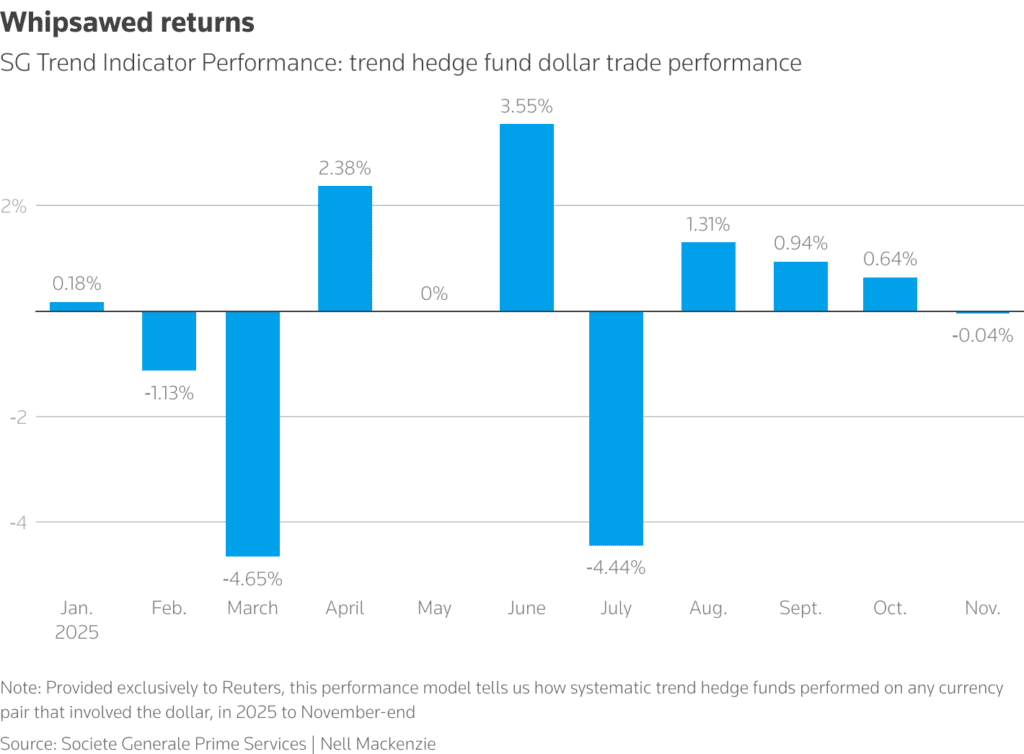

Emerging market currencies are back in focus after a year of sharp swings and surging investor interest, with the Hungarian forint leading gains and hedge funds reaping billions from 2025’s volatile foreign exchange landscape.

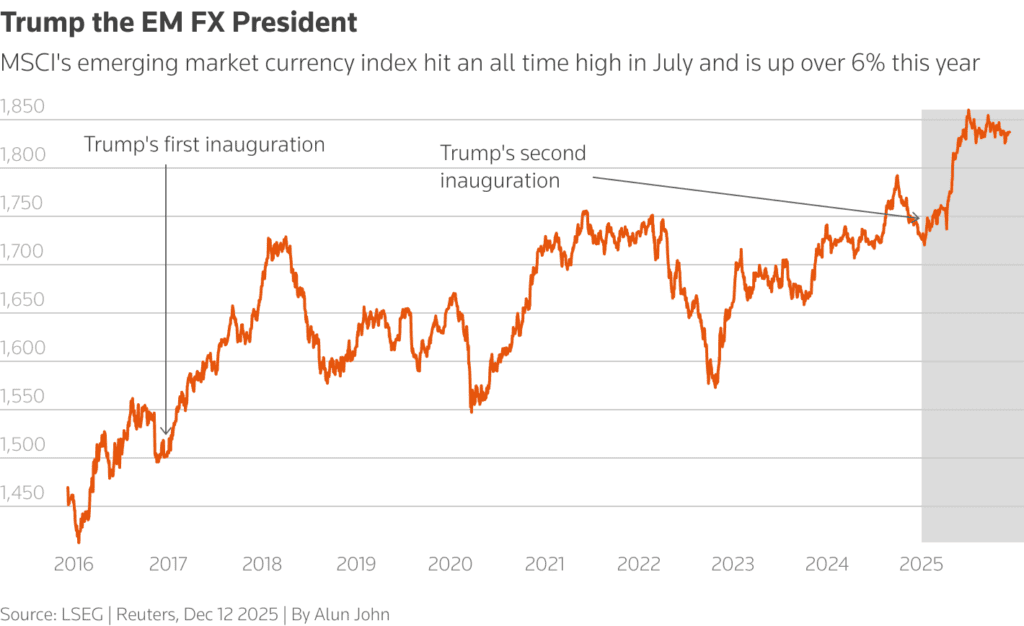

According to Reuters, trading in the forint, once a niche currency, has more than doubled since President Donald Trump’s “Liberation Day” tariffs took effect. The forint has gained around 20% against the dollar this year, making it one of the top-performing emerging market currencies and helping drive the MSCI Emerging Market Currency Index to its best year since 2017.

