Venezuela may sit on the biggest oil reserves on the planet, but decades of mismanagement, underinvestment, and poor infrastructure mean those barrels are far from easy or cheap to produce.

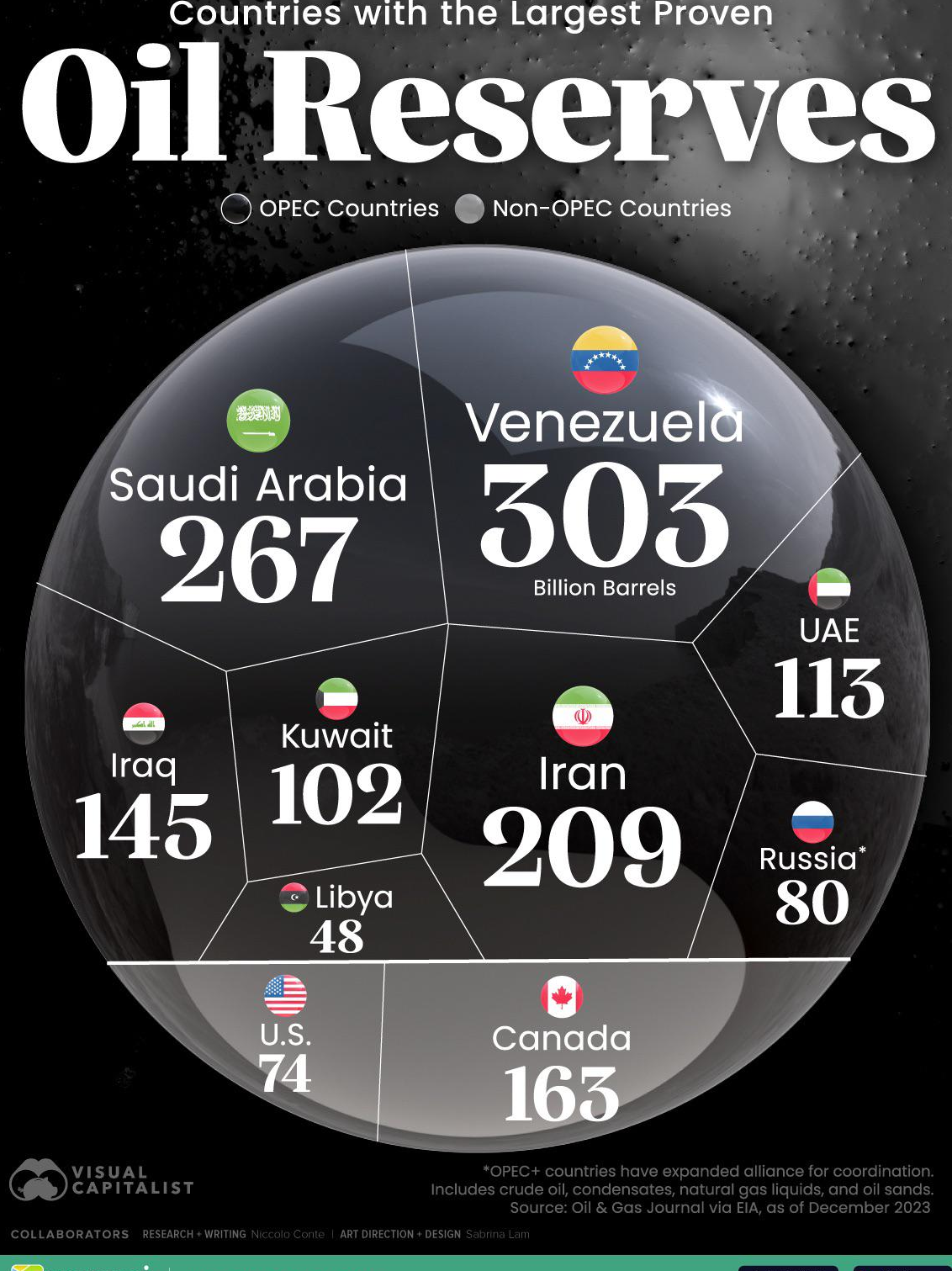

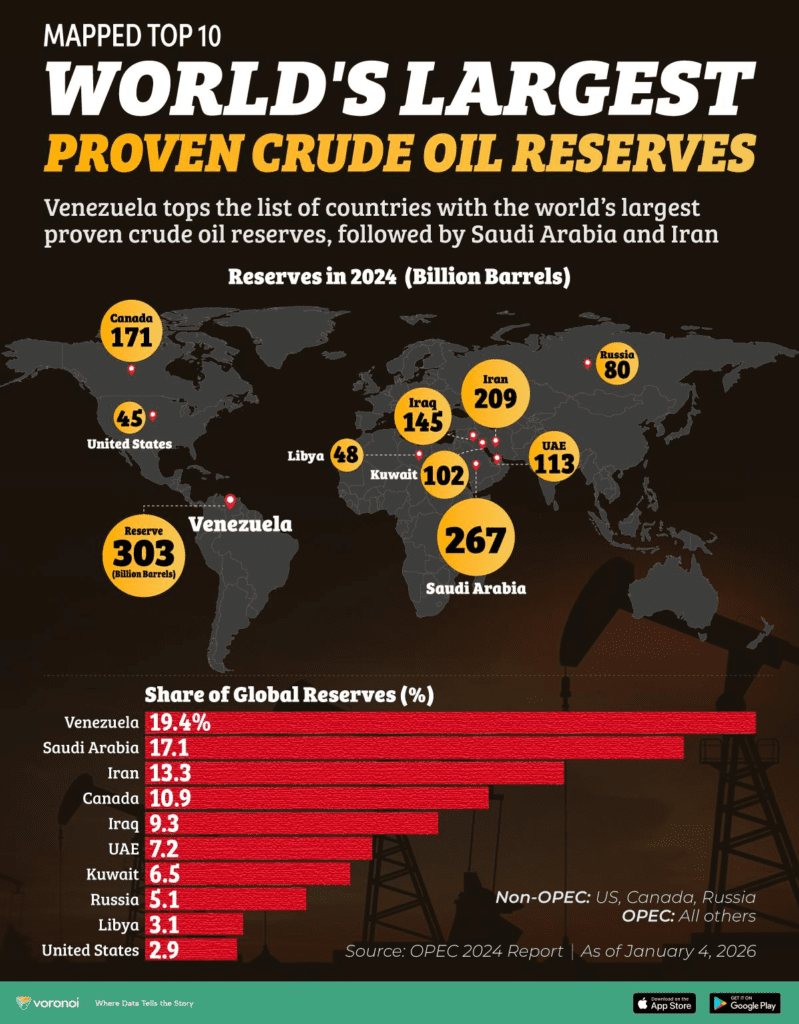

Despite exporting less than 1% of the global oil supply, Venezuela remains a constant point of discussion in energy markets because it claims around 300 billion barrels of proved crude reserves, more than any other country in the world.

That headline number places Venezuela ahead of Saudi Arabia, which reports roughly 260 to 270 billion barrels, and far above the US, with about 45 billion barrels.

But there is a catch.

Reserves on Paper vs. Oil That Can Actually Be Pumped

Venezuela’s reserve figure is self-reported and published by OPEC, where the country is a founding member. Independent audits of those reserves have never been completed.

Until 2007, Venezuela reported closer to 100 billion barrels of proved reserves. That figure tripled after the government reclassified oil fields controlled by state-run PDVSA, even though actual production remained flat.

Energy experts say the distinction matters.

Francisco Monaldi of Rice University’s Baker Institute argues Venezuela has audited resources in the ground, not economically recoverable reserves, estimating that true reserves may be closer to 100 to 110 billion barrels once realistic recovery rates are applied.

Why Venezuela’s Oil Industry Collapsed

Venezuela was once among the world’s top oil producers. That changed after full nationalization under Hugo Chávez, later continued under Nicolás Maduro.

Since then, analysts point to:

- Corruption and mismanagement

- Loss of skilled workers

- Chronic power shortages

- Severely degraded infrastructure

Even Venezuela’s crown jewel, the Orinoco Heavy Oil Belt, suffers from limited electricity, aging facilities, and poor maintenance.

The Market Does Not Need More Barrels Right Now

Oil prices also work against Venezuela’s ambitions.

