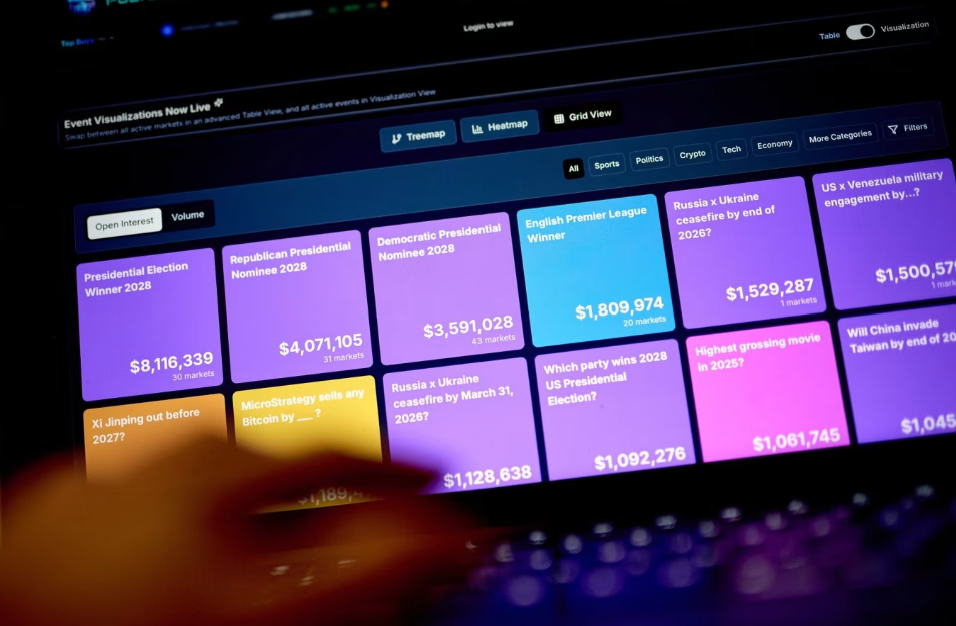

Platforms such as Kalshi and Polymarket are attracting traders who previously favoured high-risk options strategies. These markets allow users to wager directly on outcomes, from economic data to stock prices, using binary contracts that either pay a fixed amount or nothing.

Why Traders Are Switching

Former trader Andrew Courtney says prediction markets appeal because they eliminate the complexity of traditional derivatives. Instead of analyzing price movements, timing, and strike levels like options traders must, users simply choose whether an event will happen.

For example:

- An options trader betting on unemployment must analyze assets tied to labor data.

- A prediction trader can directly buy a contract such as “Will unemployment exceed 4.2%?”

The contract settles quickly once official data is released.

Simpler but Riskier

Critics argue the format resembles gambling because traders lose their entire stake if they are wrong. Unlike options, there is no partial payoff. Still, users like Chicago investor Zach Powers say the clarity is a benefit, calling the system “an organized way of telling the truth.”

Regulated US platforms fall under oversight from the Commodity Futures Trading Commission, which can block contracts tied to illegal or harmful events.

Legal and Industry Response

Kalshi is currently fighting a legal case against Nevada regulators who argue it should be licensed as a gambling operator. The company maintains its contracts are financial instruments, not bets.

Meanwhile traditional exchanges are adapting. Cboe Global Markets is exploring new “all-or-nothing” options that mimic prediction-style contracts, allowing traders to wager on simple outcomes such as whether the S&P 500 closes above a set level.

Retail broker Webull has also launched contracts tied to bitcoin prices, economic data, and even entertainment events, reflecting rising demand for quick, speculative trades.

Market Trend

Short-dated options traders, known for high-risk bets that expire within hours or days, appear especially drawn to prediction markets. Industry executives say both products serve the same audience: traders seeking fast, low-cost speculation.

Prediction markets are emerging as a rival to options trading, offering simplicity and speed. Whether they become a lasting financial tool or remain a speculative niche may depend on regulation and investor appetite for risk.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Prediction Markets See Nearly 80% Chance of New Shutdown