The broader rally comes as the US dollar weakens amid expectations that the Federal Reserve will continue cutting rates in 2026. “The 14-year bear market for EM currencies may have finally turned,” said Jonny Goulden, head of EM strategy at JPMorgan, noting that global investors are starting to diversify away from US assets.

Hedge Funds and Banks Cash In

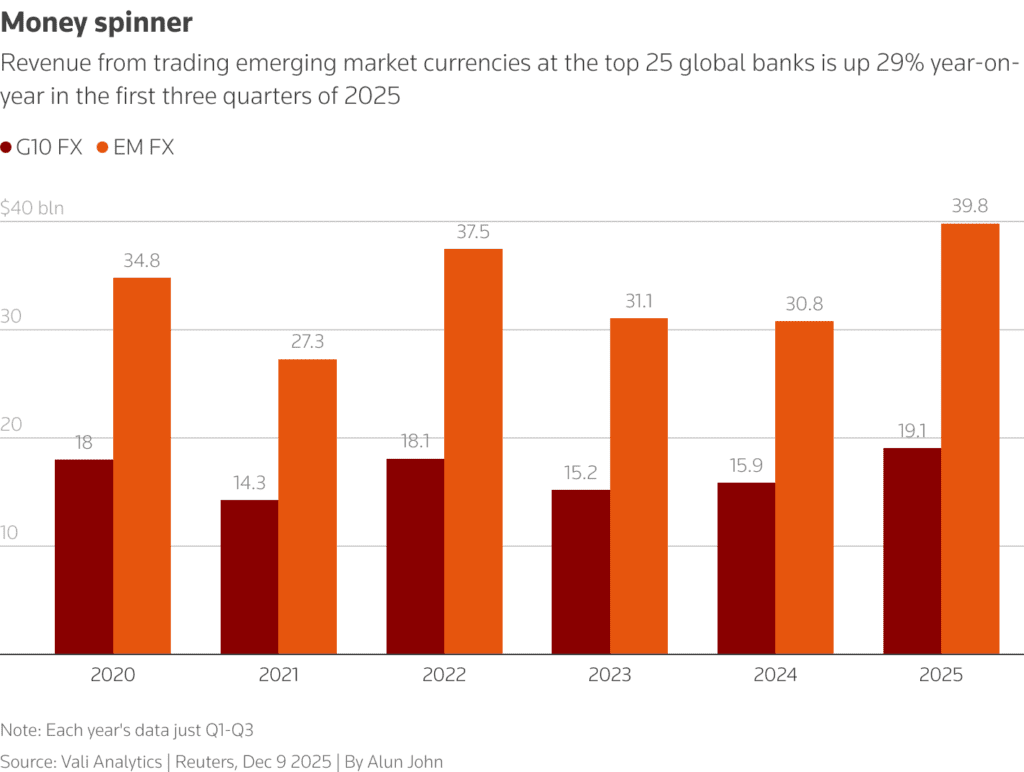

Hedge funds and global banks have been among the biggest winners. Data compiled by Vali Analytics show that emerging market currency trading generated $40 billion in revenue for the world’s 25 largest banks in the first nine months of 2025, more than double the $19 billion earned from G10 currency trading.

Funds like EDL Capital, which manages $1 billion, are up nearly 28% this year thanks to well-timed bets against the dollar, particularly around Trump’s tariff announcements.

However, the boom comes with risks. The IMF recently warned that nearly half of global FX turnover is handled by a small number of large banks, leaving the market vulnerable during stress events.

Not All Currencies Are Winning

While many emerging currencies, including the Mexican peso and Brazilian real, are rallying, others like India’s rupee and Indonesia’s rupiah are struggling due to weak trade and political instability.

Still, the overall momentum remains positive. Analysts expect the Fed’s continued rate cuts and a softer dollar to fuel more inflows into emerging markets next year.

“There have been strong inflows into EM bonds and currencies, and I would not bet on that trend reversing anytime soon,” said Nikolas Skouloudis, portfolio manager at Amia Capital, which is up 16% this year.

With global liquidity shifting and the dollar losing dominance, emerging markets, once seen as volatile backwaters, are now at the centre of global currency trading, signalling a major shift in the post-tariff financial order.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Trump’s Fed pick comes into focus, economic data, earnings: What to watch this week