When reserves were reclassified, crude traded near $100 per barrel. Today, Brent crude sits in the low $60s, while US benchmark WTI trades below $60.

At these levels, many of Venezuela’s barrels simply do not make economic sense.

Energy strategists say global markets are already well supplied, reducing appetite for risky, capital-intensive projects.

The Cost of a Comeback Is Enormous

President Donald Trump has said US companies could spend billions rebuilding Venezuela’s oil sector.

Industry estimates suggest much more would be required.

- $180 billion in total investment through 2040 to restore production

- $30 to $35 billion needed in the next two to three years alone

- $50 billion required just to maintain current output over the next 15 years

Even then, many scenarios suggest most of Venezuela’s oil may never be produced as the global energy system evolves.

Heavy Oil Creates Another Problem

Venezuela’s oil is heavy and sulfur-rich, making it harder and more expensive to extract, transport, and refine.

This type of crude:

- Flows poorly

- Corrodes equipment faster

- Must be upgraded before it can be shipped

- Requires specialized refineries

That sharply limits the number of companies willing to invest.

Chevron’s Role and Investor Hesitation

Chevron remains the only major US oil company with a consistent presence in Venezuela over the past decade.

Analysts see Chevron as a potential beneficiary if investment conditions improve, but they caution that returns are far from guaranteed.

US oil majors are currently focused on capital discipline and low-risk projects, making large bets on Venezuela a tough sell.

Venezuela’s oil wealth is real on paper, but producing it at scale requires massive capital, stable policy, higher oil prices, and years of rebuilding.

As one analyst put it, owning oil underground is very different from getting it to market.

For now, Venezuela’s vast reserves remain a geological fact, not a practical solution to global energy needs.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: