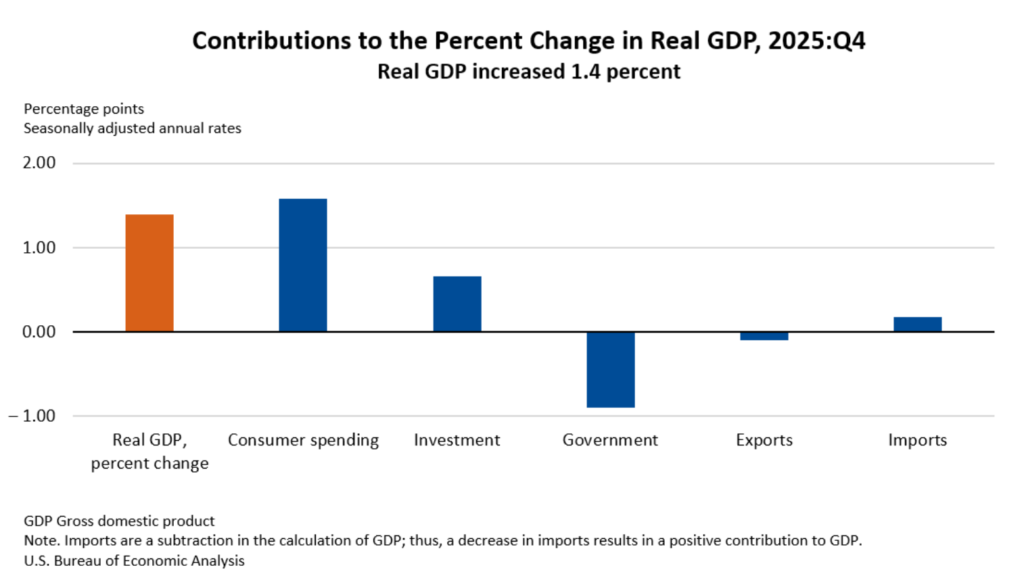

The US economy lost momentum at the end of last year, highlighting resilience but also cracks beneath the surface.

Data from the Bureau of Economic Analysis showed GDP grew at a 1.4% annual rate in the fourth quarter, sharply down from 4.4% in the previous quarter. A prolonged government shutdown was a major drag, cutting about 1 percentage point from growth.

What Drove the Slowdown

- Consumer spending rose 2.4%, slower than the prior quarter.

- Government spending plunged more than 16%.

- Imports rebounded late in the year, which subtracts from GDP.

Despite the weak finish, the economy grew 2.2% for 2025 overall, showing stronger resilience than many economists expected.

Inflation Still a Problem

The Fed’s preferred inflation gauge, the Personal Consumption Expenditures index, rose 0.4% in December, pushing annual core inflation to 3.0%, above the Federal Reserve target. Analysts say this could delay interest rate cuts.

Uneven Economy

AI investment helped support growth, especially through spending on data centers and technology. But other sectors struggled. Housing and factory construction declined, and job growth slowed significantly.

Economists say the economy looks strong on the surface but uneven underneath, with gains concentrated among wealthier households benefiting from rising markets.

The US economy is still growing, but momentum is slowing and inflation remains sticky. That mix suggests steady expansion ahead, though probably not the rapid growth policymakers once promised.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: From ‘Buy America’ to ‘Bye America’: Is Wall Street Losing Its Global Edge?

Trump tariffs ripped up global trade order. What now?