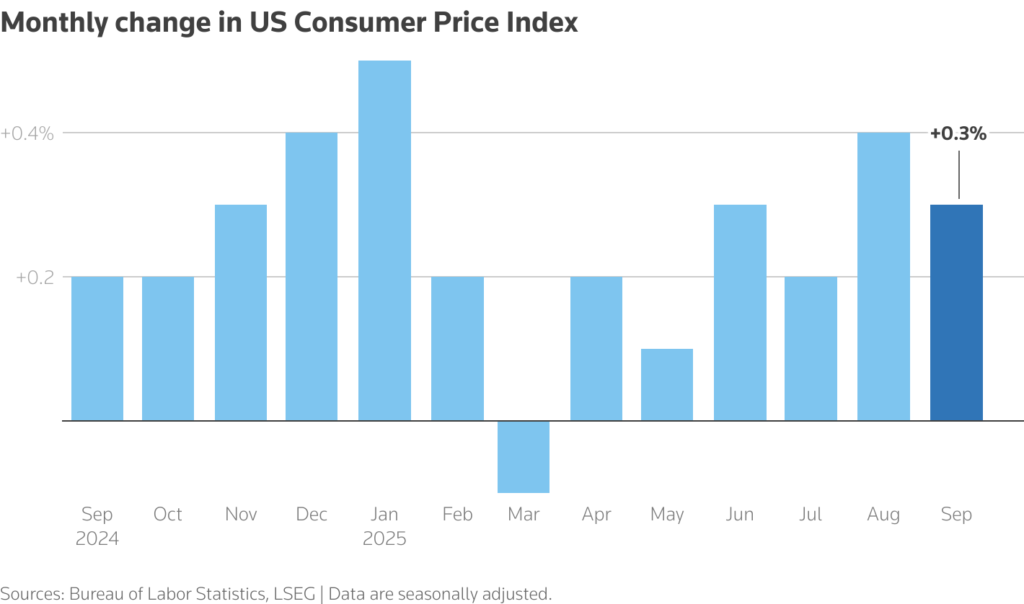

US inflation eased in September, offering the Federal Reserve some breathing room to cut interest rates again next week. The Consumer Price Index (CPI) rose 0.3% last month, slightly below expectations, as falling rents offset a jump in gasoline prices.

