D-Wave Quantum (NYSE: QBTS) fell 6.65% on Tuesday, closing at $17.55, despite unveiling its most advanced system yet and posting significantly improved earnings. The decline comes after the stock surged more than 1240% over the past year and 206% in just the last quarter, making it one of the best-performing quantum plays on the market.

But why the sudden pullback?

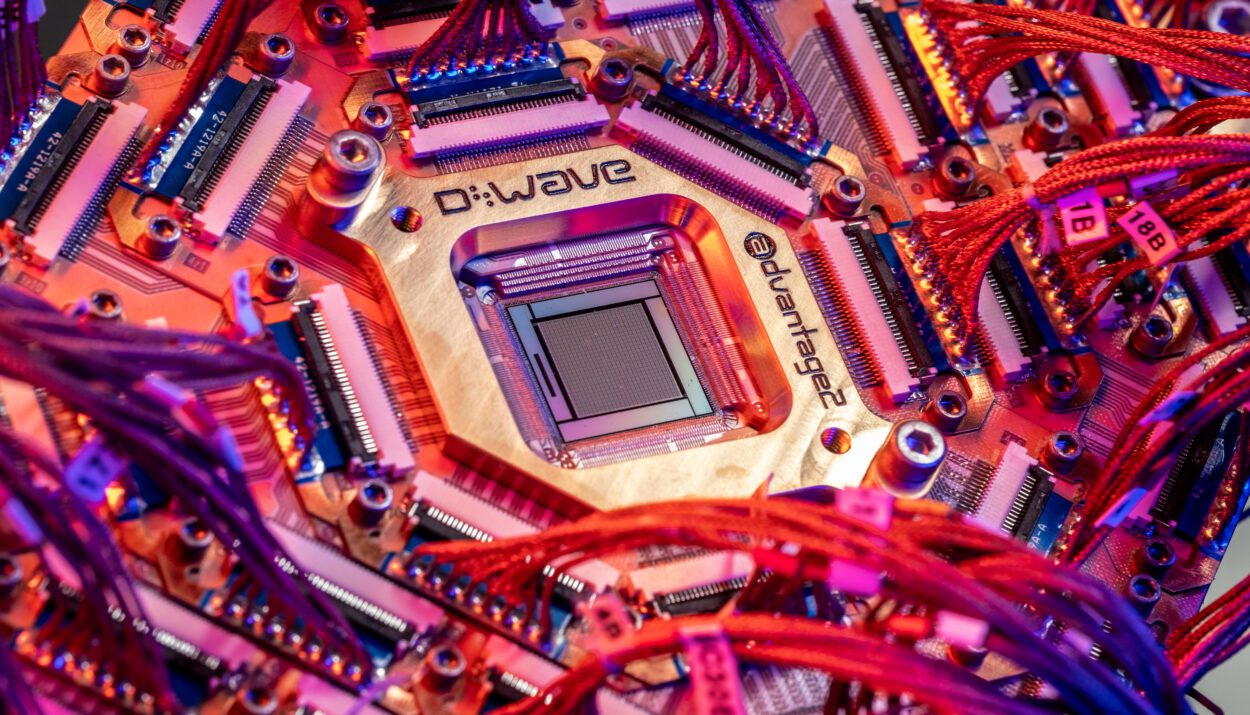

Product Milestone: Advantage2 Launch

D-Wave recently launched Advantage2™, its next-generation quantum annealing computer. The system is already live in over 40 countries via the Leap™ quantum cloud and used by 130+ clients, including 25 Fortune Global companies. Applications span AI drug discovery (Japan Tobacco), logistics (Los Alamos Lab), and materials simulation — showcasing D-Wave’s unique ability to solve optimization problems beyond classical GPUs.

CEO Alan Baratz emphasized that while competitors like IBM, Google (GOOG), IonQ (IONQ), and Rigetti (RGTI) are still focusing on gate-based quantum systems, D-Wave’s annealing approach is already producing commercial value. However, Baratz also warned that the US is falling behind in quantum annealing adoption — a comment that may have spooked investors.

