The US stock market extended its losing streak Tuesday, dragged down by fading tech momentum, weak earnings, and escalating fears around interest rates. The selloff was compounded by a brutal drop in crypto markets, with over $1 trillion in value erased from digital assets as panic grips investors.

Markets Slide as Fed Jitters and AI Valuations Collide

- Dow Jones fell 552 points (-1.2%)

- S&P 500 down 1.09%, now on a 4-day losing streak

- Nasdaq dropped 1.6%, pressured by sharp losses in Amazon, Microsoft, and Nvidia

- The Russell 2000 small-cap index briefly bucked the trend but remains down over 1% for the week.

- Nvidia, which reports Q3 earnings Wednesday, has now lost 9% this month as traders question whether the AI rally has gone too far, too fast.

“It’s Nvidia’s customers you should be more worried about than Nvidia itself,” said Peter Tuz of Chase Investment Counsel.

Investor fear is rising ahead of the results. Traders are bracing for signs that AI demand may be peaking, or worse, that fundamentals don’t justify the hype.

Trump: “Would Love to Fire Powell Right Now”

Speaking from the White House during a visit with Saudi Crown Prince Mohammed bin Salman, President Donald Trump reignited his attacks on Federal Reserve Chair Jerome Powell, calling current rates “stupid.”

“We’ve blown past Powell’s interest rate stupidity,” Trump said.

“I’d love to get the guy currently in there out… but people are holding me back.”

He added that interviews for a new Fed chair are underway, hinting he already knows who he wants to appoint once Powell’s term ends in May.

“We have some surprising names… and we have some standard names. We might go the politically correct way, but we’ll see.”

Trump’s public frustration with Powell rattled markets already on edge over inflation and growth concerns, reinforcing worries of political interference in Fed policy.

Bitcoin Plunges Below $90,000, $1 Trillion Erased in Crypto Market

Bitcoin briefly broke below $90,000, triggering liquidations and broader panic. It has since bounced above $92,000, but remains down nearly 30% from its recent peak.

Ethereum also dropped sharply before recovering slightly, now hovering near $3,100.

“Bitcoin’s free fall has now wiped out over $1 trillion in total crypto market cap,” analysts at Glassnode noted, calling it a “capitulation wave” driven by extreme fear and leveraged unwinds.

Investor Sentiment: “Extreme Fear”

CNN’s Fear & Greed Index shows markets are now firmly in the “Extreme Fear” zone. Bond yields fell as investors rushed to safe havens like gold, which rose to $4,055/oz.

What’s Coming Next: Two Key Market Tests Ahead

Worries about a potential AI bubble and broader US economic slowdown have deepened the risk-off sentiment, with markets beginning to show real signs of strain. Investors are now bracing for two key events this week that could either reinforce or ease those fears.

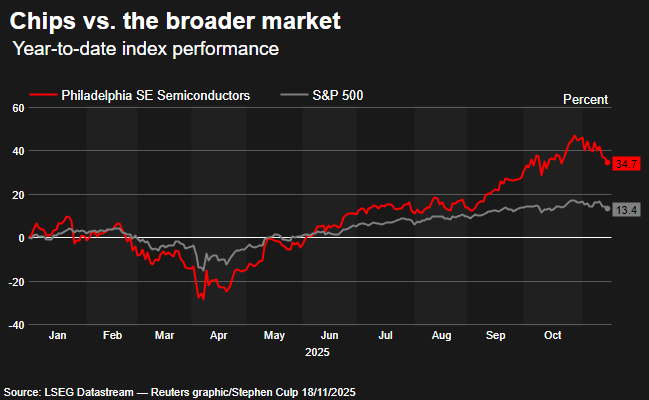

First, Nvidia reports third-quarter earnings on Wednesday, a crucial test for the sustainability of this year’s AI-fueled rally. The chipmaker, often seen as the backbone of the AI boom, led Tuesday’s tech pullback, sliding as much as 3%. Fellow tech giants Amazon and Microsoft also fell around 3%, reflecting broader unease in the “Magnificent Seven” trade.

Then on Thursday, the spotlight shifts to the delayed September jobs report, the first major economic dataset since the US government shutdown. Wall Street will be watching closely for clues about the Fed’s next moves. Just a month ago, traders were almost certain a rate cut was coming; now, those odds have dropped to a roughly 50-50 split.

Preliminary data from ADP showed private-sector job losses slowing into November, while a wave of upcoming retail earnings, including from Walmart, Target, and Home Depot, will help gauge how much strength remains in the US consumer ahead of the holiday season. Notably, Home Depot missed earnings estimates and cut its full-year outlook Tuesday, dragging shares lower and raising fresh concerns about household spending.

Markets are flashing red across the board. With Trump escalating pressure on the Fed, AI stocks losing steam, and crypto deep in fear territory, investors may be entering a new phase of caution or capitulation.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Trump Secures $1 Trillion Saudi Investment in High-Stakes White House Visit

Morgan Stanley Lifts Nvidia Price Target Ahead of Critical Q3 Report

European Stocks Slide as Fed Cut Hopes Fade and Tech Valuations Come Under Pressure