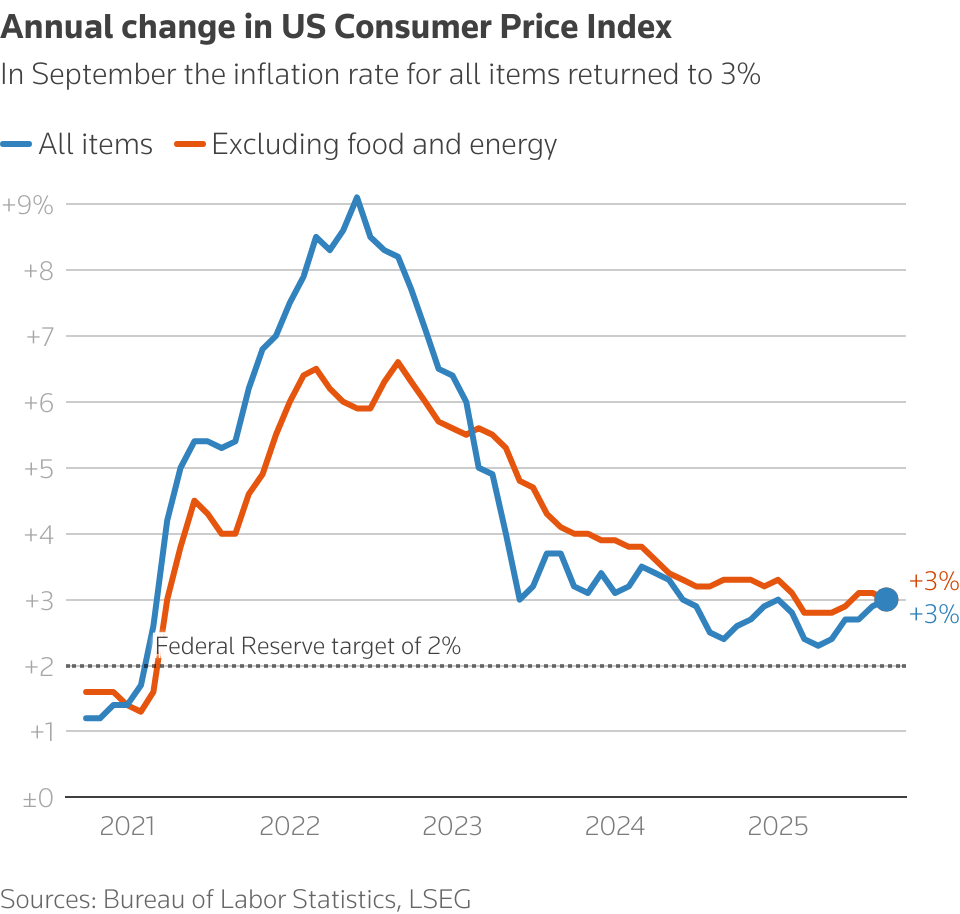

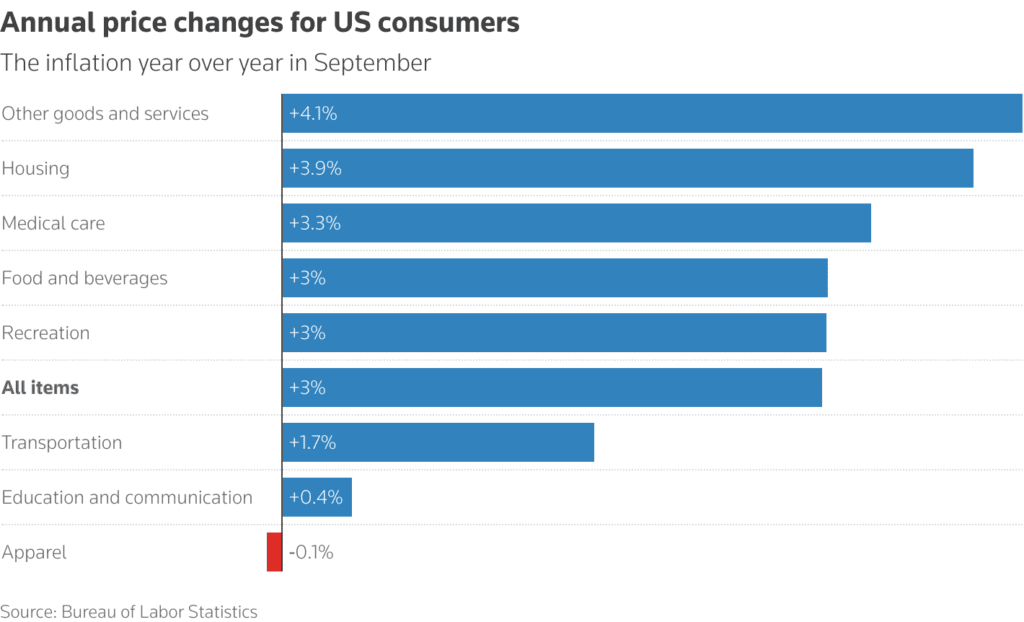

On a yearly basis, inflation increased 3.0%, while core CPI — excluding food and energy — also rose 3.0%, signaling a gradual cooling trend. Prices for airfares, hotels, and used cars dropped, but tariffs continued to push up costs for apparel, appliances, and furniture.

Economists called the report a “sigh of relief for the Fed,” with Fitch Ratings’ Olu Sonola noting that tariff impacts remain muted but the labor market is weakening. The Fed is expected to cut rates by another 25 basis points, bringing them to the 3.75%–4.00% range.

However, the ongoing government shutdown could delay or even cancel the October inflation report, a historic first. The White House warned that missing data could “deprive policymakers and markets of critical information.”

Meanwhile, prices for beef and coffee continued to surge due to droughts and tariffs, while gardening, home care, and vehicle repair costs saw double-digit increases. Businesses are depleting inventories and absorbing tariff costs — a strain that economists expect could raise prices again by early 2026.

Stocks hit record highs after the data, with Wall Street cheering signs of disinflation even as Washington’s gridlock threatens the next batch of economic reports.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Big Tech Earnings, Fed Rate Cut, and Trump–Xi Meeting Set to Define Markets This Week