A personal loan is a sum of money you can borrow for personal use, from either a bank, a credit union, or even an online lender. To secure a personal loan, you don’t have to put up any asset like your car or your home, which is contrary to other loans like mortgages or auto loans, which require some collateral. However, the amount you will be lent and the interest rates will largely depend on your credit score and overall financial health. To better understand what is a personal loan, you should also know how it works, what its types are, what its common uses are, and what its advantages and disadvantages are. Let’s get into it.

Understanding What is a Personal Loan

From personal loans, borrowers receive a lump sum of money, which they repay over a fixed period, typically ranging from 12 to 60 months, through monthly installments. The interest rate on a personal loan can either be fixed or variable.

A fixed-rate loan means your monthly payments stay the same throughout the life of the loan. On the other hand, a variable-rate loan may start with a lower rate, but your payments could fluctuate over time if interest rates change.

How do Personal Loans Work?

If you think about what is a personal loan, understand that when you apply for one, the lender will first assess your current financial situation. This typically includes gauging your income, credit history, and debt-to-income ratio. If everything is as per requirements, your loan will be approved, and you’ll receive a lump sum of money that has to be repaid over a set period, usually between one to five years. Repayments start immediately and can be made in fixed monthly installments, which include the principal amount and interest.

The total amount of the loan, your credit score, and your debt-to-income ratio are used to determine the loan’s interest rate. A higher credit score often gets you a lower interest rate.

Types of Personal Loans

- Unsecured Personal Loans: These do not require any collateral, making them riskier for lenders, which is why they usually come with higher interest rates.

- Secured Personal Loans: Although less common, secured personal loans need collateral, such as a car or savings account. Since the lender has a guarantee in case of default, they usually offer lower interest rates.

- Fixed-Rate Personal Loans: They have a set interest rate for the entire loan term.

- Variable-Rate Personal Loans: The interest rate on these loans can change over time, usually tied to a financial index. This can cause fluctuating monthly payments.

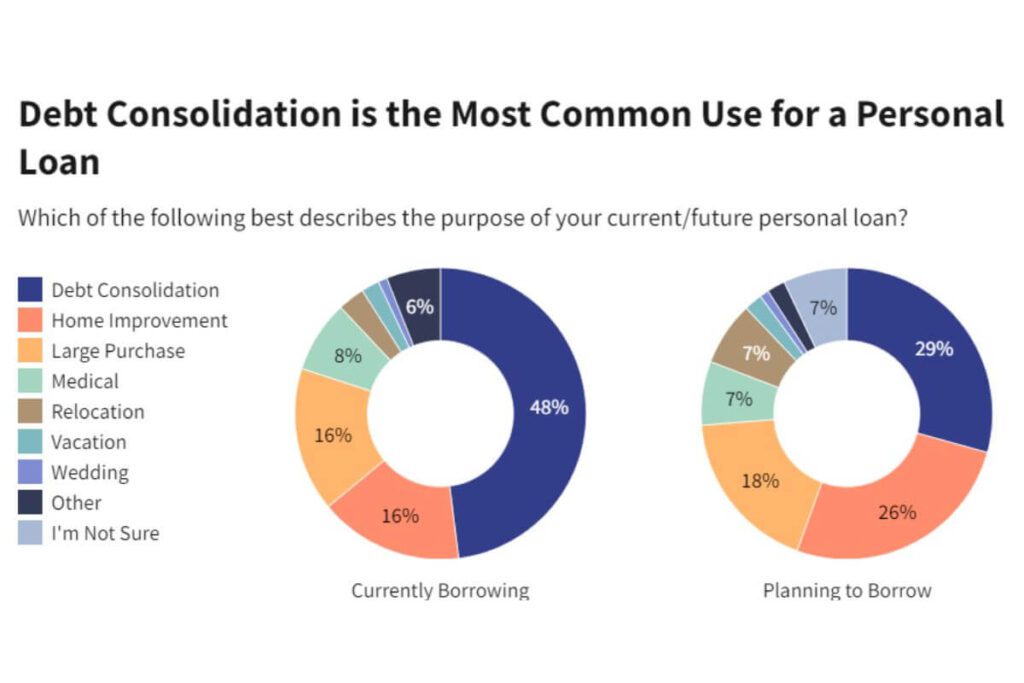

Common Uses for Personal Loans

- Home Improvement: Often, people take up personal loans to finance home renovation projects like kitchen remodeling, getting a new roof, or renovating the entire house.

- Debt Consolidation: If you have multiple credit card payments or other high-interest debt, a personal loan can help consolidate them into a single payment with a lower interest rate.

- Medical Expenses: People also take up personal loans to finance unexpected medical bills to cover heavy treatment costs without draining their savings.

- Major Purchases: From covering wedding expenses to buying new appliances, a personal loan can help you with the funds you need for significant one-time purchases.

- Emergency Situations: You can also take a personal loan to handle emergencies like accidents, sudden travel, or car repairs. A personal loan is a great way to quickly access cash when you need it most.

Pros and Cons of Personal Loans

Personal loans, like all other financial products, come with their own set of advantages and disadvantages. Therefore, to properly understand what is a personal loan, you must know their pros and cons:

Pros:

- No Collateral Required: Since most personal loans are unsecured, there is no risk of losing your assets if you’re unable to repay the loan.

- Fixed Payments: As most personal loans are fixed-rate loans, you’ll have pre-determined monthly payments. This predictability can help you better manage your budget.

- Flexible Use: From debt consolidation, to travel expenses, or home improvements, personal loans can be used for a wide range of purposes.

Cons:

- Higher Interest Rates: As personal loans don’t require any collateral, they often come with higher interest rates as compared to secured loans.

- Fees: Some personal loans require the borrower to pay certain fees, like origination fees or prepayment penalties, which add to the total cost of the loan.

- Negative Impact on Credit Score: Missing payments or defaulting on a personal loan can significantly harm your credit score.

What is a Personal Loan: Conclusion

A personal loan is a great way to access quick cash when you need to manage your expenses, consolidate debt, or fund emergencies or important life events. However, these loans can often come with higher interest rates or hidden fees, which can end up costing you more.

So, before borrowing a personal loan, make sure you carefully evaluate your financial situation and look for the best terms. This way you can properly utilize the funds to fulfill your financial needs without any burden.

Sources: