Stocks are coming off record highs, with the S&P 500, Nasdaq, and Dow all posting fresh peaks last week after the Federal Reserve delivered its first rate cut of 2025. Now, the focus shifts to what comes next: more Fed signals, crucial inflation data, and a handful of high-profile corporate earnings.

Fed in the Spotlight

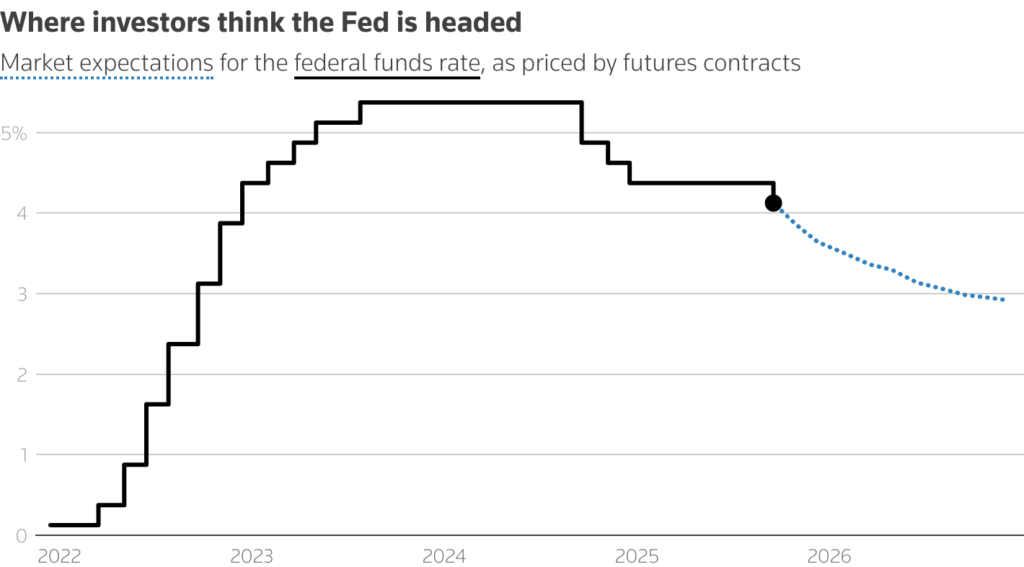

The Federal Reserve will dominate market attention again. After cutting rates by 25 basis points last week, Chair Jerome Powell and newly appointed Fed Governor Stephen Miran are set to speak. Investors will be parsing every word for hints about whether additional cuts are likely at the final two meetings of the year.

Other Fed officials — including John Williams, Mary Daly, Michelle Bowman, and Austan Goolsbee — are also on the speaking circuit this week, ensuring constant Fed chatter in the background. Markets are currently betting on at least one more cut by December, but policymakers have stressed their decisions will depend on incoming data.

Fed Chair Jerome Powell is also scheduled to speak on Tuesday.

All of which means we are back to keeping notes on Fedspeak and where rates head from here. Fun times!

Inflation, Growth, and Consumer Data

The marquee economic release is Friday’s Personal Consumption Expenditures (PCE) index. Core PCE — the Fed’s preferred inflation gauge — is expected to show a modest monthly rise of 0.2%, keeping annual inflation at 2.9%, still above the Fed’s 2% target. This number could be pivotal for shaping the Fed’s tone heading into October.

Other key macro data includes:

- GDP revision (Q2) — final adjustment to growth data, expected to confirm moderate expansion.

- Housing market updates — new and existing home sales, plus mortgage applications, as borrowing costs ease.

- Durable goods orders — a signal on business investment strength.

- Consumer sentiment (University of Michigan) — a real-time read on household confidence.

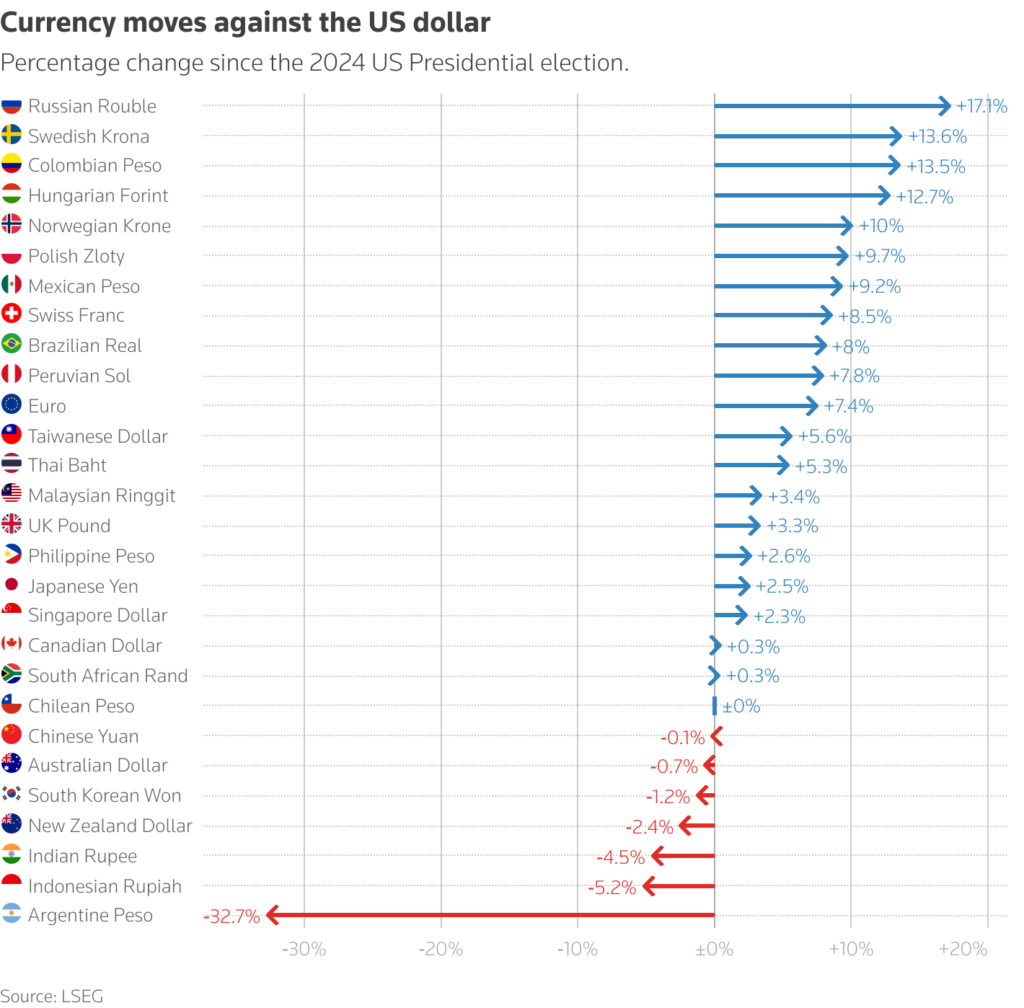

On the other hand, the dollar began the week steady following last week’s volatility, while stocks remained near record highs. Futures pointed to a subdued session, with a bare European calendar expected to keep markets listless.

Corporate Earnings: Micron and Costco Lead

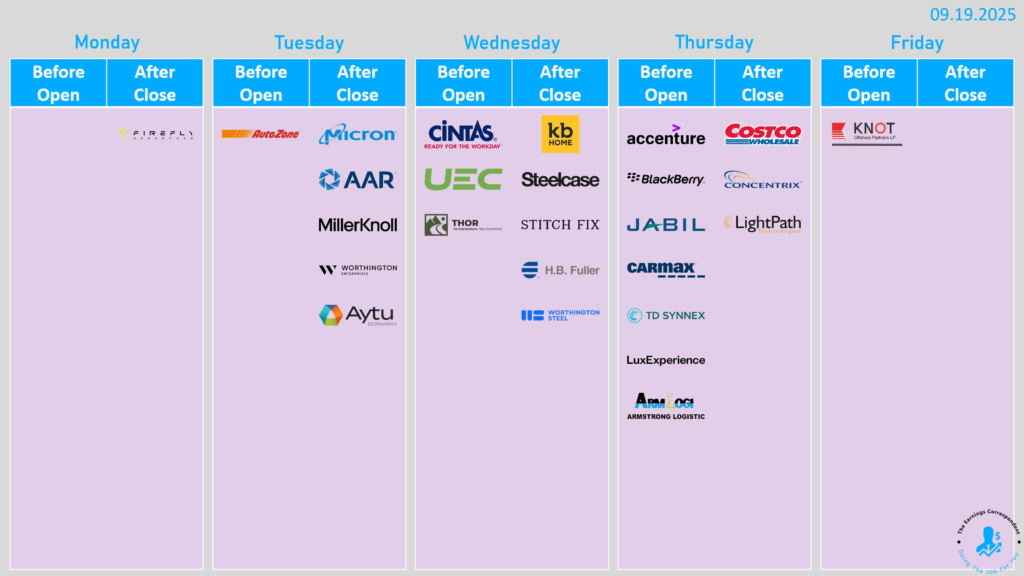

While the earnings season is in a lull, a few important names are reporting:

- Micron Technology (MU) (Tuesday): Analysts expect updates on booming AI demand for memory chips. The stock just hit record highs, and guidance will be closely watched.

- Costco (COST) (Thursday): A consumer bellwether. Investors will be looking for evidence of continued strong retail spending amid high but easing inflation.

- CarMax (KMX) (Thursday): Insights into the used-car market, where affordability remains a concern.

- Other reports: AutoZone, Cintas, Accenture, Jabil, and Firefly Aerospace add breadth across sectors.

Geopolitics and Trade

Markets continue to track U.S.-China relations. Tariffs on Chinese goods remain on a 90-day pause until Nov. 10, and last week’s Trump-Xi phone call suggested progress on TikTok negotiations and broader trade tensions. Any new developments could quickly swing sentiment, especially in tech stocks.

At the same time, the threat of a U.S. government shutdown lingers, with Congress deadlocked on spending bills. So far, markets have brushed off the risk, but brinkmanship could start weighing if headlines worsen.

Energy & Commodities

Oil prices remain under pressure despite lower interest rates and a weaker dollar. Brent and WTI crude are both down more than 10% year-to-date, weighed by rising OPEC+ production. This contrasts with gold and Bitcoin, both of which are at or near record highs. Energy weakness has raised questions about global demand, even as AI-driven electricity usage boosts other commodity markets.

Meanwhile, nuclear-linked stocks continue to gain attention as investors look for long-term solutions to surging power demand.

This Week’s Calendar

| Day | Events / Data | Key Earnings | Fed Speakers |

|---|---|---|---|

| Mon, Sept 22 | Chicago Fed National Activity Index (Aug) | Firefly Aerospace (FLY) | Miran, Williams, Hammack, Barkin, Musalem |

| Tue, Sept 23 | U.S. PMIs (Manuf/Services/Composite) | Micron (MU), AutoZone (AZO) | Powell, Bowman, Bostic |

| Wed, Sept 24 | New Home Sales (Aug), MBA Mortgage Apps | Cintas (CTAS), Thor Industries (THO), KB Home (KBH) | Daly |

| Thu, Sept 25 | GDP (Q2 final), Existing Home Sales, Jobless Claims, Durable Goods Orders, Trade/Inventories | Costco (COST), Accenture (ACN), Jabil (JBL), CarMax (KMX), TD Synnex (SNX) | Bowman, Barr, Williams, Daly, Goolsbee |

| Fri, Sept 26 | PCE Inflation (Aug), Personal Income & Spending, Michigan Sentiment (Sept) | — | Bowman, Barkin |

This week is all about inflation confirmation, Fed clarity, and corporate bellwethers. With stocks at record highs, any surprises — positive or negative — could set the tone for the next leg of the rally.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Nvidia Stakes $5 Billion in Intel: A Strategic Revival for the Chipmaker

Powell Frames Cut as “Risk Management” Amid Weakening Jobs, Tariff Risks