Retirement is a big milestone every couple dreams of after working for a good number of years. But when it comes to actually approaching retirement, many couples struggle with getting a good monthly retirement income from their savings or investments. After retirement, your expenses such as housing, food costs, transportation, and more still continue, so just living off of a monthly pension might not be enough. So, what’s a good monthly retirement income for a couple? Let’s find out as we look into the average monthly retirement income and what couples can do to increase their income.

What Is The Average Monthly Retirement Income For A Couple?

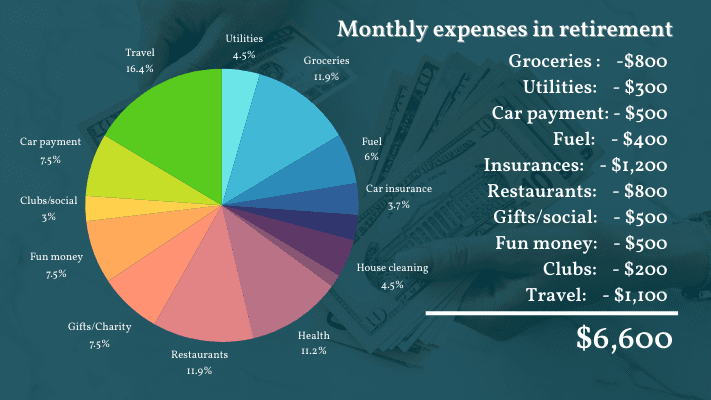

The average annual retirement income for a couple aged 65 or above comes to around $76,490 annually or $6,375 monthly. However, this figure just takes into just averages, and not the actual income needed for a couple to survive. According to the Social Security Administration, an average couple gets about $2,800 from their social security benefits monthly, which might not be enough for their survival when living in a city or on the expensive side of the country.

Even though the averages state otherwise, a much more comfortable target or a good monthly retirement income for a couple might be around $5,000-7,000. This is because it can cover everything from basic expenses to healthcare costs.

Key Factors That Determine Monthly Retirement Income For A Couple

Retirement income varies from one person to another person since many factors get involved to determine what might be a good monthly retirement income for a couple. Let’s look into some key factors that determine the monthly retirement income for a couple:

- Housing Costs: Housing is a big expense and investment when it comes to a couple’s budget. Whether you own your house fully or are still paying the mortgage will determine how much income you need for daily survival. On average, a couple can expect to spend between $1,000 and $2,000 per month on housing, including maintenance, utilities, and property taxes. You can also try downsizing or moving to a much cheaper location to save more of your income at this stage.

- Healthcare costs: Healthcare is also a big cost after retirement. A big issue when it comes to retired couples is unexpected health costs, which might drain your budget. To prepare for this, you might need to churn out an additional amount on Medicare or any other health insurance scheme. On average, a couple may spend up to $500 per month on Medicare premiums, prescriptions, and out-of-pocket medical expenses.

- Lifestyle and Leisure: Retirement doesn’t mean just sitting at home and reading books while sitting on the lawn; retired couples can also have a fun and exciting life during their retirement. Many couples hope to make up for lost time by travelling, planning dates, going out, and doing something exciting. A couple can allocate $500-1,000 or 10-15% of their monthly income towards leisure activities. However, this is fully based on choice so couples can cut back on this if needed to save money.

- Inflation: Even though inflation is not an expense you make, it can still erode your purchasing power and this means your living costs will also rise. So to protect against inflations, try investing in Treasury Inflation-Protected Securities or real estate to ensure your money still holds its value even for years to come.

What Can Couples Do To Increase Their Monthly Retirement Income?

Many couples simply depend on their Social Security Income for their baseline expenses, but as mentioned above, it might not be just enough to fully enjoy their life. Many couples might need additional income from savings, pensions, or investments to achieve financial stability in retirement. Here’s a breakdown of what couples can do to increase their monthly retirement income:

- Social Security: An average Social Security income for a couple comes to around $2,800, but you can delay claiming your Social Security until 70, since your benefits increase by 8% each year and give you a huge sum of money when you retire after that.

- 401(k) and IRAs: Many couples might also rely on 401(k) and IRAs apart from their Social Security. Depending on how much you contribute, you can withdraw $1,000 to $3,000 from your retirement savings account annually if you follow the 4% rule.

- Investment income: For couples who have spent a good amount on stocks, real estate, or other assets, you can receive dividends or rental income monthly apart from your base Social Security income. This gives a boost towards your net worth since you can also benefit from capital gains.

To Wrap It Up

Even though the average monthly retirement income for a couple comes to about $6,000, a good monthly retirement income for a couple based on the above calculations and lifestyle choices comes to around $7,800. This doesn’t mean that the income you get is not enough for your retirement – it all comes down to planning ahead and budgeting.

Sources: