After last week’s $820 billion wipeout in AI market value, investors are questioning whether Big Tech’s aggressive AI spending can keep delivering the growth baked into their valuations. The Nasdaq logged its worst week since March, led by steep losses in Nvidia, Meta, and Microsoft, as markets reassessed just how much capital is flowing into AI infrastructure versus how much profit it’s actually generating.

Nvidia’s latest partnerships, including its $6.3 billion deal with CoreWeave, a company it partly owns, have intensified debate over “circular AI financing,” where chipmakers, AI developers, and cloud firms invest in each other to sustain demand. Analysts at LPL Financial said investors are torn between seeing this as “a vote of confidence” or as a system built on “maintaining unprofitable business lines to preserve demand.”

Meanwhile, Meta’s 10% post-earnings drop and OpenAI’s $1.4 trillion eight-year investment projection have reignited fears that the “build now, monetise later” playbook might finally hit limits. The market’s near-term question: will AI firms’ next earnings reports show real monetisation — or just more expansion spending?

How Big Tech Created the 2025 AI Boom on Debt

Sam Altman says OpenAI isn’t trying to become ‘too big to fail’

Earnings Catalysts

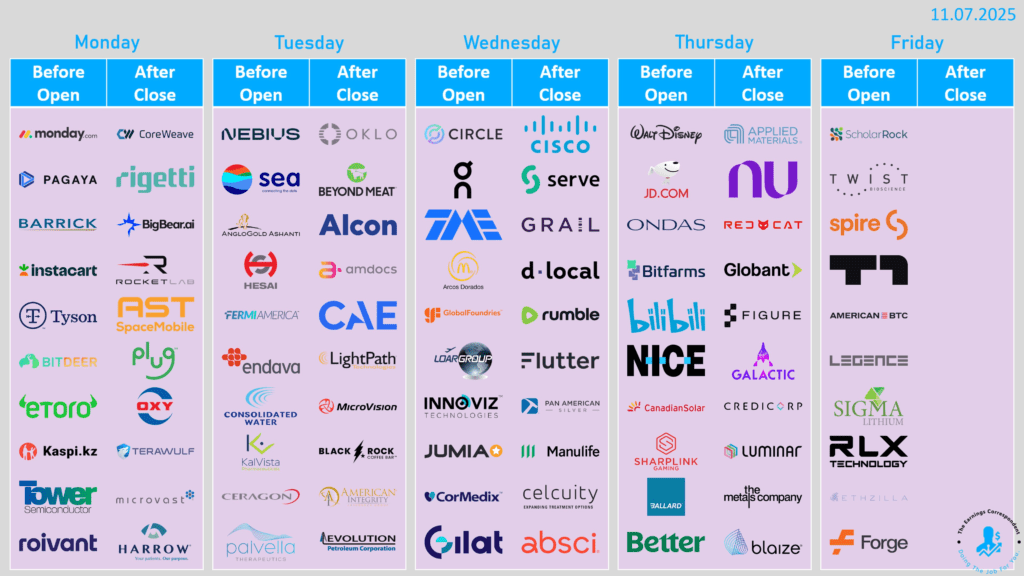

This week still brings a handful of critical earnings reports that can shape sector sentiment.

- Disney (DIS) headlines Thursday with its first results since launching the new ESPN app and announcing plans to buy the NFL Network — a move meant to cement its streaming dominance.

- CoreWeave (CRWV) reports Monday, giving investors the first real look at one of Nvidia’s key AI partners and its growth trajectory after going public this year.

- Cisco (CSCO) follows midweek after nearly doubling its AI sales target last quarter, while Applied Materials (AMAT) will update investors on chip-equipment demand amid fresh US–China export restrictions.

- Sony (SONY) and Oklo (OKLO) will also draw attention, with Oklo seen as a bellwether for nuclear-powered data-center energy solutions.

