This keeps getting worse:

Hayden Davis, an insider behind the meme coin endorsed by Javier Milei, $LIBRA, said they made “more or less $110 MILLION.” Some insiders were reimbursed $5+ million while retail saw -$4.4 BILLION of market cap erased.

What is happening here?

An exclusive interview with Hayden Davis, the lead insider behind $LIBRA, was just released by Coffeezilla.

As seen in the clip below, Hayden says he now has:

1. More or less $100 million cash

2. $11 million in tokens

3. $13 million in fees

Total cash is ~$113 MILLION.

An exclusive interview with Hayden Davis, the lead insider behind $LIBRA, was just released by Coffeezilla.

— The Kobeissi Letter (@KobeissiLetter) February 17, 2025

As seen in the clip below, Hayden says he now has:

1. More or less $100 million cash

2. $11 million in tokens

3. $13 million in fees

Total cash is ~$113 MILLION. pic.twitter.com/2291C8EVHC

But, it gets even worse.

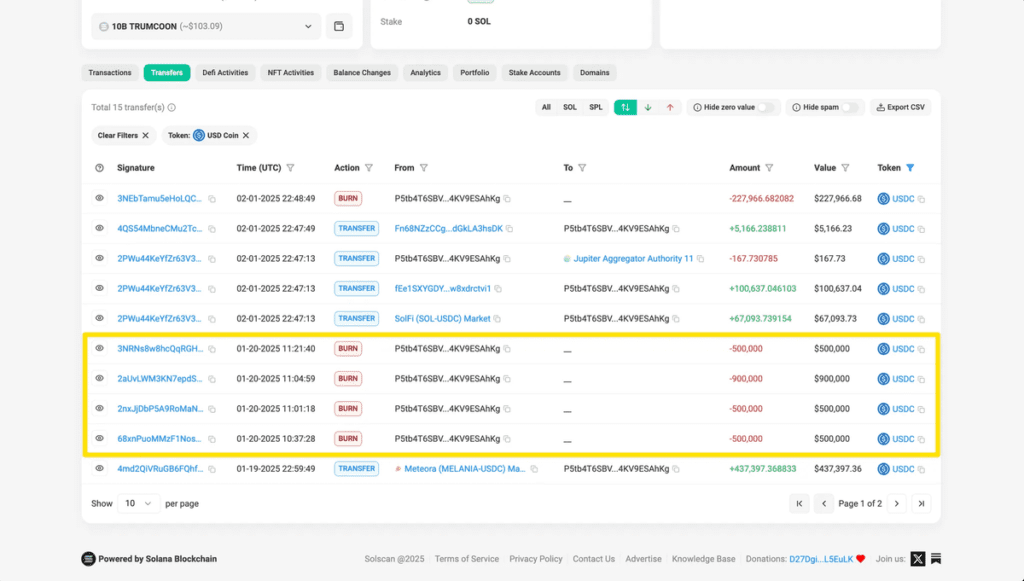

Hayden admits that he was a part of the launch of Melania Trump’s meme coin. After the launch of $LIRBA, wallet P5tb4 sent $2.4M of profits to 0xcEA, a $MELANIA insider’s wallet, per @Bubblemaps.

The same insiders cashed-in MILLIONS on $MELANIA.

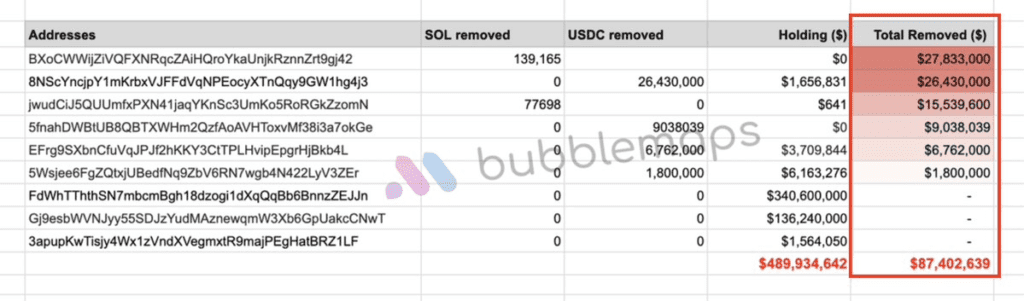

Now that we know 0xcEA is likely both a $MELANIA and $LIBRA insider’s wallet, this makes more sense. 0xcEA is also linked to wallet DEfcyK, an insider that cashed out $87.4 MILLION on $LIBRA’s launch day.

