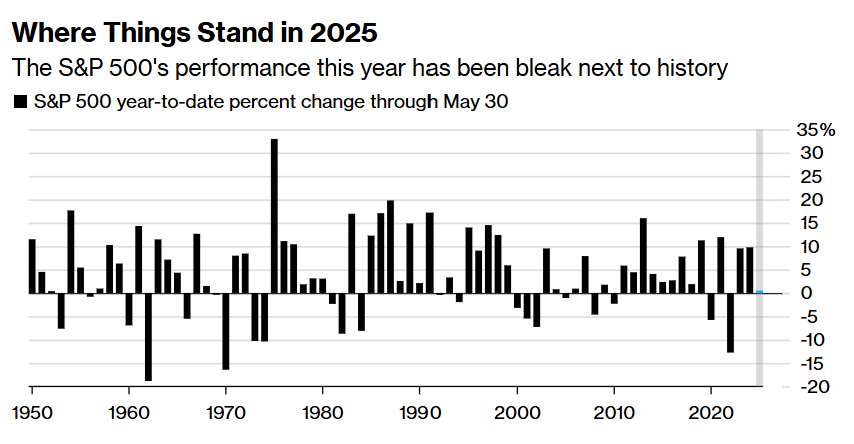

The US stock market has closed the first five months of 2025 on a turbulent note. Despite a powerful rebound in May—the S&P 500’s best May since 1990—the benchmark index is still barely positive for the year, trailing far behind global markets and offering little comfort to investors looking for clarity.

After tumbling nearly 19% from February highs to April lows, the S&P 500 has recovered most of its losses, now hovering just 4% below its all-time record. Still, it’s up only 0.5% year-to-date, making 2025 one of the weakest starts for the US market since the 1950s.

What’s Behind the Choppy Performance?

A cocktail of economic uncertainty, aggressive geopolitical maneuvers, and mixed Fed signals has rattled investor confidence:

- Trump’s trade wars have reignited volatility, with escalating tariffs on China and steel imports triggering global backlash.

- Growth concerns linger, as CEO confidence surveys show pessimism not seen since 2022.

- Interest rate path remains unclear as the Fed weighs inflation control against economic momentum.

“There’s too much noise for traders to commit fully,” said Eric Beiley of Steward Partners. “I’ve kept nearly 10% in cash and moved into international and defensive names—it’s just safer right now.”

Global Markets Leave the S&P Behind

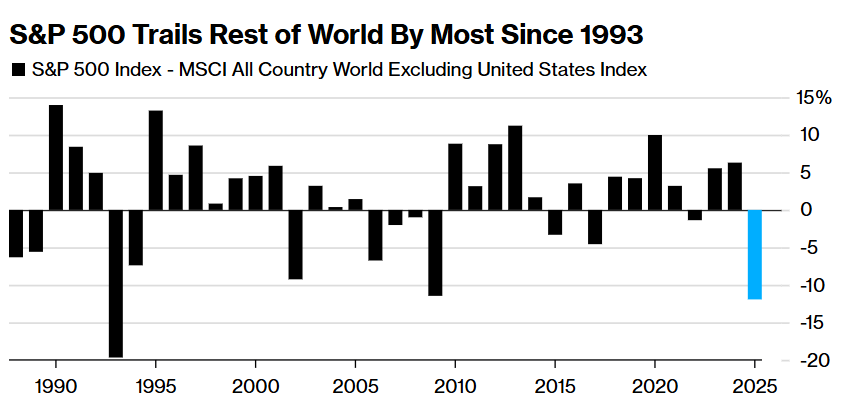

While US equities flounder, international markets are thriving. The S&P 500 is lagging the MSCI All-Country World Index ex-US by nearly 12 percentage points in 2025—its worst relative performance since 1993.

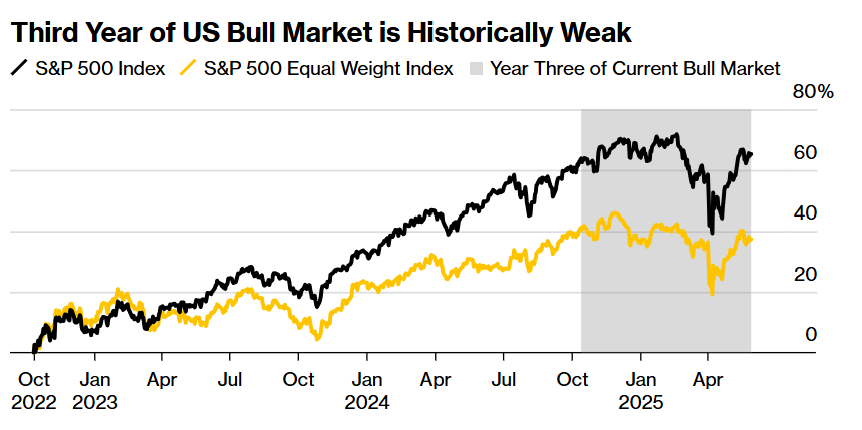

This reversal follows two blockbuster years in 2023 and 2024, when the S&P posted back-to-back 20% gains. Historically, the third year of a bull market is the weakest, and 2025 appears to be following that script. Since WWII, year three typically delivers only a 5.2% average gain, often with corrections of 5–10%.

Still, with the index up 65% from its bear market bottom in October 2022 and the average bull market lasting 55 months, there’s room to run—though probably with turbulence.

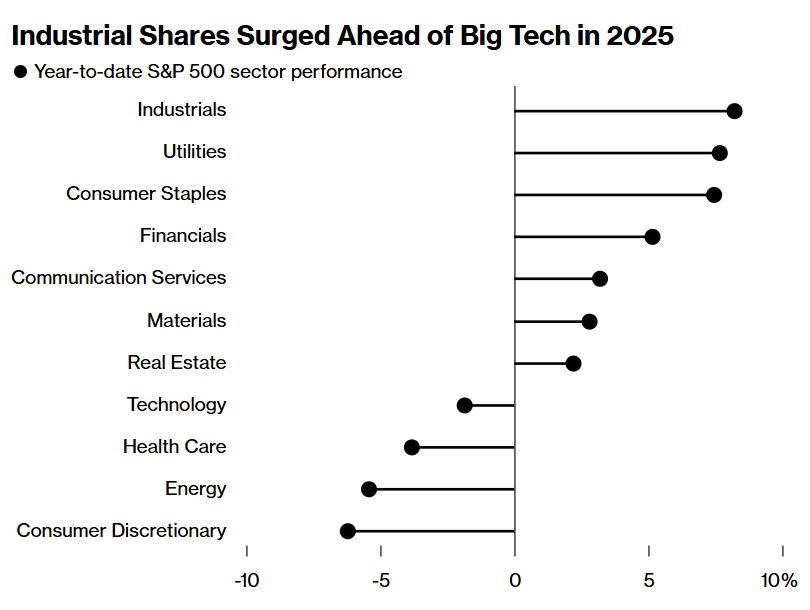

Industrial Stocks Lead, Tech Wobbles

One surprising twist this year has been the outperformance of industrial stocks, which are up 8.2%—beating Big Tech. The sector’s strength signals investor interest in economically tied sectors as global manufacturing and infrastructure projects heat up.

In contrast, consumer discretionary stocks, especially retailers and homebuilders, are dragging. The Magnificent Seven—Apple, Amazon, Alphabet, Meta, Microsoft, Tesla, and Nvidia—have staged a powerful comeback since April, rising 29%, but are still down 4.3% for the year overall.

Meanwhile, defensive sectors like utilities and consumer staples have gained traction thanks to their lower valuations and steady dividend appeal.

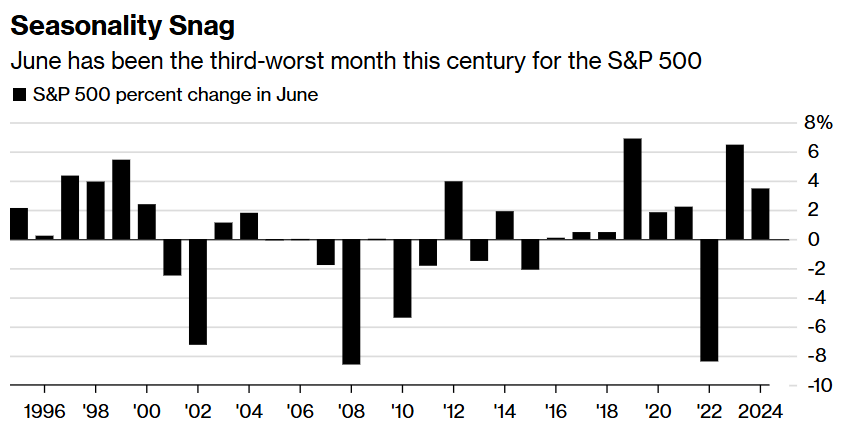

June Could Bring More Stillness Than Strength

Looking ahead, history suggests June may be a seasonal stumbling block. Over the past 30 years, the S&P has averaged just a 0.2% return in June, compared to 0.8% in other months. The effect is more pronounced in post-election years, when early summer profit-taking tends to weigh on markets.

Given May’s 6.2% jump, the stage is set for consolidation—or stagnation.

What’s Next for Investors?

With the Federal Reserve’s next move unclear, China-US trade frictions escalating, and global elections adding risk, many investors are opting for caution.

“After a chaotic start, we’re seeing capital rotate into international markets and safe sectors,” said CFRA strategist Sam Stovall. “Until there’s more visibility on policy and inflation, the big moves might stay overseas.”

In short: 2025 is not a year to chase every rally. It’s a time to stay nimble, watch global trends, and prepare for another round of surprises.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The original article was featured on Bloomberg.

Related:

Defense Stocks to Watch After US-China Tensions Escalate

China-US Trade Truce Frays Over Rare-Earth Dispute, New Tech Sanctions

Trump says he plans to double steel, aluminum tariffs to 50%

SEC Drops Binance Lawsuit in Major Win for Crypto – Trump-Linked Ventures Surge Ahead

From Chips to Humanoids: Nvidia CEO Jensen Huang Bold Vision for Future

Trump Taps Palantir to Build Massive Government Spy Network

Germany Considers 10% Digital Tax on Google, Meta – Risks New Clash With Trump

Appeals Court Reinstates Trump’s Tariffs – Legal Battle Heats Up