This is insane:

Warren Buffett’s Berkshire Hathaway just announced they now hold a record $334 BILLION in cash. To put this into perspective, between Q1 2024 and Q4 2024, their cash balance rose a massive $145.2 BILLION.

What does Warren Buffett see here?

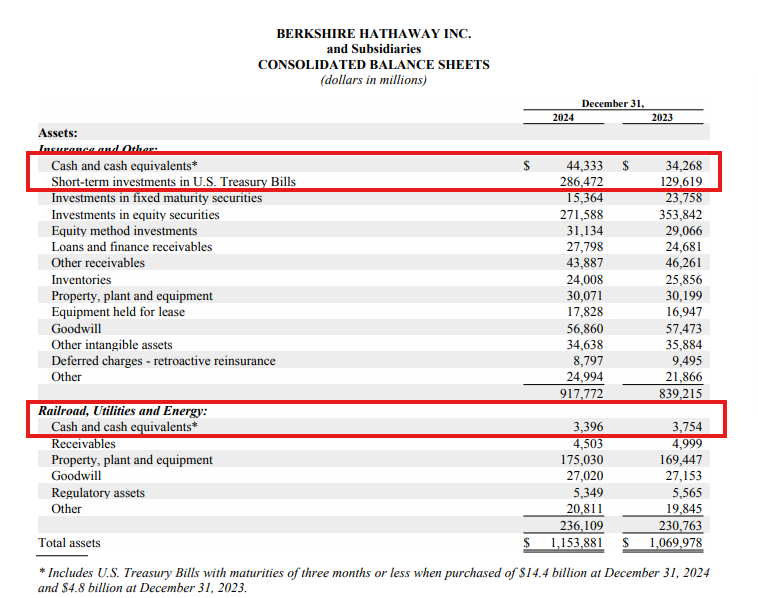

Below is Berkshire Hathaway’s balance sheet:

They now hold $286.5 BILLION of US Treasury Bills and $44.3 billion of cash in their insurance and other business. In their Railroad, Utilities and Energy business, they hold another ~$3.4 billion of cash.

This is unprecedented.

To put this in perspective, the US Federal Reserve currently holds $195.3 billion in US Treasury Bills. This means that Berkshire Hathaway now holds ~$91.2 billion MORE of T-bills than the Fed.

Berkshire Hathaway’s T-bill balance is ~47% HIGHER than the Fed itself.

Furthermore, this cash balance is larger than the market cap of all but 30 public companies in the world. In fact, Buffett’s cash pile is now larger than the market cap of Coca-Cola, $KO, and T-Mobile, $TMUS.

Should the market take this as a warning sign from Buffett?

Not only did Berkshire Hathaway build a record cash balance, they also repurchased $0 of stock in Q4 2024. This is the 2nd straight quarter without buybacks.

In Q3, Berkshire said buybacks will resume when Buffett “believes that the repurchase price is below intrinsic value.”

Last year, the S&P 500 gained +23.3% and market back-to-back annual returns of +20% or more. The last time this happened was in 1998; this is a historically strong market.

Even so, Berkshire Hathaway is effectively saying they are not bullish of their own stock.

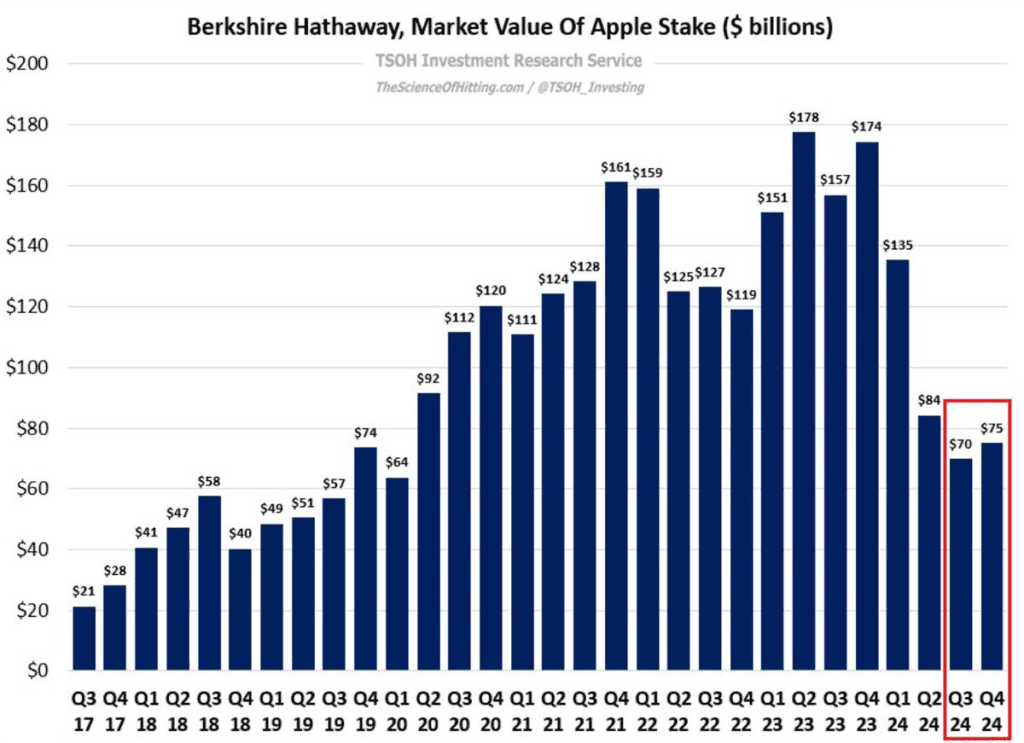

Interestingly, Buffett started to build his Apple, $AAPL, position again.

After cutting it by ~$104 billion since Q4 2023, it jumped +$5 billion to $75 billion in Q4 2024. Buffett says Apple will remain their largest investment unless something changes capital allocation.

Berkshire Hathaway also paid $26.8 BILLION of income taxes in 2024.

This represents ~5% of ALL corporate taxes paid in the US last year. Buffett says that if he mailed the IRS a $1 million check every 20 minutes in 2024, it still wouldn’t cover the full tax amount paid.

Furthermore, Berkshire updated their track record:

Since 1964, Buffett has returned +5,502,284%, compared to +39,054% in the S&P 500. That’s a compounded annual gain of +19.9% for 60 YEARS compared to a +10.4% in the S&P 500.

Is this the best track record of all time?

Buffett commented on their recent cautious outlook of equities. “Often, nothing looks compelling; very infrequently we find ourselves knee-deep in opportunities,” he said.

It appears that Buffett is having difficulty finding bargains in a historically strong market.

Lastly, while Buffett has sold off some of his equity holdings, he still holds TONS of equities. In 2024, investment gains on their equity securities were $52.8 BILLION.

Warren Buffett maintains significant exposure to the stock market even with recent cautious moves.

Heading into 2025, Berkshire Hathaway is holding over ~27% of their assets in cash. This marks the highest percentage on RECORD in one of the strongest bull markets of all time.

If Buffett turning bearish?

Source: TKL

Related:

Bank of America Sees an ‘Attractive Entry Point’ in These 2 Stocks

Wall Street’s latest favorites – Hedge Funds’ Top Picks in Q4

This Week S&P500 ChartStorm – Bad News Damages Investor Sentiment

Key Earnings Takeaways from This Week: AI, E-Commerce, and Travel Stocks Lead Market

Will Elon Musk Enter Quantum Computing? Here’s Why It Might Happen in 2025

Intel Turbulent Week: Breakup Rumors, Strategic Deals, and What It Means for $INTC Stock

Nvidia CEO Jensen Huang directly addresses DeepSeek stock sell-off, saying investors got it wrong

Gold market cap hit $20 TRILLION for first time in history. Why are people still piling into gold?

Analysis: Is Kelsier’s $200MM insider trading scandal the next FTX?

How Dirty Money From Fentanyl Sales Is Flowing Through China

Trump plans to impose 25% tariffs on autos, chips and pharmaceuticals – Stock Market Impact

Congressional Stock Trading Scandal: Lawmakers Profit Big on Palantir Stock Surge

![Key Events to Watch in [Week] & Their Market Impact](https://finblog.com/wp-content/uploads/2025/02/DALLE-2025-02-08-220750-A-dynamic-and-professional-looking-featured-image-for-a-financial-market-report-titled-Key-Events-to-Watch-in-Week-Their-Market-Impact-The-imag-150x150.webp)