Stocks ended last week mixed, with the Nasdaq Composite down 1.7%, the S&P 500 slipping 1%, and the Dow Jones Industrial Average easing 0.5% on Friday after touching record highs a day earlier. As investors head into a new week, focus shifts toward Trump’s upcoming Federal Reserve pick, the release of delayed economic data, and a heavy corporate earnings slate.

1. Trump’s Fed Pick Takes Center Stage

Following last week’s 25 basis point rate cut, markets are now looking ahead to who President Donald Trump will select to replace Fed Chair Jerome Powell, whose term ends in May.

Reports suggest Trump is leaning toward Kevin Hassett, director of the National Economic Council, or Kevin Warsh, a former Fed governor. “I think the two Kevins are great,” Trump told The Wall Street Journal, adding that both are “serious contenders.”

Trump says, “US should have the lowest interest rate in the world”

Betting markets show Hassett slightly ahead with 57% odds, while Warsh trails at 39%, after Friday’s reports sparked renewed speculation. Both candidates are known to favor lower interest rates, aligning closely with Trump’s push for rates near 1% or lower by next year.

Analysts say a Trump-aligned Fed could mark a shift toward a more dovish policy stance, potentially weakening the US dollar as currency traders price in looser monetary conditions. “Markets are already reacting to expectations of a Fed led by a Trump ally,” said Thierry Wizman, strategist at Macquarie.

Bond traders are watching closely as well. Lawrence Gillum of LPL Financial cautioned that if the Fed is perceived to prioritize growth over price stability, it could “unanchor expectations” and challenge the long-standing credibility of US Treasurys as safe-haven assets.

2. Backlog of Economic Data Resumes After Shutdown

After weeks of delays from the government shutdown, key reports are finally set to hit the calendar. The November jobs report and inflation data will offer the clearest picture yet of the economy’s direction heading into 2026.

Key releases to watch:

- Tuesday: November Nonfarm Payrolls (+50,000 expected), Unemployment Rate (4.4%), and Retail Sales (+0.3%).

- Thursday: Consumer Price Index (CPI) (+3.1% expected) and Core CPI (+3.0%).

- Friday: Existing Home Sales (4.15M expected) and University of Michigan Sentiment (final December reading).

These data points will be crucial as investors reassess whether the Fed’s December rate cut marks the end of its easing cycle or if further cuts could follow in 2026.

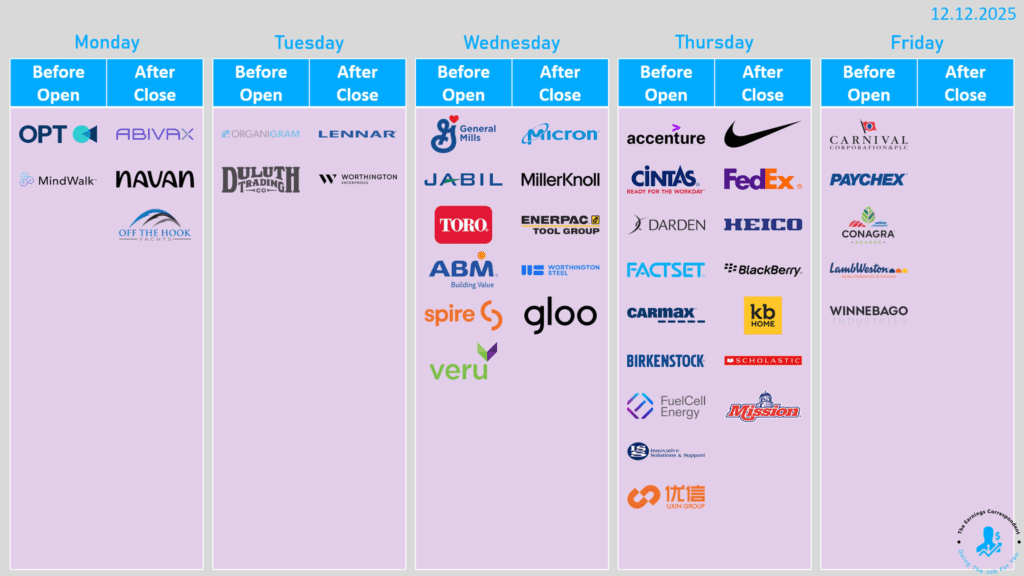

3. Corporate Earnings: From Micron to Nike and FedEx

Earnings season continues, led by major names across tech, logistics, retail, and industrial sectors.

- Wednesday: Micron Technology (MU) reports after the bell — results will be a key test for AI-related semiconductor demand following weakness at Oracle and Broadcom.

- Thursday: A heavy lineup includes Accenture (ACN), NIKE (NKE), FedEx (FDX), Darden Restaurants (DRI), HEICO (HEI), FactSet (FDS), and Birkenstock (BIRK).

- Friday: Paychex (PAYX), Carnival (CCL), and Conagra Brands (CAG) close out the week.

Recent earnings pressure in Big Tech has raised questions about AI investment cycles. Oracle’s 10% stock drop and Broadcom’s 11% plunge last week showed growing concerns about AI overspending and margin compression. Analysts at Capital Economics said this could signal a “changing of the guard”, with future AI benefits shifting toward companies using AI for productivity rather than those building the infrastructure.

Related: Oracle-Broadcom Double Blow Jolts AI Stocks

4. Energy Stocks Defy Falling Oil Prices

Another key theme this week is the unusual divergence between oil prices and energy stocks.

While Brent crude and WTI have fallen 12–15% in recent months, the Energy Select Sector ETF (XLE) has risen about 6%, driven by investor optimism around cost-cutting and free cash flow growth among oil majors.

- Exxon Mobil (XOM) raised its long-term earnings and cash flow forecasts by $5 billion without additional spending.

- Chevron (CVX) expects 10% annual growth in cash flow while cutting capital expenditures by $3 billion.

Analysts expect an oil supply surplus in 2026 but note that major producers appear well-positioned to maintain profitability even if prices drop into the $50s or lower.

This week’s mix of economic data, Fed drama, and key earnings will set the tone for the year’s final stretch. The markets are balancing optimism over easing rates with growing caution around policy direction, corporate spending, and global trade risks.

In short: Expect a week packed with Fed speculation, economic clarity, and corporate crosswinds, all of which could decide whether the market closes the year in rally mode or retreats into consolidation.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Fed Powell Cuts Again: Here is why