US stocks closed lower on Wednesday, extending recent losses as renewed concerns over AI spending, debt levels, and returns on massive data center investments weighed heavily on technology shares.

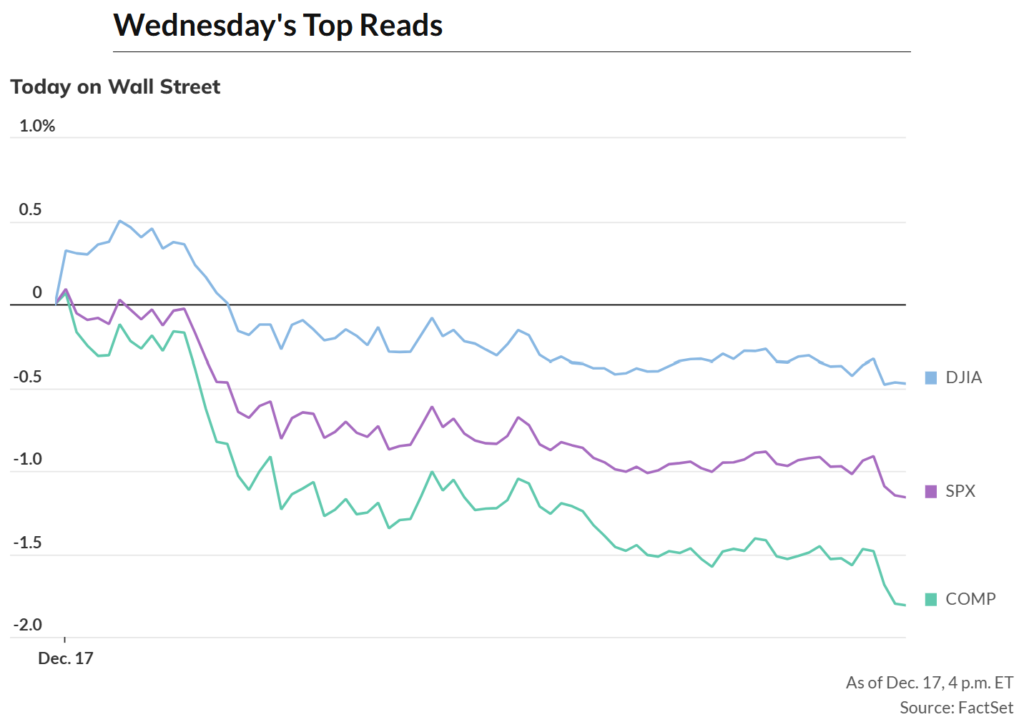

The S&P 500 fell 1.15%, while the Nasdaq Composite dropped 1.8%, pushing both indexes to their lowest levels in three weeks. The Dow Jones Industrial Average declined 0.47%, marking a fourth straight day of losses for the broader market.

The selloff was led by AI-linked stocks, after reports raised questions about the sustainability of aggressive capital spending across the sector.

Oracle shares slid sharply after reports suggested its largest data centre partner, Blue Owl Capital, would not support a $10 billion facility, citing concerns over debt and spending levels. Although Oracle later disputed the report and said the project remains on track, investor confidence was shaken. The stock still ended the session lower.

The weakness spilled across the AI complex:

- Nvidia fell about 3%

- Broadcom dropped around 4%

- AMD declined roughly 5%

- Alphabet lost close to 3%

Market strategists say the issue is no longer excitement around AI, but whether these enormous investments can deliver real returns.

“There’s growing anxiety around the AI trade,” said Ross Mayfield of Baird Private Wealth Management. “The key question heading into the new year is the sustainability and return on investment of all this spending.”

Amazon shares also edged lower after news that the company is in talks to invest around $10 billion in OpenAI, adding to concerns that major tech firms may be stretching balance sheets further to stay competitive in AI. (OpenAI in Talks With Amazon Over Potential $10B+ Investment)

Outside tech, energy stocks rose, supported by higher crude prices after President Donald Trump ordered a blockade on sanctioned oil tankers linked to Venezuela. Shares of ConocoPhillips and Occidental Petroleum both gained.

In media, Warner Bros Discovery fell after its board rejected a hostile bid from Paramount Skydance, while Netflix shares rose after submitting a competing offer.

Providing some relief, Fed Governor Christopher Waller said the central bank still has room to cut interest rates as the labor market softens, helping limit deeper losses.

Investors now turn their focus to Thursday’s US inflation report, which could shape expectations for the Federal Reserve’s next move and determine whether the recent pullback turns into a deeper correction or stabilizes going into year-end.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.