You could feel a bit of “green on the screen” in the coverage as the Zelenskyy–Trump meeting kicked off: friendlier tone, upbeat soundbites, and talk of “progress.” But beneath the smiles is truly imminent.

Below is the clearest rundown of what actually happened, why it matters, and what to watch next.

What changed versus February: style, stakes, and choreography

- New optics. Unlike the combative Oval Office clash on Feb. 28, Zelenskyy arrived in a suit, dialed down the rhetoric, and front-loaded gratitude. The vibe was deliberately non-confrontational—what BBC Monitoring called leaving the White House “unscathed” and buying time.

- Bigger table. Seven European leaders and the heads of NATO and the European Commission joined at the White House—an intentional show of Western unity after the Trump–Putin Alaska summit last week.

- Ceasefire split. Europe kept pushing a ceasefire first approach; Trump questioned whether a ceasefire is “necessary,” arguing for a fuller, faster, “final” deal.

Brian Glenn, the chief White House correspondent of conservative outlet Real America’s Voice, praised Ukrainian President Volodymyr Zelensky’s military-style suit during Monday’s Oval Office sitdown with President Trump. President Trump chimed in, joking that he said “the same thing” to Zelensky.

The meat of the talks

1) Security guarantees (the headline deliverable)

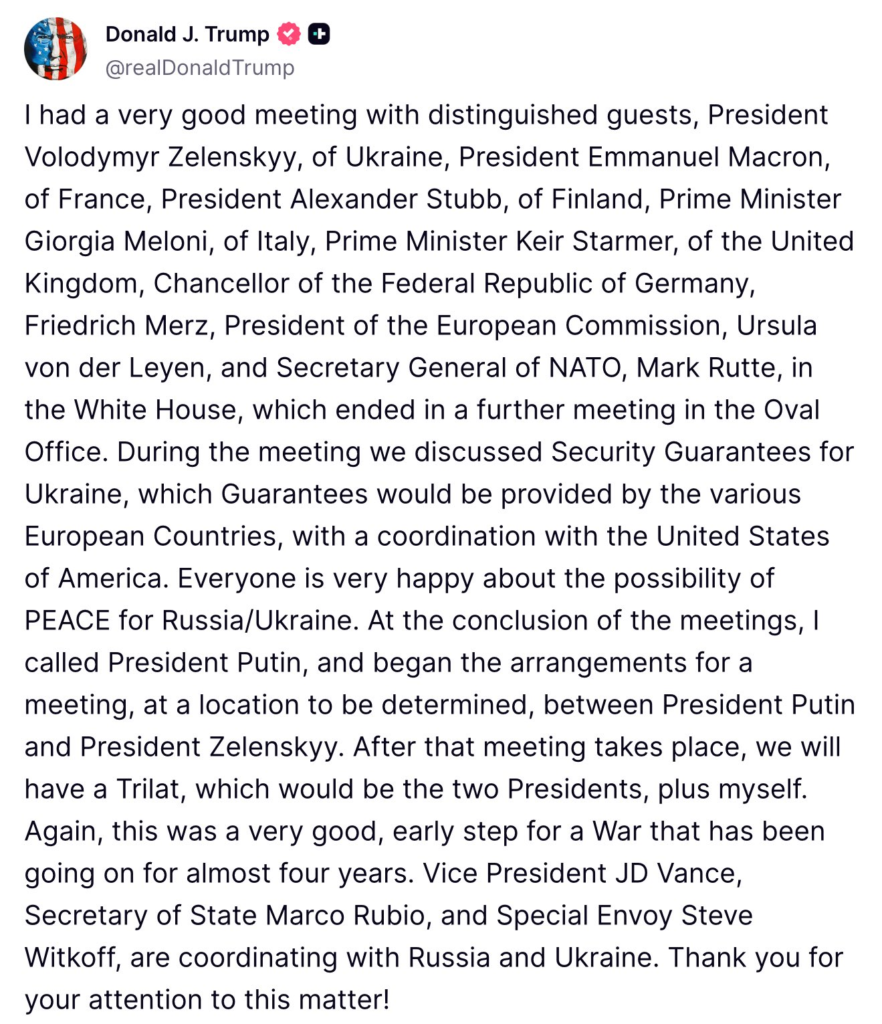

Trump signaled U.S. willingness to coordinate security guarantees with Europe—called a “breakthrough” by NATO’s secretary general—even as NATO membership for Ukraine remains off the table for now. Zelenskyy said details could be shaped within 7–10 days.

