The H-1B visa has long been the backbone of America’s ability to attract top global talent in fields like software engineering, medical research, and artificial intelligence. From Silicon Valley giants to universities and hospitals, employers have relied on the program to fill specialised jobs that are hard to staff domestically. But the landscape shifted dramatically after President Donald Trump signed an executive order adding a $100,000 fee for every new H-1B petition. The move is sparking fierce debate among policymakers, industry leaders, and investors about what this will mean for US competitiveness, corporate costs, and global talent flows.

What Is the H-1B Visa and How Does It Work?

The H-1B program, created in 1990, allows US employers to temporarily hire foreign workers in “specialty occupations” that require highly specialized knowledge and at least a bachelor’s degree.

- Annual caps: 65,000 visas for applicants with bachelor’s degrees and 20,000 more for advanced degree holders.

- Duration: Typically valid for 3 years, renewable up to 6.

- Exemptions: Universities and research institutions often operate outside the cap, giving them more flexibility.

The program has been instrumental in shaping America’s tech boom: CEOs like Satya Nadella (Microsoft), Sundar Pichai (Google), and Elon Musk (Tesla/SpaceX) all started out on H-1B visas. Studies show more than half of US billion-dollar startups have at least one immigrant co-founder, underscoring the visa’s economic importance.

Trump’s New Changes

President Trump’s new order imposes a one-time $100,000 fee for each new H-1B petition filed after September 21, 2025. While officials pitched it as a way to “prioritize American workers,” the rollout has been messy: some comments from the Commerce Department suggested it would apply to renewals too, though the text of the order specifies only new petitions.

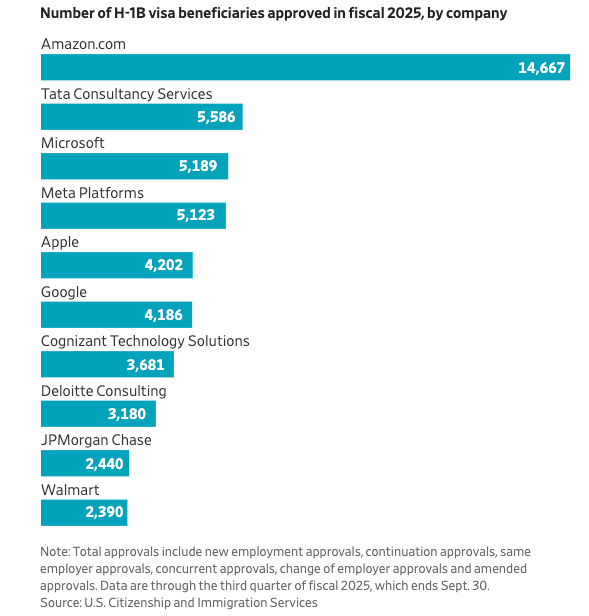

At the same time, Congress is increasing pressure: Senators Chuck Grassley (R-Iowa) and Dick Durbin (D-Illinois) sent letters to Amazon, Apple, Google, Meta, Microsoft, JPMorgan, Deloitte, Walmart, Cognizant, and Tata Consultancy Services demanding they justify continued H-1B hiring while conducting layoffs. These companies must respond by October 1.

Market Reaction

Markets initially shrugged off the announcement. Tech shares held steady because the fee affects future hiring, not existing workers. Still, analysts flagged potential margin pressures and talent bottlenecks if the policy sticks.

