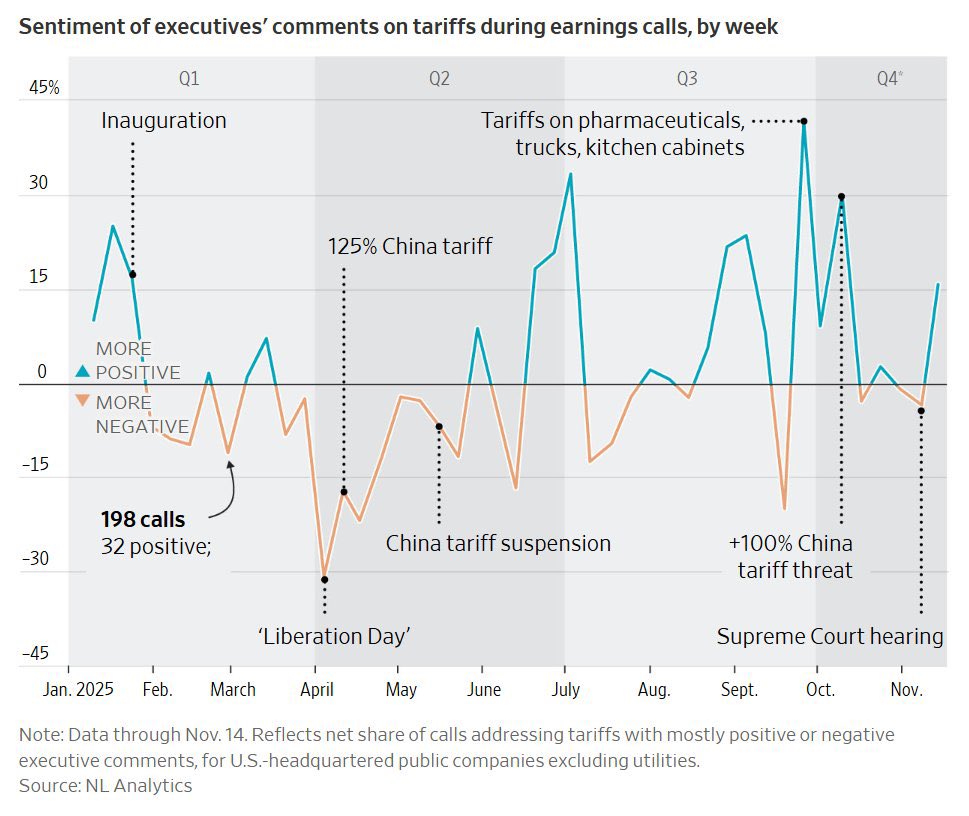

US companies sound less alarmed about tariffs than they did earlier this year, as the real impact on their costs turns out to be smaller than headline rates and more exemptions start to bite.

Data from NL Analytics and The Wall Street Journal show that on more than 5,000 earnings calls in 2025, executives are mentioning tariffs less often as a major risk and their tone has shifted from mostly negative to more mixed and even cautiously positive in some sectors.

Tariffs still hurt, but less than feared

Consultancy Oxford Economics estimates that in October companies paid tariffs worth around 12% of the value of their imports. That is roughly 10 percentage points higher than in January, but still below the worst case suggested by some of Trump’s headline announcements earlier in the year.

Firms have also had time to adapt. Many have:

- Secured exemptions on key products

- Raised prices selectively

- Cut costs in other parts of the business

- Shifted parts of their supply chains

As a result, big corporations with healthy margins have absorbed part of the shock instead of passing everything to consumers. Oxford Economics says companies now pass on about two-thirds of tariff costs to customers, down from close to 100% during Trump’s first term.