Given the market’s fragility, guidance and tone will matter as much as results — especially any signs of capex discipline or margin improvement in the AI ecosystem.

| Day | Earnings Highlights |

|---|---|

| Monday, Nov 10 | Barrick Mining (B), CoreWeave (CRWV), Occidental Petroleum (OXY), Rocket Lab (RKLB), AST SpaceMobile (ASTS), Tyson Foods (TSN), Venture Global (VG), Paramount Skydance (PSKY), Rigetti Computing (RGTI), Tower Semiconductor (TSEM), Maplebear (CART), Metsera (MTSR), TeraWulf (WULF), Plug Power (PLUG), eToro (ETOR), Gemini Space Station (GEMI) |

| Tuesday, Nov 11 | Sony Group (SONY), Sea Limited (SE), Alcon (ALC), AngloGold Ashanti (AU), Vodafone Group (VOD), Oklo Inc. (OKLO), Fermi Energy (FRMI) |

| Wednesday, Nov 12 | Cisco Systems (CSCO), TransDigm Group (TDG), Manulife Financial (MFC), Flutter Entertainment (FLUT), Tencent Music Entertainment (TME), ORIX Corporation (IX), Circle Internet Group (CRCL), GlobalFoundries (GFS), Pan American Silver (PAAS), Ascendis Pharma (ASND), On Holding (ONON), Firefly Aerospace (FLY), McGraw Hill (MH) |

| Thursday, Nov 13 | The Walt Disney Company (DIS), Applied Materials (AMAT), Brookfield Corp (BN), Nu Holdings (NU), JD.com (JD), Dillard’s (DDS), Figure Technology Solutions (FIGR), StubHub (STUB), The Metals Company (TMC), Better Home & Financing (BETR) |

| Friday, Nov 14 | Alibaba Group (BABA), Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial (SMFG), Mizuho Financial (MFG), LATAM Airlines (LTM), Spire Global (SPIR), American Bitcoin (ABTC), Legence (LGN), Quantum Computing (QUBT), Perpetua Resources (PPTA) |

Policy & Fiscal Tailwinds

The Senate’s weekend vote to advance a shutdown-ending deal lifted markets, as investors welcomed a move toward stability. The agreement, funding the government through January 30, 2026, includes back pay for 1.4 million federal workers and continued SNAP benefits, but also sets up another fiscal cliff early next year.

US Senate passes deal aimed at ending government shutdown

S&P 500 futures rose 0.8% and Nasdaq 100 futures rose 1.3%. Risk-sensitive currencies such as the Australian dollar climbed. Safe-havens such as U.S. Treasuries and the yen slipped.

Markets view the deal as a short-term relief that restores data flow and allows agencies like the Bureau of Labour Statistics and the Treasury to resume operations. Strategists at ANZ and MUFG said the progress is a “positive signal for sentiment.” However, the limited duration means fiscal uncertainty will return within months — a potential volatility trigger for early 2026.

Macro Drif

With no CPI or jobs report, markets will look to smaller indicators for direction (If Congress finalises the shutdown deal and agencies reopen soon, CPI and PPI could be released next week or later, once the BLS resumes normal operations). The NFIB Small Business Optimism Index on Tuesday and mortgage application data on Wednesday will serve as key sentiment proxies. Economists expect modest declines in both, reflecting the squeeze on small firms from higher rates and weaker consumer demand.

In the absence of hard data, corporate earnings and investor psychology will drive price action. Traders will be watching whether the combination of a fiscal reprieve and improving earnings tone can offset the broader worries about stretched valuations and slower global growth.

| Day | Time (ET) | Release |

|---|---|---|

| Tuesday | Morning | NFIB Small Business Optimism (Oct) |

| Wednesday | Early | MBA Mortgage Applications (week ending Nov 7) |

| Thursday | — | Note: Key data (e.g., CPI, PPI) likely delayed due to the US government shutdown |

| Friday | — | Retail Sales (Oct) & Producer Price Index (Oct) — watch for whether they are released or delayed |

Markets are breathing a little easier after progress on the US shutdown deal, but the relief feels cautious. The focus now shifts back to earnings and whether companies can justify high valuations after last week’s AI selloff. With key economic data still missing and growth concerns simmering, investors are likely to stay selective, optimistic, but not convinced yet.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.