Microsoft delivered a clear earnings beat in Q2, yet the market reaction was brutal. Shares sank nearly 10 to 12 percent in a single session, erasing about $357 billion in market value. So what spooked investors?

Here is the full picture, step by step, with all the key data.

First, the numbers were actually strong

On the surface, this was a good quarter.

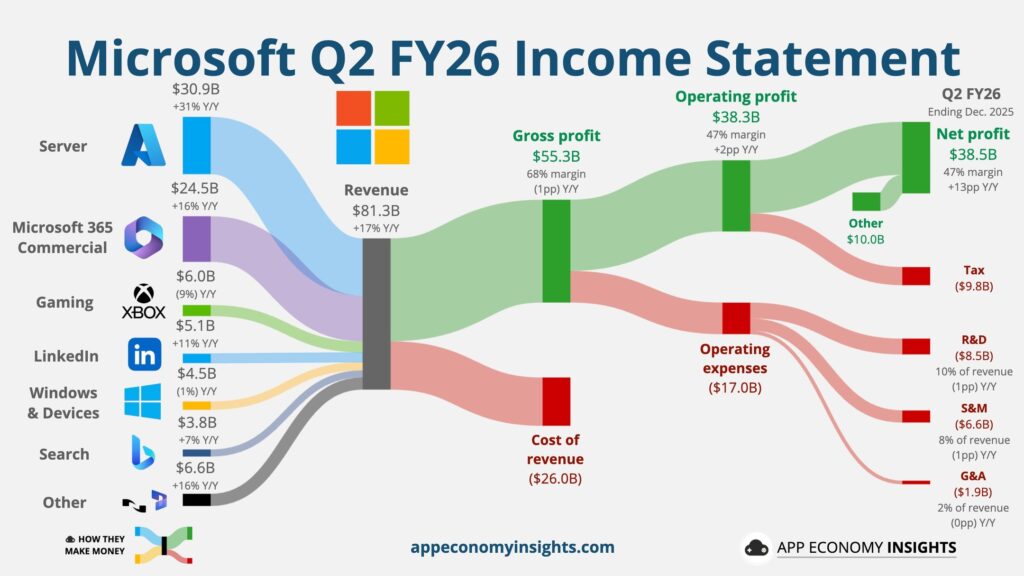

- EPS: $5.16 vs $3.92 expected

- Revenue: $81.27B vs $80.3B expected

- Cloud revenue: $51.5B, the first time ever above $50B

- Intelligent Cloud (Azure + others): $32.9B vs $32.2B expected

- Productivity & Business Processes: $34.1B vs $33.6B expected

- Net income: $38.5B, up about 60% year over year

CEO Satya Nadella summed it up simply: Microsoft has already built an AI business larger than some of its legacy franchises.

So why did the stock collapse?

Problem #1: Azure growth was not “good enough”

Azure grew 39% year over year.

That sounds great. But Wall Street wanted more.

- Last quarter: ~40% growth

- This quarter: 39%

- Consensus expectation: slightly above 39%

That tiny deceleration was enough to trigger alarms. Investors are now extremely sensitive to any sign that cloud growth might be peaking, especially at Microsoft’s size.

As one analyst put it, the number was strong, just not strong enough for a stock priced for perfection.

Problem #2: AI spending is exploding faster than revenue

This was the real shock.

- Capital expenditures: $37.5B in one quarter

- Up from $22.6B a year ago

- Up roughly 65% year over year

- Highest quarterly capex in Microsoft’s history

Most of that money is going into AI data centers, GPUs, and infrastructure.

CFO Amy Hood admitted demand is exceeding supply, meaning Microsoft cannot fully monetize AI demand yet. That puts a temporary ceiling on revenue while costs keep rising.

Investors are now asking a hard question: Is Microsoft spending too much, too fast, before returns are clear?

Problem #3: Capacity constraints are capping growth

Microsoft openly said it cannot deliver all the AI and cloud demand it is seeing.

- AI demand > available compute

- GPU shortages remain a bottleneck

- Constraints expected to last until at least mid 2026

Hood even said that if Microsoft had allocated all new GPUs to Azure, growth would have been above 40%. Instead, compute is being split across Azure, Microsoft 365 Copilot, GitHub Copilot, security tools, and internal AI projects.

That long term strategy makes sense. Short term traders hated it.

Problem #4: A massive backlog raises concentration fears

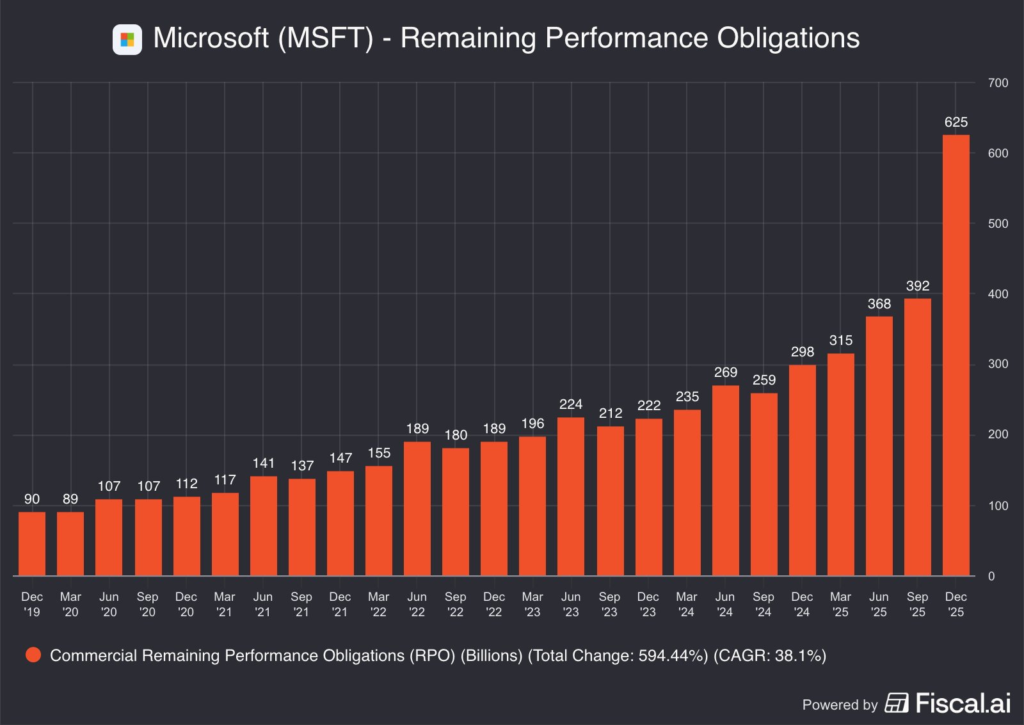

Microsoft disclosed a stunning number:

- Remaining Performance Obligations (RPO): $625B

- Up 110% year over year

- About 45% tied to OpenAI commitments

While management stressed that over $340B comes from a broad customer base, investors are uneasy about how much future revenue is linked to AI model builders and long dated contracts.

Big backlog is good. Big backlog tied to AI spending cycles is risky.

Problem #5: The market is rotating, not panicking

This is important.

The selloff was not a tech collapse across the board.

- Meta jumped about 10% after earnings

- Google is up roughly 69% over the past year

- Microsoft underperformed Amazon over 12 months

Investors are becoming selective. They want proof that AI spending turns into accelerating profits, not just bigger data centers.

Nothing is fundamentally broken at Microsoft. But the stock is priced for flawless execution.

This quarter delivered:

- Slightly slower Azure growth

- Record breaking AI spending

- Clear capacity limits

- Uncertainty around near term returns

That combination was enough to flip sentiment fast.

The story has shifted from “AI winner” to “show me the ROI.”

Until Microsoft proves that massive AI investments convert cleanly into margins and growth, volatility is likely to stay.

The earnings beat was real. The market’s patience was not.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.