US Treasuries fell on Monday after reports that Chinese regulators asked domestic banks to rein in their holdings of US government bonds, citing concerns about market volatility and risk concentration.

The move pushed yields higher across the curve. The 10-year Treasury yield rose as much as four basis points to around 4.25%, while the 30-year yield climbed to about 4.88%. The Bloomberg Dollar Spot Index slipped roughly 0.3%, adding pressure to US assets.

According to people familiar with the matter, Chinese officials encouraged banks to limit new purchases of US Treasuries and asked institutions with higher exposure to gradually reduce positions. The guidance did not include specific targets or timelines and does not apply to China’s official state reserves.

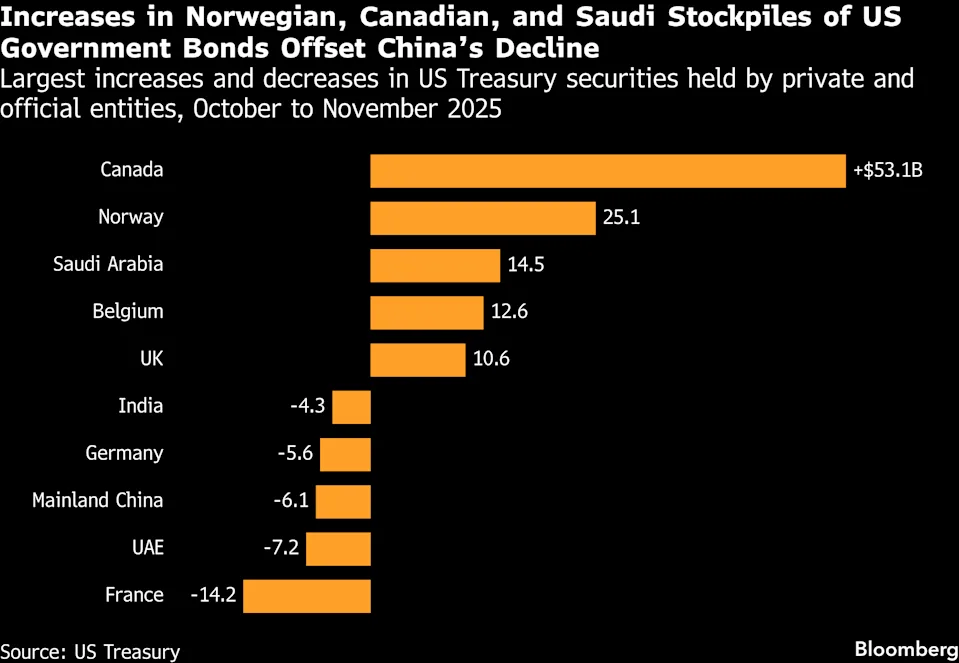

Market participants say the message reinforces a broader global shift toward diversification away from US assets, rather than an abrupt selloff. Countries such as India and Brazil have also trimmed exposure to Treasuries in recent years, amid geopolitical tensions and questions around long-term US fiscal stability.

“It’s another signal that expectations of structural outflows from the dollar are gaining traction,” said Gareth Berry, a strategist at Macquarie. Others stressed the risk of overreacting. Kathleen Brooks, research director at XTB, noted that any large-scale liquidation by China would sharply disrupt global markets, something investors largely view as unlikely.

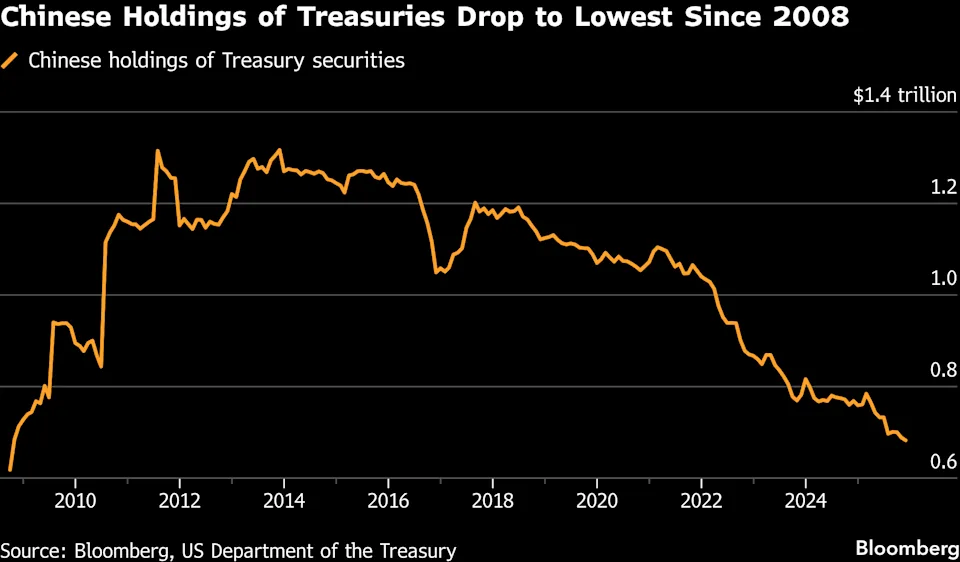

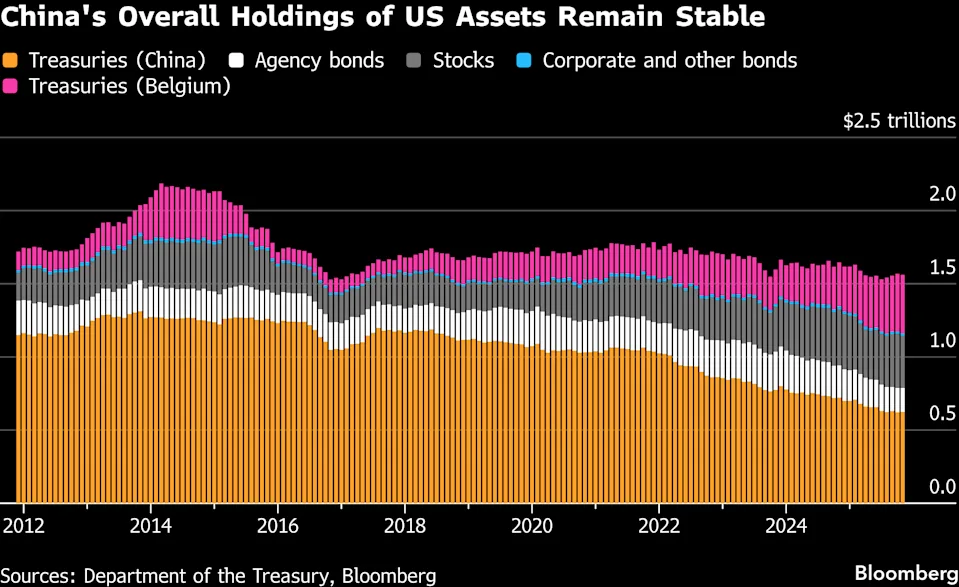

China-based investors’ Treasury holdings have already fallen to about $683 billion, roughly half their 2013 peak, according to US data. Still, total Chinese exposure to US securities, including agency bonds and equities, has remained broadly stable since late 2023. China remains the world’s third-largest foreign holder of US Treasuries, behind Japan and the UK.

Analysts emphasized that much of China’s remaining Treasury exposure is short-dated and held for liquidity purposes, limiting the immediate market impact. Overseas demand for US government bonds overall remains strong, with foreign holdings hitting a record high late last year.

For now, markets are interpreting Beijing’s move as a push to diversify risk, not a step toward rapid de-dollarization.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: White House Talks Up a Strong Dollar, but Investors Remain Skeptical