The money-and-metal angle: multiple outlets confirmed Ukraine floated a $100 billion U.S. weapons purchase (financed by Europe), plus a $50 billion U.S.–Ukraine drone production plan—designed to lock in American industry and political support.

2) A Zelenskyy–Putin meeting (promise vs. plausibility)

Trump said he called Putin from the White House and “began the arrangements” for a Zelenskyy–Putin meeting, followed by a U.S.–Russia–Ukraine trilateral. The Kremlin’s readout was notably cooler, speaking only about “raising the level of representatives” rather than confirming leader-to-leader talks.

Germany’s Chancellor Friedrich Merz told reporters Putin agreed to a meeting within two weeks, but that timeline has not been validated by Moscow; treat it as aspirational until there’s a venue and date.

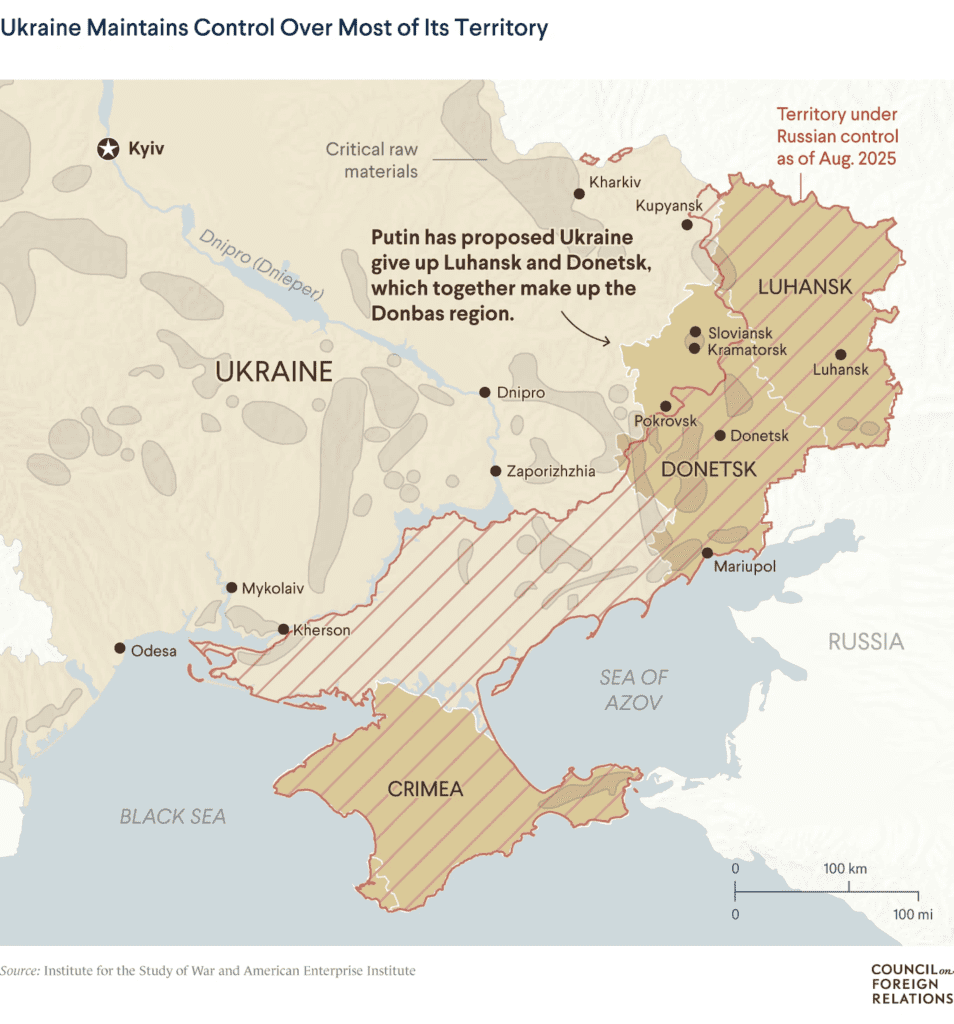

3) The map, the land, and the silence

Pressed on territory, leaders deferred: NATO’s Mark Rutte said redrawing boundaries wasn’t discussed at this stage—it’s for Zelenskyy and Putin to address directly if/when they meet. Zelenskyy said he argued with Trump over a map of occupied areas and stressed that security guarantees are the “starting point” to end the war.

The soundbites that mattered

- Trump, on tone & trajectory: optimistic about “substantial progress,” pushing for a deal, and not insisting on a ceasefire first. He also said he’d phone Putin—which he did.

- Hot-mic moment: before the multilateral, Trump told Macron he thinks “Putin wants to make a deal for me.” It captures both Trump’s confidence and European concerns about over-personalizing the diplomacy.

- Europe’s line: Macron, Merz, Starmer and others praised movement on guarantees yet insisted a ceasefire is the necessary condition for meaningful talks.

Analyst reads (and why they differ)

- CFR (Matthias Matthijs): friendlier Zelenskyy–Trump tenor, still thin on parameters of a truce. Europe shows unity, but a real deal will require clarity on guarantees that Moscow can accept—or be seen to reject.

- ISW: caution on the Kremlin’s ambiguity—the Russian readout falls short of endorsing a leader-level meeting; don’t over-extrapolate from Trump’s framing.

- Washington Post: Europeans raced to Washington to pull Trump away from Kremlin-friendly outcomes, offering political cover for stronger guarantees while resisting territorial concessions.

Key takeaways (fast)

- Security guarantees moved from concept to design phase. That’s substantive, even if the fine print is TBD.

- Money talks: Kyiv’s $100 bn weapons + $50 bn drone proposals are intended to anchor U.S. skin in the game via industry.

- Meeting math: Trump says leaders will meet soon; Moscow has only implied higher-level talks. Watch for an actual date/place before pricing a breakthrough.

- Europe’s red line remains a ceasefire first; Trump’s is speed and a “final” peace—this tension will shape the next steps.

What to watch next (the next 10–14 days)

Drafting the guarantees: Does a written framework surface from the U.S.-Europe “coalition of the willing”? Scope could include ISR, air defense, munitions pipelines, training, and funding mechanics tied to that $100 bn/$50 bn package.

Date/venue for Zelenskyy–Putin: If Merz’s two-week window is real, expect intense pre-talks; if it slips, it validates the ISW caution on Kremlin hedging.

Kremlin signals: Do Russian statements move from “raising the level of representatives” to confirming a leader-level meet? That’s your bar for calling this a breakthrough rather than a process.

In the end, Zelenskyy leaves Washington with time banked, a friendlier U.S. posture on security guarantees, and a potential path to direct talks. Europe showed up united and kept the ceasefire drumbeat going. Trump owns the momentum narrative—but Moscow hasn’t yet given him the meeting he wants.

Market Pulse: Global Investor Response to the Washington Summit

Markets perked up slightly as the summit began—with a cautious “risk-on” mood emerging. European equity futures edged higher (~0.2%), reflecting optimism about potential security guarantees. Oil prices dipped modestly while gold held firm, signaling tempered relief. The dollar and euro remained steady. Investors are now bracing for fallout ahead of the Federal Reserve’s Jackson Hole statements later this week.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Zelensky–Trump Meetings: How 2025 Shaped Energy & Defense Stocks