The stock market is starting to change, and investors are watching two big trends that could shape returns this year.

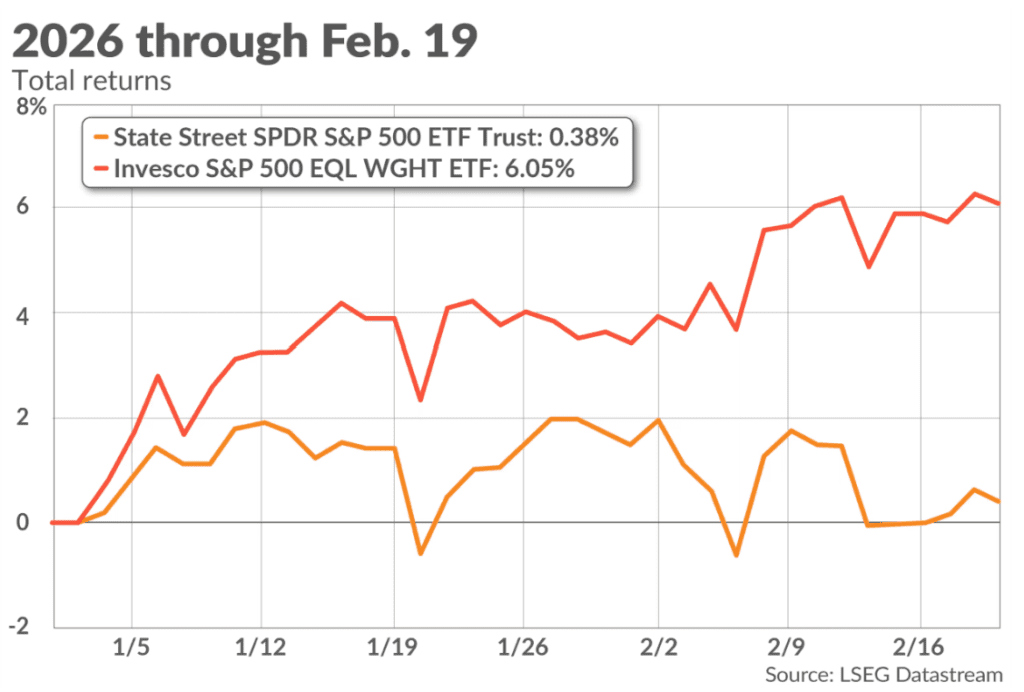

First, the S&P 500 is behaving differently. Usually, the biggest companies drive most of the gains because the index is weighted by company size. Stocks like Nvidia, Apple, and Microsoft make up a large part of it. But in 2026, an equal-weight version of the index, where every stock counts the same, is actually doing better. That suggests gains are spreading across more companies, not just the biggest ones.

Second, global markets are starting to outperform US stocks. International and emerging markets beat US returns last year and are still ahead so far this year. That is making some investors rethink keeping all their money in American stocks.

Another shift is happening in tech. After years of leading the market, tech stocks are down slightly this year. Analysts at UBS recently lowered their outlook for the sector, saying prices may be too high and growth could slow.

What this means: the market is broadening. More sectors and more countries are starting to lead. For investors, that could mean new opportunities outside the usual big tech trades.

Related: Prediction Market ETFs Could Be on the Way. Here’s What You Need To Know About Them