In fact, not only is DEfcyK an insider, it’s the creator of $LIBRA.

Hayden admits insiders traded on nonpublic information, which is a violation of securities law. He also said they used insider access to “snipe” price, control liquidity, and influence price action. This is a clear confession of market manipulation (also illegal).

And, it keeps getting worse.

Dave Portnoy, @stoolpresidente, revealed that Hayden “refunded” $5 million of his losses on $LIBRA. Hayden claims this is his “personal money” and not related to the $110M from $LIBRA.

Where did the money come from? Likely $MELANIA and other rugs.

And, it keeps getting worse.

— The Kobeissi Letter (@KobeissiLetter) February 17, 2025

Dave Portnoy, @stoolpresidente, revealed that Hayden "refunded" $5 million of his losses on $LIBRA.

Hayden claims this is his "personal money" and not related to the $110M from $LIBRA.

Where did the money come from? Likely $MELANIA and other rugs. pic.twitter.com/E08daZpQmn

In a separate post, @stoolpresidente says his friend “Elio” is behind wallets that have bought multiple coins Portnoy promoted. He says there “are advantages to being one of my best friends staying in my house when I’m trenching.”

This is another case of insider trading.

To put this into perspective, this admission is like Jeff Bezos telling a friend what Amazon’s earnings will be before they are posted. Sharing material non-public information with a friend who then trades on it is the DEFINITION of insider trading.

Incredible.

Coffeezilla then asks if its unfair for Hayden to snipe $LIBRA if he launched it. His answer: “So, I would say no.” His rationale? If he doesn’t “snipe” it then someone else will.

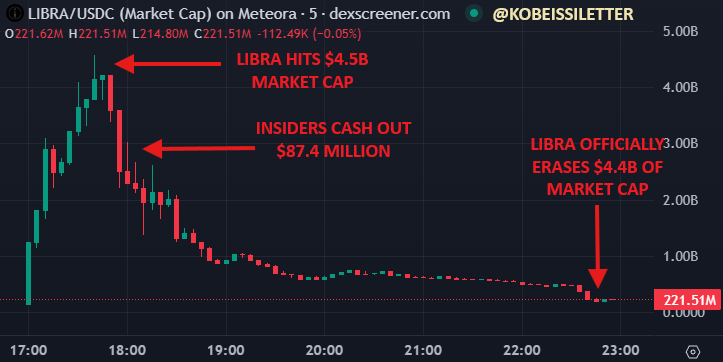

In other words, Hayden believes $LIBRA creators’ insider trading is completely justified. As seen in our chart below, the $87.4 million “snipe” by $LIRBA insiders marked the near EXACT top. This is the same $87.4 million linked to the creator’s wallet.

Insiders cashing out ~$110 million resulted in a -$4.4 BILLION crash due to lack of liquidity in the market.

Hayden goes on to say that he is using the $110M+ from $LIBRA as leverage in negotiations. Not only is this Misappropriation of Funds (Potential Fraud), but he is also using those funds as a bargaining chip.

Coffeezilla then asks if its unfair for Hayden to snipe $LIBRA if he launched it.

— The Kobeissi Letter (@KobeissiLetter) February 17, 2025

His answer: "So, I would say no."

His rationale? If he doesn't "snipe" it then someone else will.

In other words, Hayden believes $LIBRA creators' insider trading is completely justified. pic.twitter.com/129PY2wEVp

Hayden admitted to at least 7 felonies throughout the interview. Hayden proposed 3 solutions with the $110M in cash he holds:

1. Give the $110M to an Argentina non-profit

2. Give the $110M back as a refund

3. “Inject” the $110M back into the chart

He is leaning towards option #3, likely because it allows him to keep the most money. Lastly, the most ironic part is that $LIBRA jumped 100% on hopes of the capital “injection.” This means investors could be rugged AGAIN if he doesn’t follow through.

Did Milei just destroy the memecoin market?

Related: Javier Milei just DESTROYED market: Are meme coins officially DEAD?