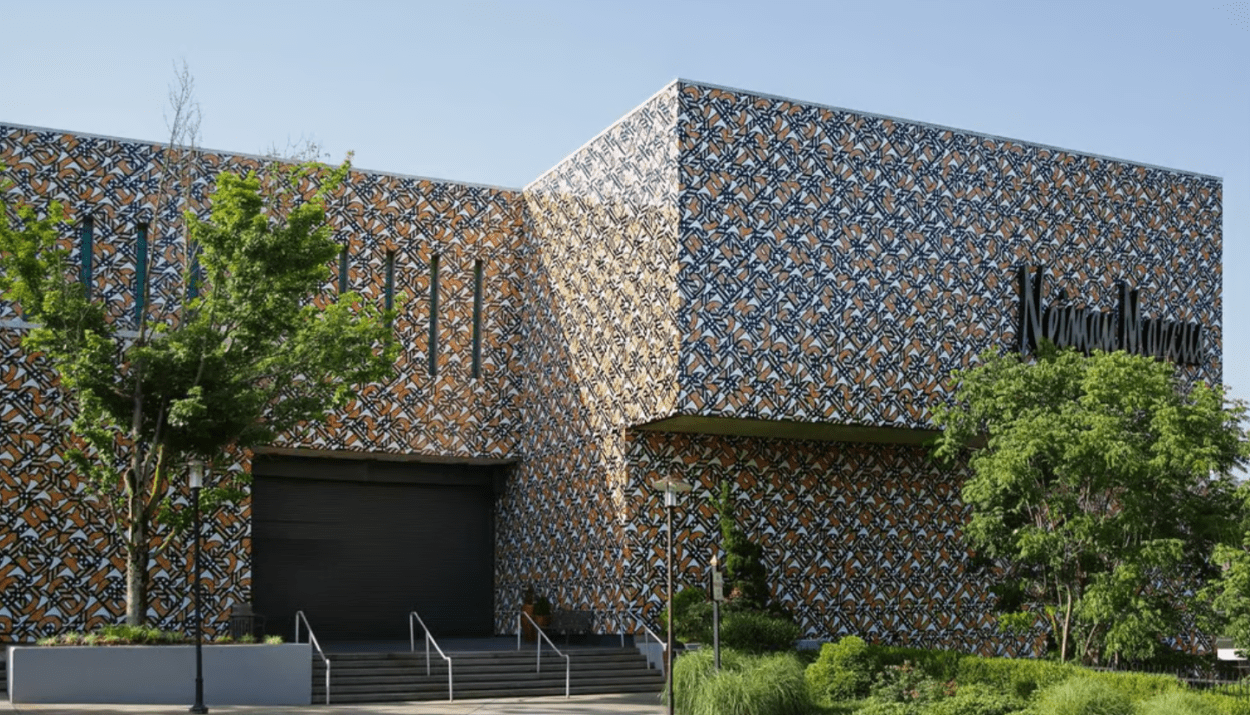

Saks Global completed its $2.7 billion acquisition of Neiman Marcus Group, adding luxury staples Neiman Marcus and Bergdorf Goodman to its portfolio, which already includes Saks Fifth Avenue and Saks Off Fifth. Despite concerns about the Biden administration’s strong anti-trust stance, the deal went through, positioning Saks Global as a dominant player in the luxury retail sector.

- Impact of the Merger:

- Consolidated operations, including logistics and fulfillment.

- Streamlined leadership, with Saks CEO Mark Metric assuming NMG’s Geoffroy van Raemdonck’s responsibilities.

- Increased negotiating power with major European luxury conglomerates like LVMH and Kering.

- Opportunity to improve consumer experiences and diversify product offerings while maintaining the distinct identities of Neiman Marcus and Bergdorf Goodman.

Gary Wassner, CEO of Hilldun Corporation, emphasized that the move allows Saks Global to regain autonomy from shareholder pressures, enabling bold decisions to innovate and strengthen their retail presence.

Nordstrom Goes Private

Nordstrom achieved privatization through a $6.25 billion buyout by the Nordstrom family and Mexican retailer El Puerto de Liverpool. The move is expected to grant the brand the flexibility to explore long-term strategies, focus on experiential retail, and address operational challenges.

- Challenges and Opportunities:

- The brand has struggled with direction in recent years, including the closure of all Nordstrom and Nordstrom Rack stores in Canada in 2023.

- Experts like Jeanel Alvarado hope the shift in ownership will refocus Nordstrom on its heritage and strengthen its core brand identity.

- Privatization is seen as an opportunity to differentiate from major players like Amazon and Walmart through exclusivity and personalization.

Industry-Wide Trends

The luxury retail sector faces mixed sentiments about the future, with a recent McKinsey Executive Survey revealing:

- 20% of respondents expect improvement in the industry.

- 41% predict stability.

- 39% anticipate a decline, citing diminished consumer confidence, geopolitical instability, and economic uncertainty.

However, the stabilization of interest rates has alleviated inflation concerns, offering a glimmer of hope for the sector.

Consumer-Centric Strategies

To combat challenges, luxury retailers are focusing on:

- Enhancing In-Store Experiences: Well-trained staff and personalized services aim to attract affluent shoppers, including the often-overlooked Silver Generation (over-50 customers).

- Adopting Omnichannel Approaches: Integrating e-commerce and physical stores to offer seamless shopping experiences.

- Differentiation Through Innovation: Leveraging shared inventory and technology to compete with platforms like Farfetch.

Albert Varkki, co-founder of Von Baer, noted that these strategic shifts reflect an industry at a crossroads, with exclusivity and simplicity as key to future success.

Outlook for 2025

The luxury retail sector stands at a critical juncture. While the Saks-Neiman Marcus merger and Nordstrom’s privatization bring opportunities for innovation and streamlined operations, they also highlight the challenges of adapting to a rapidly changing market. The industry’s trajectory will depend on its ability to balance heritage and innovation while addressing consumer needs and economic pressures.

Industry Sentiment: A Snapshot

Below is a graphical representation of the industry’s sentiment based on the McKinsey Executive Survey:

- 20% of industry executives are optimistic about improvement.

- 41% expect the sector to remain stagnant.

- 39% predict further decline.

These changes represent either a resuscitation of the luxury retail industry or its final attempt to regain relevance. The coming months will reveal whether these strategies will lead to long-term success or continued challenges.

Source: FashionNetwork.com, McKinsey Executive Survey, industry expert interviews.