“DOGE is just becoming the whipping boy for everything,” Baratz said in an interview, referring to the Department of Government Efficiency, which oversees support for emerging tech like D-Wave’s.

Financial Performance

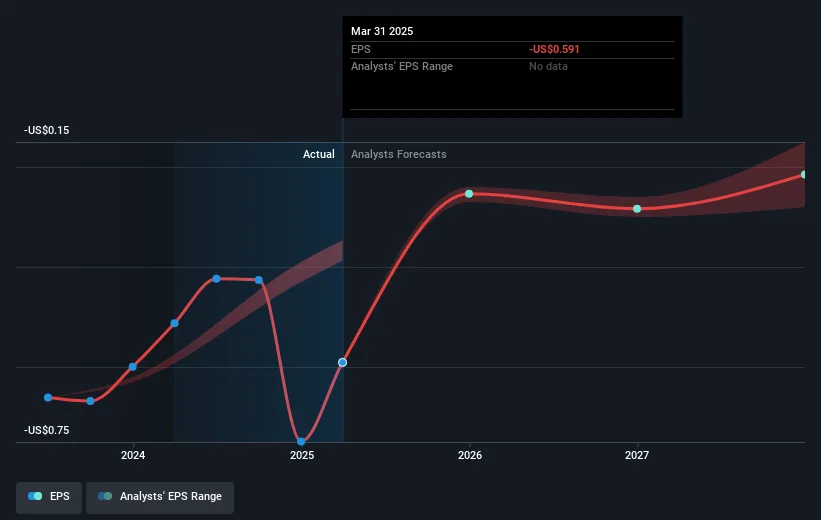

- Quarterly sales jumped from $2.47M to $15M, showing strong demand for the company’s services.

- Net losses narrowed, fueling optimism that D-Wave is heading toward positive cash flow.

- Despite these improvements, the current share price now trades above the consensus target of $12.83, raising valuation concerns.

Why the Stock Dropped

The immediate trigger appears to be investor reaction to geopolitical risk — particularly D-Wave’s open criticism of US government support. Investors are also taking profits after the recent parabolic rally, especially given the overvaluation risk flagged by analysts.

Furthermore, CEO Alan Baratz publicly warned that the US is lagging other nations in quantum annealing support, calling out the lack of government backing.

“The U.S. is missing out on near-term benefits — while rivals accelerate their programs.”

Valuation concerns: The stock is now trading above analysts’ consensus price target of $12.83, raising red flags about potential overvaluation.

Profit-taking after the rally: After a 5-day surge of over 50%, the selloff may reflect short-term traders locking in profits.

Analyst Takeaway

Commercial traction is real: D-Wave is one of the few quantum firms with an actual client base and functioning global infrastructure. That’s a huge advantage.

Geopolitical risk is rising: Without stronger US support, D-Wave risks losing ground to better-funded global rivals. That uncertainty is weighing on sentiment.

Valuation is stretched: After a 1200%+ rally, the stock trades well above fair value. Until recurring revenue solidifies, volatility will remain.

What to watch next:

- Government contracts

- Expansion of current pilot programs into enterprise-scale deals

- Further traction from Advantage2 performance

D-Wave’s drop looks more like a healthy correction than a reversal. But going forward, execution — not just tech — will decide whether this quantum pioneer becomes a true industry leader or remains a speculative darling.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

US Consumer Confidence Soars in May Amid Hopes for Trade Peace

Tesla Sales Crash 49% in Europe Despite EV Boom

Trump Threatens 25% Tariff on Apple as Foxconn Invests $1.5B in India

Trump Media Slams $3B Crypto Report as “Fake News”

China has quietly relaxed export restrictions on rare earth elements

Hedge funds are shorting stocks again, boosting leverage to new record

Trump says he’ll delay a threatened 50% tariff on the European Union until July

Angry Elon Is Back — And He’s Betting Big on Driverless Teslas and AI