2024 was transformative for the cryptocurrency industry, marked by Bitcoin’s historic rally past $100,000, the rise of AI-integrated crypto projects, and growing interest in tokenized real-world assets (RWAs). With pro-crypto policies expected from the incoming Trump administration, industry leaders anticipate another year of significant opportunities in 2025. Here’s a breakdown of key trends:

1. The Safe Bet: Bitcoin

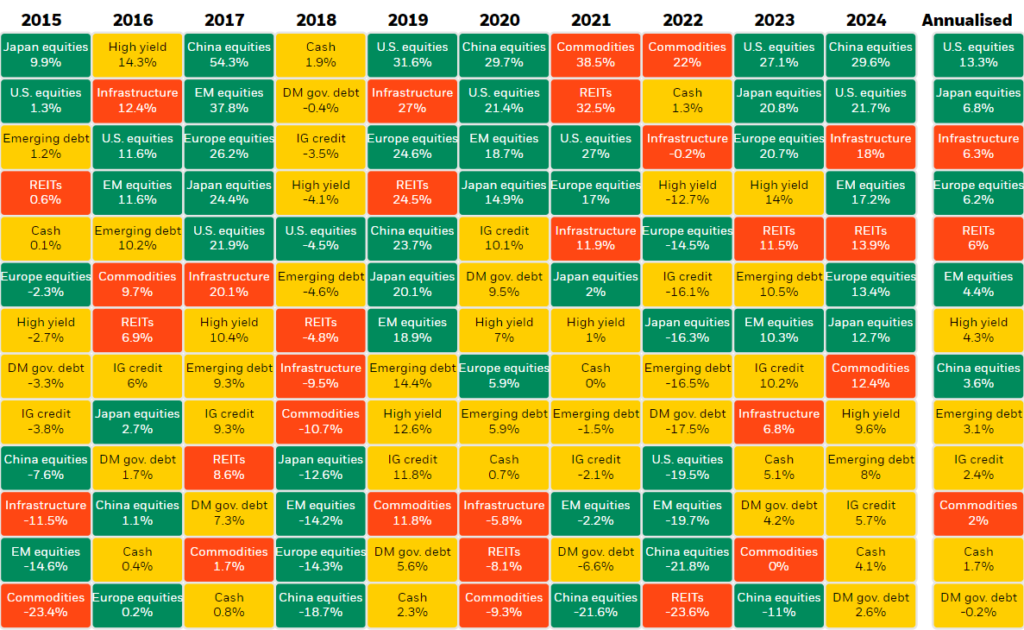

- Performance and Adoption: Bitcoin is the cornerstone of the cryptocurrency industry, providing a secure and decentralized hedge against monetary debasement. In 2024, Bitcoin delivered an impressive 110% return, outperforming traditional assets like U.S. equities (21.7%) and China equities (29%), per BlackRock data.

- Institutional Involvement: Bitcoin ETFs saw growing adoption, with institutions owning 27% of Bitcoin ETFs by mid-2024. Analysts predict continued robust performance, potentially driving Bitcoin to $160,000 by the third quarter of 2025, according to Matrixport.

- Strategic Bitcoin Reserve: Speculation around the Trump administration potentially endorsing a Bitcoin reserve could push BTC toward $1 million, as suggested by Blockstream’s co-founder Adam Back.

- Potential Correction: Experts warn of a possible correction in early 2025, with Bitcoin retracing to $70,000 before resuming its upward trajectory.

2. The Speculative Investment: AI-Driven Crypto Projects

- Emerging Technologies: AI-powered blockchain projects like ai16z and Hyperliquid are poised for substantial growth in 2025, integrating decentralized AI agents and creating tokenized solutions.

- Revenue Growth: AI-based blockchain applications generated $8.7 million in revenue in just five weeks in mid-2024, according to VanEck data. This reflects increasing investor and institutional interest in merging AI with decentralized finance (DeFi).

- Complementary Paradigm: The synergy between AI’s reliance on data and blockchain’s ability to ensure data transparency and reliability positions these projects as transformative.

- Market Applications: AI-driven tools for decentralized identity, gaming, and infrastructure optimization are anticipated to gain significant traction.

3. The Blockchain Infrastructure Play: Tokenized Real-World Assets (RWAs)

- Market Potential: RWA tokenization, which converts tangible assets like real estate and equities into blockchain-based tokens, is revolutionizing traditional financial markets. The sector is projected to grow more than 50-fold to $10 trillion by 2030, per Tren Finance.

- Institutional Milestones: BlackRock’s tokenized treasury fund surpassed $500 million in 2024, showcasing the growing acceptance of RWAs among mainstream investors.

- Key Benefits: Tokenization offers fractionalized ownership, improved liquidity, and 24-hour trading, addressing inefficiencies in traditional markets.

Looking Ahead to 2025

The Trump administration is seen as a positive catalyst for crypto, with the appointment of Paul Atkins as the new U.S. Securities and Exchange Commission (SEC) chair expected to foster innovation-friendly regulation. Analysts predict another year of upside for cryptocurrencies, with Ethereum (ETH) potentially reaching over $6,000, fueling an anticipated altcoin rally.

Key Takeaway: With Bitcoin leading the pack, emerging AI-crypto projects redefining technology, and tokenized assets revolutionizing finance, 2025 could be another transformative year for the cryptocurrency market.

This story was originally featured on Cointelegraph.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.