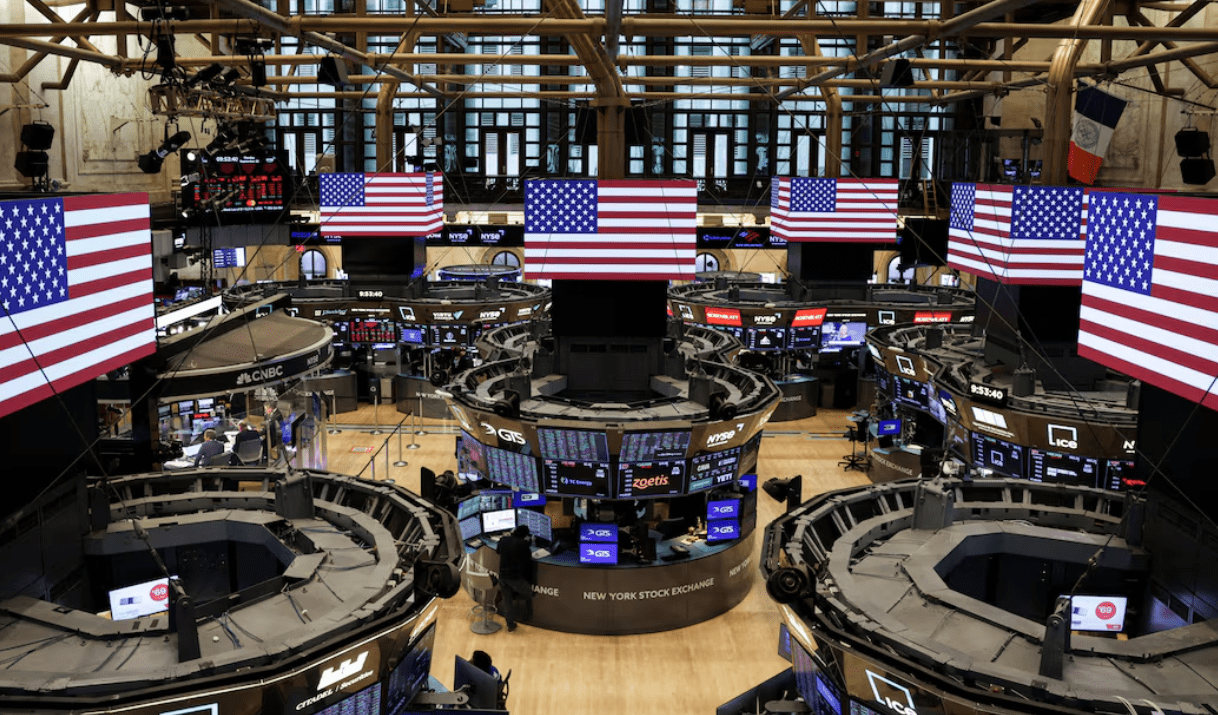

Wall Street paused its blistering rally on Thursday, with investors turning cautious amid the ongoing US government shutdown, renewed valuation concerns, and mixed signals from the Federal Reserve.

The S&P 500 slipped 0.35%, the Dow Jones lost 0.4%, and the Nasdaq Composite declined 0.43% after hitting a record high earlier in the week. Despite the pullback, major indexes remain near all-time highs, underscoring how resilient the market has been through fiscal and political noise.

Analysts say investors are struggling to justify stretched valuations after months of gains powered by AI optimism and rate cut expectations. “Concerns around excessive valuations, high government borrowing, and political turbulence are omnipresent,” said AJ Bell’s Russ Mould, adding that “there are more bulls than bears — but caution is creeping back.”

The Fed’s September meeting minutes, released Wednesday, showed officials divided over the pace of future rate cuts, with several policymakers still worried about inflation risks. New York Fed President John Williams said he supports additional cuts this year, while others, including Governor Michael Barr, hinted at a slower approach — leaving markets uncertain.

Meanwhile, the shutdown continues to delay key government data releases, leaving traders without crucial economic updates that normally guide rate expectations. “Without fresh data, markets are drifting,” one strategist noted.

In corporate news, Tesla fell nearly 2% after regulators launched an investigation into its Full Self-Driving system. Apple, Microsoft, and AppLovin also traded lower, weighing on the Nasdaq. On the upside, Delta Air Lines gained 5% after strong earnings and upbeat guidance, while PepsiCo rose over 2% on a solid quarterly beat.

Commodity markets saw modest movement: oil prices eased to around $62 a barrel as Israel and Hamas agreed to pause fighting under a Trump-brokered Gaza plan, while gold pulled back slightly but remained above $4,050 an ounce, near record highs.

Wall Street’s rally is showing its first cracks as investors weigh lofty valuations against rising macro uncertainty. The next major catalysts, inflation data, Fed speeches, and earnings season, will determine whether the market’s historic run can continue.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.