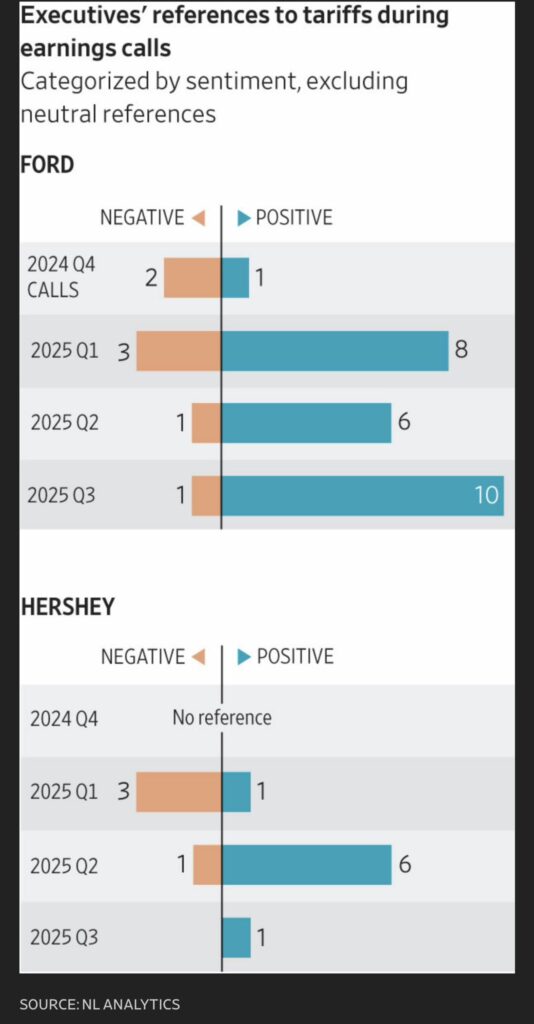

Ford: from “huge impact” to relative advantage

Ford’s own language shows how sentiment has evolved.

- In February, CEO Jim Farley warned that earlier tariff proposals “would have a huge impact” on the auto industry and could wipe out billions in profits.

- By early May, after Trump’s “Liberation Day” tariff package, Ford estimated tariffs could cut 2025 earnings by about 1.5 billion dollars before interest and taxes, later raising that to 2 billion.

Then two things changed in Ford’s favour:

- Washington expanded a program that offsets tariffs on some imported auto parts, cutting Ford’s expected 2025 tariff hit to about 1 billion dollars.

- The US sharply increased duties on medium and heavy trucks, but Ford does not import those vehicles, which gives it a relative edge over competitors that do.

By the late October earnings call, Ford’s tone on tariffs was less negative and more balanced, according to NL Analytics’ sentiment coding of management comments.

Hershey: from anxiety to cautious relief

Chocolate maker Hershey also moved from concern to cautious optimism.

Earlier in the year, management worried about tariffs on cocoa imports and possible retaliatory duties from Canada, on top of already surging cocoa prices. In late October they warned that losing exemptions could increase tariff exposure by around 200 million dollars in 2026.

But in mid November the White House exempted cocoa and many other food products from much of the tariff regime. Hershey’s finance chief later said there was now “a little bit more optimism on tariffs”, and the company confirmed that cocoa accounted for more than half of its exposure, so the decision significantly improves the outlook for 2026.

Why the mood shifted

Several big forces are behind this calmer tone:

- Real rates lower than headlines: Companies rarely pay the full “sticker price” of announced tariffs, because of carve outs, special programs and negotiated exemptions.

- New trade deals and legal limits: The US has signed fresh agreements, and recent Supreme Court questioning of how far a president can go on broad tariffs has added another check in the system.

- Time to adapt: After nearly a year of living with tariff threats, firms have had time to reprice, renegotiate and re-route supply chains rather than react in panic.

Analysts say the message from earnings calls is clear: tariffs are still a headwind, but no longer the dominant risk they seemed earlier in the year. “What they are saying is the tariffs are manageable for them,” noted Deutsche Bank equity analyst Parag Thatte.

Not everyone is relaxed

Some sectors still feel the pressure.

Cabinet maker MasterBrand, for example, warned that new tariffs on kitchen cabinets, bathroom vanities and wood products could knock nearly one percentage point off third quarter gross margin and expose up to 8% of annual net sales before mitigation. The company imports most of its vanities from Mexico and relies heavily on lumber and wood inputs.

MasterBrand expects to offset the hit over time through higher prices and supplier negotiations, but CEO David Banyard admitted that the lag is painful: tariffs arrive quickly, while mitigation takes quarters.

Corporate America is not cheering tariffs, but the panic has cooled. Real paid rates are lower than the scary headline numbers, some firms now benefit at the expense of rivals, and many have adjusted business models to absorb part of the shock.

For now, executives are treating Trump’s trade war as a drag they can manage rather than an existential threat, even as they keep a close eye on the next round of policy moves and exemptions.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Japan Bond Market Explained: Why Yen Carry Trade Still Moves Stocks And Crypto?