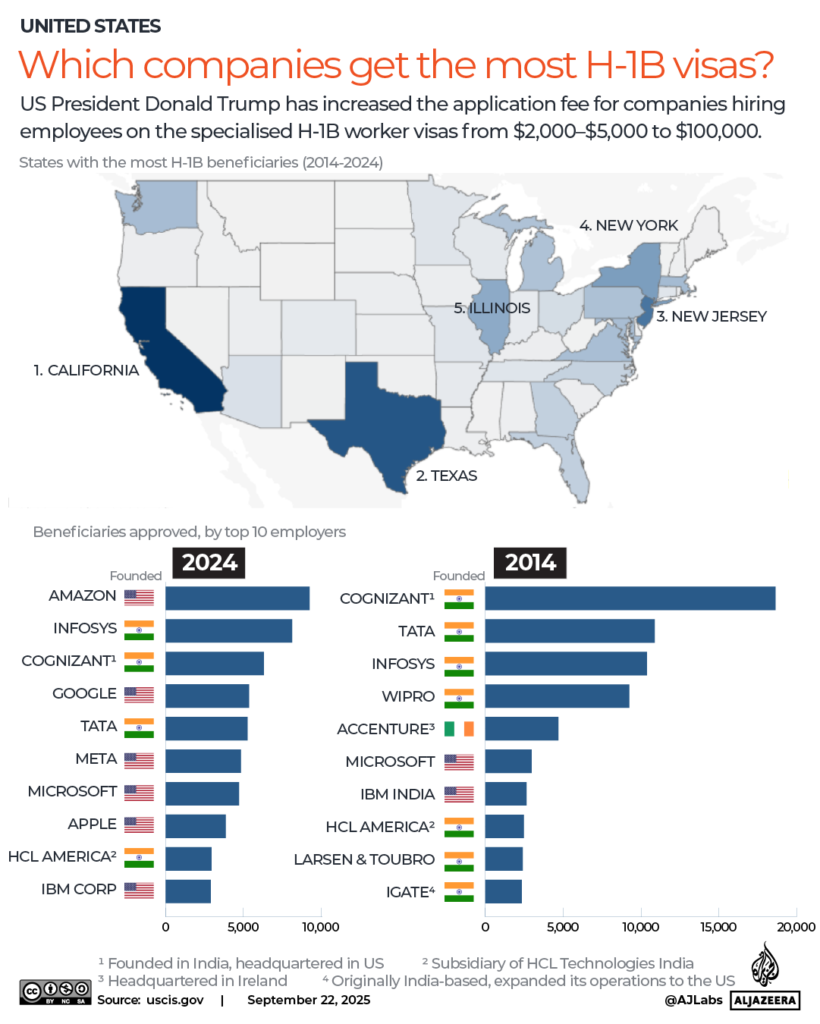

- Indian IT stocks — Infosys, Wipro, and TCS — slumped, with the sector facing its worst week since April.

- US tech giants like Amazon and Microsoft saw little immediate price movement, but analysts warn of higher long-term labor costs.

- Bond markets and broad equity indices largely focused on other macro drivers (tariffs, Fed cuts), keeping visa policy in the background — for now.

Which Companies and Sectors Are Most Exposed?

The impact of the new fee won’t be uniform. Some firms can absorb the cost, while others may struggle.

- Cloud & AI platforms (GOOGL, MSFT, AMZN, META): Large H-1B pipelines but deepest pockets and global hubs; likely to pay up for critical roles while accelerating Canada/U.K./EU hiring. Watch operating-expense lines, not core growth.

- IT services & consulting (TCS, INFY, WIT, HCL): Heavier near-term squeeze; clients may accept some pass-through, but on-site work will be pruned further; margin headwinds of 10–100 bps are plausible per brokers. Stocks already reflected stress this week.

- Healthcare & universities (Mayo, UMN et al.): Recruiting sub-specialists and researchers becomes costlier/harder; expect more exemptions lobbying and potential delays in filling niche roles.

- Startups: Biggest losers. Harder to win visas, pricier to keep stars, easier to open an engineering pod in Toronto/London/Dubai instead. (This is exactly what talent magnets are hoping for.)

What this could mean for companies (near term vs. longer term)

Near term (next 6–12 months):

- Costs creep up, but aren’t fatal for giants. A leading Indian ratings firm (CRISIL) estimates the new fee would trim Indian IT operating margins by 10–20 bps, with 30–70% of the new cost passed through to clients. That’s small, but it still tightens budgets.

- Big Tech can absorb or reroute. Expect more U.S. local hiring (at higher wages), near-shoring (Canada/Mexico), and remote/offshore expansion to keep product roadmaps on track. That’s why day-one stock reactions were muted.

Medium term (12–36 months):

- Startups and mid-sized firms feel it most. They don’t have the cash to pay $100k per new hire or the HR/legal engines of megacaps—so they slow critical hires, delay launches, or grow outside the U.S. (Canada/U.K./UAE). University pipelines and spin-outs are collateral damage.

- Talent goes where the doors are open. The U.K. is weighing visa fee cuts for top talent; Canada keeps widening permanent-residence pathways; the Gulf (UAE/Saudi) is actively recruiting AI engineers with tax-light pay packages and long visas. Put bluntly: this policy intensifies the global talent war—and the U.S. could lose share if uncertainty lingers.

- India impact is real but manageable. Nomura warns of longer-term risk to India’s services exports and margins if the fee sticks (and if a proposed HIRE Act outsourcing tax advances). The industry has already shifted more delivery off-site (90% now) to reduce U.S. on-site dependency, which cushions the blow.

Analysts’ Expectations and Economic Outlook

Analysts at Crisil estimate that Indian IT firms can pass 30–70% of the new cost on to clients but will still feel a squeeze on margins. Nomura warns that India’s services exports, half of which go to the US, face longer-term risks if both the $100k fee and a proposed HIRE Act outsourcing tax advance.

Economists broadly agree on three points:

- Inflation risk: Higher hiring costs could trickle into wages and service prices.

- Brain drain: Skilled workers may choose Canada, the U.K., China, or Gulf states offering golden visas, high pay, and fewer barriers.

- Offshoring acceleration: Companies may move even more jobs outside the US, countering the administration’s intent to reshore talent.

Middle East Emerges as a Surprise Winner

Trump’s $100,000 H-1B fee could end up boosting the Middle East. Gulf nations, such as the UAE and Saudi Arabia, are already investing billions in AI and smart-city projects, offering golden visas, tax-friendly regimes, and top compensation packages. Analysts say this combination could attract displaced tech talent from the US and Europe. With initiatives like Saudi Arabia’s Vision 2030 and the UAE’s National AI Strategy, the region positions itself as a new global hub. However, experts warn that regional instability and limited citizenship pathways may temper how much of this talent actually stays long-term.

The H-1B visa has been a cornerstone of US innovation for 35 years, filling gaps in software, research, and medicine that domestic pipelines can’t meet fast enough. Trump’s new $100,000 fee on new petitions may score political points on protecting American jobs, but in practice it risks raising costs for companies, squeezing startups, and driving top global talent elsewhere. Big Tech will adapt, but the long-term danger is that America slowly loses its edge in the global race for skills, while countries like Canada, the U.K., and the UAE roll out the welcome mats. The stock market’s calm reaction today doesn’t change the fact that this is a structural risk investors, policymakers, and employers will have to track closely in the years ahead.

Related: From Musk to Microsoft’s CEO, these tech leaders were once H-1B visa holders

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.